Brett_Hondow

The Records Keep Coming

Eaton Corp. (NYSE:ETN) continues to set records in operating margin and non-GAAP EPS as we see in its 3Q 2022 results. Orders and backlog are also high. This suggests continued strong demand leading to future sales as supply chain issues and manufacturing inefficiencies return to normal. The company has repositioned itself in recent years, selling cyclical businesses like Hydraulics and buying businesses with secular growth in the electrical and EV markets.

Eaton is now positioned to take advantage of several secular growth drivers as discussed in the 3Q earnings presentation. The company won about $950 million of new business in 3Q tied to these growth drivers, which include:

- Electrification (re-shoring of factories, EV infrastructure build-out)

- Energy Transition (grid resiliency and microgrid installation)

- Digitalization (data center growth)

- Vehicle Efficiency (components for EV and cleaner ICE vehicles)

- Recovery of Travel (Increasing new plan build rate in commercial business)

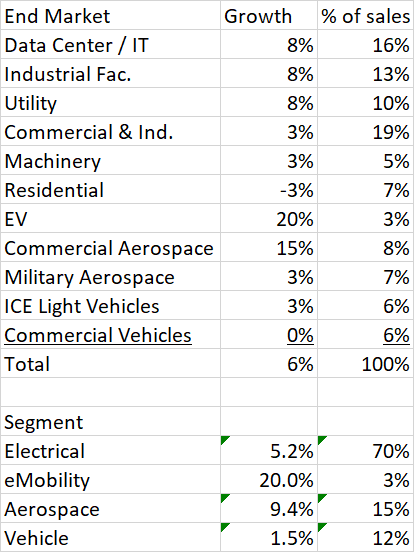

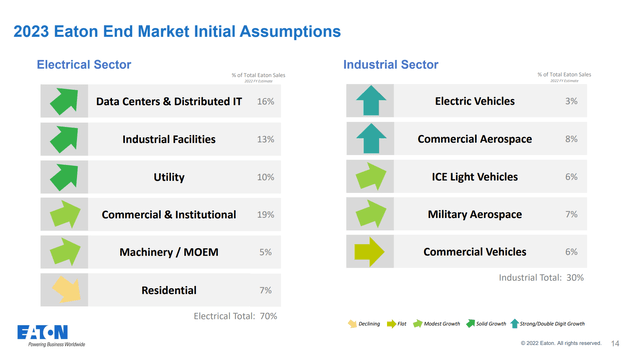

On the earnings call, Eaton guided basically in-line for 4Q and FY 2022 but also provided a preview of 2023 sales estimates for their various end markets. Significantly, management noted that a recession was built into their assumptions, yet they still expect growth in most end markets. The only down market for next year is Residential, which makes up only 7% of total sales. The commercial vehicle market, with only 6% of sales, is expected to be flat in 2023. In line with the growth drivers noted above, several end markets are expected to have strong, even double-digit growth. These include data centers, factories, and utilities in the Electrical businesses, and EV’s and commercial aviation in the Industrial businesses.

This averages out to about 5.6% sales growth for the company overall despite a recession built into the assumptions. With slowing inflation and supply issues being addressed, I expect continued strong margins next year. With the big M&A deals completed, Eaton should have less restructuring and integration costs as well as cash flow available for larger buybacks. Given these factors, I see Eaton growing earnings per share by about 12% per year for the next couple years which is not bad for an industrial company in a recession.

