Khanchit Khirisutchalual

A Quick Take On Earlyworks

Earlyworks Co., Ltd. (ELWS) has filed proposed terms to raise $6 million in gross proceeds from the sale of American Depositary Shares representing underlying common stock in an IPO, according to an amended registration statement.

The firm is developing distributed ledger software technologies.

Given the company’s tiny size, thin capitalization, high operating losses and excessive valuation assumptions, I’ll pass on the Earlyworks Co., Ltd. IPO.

Earlyworks’ Overview

Tokyo, Japan-based Earlyworks Co., Ltd. was founded to create its Grid Ledger System, a blockchain-type software technology for use in various industries such as metaverse applications.

Management is headed by Chief Executive Officer Mr. Satoshi Kobayashi, who has been with the firm since its inception in 2018 and was previously a representative director at FEELO and manager of Pasona in charge of consulting.

The company’s primary offerings include:

-

Advertisement tracking

-

Online visitor management

-

NFT sales.

As of April 30, 2022, Earlyworks has booked fair market value investment of $14.3 million from investors including Satoshi Kobayashi, Hiroki Yamamoto and Themis Capital GK.

Earlyworks – Customer Acquisition

The company pursues customers needing its software development, consulting and solution service offerings to businesses.

The firm’s top three customers accounted for 81.5% of its revenue for the fiscal year ended April 30, 2022, so it has high customer concentration risk.

Selling & Marketing expenses as a percentage of total revenue have dropped as revenues have increased from a tiny base, as the figures below indicate:

|

Selling & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

FYE April 30, 2022 |

6.4% |

|

FYE April 30, 2021 |

19.4% |

(Source – SEC.)

The Selling & Marketing efficiency multiple, defined as how many dollars of additional new revenue, are generated by each dollar of Selling & Marketing spend, was 8.4x in the most recent reporting period. (Source – SEC.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ELWS’s most recent calculation was negative (6%)% as of April 30, 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

117% |

|

EBITDA % |

-123% |

|

Total |

-6% |

(Source – SEC.)

Earlyworks’ Market & Competition

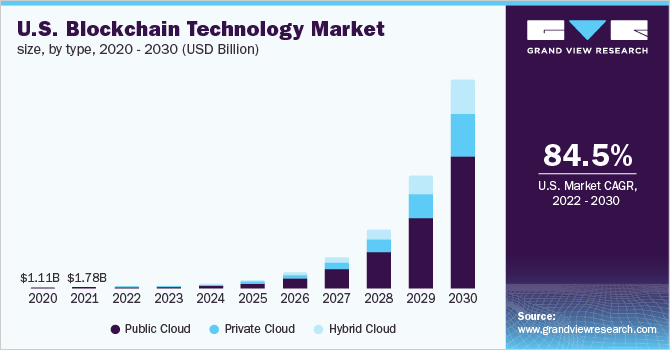

According to a 2022 market research report by Grand View Research, the global market for blockchain technologies was an estimated $5.9 billion in 2021 and is forecast to reach $1.6 trillion by 2030.

This represents a forecast CAGR of 85.9% from 2022 to 2030.

The main drivers for this expected growth are increased adoption by emerging businesses, growing venture capital funding, and broadening of legalization of cryptocurrency activities worldwide.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. blockchain technology market through 2030:

U.S. Blockchain Technology Market (Grand View Research)

Major competitive or other industry participants include:

-

IBM Corp.

-

Microsoft Corp.

-

The Linux Foundation

-

BTL Group Ltd.

-

Chain

-

Deloitte Touche Tohmatsu

-

Digital Asset Holdings, LLC

-

Global Arena Holding, Inc.

-

Monax

-

Others.

