Miro Nenchev

Investment Thesis:

Eagle Bulk Shipping Inc. (NASDAQ:EGLE) is a dry bulk shipping business, providing its ships for the transport of commodities such as coal. We like the business because its vessels are the type that have the least amount of volatility in price and, due to macro headwinds, are likely to be hit the least.

Although we think macro conditions will be net-negative for EGLE, the business is positioned well to take advantage of current charter rates to at least have a good 2022. With the current order book remaining low, we are expecting the cyclical nature of the industry to be less damaging. Charter rates remain at a heightened level, as a result of inflation and the Russian invasion of Ukraine. The impact of these two will not dissipate quickly and that is what investors can benefit from with EGLE.

Within this industry, it is not uncommon to find businesses with shaky balance sheets that are one recession away from being deleted from existence. This is not the case with EGLE: the balance sheet is solid, and the vessels’ value more than covers the debt positions.

With the business’s current dividend policy and efficient operations, investors should be rewarded comfortably with a strong yield, which currently sits at 12.82%.

We thus rate EGLE a buy.

Company Description:

Eagle is a shipping business with a fleet of 53 dry bulk ships, comprising predominantly Ultramax and Supramax.

EGLE’s ships are in the region of 55-65 thousand metric tons (DWT) and carry such goods as coal, iron ore, grains, and other bulks.

The shipping industry has had eventful few years. It had an initial crash during the COVID-19 pandemic, as economies (and thus demand) ground to a halt. Subsequently, we saw a resurgence as supply chains struggled to get up to capacity, while pent-up demand exploded.

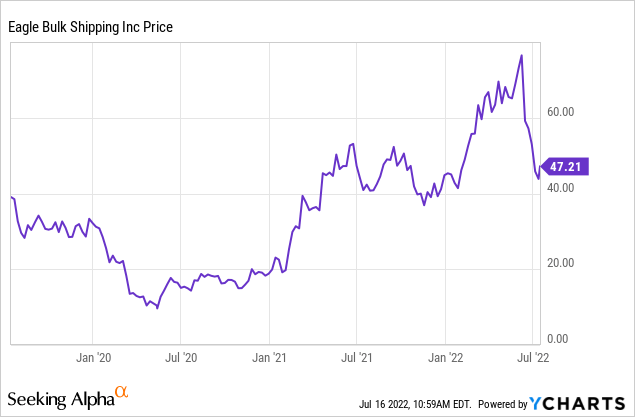

EGLE’s share price has moved in unison with this, falling from $30 to $10 and then subsequently rising to $76, before falling again to $47. Prospective investors should understand this from the start: although shipping businesses are attractive for their yield, their stock prices are far more volatile than your average high dividend stock.

Macro considerations:

Shipping businesses act as a bridge between the demand for goods within an economy and the producers. With the move towards globalization, the shipping industry and the world economy have become highly correlated. Therefore, to assess EGLE’s medium-term prospects, we need to look at the health of the world economy.

Inflation:

Inflation in the U.S. hit 9.1% in May-22, on the back of persistent cost increases across specific industries, including energy. This has led to many countries approaching a cost-of-living crisis, with people struggling to service their short-term obligations. This has investors fearing stagflation, as discretionary spending falls but inflationary pressure remains. The problem for EGLE here is that charter rates have risen on the back of this inflation, and companies have bid-up rates in order to meet demand. This can only continue for so long, however, and we may finally be seeing the impact of this. If economic growth slows, so will the demand for dry commodities.

A counterpoint here is that many of the goods EGLE transports are necessities, such as grain and coal, and so even if economies begin to struggle, much of the demand will not dissipate.

Russian Invasion:

The Russian invasion of Ukraine has had a material impact on EGLE’s industry. The reason for this is that Ukraine is a major exporter of coal and grain, as is Russia. With sanctions placed on Russia, these commodities need to be transported from other countries, causing major disruption and thus demand for ships. Further, it is significantly more difficult to now get Ukrainian goods outside of the country as Russia has targeted ports. Should Ukraine fall, these commodities will also be lost.

