underworld111/iStock via Getty Images

Introduction

East West Bancorp (NASDAQ:EWBC) focuses on California where the vast majority of its loans have been issued. Rather than being a US-only bank, East West has a commercial business operating license in China and EWBC currently operates four branches in China and Hong Kong.

The Q3 results are starting to show the impact of higher interest rates

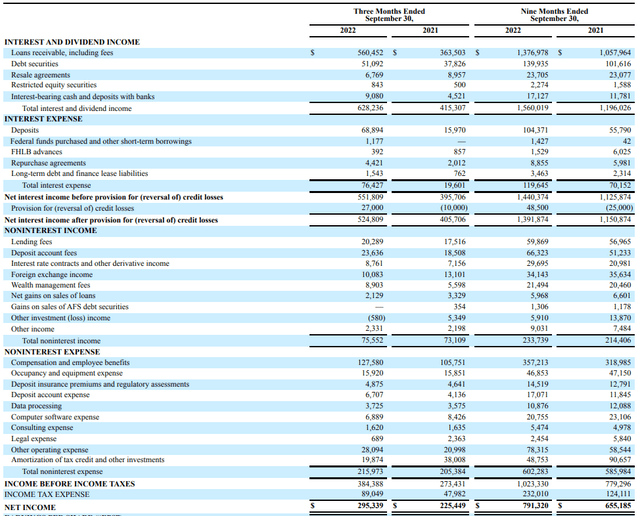

East West clearly saw the impact of increasing interest rates as the total interest and dividend income during the quarter came in at $628M. That’s more than 50% higher than in the third quarter of last year. While the interest expenses obviously also increased (and actually almost quadrupled), the net interest income increased from $396M to $552M. An increase of almost 40%.

The bank reported a total net non-interest expense of approximately $140M which brings the pre-tax and pre loan loss provision at $411M. East West recorded a $27M loan loss provision and allocated $89M in taxes, for a net income of just over $295M. This represents an EPS of $2.10 per share.

In the first nine months of this year, the net income was just over $791M or $5.59 per share, and that includes a $48.5M loan loss provision. The bank currently pays a quarterly dividend of $0.40 per share and that is very clearly very well covered by the quarterly earnings. As a direct consequence, EWBC is not a high dividend payer but the 2.4% dividend yield is very reliable.

The element I like the most? The low LTV ratio of the loan book

I’m not too worried about seeing a sharp increase in the loan loss provisions to $27M. Not only is $27M on a total loan book of almost $47B just a drop in the ocean, it also is just the name of the game: loan losses are unavoidable, it’s just important to keep them as limited as possible. And in EWBC’s case, the loan loss provision represented less than 7% of the pre-tax income.

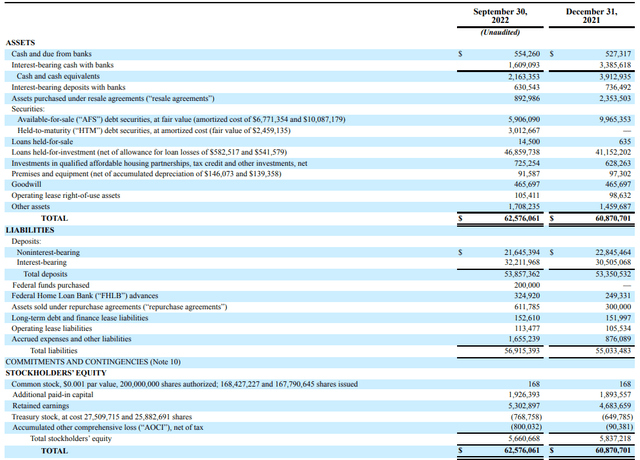

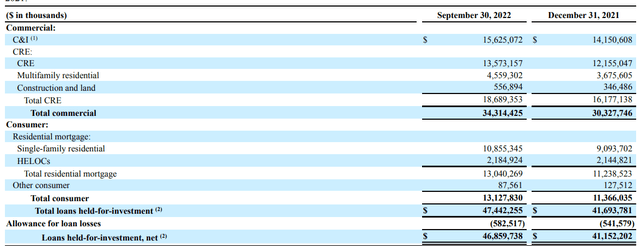

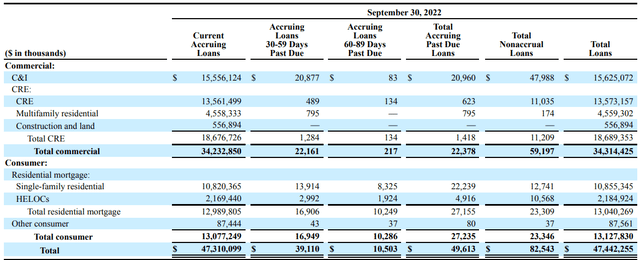

As you can see in the image above, the vast majority of the assets is invested in the loan book, which had a total size of almost $47B as of the end of September. Approximately $13B is related to residential asset related loans with about $34.3B related to commercial and commercial real estate loans.

