gremlin/E+ via Getty Images

Palantir Technologies Inc. (NYSE:PLTR) is a battleground stock. Over the last year returns (rather losses) have been absolutely brutal. Frankly, it has been a total disaster for longs, and shorts have succeeded. About a month ago, we hypothesized that the bottom was in. So far, we think that the bottom was recognized. The coming earnings (scheduled for August 8) will undoubtedly be a catalyst to send the stock moving in either direction on massive volumes.

To be clear, we are expecting a major move. Investors should prepare for a bull/bear war, and traders should be able to leverage the volatility in the short-term for some easy swing trade gains. That said, we still view Palantir as a long-term investment, and so long as management does not dilute shareholders into oblivion, we believe the stock will provide returns from the single-digit levels. We understand that there are still a lot of retail “bag-holders” out there who piled into the stock in the high teens or 20’s.

The stock has more than made a round trip from its direct public offering price. We had been very bullish even in the 20s on the prospects for the company and the stock. Of course, the bear market of 2022 has had an iron grip on investors, and frankly just about every no-earnings or low-earnings tech stock has been obliterated from highs. It is not uncommon to see some of these down 60-70, even 80%. But the stock has emerged from the depths, and is quietly up 50% off lows.

Still, most investors are underwater. Traders have made money long and short. While we are traders week to week, we are also very long-term investors. And we hate to see investors lose money, and we know it can be painful. The question is, what can we expect going forward? The stock will be held back until it can reliably grow and slow down dilution. Further, in this column we look back to performance, and discuss the Q2 view that was provided by management. We also believe that the reported results may come in ahead of expectations on some areas (such as new customers and backlog), but below expectation in other areas, such as earnings per share.

The biggest short-term issues holding back shares

The stock has been beaten and then relatively pinned down due to being a high revenue growth, innovative tech stock. Palantir, and stocks of companies that are similar to it, are indeed often extremely expensive in the early stages of being public. They usually lose money and fight to grow sales, then eventually work toward breakeven, positive cash flow, and eventually, EPS positive. The thing is that you really cannot value these stock on an earnings basis because there are no or very little earnings. So, valuation woes are an issue. Even in the high single-digits the stock is expensive on most valuation measures. Prepare to hear that in the coming war between bulls and bears. It is coming. Overvalued vs. growth at a somewhat reasonable price. That will be one of the debates you see in the comment sections of articles discussing earnings.

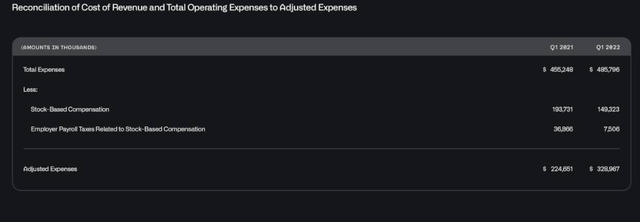

The second issue, which has been discussed before, still remains a huge issue. Palantir has a massive dilution problem, which means consistent positive EPS gets kicked further down the road. We continue to think Palantir has a lot of potential, but this market is beyond unforgiving to those companies that do not make money or have sky high valuations. So by issuing stock based compensation, EPS gets lower and lower even if net income is positive or grows. For years, Palantir may lose money or breakeven. Of course, the theory goes that companies like this will lose money as they spend to attract customers and build their moat. They invest heavily in their growth while seeing revenues increase dramatically. And as we know, Palantir is seeing revenues grow tremendously. Stock based compensation, many would argue, is an investment to attract, acquire, and retain top talent in the tech field. There is a lot of merit to this argument. But in the first quarter of 2022, stock based compensation was still $149 million.

So, this makes increasing EPS all the more difficult. This is another area bears have ammunition in the war against bulls. It has merits. The larger subsequent risk could be that Palantir’s growth fades some or new competitors could emerge, and income generation stalls. The added dilution could continue so long that positive EPS becomes out of reach without future buybacks. It is an issue, even though management acknowledged on the Q1 call that this is a problem.

Operational strengths and weaknesses: perceived or actual war is potentially profitable

You have all heard of the military industrial complex. Palantir has a role in it as governments pay a lot of money for defense (or offense). As we move into the 21st century data is becoming its own weapon. Knowledge is power. Decision making through algorithmic calculation is a gamechanger. Many governments (and businesses) believe the investment in data analytics to power decision-making is worth every cent. Just look this year. We have a conflict in Europe with Russia and Ukraine that Palantir is involved in. You have the United States still selling weapons to Taiwan despite warnings from China. You have North Korea still playing war games. In Palantir’s 10-Q, it indicates it does not do business with those who seek to do harm to the U.S. or go against western democracy, but the many nations that are democratic need the data analysis. We think that government growth is a big future source of growth. For now, commercial growth has been the main driver.

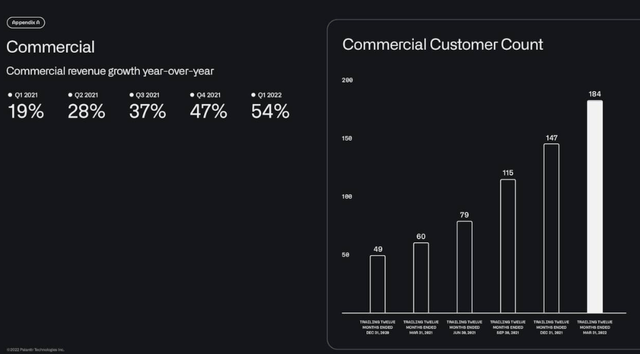

Palantir’s commercial segment strong

In the first quarter, performance was strong on the top line and ahead of consensus estimates. That is great. Again, this is mostly a revenue growth company that is close to breaking even consistently, with some losing and some winning quarters. Total revenue grew 31% year-over-year to $446 million, beating estimates by almost $3 million. However, its profitability was lower than expected by $0.02. Now, that said, Palantir has both government and commercial segments. The commercial revenue stream continues to grow rapidly, while government contracts have grown more moderately.