The final impact, which is likely the most impactful in the short-to-medium term, is the restrictions on Russian oil (and the potential loss of Ukrainian liquefied natural gas). Russia is the largest provider of oil to the continent of Europe, and the region is now looking to completely move away from Russian imports. Germany has already halted the controversial Nord Stream 2 and is targeting an end to imports in 2022. The replacement for this, especially for Germany (Who is the largest European economy and anti-nuclear), is likely coal. Even those who would like to ramp up nuclear have little choice in the short-term due to the initial set up cost (time and financial).

This should mean sustained demand for coal, which otherwise was a commodity being slowly phased out in the western world. With winter approaching, we could see a short-term spike in demand for coal transportation, especially if Russia shuts off supply to Europe at a critical time.

Fuel prices:

As these ships require fuel, it is logical to argue that rising fuel prices will harm EGLE’s margins, and so there is an offset effect. According to Star Bulk Carriers (SBLK), though, this is not necessarily the case. The reason for this is that when fuel prices increase, the ships go slower to compensate. This leads to less overall tonnage being transported which bids up charter rates.

Further, 47 of EGLE’s ships can operate on high sulfur fuel oil (HSFO) and so can take advantage of lower costs relative to very low sulfur fuel oil (VLSFO). The delta between the two fuels is widening, with HSFO falling. EGLE estimated that the benefit of this is c.$39M, although it will likely be higher now.

Interest rates:

Interest rates are slowly increasing globally in response to inflation. This has a compounding effect of slowing growth, which as we touched on above, will bring down demand. Further, this will impact EGLE’s current and future financing arrangements, which will eat away at profits and distributable returns.

China:

If problems from one country were not enough, we have China as well. The Chinese economy has been showing cracks in the last year or so, with the housing market beginning to struggle and the country remaining stubborn on its zero-COVID policy. Although the economy is growing, it is not by much, and many have suggested the period of expansionary Chinese growth through domestic spending may end. This has already had an impact on iron ore prices, which have fallen aggressively on the fears that demand from the Chinese construction market will fall.

Additionally, with China continuing to threaten Taiwan and speak ill of Australia, we may see further negative disruption in the future. Even if this is just China reducing its exposure to Australian coal. The question is if they begin importing from Russia, which could lock EGLE out of the market.

GDP:

The culmination of the above is a bleak outlook for growth, which is one of the reasons we are seeing markets react as they are. We should however add that a period of stagflation or even a recession is not a certainty. The UK economy, for example, returned to growth in May, which was surprising to some but evidence of health in the economy.

Shipping industry:

The shipping industry has seen a boom in new builds / the order book as businesses look to take advantage of heightened prices. The issue here is that we may approach a time where demand falls but supply of ships continues to expand. The inevitable impact is a correction in charter rates. For dry bulks, however, this is not the case. Intermodal notes that levels remain low, with this unlikely to change. This should mean that there is not price decay from supply at least, which is very good news for investors.

EGLE is arguably in the best segment of the dry bulk market, owning Supramax and Ultramax vessels. The reason for this is that these vessels historically have had less volatility and generally have a better utilization. This is due to the greater flexibility that comes with the size, allowing for more types of commodities which can be shipped. The attractiveness of Capesize is the greater margins, but you trade on volatility and less certain income. With coal and iron ore coming under pressure, we could see Capesize vessels struggle going forward.