Earlyworks Co., Ltd. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue from a tiny base

-

Increasing gross profit but reduced gross margin

-

Higher operating losses

-

Growing cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

FYE April 30, 2022 |

$ 3,569,814 |

117.2% |

|

FYE April 30, 2021 |

$ 1,643,207 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

FYE April 30, 2022 |

$ 2,735,482 |

97.0% |

|

FYE April 30, 2021 |

$ 1,388,287 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

FYE April 30, 2022 |

76.63% |

|

|

FYE April 30, 2021 |

84.49% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

FYE April 30, 2022 |

$ (4,404,302) |

-123.4% |

|

FYE April 30, 2021 |

$ (677,373) |

-41.2% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

FYE April 30, 2022 |

$ (4,637,987) |

-129.9% |

|

FYE April 30, 2021 |

$ (535,935) |

-15.0% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

FYE April 30, 2022 |

$ 771,876 |

|

|

FYE April 30, 2021 |

$ 262,365 |

|

(Source – SEC.)

As of April 30, 2022, Earlyworks had $5.1 million in cash and $1.2 million in total liabilities.

Free cash flow during the twelve months ended April 30, 2022, was $764,298.

Earlyworks’ IPO Details

Earlyworks Co., Ltd. intends to sell 1.2 million American Depositary Shares representing underlying common stock at a proposed midpoint price of $5.00 per ADS for gross proceeds of approximately $6.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

The firm has also registered 1.8 million ADSs for potential sale by selling shareholders.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $64.2 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 7.98%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately 50% of the net proceeds from this offering for investment in the research and development of GLS and GLS-SDK. GLS is a parallel processing blockchain technology that allows for fast transaction approval. Currently, we are developing a system for a client to verify the functionality of GLS, and we believe the following expenses are necessary to verify the functionality of GLS: programming costs for performance testing, server fees, personnel costs and outsourcing costs for testing, and personnel costs for research based on the testing;

approximately 30% of the net proceeds from this offering for the recruitment of global talents, especially those who have a perspective about global strategies and overseas business development; and

approximately 20% of the net proceeds from this offering for the strengthening of internal governance systems and the investment in businesses engaged in the development of blockchain-based products and services, although as of the date of this prospectus, we have not identified, or engaged in any material discussions regarding, any potential target.

(Source – SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, Earlyworks Co., Ltd. management said the company is not a party to any legal proceeding that would have a material adverse effect on its operations.

The sole listed underwriter of the IPO is Univest Securities.

Valuation Metrics For Earlyworks

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$75,197,000 |

|

Enterprise Value |

$64,166,239 |

|

Price / Sales |

21.06 |

|

EV / Revenue |

17.97 |

|

EV / EBITDA |

-14.57 |

|

Earnings Per Share |

-$0.30 |

|

Operating Margin |

-123.38% |

|

Net Margin |

-129.92% |

|

Float To Outstanding Shares Ratio |

7.98% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

$764,298 |

|

Free Cash Flow Yield Per Share |

1.02% |

|

Debt / EBITDA Multiple |

-0.10 |

|

CapEx Ratio |

101.86 |

|

Revenue Growth Rate |

117.25% |

(Source – SEC.)

Commentary About Earlyworks

Earlyworks Co., Ltd. is seeking U.S. public capital market investment to fund continued R&D efforts and general corporate working capital requirements.

The company’s financials have shown increasing topline revenue from a tiny base, growing gross profit but lower gross margin, increased operating losses and higher cash flow from operations.

Free cash flow for the twelve months ended April 30, 2022, was $764,298.

Selling & Marketing expenses as a percentage of total revenue have fallen as revenue has increased; its Selling & Marketing efficiency multiple was 8.4x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future earnings to reinvest back into its growth initiatives.

The company’s Rule of 40 results have been negative, with growth in revenue more than offset by operating losses contributing to a negative figure for this metric.

The market opportunity for producing distributed ledger technologies is considered to be large and likely to exhibit a very high growth rate in the future, so the company enjoys strong industry growth dynamics in its favor.

Univest Securities is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (53.7%) since their IPO. This is a bottom-tier performance for all significant underwriters during the period.

Risks to the company’s outlook as a public company include its tiny size, thin capitalization and high operating losses.

As for valuation, management is asking IPO investors to pay an Enterprise Value / Revenue multiple of approximately 18x.

The “blockchain” for enterprise approach is an idea that has little in the way of success, so, outside of Bitcoin’s use as an alternative money, the technology is still a solution in search of a problem.

Given the firm’s tiny size, high operating losses and excessive valuation assumptions, I’ll pass on the Earlyworks Co., Ltd. IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment