landbysea

An Intro To Eagle Bulk Shipping

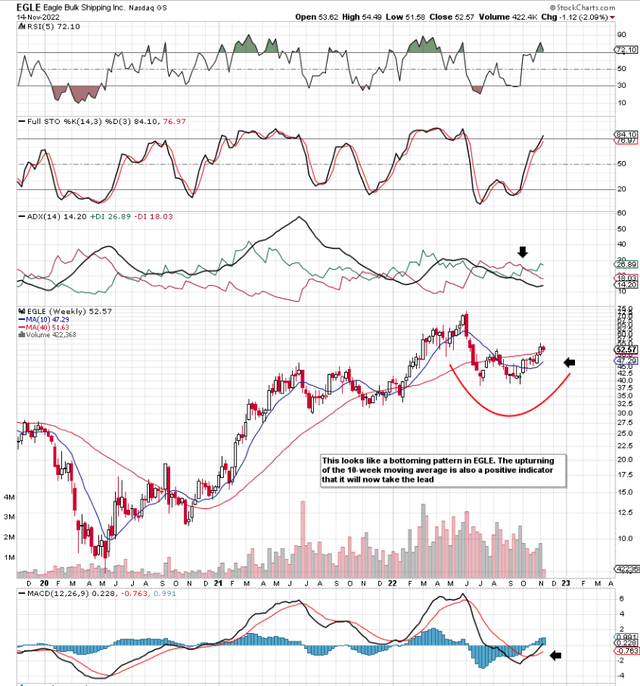

If we pull up a 5-year technical chart of Eagle Bulk Shipping Inc. (NASDAQ:EGLE), we see that shares have been in bullish mode for quite a number of weeks now. Recently, we got our ADX crossover which coincided briefly thereafter with a crossover of the popular MACD indicator. Probably the final piece of the jigsaw with respect to confirming Eagle’s bullish technicals would be for the stock’s 10-week moving average ($47.29) to cross above the corresponding 40-week average ($51.63). This would bring trend-followers into the picture as a sharp up-move would most likely increase that ADX reading above the important “20” level (this would potentially mark the beginning of a sustained trend).

Eagle Bulk Technical Chart (Stockcharts.com)

If indeed, EGLE is destined to commence a sustained bullish move, the real calling card in this play is its excellent dividend. The board of directors is just off the back of announcing a quarterly dividend of $1.80 per share, which was paid to shareholders yesterday (November 14th). Although this amount was down from the previous quarter ($2.20), the trailing dividend yield now comes in at 15%+. This is based on $8.05 in dividend payments on a present share price of $52.57.

Therefore, let’s delve into the trends of the key metrics which make up Eagle’s dividend. A strong, sustainable dividend is usually a sign that a higher share price in Eagle is on the way.

EGLE’s Dividend Pay-Out Ratio

Probably the fastest way to get a snapshot of the sustainability of the payout is the payout ratio. With $8.05 per share of dividends having been paid out over the past four quarters from a free-cash-flow purse of $23.23 per share, EGLE’s dividend payout ratio currently comes in at 34.65%. Although this number looks very attractive on the surface, projecting payout ratios in this industry is an extremely difficult task given how trading conditions can change. In saying this, Eagle´s forward cash-flow multiple of 2.68 is definitely a bullish multiple with respect to dividend affordability.

Interest Coverage Ratio

Declining or stable interest payments is bullish for the dividend long-term, as more of the company’s EBITDA can drop to the bottom line. Just under $19 million in net interest expense was paid over the past four quarters from an operating profit of $311.8 million. These numbers correspond to an interest coverage ratio of 16.76, which is well north of the average in this sector (10.61).

Two trends have really taken the pressure off Eagle’s income statement and the cash-flow statement probably for some time to come. Firstly is obviously Eagle’s recent operating results, where we have seen really strong sales and earnings numbers over the past four quarters in particular. Furthermore, due to management fixing the debt load to a fixed rate in October of last year as well as using its strong cash-flows to also bring down the debt load aggressively, long-term debt came in almost $100 million lower compared to Q3 last year. Suffice it to say, declining company debt ($354 million) combined with rising shareholder equity ($819.2 million) is bullish for the sustainability of Eagle’s dividend, as these trends definitely give the dividend leeway if indeed earnings disappoint somewhat in upcoming quarters.

Projected Earnings Forecasts

If we look at analysts’ bottom-line estimates over the next few years, we see that earnings per share are expected to drop to $7.39 next year. If we go by a 30% allocation to the dividend which management has been using, the annual dividend would come in at approximately $2.21 per share next year. Therefore, based on Eagle’s prevailing share price of $52.72, the expected yield next year would come in at 4.19%. This yield is obviously a stark difference from what shareholders are earning at present, but it is prudent practice to keep the payout ratio constant in order to protect the balance sheet so the company can keep moving forward. Furthermore, the fact that dividend payments are always a fixed fraction of earnings makes it easier for the market to project the company’s future cash flow.

Conclusion

Investors looking at Eagle Bulk Shipping Inc. should expect a sizable fall in the company’s dividend next year, but this should not deter one from investing in this name. The fixed dividend pay-out ratio brings stability to how cash is allocated and the balance sheet continues to get stronger every quarter. Eagle Bulk Shipping shares remain really cheap from a cash-flow standpoint, and the technicals are pointing to rising prices. We look forward to continued coverage.

Be the first to comment