First of all, it’s important to know that the vast majority of the loans is current. The total amount of non-accruing loans was just $82.5M as of the end of September. This is less than 0.2% of the loan book.

This total amount of $82.5M in non-accruing loans and even the $130M in total loans past due (including the loans that are past due but are still accruing) is very handsomely covered by the almost $583M in total loan loss provisions.

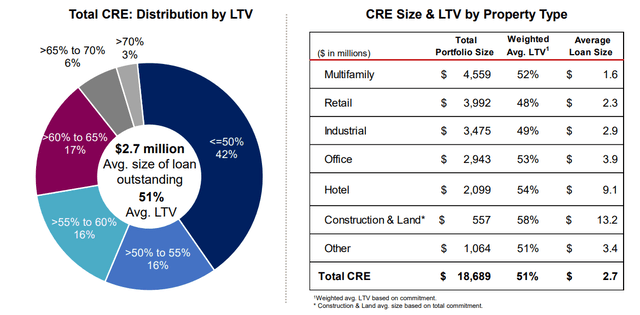

Another reason why I’m not too worried about EWBC’s loan book is the quality of the loans with very low LTV values. Looking at the average LTV ratio in the commercial real estate portfolio, the Loan-To-Value ratio is 51%. That being said, about 42% of the loans has an average LTV ratio of less than 50% and 74% of the loans has an LTV ratio below 60%. While this obviously does not exclude all risks, it is clear EWBC chose to run its balance sheet in a relatively conservative way.

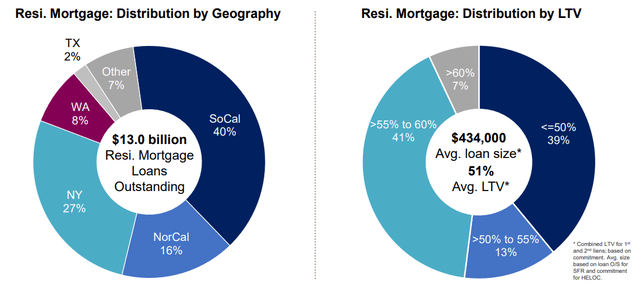

We see a similar ratio in the residential mortgage portfolio. The average LTV is approximately 51% as well with a stunning 93% of the loans having a loan-to-value ratio of less than 60%.

And with about 52% of the residential mortgage portfolio having an LTV value of less than 55%, I think EWBC is pretty safe as well. Again, loan losses can never be ruled out, but it should be pretty manageable given East West’s strong net income generation and robust balance sheet.

Investment thesis

Unfortunately EWBC was hit by the value decrease of the securities available for sale and that resulted in a loss of in excess of $0.6B. A portion of the portfolio that was officially recorded as ‘available for sale’ has now been moved over to the ‘held to maturity’ status and this should reduce the swings in the fair value of these securities as those no longer have to be marked to market.

The loss on the fair value of the securities AFS portfolio had a negative impact on EWBC’s balance sheet. Despite reporting a total net income of in excess of $790M and even after taking the $170M in dividend payments in the first nine months of the year into account, the book value did not increase by the $600M in retained earnings: the total equity value decreased to $5.66B and this drop of ‘just’ $177M is largely thanks to EWBC’s ability to generate strong earnings. This likely also indicates the worst is behind us and East West Bancorp will likely be able to increase its book value again from either this quarter or next quarter on.

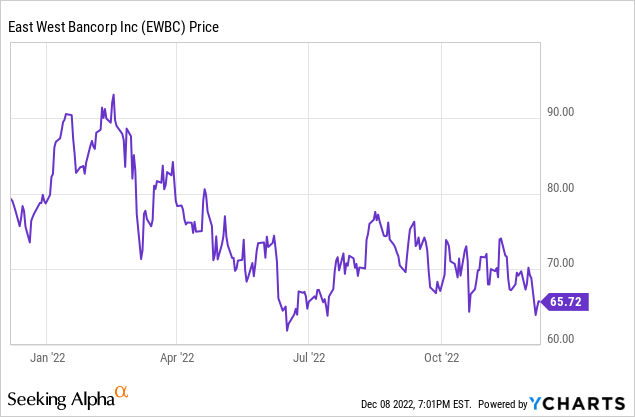

The tangible book value per share as of the end of September was just under $37. This means the stock is trading at about 1.8 times the tangible book value. That’s rather rich but EWBC will likely be able to increase its book value by about $5/share per year by retaining a large portion of its quarterly earnings. I would not be surprised if East West would end 2024 with a tangible book value of $48-49 per share and this, in combination with increasing earnings thanks to the higher interest rates, make the bank appealing. I currently have no position, but I will give EWBC a good look.

Be the first to comment