Phil Walter/Getty Images Entertainment

A slowdown in the economy indicates layoffs, which in turn indicate people showing up as their best self at interviews. When someone is stacked against 20 other candidates for a position, they have very good reason to gain a noticeable edge, which makes buying an affordable fast-fashion piece a very appealing option. This is part of the reasoning why investors should take a closer look at Industria de Diseño Textil, S.A. (OTCPK:IDEXY, OTCPK:IDEXF) – commonly referred to as Inditex – as the company may be set at to become even bigger due to current economic shifts.

Inditex seems to be in a position to benefit from a slowdown because of the mid to lower-end pricing structure of their merchandise. As people’s earning power is being pressured by rising rates, they tend to lower their shopping preferences, giving the company an opportunity to take more market share.

I find Inditex to be intrinsically undervalued and a good option for investors looking to get into a portfolio of consumer staples, with a large cap market leader. The stock is a balanced play between long-term growth and a dividend yield of around 4.15%. In my valuation, I estimated the company and its brand Zara to be worth €85.6 billion, or €27.5 per share, implying a 20% discount.

Zara’s 6k+ stores, brand recognition and global presence will allow the company to keep scaling and be a market leader in the industry.

Zara’s Defensive Attributes: The Collection FOMO Cycle and Inflation

A major part in the appeal of fast-fashion retailers is the therapeutic aspect of hunting for bargains. Inditex positions itself as a mid to low-end retailer, allowing people to dress comparably to higher-end brands while gaining a sense of bargain hunting.

The company has a five-week design-to-retail cycle and ships more than 20 collections annually. This cycling between stores (mostly with Zara) keeps the collections fresh and instills a fear of missing out (“FOMO”) in clients, because they know that if they find a good piece, it won’t be there next week. Inditex further pressed the FOMO card by deciding to pass the inflation costs to consumers rather than absorbing the shocks. For customers that expect more inflation in the coming months, this is an additional incentive to buy merchandise now, even though prices are up – since they can expect additional inflation in the future.

Inditex Segments and Geo

Inditex has a rich brand portfolio consisting of its flagship brand Zara – a trend retailer – and five more differentiations. Here is how their brands approach the market relative to Zara:

-

Pull&Bear – Casual & sports

-

Massimo Dutti – Relatively higher end business wear

-

Bershka – Relatively lower end, latest fashion

-

Stradivarius – Women’s urban & casual

-

Oysho – Women’s sports, lingerie, sleepwear.

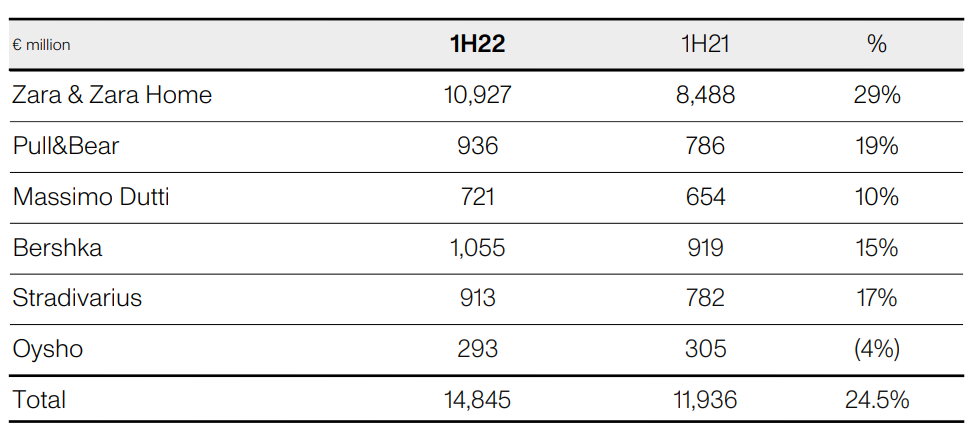

The table below shows the performance of each brand in the first six months of 2022:

Chart 1. Inditex’s Revenue Distribution by Brand (Company presentation)

We can see that total sales increased by 24.5% YoY, with Zara leading the rise, and accounting for 74% of the sales.

For investors, it is important to note that a diversified product portfolio helps drive down risk by testing and establishing different branding strategies. It also allows the company to capture different market segments.

