Olemedia

E3 Lithium Limited (OTCQX:EEMMF) is one of several pre-production lithium producers currently developing some form of Direct Lithium Extraction (“DLE”) technology. The Canadian company intends to use its proprietary DLE process to extract lithium from a large aquifer in the western Canadian province of Alberta. The project holds a great deal of promise and has even managed to attract investment from Imperial Oil Limited (IMO), a large Canadian oil and gas producer. However, this company is not your typical lithium play, as its planned use of the unproven DLE tech means that its stock is subject to an even higher degree of risk than that of your average junior miner. This article will discuss those risks as well as their potential impact on the value of E3’s shares.

Company Backgrounder

E3 has secured claims on Alberta’s Leduc aquifer that will allow it to extract brine from which lithium will be extracted. The company plans to then process the concentrate into hydroxide at an on-site conversion facility capable of producing 20ktpa of battery grade LHM. The hydroxide will presumably then be sold to one of the large numbers of EV battery factories currently under construction in North America.

Exploration work done so far has revealed a resource size of 24.3Mt LCE (Inferred) which, according to E3’s Sept/2021 Preliminary Economic Assessment (“PEA”), would be extracted over 20 years. Management anticipates initial CAPEX to come in at $602 million and opex costs to be just over $3,600/t LHM. The project’s pre-tax NPV8% is just over $1.1 billion, with a pre-tax IRR of 32%. The LHM average selling price per tonne used in deriving these numbers was only ~$14k/t, a reasonable amount when these calculations were made last September but an extremely conservative amount for today’s lithium price environment.

Management has also indicated that there are “significant opportunities” for an upward revision to the resource estimate. That’s unsurprising given the size of the aquifer, which spans hundreds of kilometers and is 200 meters thick, but one would also like to see a higher level of confidence to that estimate. Luckily, we may see that sooner rather than later, as the company recently completed a drill program that will help it get there. Upon completion of the program, Chris Doornbos, E3’s CEO, said that, “confirming our understanding of the Leduc Reservoir increases the geologic confidence in our resource and supports us in meeting important upcoming milestones, such as upgrading from Inferred resources to Measured and Indicated.”

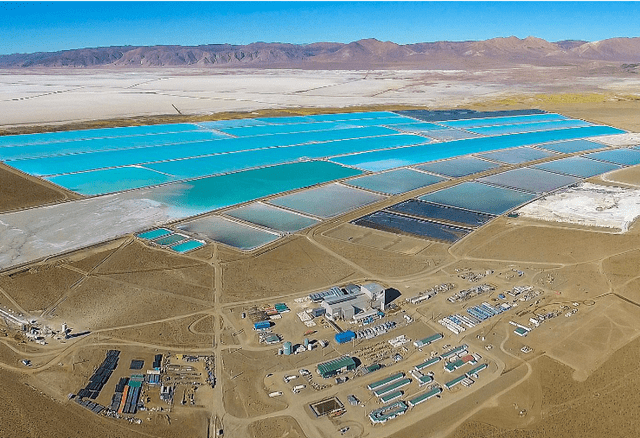

As mentioned in the intro, E3 plans to use a proprietary DLE method to process the brine. That’s a notable departure from almost all conventional lithium brine extraction operations currently in existence. Presently, most of the world’s lithium brine operations are located in the Lithium Triangle, an extremely arid region in South America that stretches between Argentina, Chile, and Bolivia. At such projects, underground brine water is pumped into large ponds that can stretch for kilometers. The brine is then left to evaporate over periods lasting from months to years, after which the residue is processed and eventually produces lithium hydroxide. Evap ponds can account for up to 40% of a project’s CAPEX costs. Below is an image of Allkem Limited’s (OTCPK:OROCF) brine operations in Argentina.

The reasons why E3 plans to use a DLE process are twofold. Firstly, unlike the dry Salars of South America, Alberta’s climate is unsuitable for evaporation ponds. And secondly, lithium concentrations at Leduc are too low. Even if traditional evap ponds were an option, Leduc’s 75 mg/L lithium grade would be uneconomical and could not justify the build out.

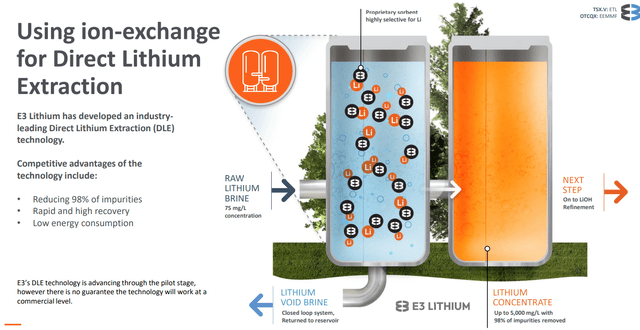

E3 plans to deal with these issues by using its DLE tech which uses proprietary sorbents to extract lithium from the brine through an ion-exchange process. The brine is extracted from the aquifer and pumped through a column filled with sorbents where the lithium is extracted. After which, the brine is then pumped back into the aquifer and E3 is left with high purity lithium concentrate. The aquifer is confined, meaning that there are no inflows or outflows, so all of that lithium is sitting and waiting to be extracted.