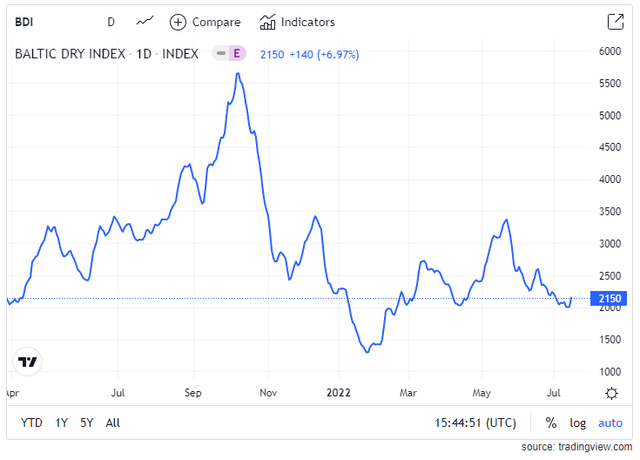

The Baltic Dry Index (BDI) is a great indicator for the health of the market, as it tracks the daily charter rates of dry bulk vessels in several routes.

We note that prices seem to be stabilizing after a sharp fall in October. Inflationary pressures and the Russian invasion likely have been catalysts for the move higher at several points in the last few months, and these issues are not going away. We could realistically see this continue in 2023. At these prices, EGLE is incredibly profitable, and that should mean large distributions for shareholders.

Financials:

EGLE has spent 9 of the last 11 years losing money, which is quite the achievement. In FY20, however, the business posted a fantastic $185M in net profit. This was on the back of 116.1% increase in revenue. What we like is that the business has very little in expenses outside of CoGS, with its OPM at 44% and GPM at 58.7% (Source: Tikr Terminal).

Balance sheet-wise, EGLE is in a good place. The business currently has c.$330M in long-term debt, which has been refinanced in Oct-21 at a lower interest rate and has a maturity in 2026. With vessels valued at c.$900M, the business is comfortably capitalized. In all likelihood, vessel valuations will begin to fall somewhat but EGLE has the margin to be comfortable. Given the cyclical nature of the business, liquidity is key and we believe the cash balance of $84M is sufficient. The business’s current ratio is 1.37, underpinning this (Source: Tikr Terminal).

Valuation:

EGLE’s current yield is extremely attractive at 12.82%. With inflation eating away at the value of cash, and equity markets heading in one direction, EGLE is a great proposition for investors looking for cash returns. EGLE’s policy is to distribute 30% of net income, which, based on analyst estimates, would mean a yield of 13.5% in 2022 and 7.7% in 2023 (Source: Tikr Terminal / Author’s calculation).

The entry price, however, must be correct. As we have mentioned, the sector is extremely volatile, and so investors should look to make money in both capital appreciation and dividends, as a sharp correction can wipe out any cash returns.

EGLE is currently trading at a P/E ratio of 0.95 and a multiple of FCF of 4.4x. This is incredibly attractive, with the business trading well below the likes of Danaos (DAC), Costamare (CMRE), GSL and others. Although some may have greater visibility on cash flow, such as GSL, the discount on the valuation reflects the risk.

Furthermore, we should take a step back. The business has a market cap of c.$646M. With vessels worth c.$919M, cash of $86M and net current assets to convert into cash of $50M. When we deduct the businesses debt positions of $330M, we get a value of $725M. This gives us a large margin of safety on the current asset base, and this does not factor in the free cash flow that will be generated in the near future.

Final Thoughts:

EGLE is a great business and arguably has the best potential among a lot of the shipping businesses at its size. We really like the size of its vessels, and, at their current age, we are not fearful of a need to replace them. Certain macro conditions should be beneficial for the business, but the overall view is that headwinds are ahead. This is not a low-risk investment, however. Although the charter rates have lower volatility than others, it is still quite volatile. Eagle’s profitability history is evidence of this. Investors will need to monitor this stock very carefully.

What has tipped our view on EGLE stock is its current valuation. At this price, you are buying the businesses at a slight discount to its book value, with several months at least of the current heightened charter rates. During this period, investors can enjoy high dividends.

We are under no illusion that market sentiment is low, and so in all likelihood EGLE will follow whatever the market does. Therefore, investors assessing EGLE should consider scaling into a position over time, as dividends will not protect against large swings.

We rate EGLE a buy.

Be the first to comment