da-kuk/E+ via Getty Images

It’s been about 49 months since I bought Eastman Chemicals (NYSE:EMN), and in that time the shares have returned about 23% against a gain of about 64% for the S&P 500. The lion’s share of that gain from Eastman has come from the dividend, though, so in this missive I want to pay particular attention to it. Now that some time has passed, it’s time to review the position again to see whether I should buy more, sell the position or stand pat. I’ll make that determination by looking at the financial history here, and by looking at the stock as a thing distinct from the underlying business. In addition, I think it’s worth writing about put options, because it’s always worth writing about put options.

I imagine that you’re a busy crowd, dear readers, and you’ve much more fun and interesting things to do than read more of my ponderous blathering. For my part, it’s April 1st in Toronto, and, of course, it’s snowing outside, because I live in a frozen hellscape. My plan is to start the weekend early, so I need to get this done so that I can make my appointment with Dr. Jack Daniels. Because you’re busy, I’m going to offer you the gist of my thesis here so you won’t have to wade through the entirety of this meandering, ponderous mess. In my view, Eastman Chemicals has had an excellent year, and the company has rewarded shareholders with yet another dividend raise. This represents the 12th year of dividend increases at the firm. Also, I’ve concluded that we’re likely to see future dividend increases because the dividend is well covered. In spite of this, the shares are very reasonably priced in my view, and so I’ll be adding to my position. Further, because I’m a greedy sort, I’ll be adding to the whiskey acquisition fund today by selling the September puts with a strike of $90. I consider this to be a win-win trade because if the shares remain above $90, I’ll pocket the generous premium. If the shares fall in price by about 20%, I’ll be obliged to buy at a price that lines up with a very attractive dividend yield. There you have it. Have a good weekend.

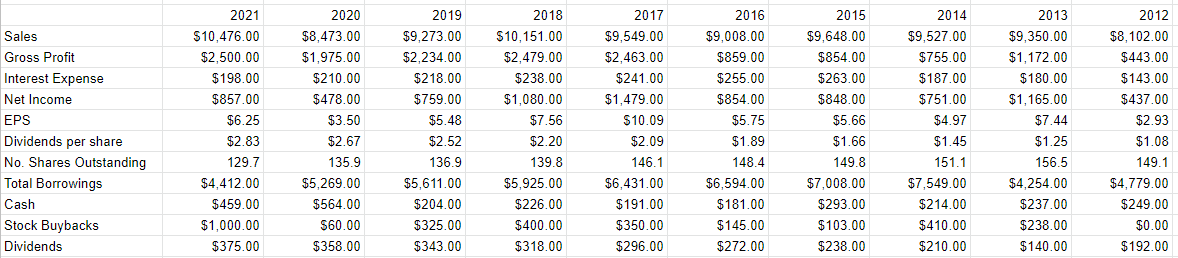

EMN Financial Snapshot

Given that I’m a “glass half empty” kinda guy, on some level it pains me to admit that I see nothing to complain about regarding the financial picture here. Over the past year, the top line has grown nicely and the bottom line has grown very nicely, up 24% and 79% respectively. Management has rewarded shareholders with a nice 6% increase in the dividend, which continues a very nice tradition the company established years ago. Also, the capital structure has improved dramatically in 2021 relative to 2020, with long term debt down by about $857 million.

Those of you who are interested in history may remember that 2020 was a bit of an awful year, though. That was the year that the world was struck by this virus of still unknown origin called “Covid.” Thus, you may reasonably worry that a comparison to the harsh conditions of 2020 will make the performance in 2021 look unreasonably rosy. If that describes you, fret no further, dear reader. The year 2021 was also quite good relative to 2019. Both revenue and net income in 2021 were ~13% higher than they were in 2019. In my view, the company is quite solid from a financial perspective. If the dividend is sustainable, it might be worth adding to my position here.

Dividend Sustainability

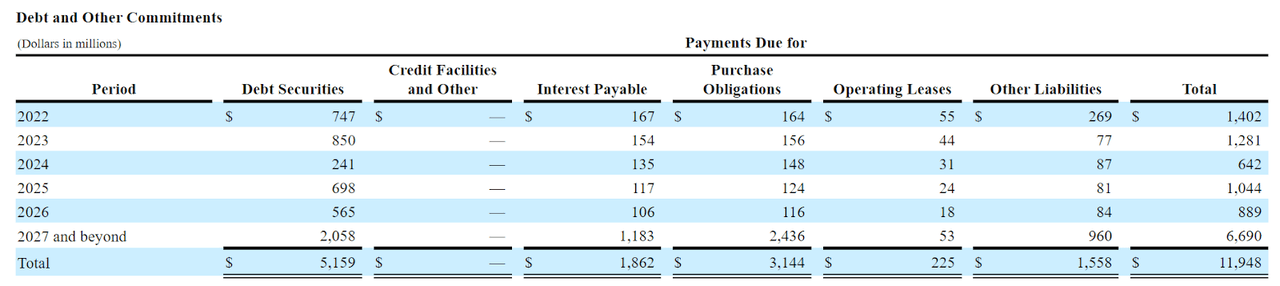

I’m as interested in financial history as the next semi-literate, semi-sane person, but investors are more interested in the future for obvious reasons. In particular, they’re interested in dividend sustainability at a company like this because a sustainable dividend funds things like my whiskey acquisition fund, and also offers support for the stock price. Given that I’m absolutely obsessed with making my reader’s lives easier, I want to spend some time writing about the dividend. Although I’m as much of a fan of accrual accounting as any semi-sane person can be, when it comes to tracking the sustainability of a given dividend, I look at cash. I specifically want to compare the size and timing of future cash obligations to the current and likely future sources of cash. Let’s start with the obligations. I’ve taken the liberty of clipping the size and timing of future obligations from page 53 of the latest 10-K for your enjoyment and edification, dear readers. We see from the table below that the company is “on the hook” for ~$1.4 billion this year, and about $1.28 billion next year. Note that debt constitutes the lion’s share of these obligations.