The company added 37 customers on the commercial side. They also have expanded commercial revenue growth significantly, with commercial revenue rising 54% in Q1. We think we see some normalization in Q2, with 30-40% revenue growth. But war is good for business. And not just for government contracts. Businesses want to know how it may impact them too. Global peace is a hidden headwind to the company in our opinion.

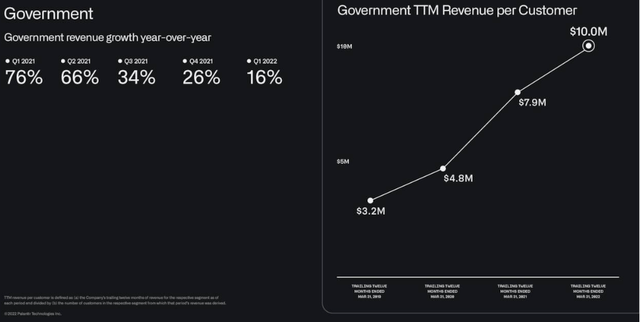

Government segment growing, but slower

Palantir has expanded its sales team and they have been working to secure new orders. However, the Government revenues have slowed their growth somewhat, to just 16% from last year, 3 new customers on the government side. Revenue growth is trending in the wrong direction, for now.

While revenue per customer is up, the revenue growth has clearly decelerated. We do believe that the government segment will see increased demand as global risks increase. We are closely watching for progress on this front when Q2 is reported. We do know of a few recent contracts, including the Army’s Titan program, as well as the U.S. Space Systems.

Palantir is slightly profitable, for now

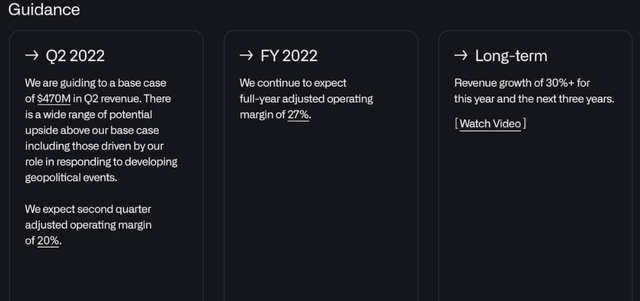

Make no mistake, Palantir is seeing very positive momentum in its margins, which is important in a software company. Adjusted gross margin was 81%. Contribution margin was 57%. First quarter adjusted income from operations, excluding stock-based compensation and related employer payroll taxes was $117 million, representing an adjusted operating margin of 26%, ahead of management’s prior guidance of 23%. This is positive.

However the Q2 expectations are not as bullish.

The biggest concern right now is not valuation. It is not dilution. It is not the “overall market.” The largest issue is a slowdown in performance and the Q2 guidance suggests a slowdown. Management guided to a base case of $470 million in revenue. This was below consensus of $484 million. Now some new contracts may indeed help this revenue figure. However, in the release management noted that “there is a wide range of potential upside [for this] guidance.” Palantir continues to see 30% annual revenue growth through 2025. But where our concerns are here is a lower guide on margins to just 20%. Labor is becoming more expensive. The company had been hiring in Q1 and likely in Q2. Costs of operations are rising thanks to inflation like utilities. These are things many investors do not consider. But every expense matters.

The company lost $39 million in the quarter operationally, but adjusted income from operations was $117 million. The company is still free cash flow positive. Adjusted free cash flow was $30 million for the quarter. That said, the company was profitable at a $0.02 adjusted EPS bottom line figure. We are concerned that if margins come in even lighter than expected, the company will lose on EPS. Frankly, we expect $0.02-$0.03 in EPS on 20% margins, with revenue of $475-$480 million. It is difficult to pinpoint however, as revenue recognition from contracts is never straightforward.

While war is a positive catalyst in many regards, the threat of a recession could be a catalyst in either direction. On one hand, companies will want to save money. If they get a big return on investment in Palantir’s software, they may up their spend here collectively. Alternatively, inflation is putting a lot of pressure on consumers, and while Palantir’s technology should help businesses operate more efficiently, and therefore more profitably, we could see reduced spending on services like this. If tax rolls are impacted, government spending could also go either way.

Final thoughts

We think the Q2 results are going to move Palantir stock heavily. We love that the company operates with no debt and has nice positive free cash flow. Big data, analytics, and algorithmic decision making to improve operations can benefit both businesses and governments alike.

War seems to be a real catalyst, while recession could be either a negative or positive catalyst. The customer growth is impressive as is the revenue growth on the commercial side, but there remains a strong opportunity to start expanding revenue growth on the government side. We are closely watching margins in Q2, as they could be a driver for stock movement.

While the stock remains expensive on most valuation approaches, we also want to see a reduction in stock based compensation to limit dilution. Most importantly, understanding how the current economic climate is impact the business will be paramount.

Be the first to comment