Back in January, E3 announced positive test results after running its DLE system for 50 cycles in a lab. That was great news, but it nevertheless happened under ideal conditions in a laboratory. But if E3 can get one column up and running under real-world conditions, it will then be able to use the resulting free cash flow to finance additional columns. This would give E3 the ability to scale production much more quickly than all other lithium producers who use more traditional methods such as evaporation ponds or even hard rock mining.

Rationale For the Hold Rating

E3 currently trades at an Enterprise Value of about $100M, just 9% of NPV which itself was calculated using a very conservative lithium price assumption. On the face of it, the stock looks like a screaming buy relative to most other junior lithium plays. The issue that I have with it, however, is that at present I don’t view E3 as a typical lithium play.

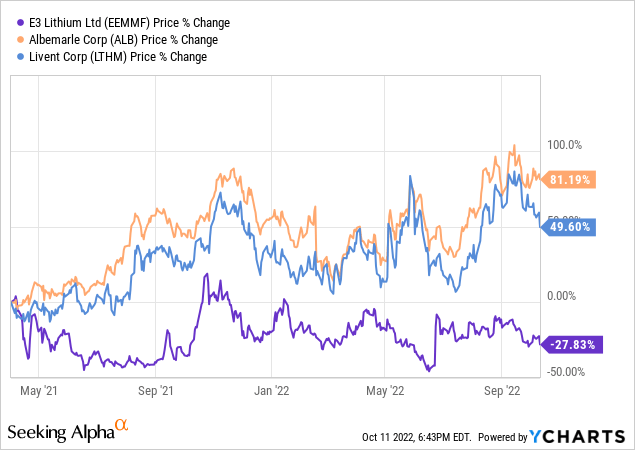

After peaking and falling back somewhat in early 2021, the stock has been rangebound for most of the last year and a half. That’s in spite of the sharp rise in the price of carbonate that has pushed most other lithium stocks much higher. Below is a comparison of E3’s share price with that of Livent Corporation (LTHM) and Albemarle Corporation (ALB).

The results to E3’s DLE field test will eventually determine whether or not this project is viable and can move forward. The company has been built under the assumption that its DLE process will work and, therefore, the test results will determine whether the stock is worth a lot or not worth much at all.

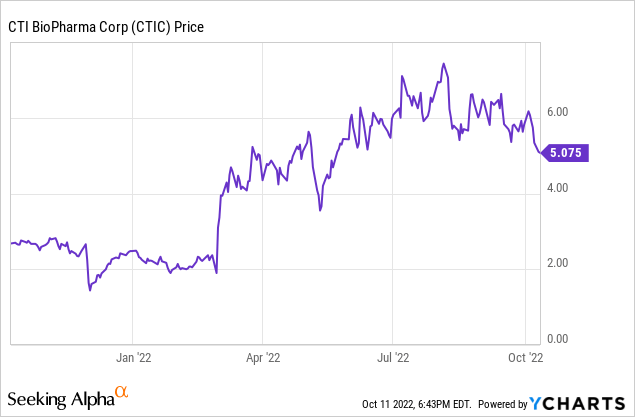

This has created a great deal of event risk and led to E3’s shares trading in a holding pattern very similar to that of biotech stocks awaiting FDA approval. Biotech stocks will often trade flat to down for months or even years until their experimental drug gets either approved or denied by the FDA, at which point the stock usually rockets higher or crashes. An example is the FDA approval of CTI BioPharma Corp.’s (CTIC) therapy in March, which caused its share price to rocket up over 100% in a day.

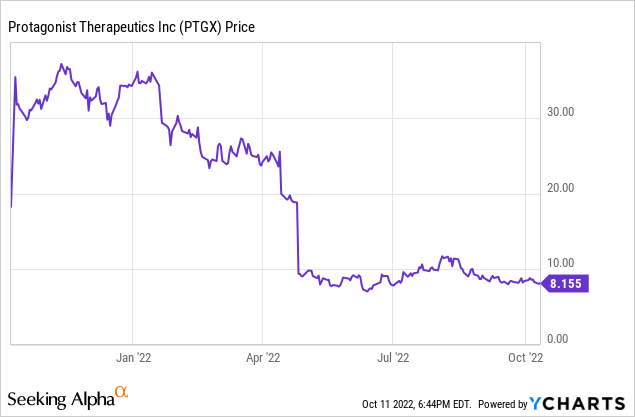

And the opposite can also occur, as a negative FDA announcement in April caused Protagonist’s stock to plummet.

I believe that E3’s shares will continue to trade within the same range until there is some clarity as to whether or not its DLE technology will work in the field. And when that announcement is eventually made the stock will either rocket higher or plummet, depending on the success of the company’s field tests.

Takeaway

Of course, there’s nothing wrong with investing in companies that have a lot of event risk. In fact, investing in convention junior lithium miners comes with a great deal of both execution risk as well as some event risk surrounding resource discoveries, resource size adjustments, and yields. But as most readers are probably well aware, the amount, degree and type of risk that one chooses to include in their portfolio must be carefully calibrated. The binary outcome that is inherent in E3’s stock is fine for some but this type of straight up or down bet is outside of my risk tolerance. I hope the company is successful in its upcoming field tests but I won’t be an investor until I see those results. However, if the company’s DLE tech does prove to work as promised I’ll definitely take another look at the company and I will probably even be ready to buy the stock at a substantial premium to what it trades at today.

Be the first to comment