Eastman Chemicals Contractual Obligations. (Eastman Chemicals latest 10-K)

Against these obligations the company has about $459 million in cash and equivalents. Additionally, they’ve generated an average of $1.5 billion in cash from operations over the past three years, while spending an average of about $301 million on CFI activities. All of this suggests to me that the annual dividend payment of ~$375 million is reasonably well covered, and for that reason, I’d be very happy to add to my position at the right price.

Eastman Chemicals Financials (Eastman Chemicals investor relations)

The Stock

Some of you who follow me regularly for some very strange reason know that it’s at this point in the article where I turn into a real spoil sport because I start yammering on about how wonderful companies like Eastman Chemicals can be terrible investments at the wrong price. This is because the business is an organization that sells for a profit. The stock is a proxy whose changing prices supposedly reflect changes in the fortunes of the underlying business. I’m of the view that the stock price changes are much more about future expectations, and the whims of the crowd than anything to do with the business. This is why I look at stocks as things apart from the underlying business.

If you thought I couldn’t belabour this point further, think again, dear reader. I’ll argue this point further because I think it’s important to understand that companies and stocks are different things. I’ll use Eastman Chemical stock itself to demonstrate. The company released annual results on February 24th. If you bought this stock the next day, you’re down about 7.5% since then. If you waited until March 7th, to pick a date completely at random, you’re up about 7.5% since then. Obviously, not much changed at the firm over this short span of time to warrant a 15% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

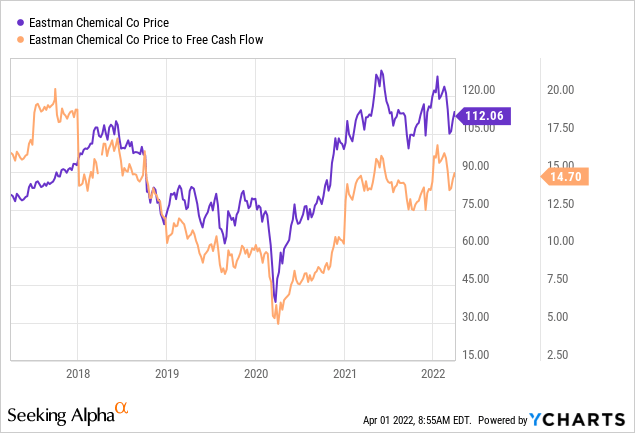

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on this name, I was neither excessively pessimistic nor optimistic about the valuation on a free cash flow basis. In particular, shares were trading at a price to free cash flow of ~21. If you ever wondered what “30% more inexpensive on a price to free cash flow” looks like, well wonder no longer, dear readers. Feast your eyes ‘pon this graphic representation of it.

Source: YCharts

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Eastman Chemicals at the moment suggests the market is assuming that this company will grow at about 2% over the long term. This is pretty nicely pessimistic in my view. Given the valuation, and the history of raising dividends for the past 12 years, I’m going to add to my position here.

But Wait, There’s More…

If you read my stuff regularly, you know that I’m a fan of selling put options on wonderful businesses, because the premia thus received add to the returns. I consider these to be “win-win” trades because the results are positive no matter the outcome. If the shares remain above the strike price, I’ll simply pocket the premium. If the shares fall below the strike price, I’ll be obliged to buy, but will do so at a strike price that I find attractive.

In terms of specifics in this case, I like the September Eastman Chemicals put with a strike of $90. These are currently bid at $2.50, which I consider a reasonable level. So if the shares remain above $90 per share over the next six months, I’ll simply pocket the premium and move on. If the shares drop by about 20% from their current level, I’ll be obliged to buy at a price that generates a 3.4% forward yield.

Now that all of you are hopefully downright giddy at the prospect of discovering a “win-win” trade, it’s time to indulge in my sadistic tendency to spoil the mood by writing about risk. My hope is that this hurts you way more than it does me. Every investment comes with risk, and short puts are no exception. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices. So, for my part, I don’t consider all short puts to be so-called “win-win” trades. I consider them to be “win-win” when they are written on stocks I’d like to own, at prices I’d like to buy. That is definitely a small subset of all put options. Some might suggest that I become less hyperbolic in my speech. Some might be ignored.

Puts are distinct from stocks in that some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. These people don’t want to own the underlying security. I like my sleep far too much to play short puts in this way. I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. For that reason, being exercised isn’t the hardship for me that it might be for many other put writers. My advice is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you’d be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. I think my earlier experiences with The Gap short puts demonstrate this point. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this lengthy, ponderous discussion of risks by revisiting the specific trade I’m recommending here. If Eastman Chemical shares remain above $90 over the next six months, I’ll simply pocket the premium and move on. If the shares fall about 20% in price, I’ll be obliged to buy, but will do so at a net price much lower than the current, already cheap level. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” Strange for me to end a discussion of risk by writing about the risk reducing potential of short puts, but such is the world.

Conclusion

I think Eastman Chemicals had a wonderful year, and I think the dividend is well covered. In spite of this, the shares are very attractively priced in my view. I’m buying 200 more shares this morning, and will be selling the puts described above. If you’re just joining the party and you’re comfortable with selling put options, I’d recommend buying shares and selling the puts described above or similar. If you’re not comfortable with puts, I’d recommend buying the shares of this dividend superstar.

Be the first to comment