Earnings Model Update

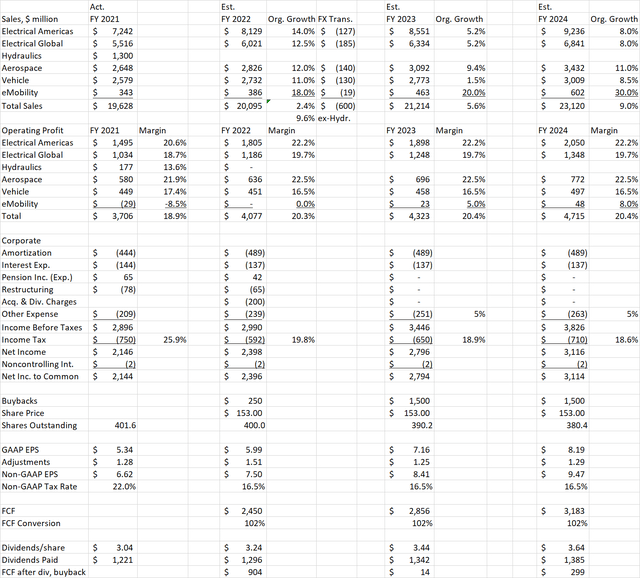

I have updated the earnings model I used in previous articles with the company’s initial outlook for 2023 sales. I translated the arrows on the above slide to numeric growth estimates using the following assumptions:

Author Spreadsheet

For 2024, I project a return to Eaton’s longer term sales growth targets of 8-10%. I am leaving operating margin assumptions constant with 2022. This is probably conservative as the end of supply chain constraints and lower inflation should result in more efficient manufacturing and lower costs.

For corporate and other costs, the end of the big M&A period should help keep these costs under control. Amortization is assumed to be flat with 2022 levels for the next 2 years and restructuring and M&A charges are nil. On other corporate expense, I am using the company’s guidance of $30 million higher in 2022 but then assume a lower rate of increase going forward at 5% per year.

One risk to this forecast is pension expense. I am assuming zero for the time being, but a decline in pension asset values and higher interest rates could require the company to make contributions next year. My tax rate assumption is 16.5% on non-GAAP earnings, consistent with company guidance for 2022.

The resulting non-GAAP EPS estimate for 2022 is $7.50, a penny below the company guidance. For the next 2 years, EPS grows by about 12% per year, to $8.41 in 2023 and $9.47 in 2024. That is within the existing range of analyst estimates but above the midpoint.

The company still predicts a relatively low share buyback of $250 million in 2022. In future years, if free cash flow conversion stays around 100%, lower M&A activity should make about $1.5 billion available for buybacks. That is after annual dividend increases of $0.05 per quarter, or 6% annual dividend growth.

Valuation

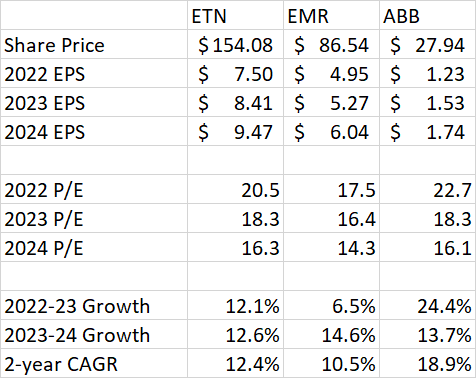

Assuming a $154 share price at time of writing, P/E’s on these estimates would be 20.5 times 2022 earnings, 18.3 times 2023, and 16.3 times 2024. These values are up slightly from last quarter despite increasing interest rates. Compared to close peers with similar market caps, Eaton remains more richly valued than Emerson Electric (EMR) but cheaper than Swiss company ABB, however. As Eaton’s 2-year growth rate is still in between these two peers, I conclude that Eaton is now about fairly valued.

Author Spreadsheet

Conclusion

Eaton has powered through inflation and supply chain constraints in 2022, still delivering record operating margins and EPS. For 2023, the company expects decent growth in many end markets despite the prospect of a recession. This is a result of the repositioning Eaton has done over the last couple years to get rid of cyclical businesses and participate more in secular growth trends.

At $154, Eaton stock has increased in price since my last review and still looks fairly valued compared to peers. The P/E is also not cheap considering the higher interest rate environment. Still, Eaton is in many ways a secular growth company hidden in the industrial sector. The stock is subject to pullbacks on macro worries over the next year, but its participation in secular trends means it can be bought now for a long-term investment.

Be the first to comment