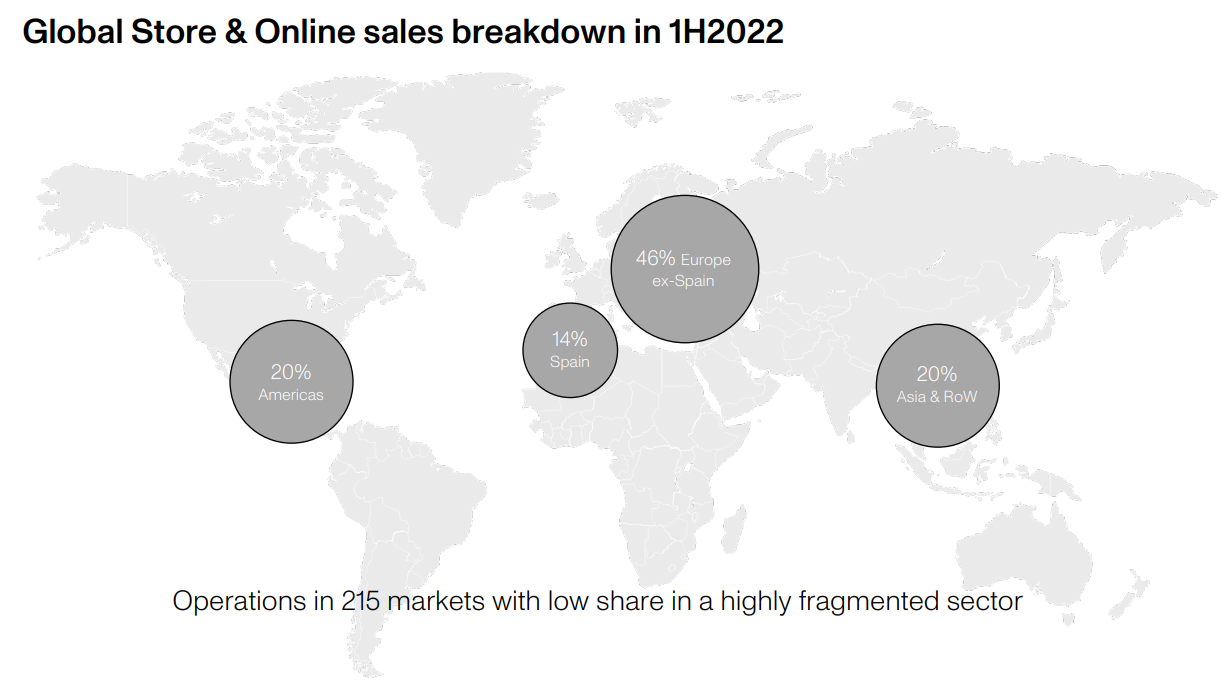

Inditex is a global retailer with 6,477 stores, equivalent to 4.7 million square meters at the end of 2021. The company strives to optimize existing locations and drive growth through digital channels, where it expects online sales to exceed 30% of total sales by 2024 (1, 2).

Chart 2. Inditex’s Revenues by Geography (Company Presentation)

Next, we will examine the fundamentals and see what this means for the company’s valuation.

Financial Performance and Valuation

I estimated the value of Inditex at €85.6 billion, or €27.5 per share. This gives us a 1-year price target of €28.7, implying an upside of around 31%.

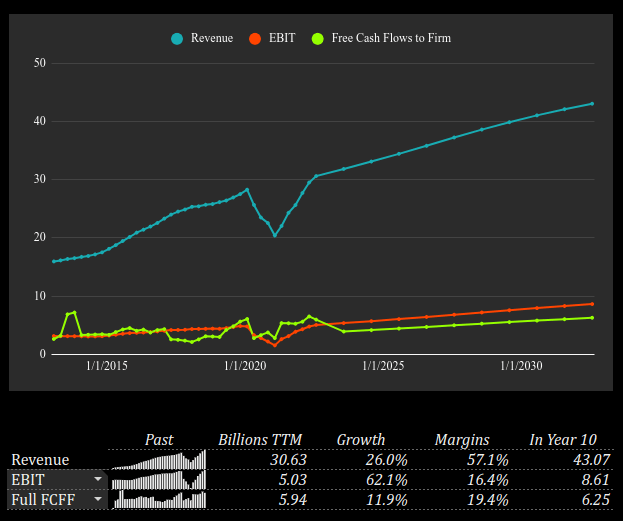

The chart below depicts the model used to arrive at our valuation. You can also view and edit the full model to incorporate your vision of the company.

Chart 3. Inditex’s Financial History and Future Estimates Model (Image created by author with data from FMP)

In order to create the model above, we needed to make some assumptions for the future of the company:

Growth

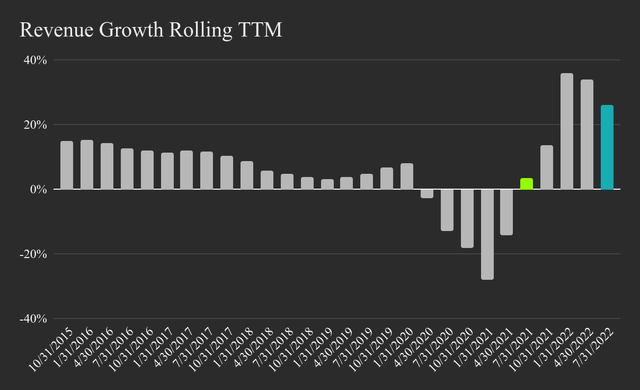

Inditex has managed to get back on the growth trajectory and recovered to €30.6 billion revenue in the last 12 months. Given that the company manages to pass down inflation costs, we can reasonably assume that nominal top-line growth will continue at a steady pace.

Chart 4. Inditex’s Revenue Growth on a TTM Basis (Image created by author with data from FMP)

Profitability

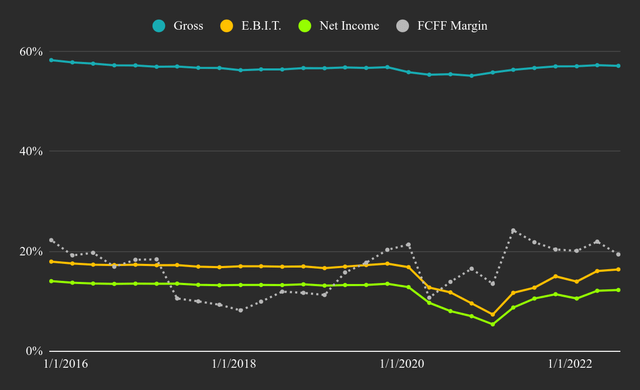

I focus on free cash flows to the firm as a measure of the bottom line. For Inditex, it seems that the company is doing a good job at cash conversion, and the free cash flows frequently rise above EBIT. This is due to a good working capital management and a negative net CapEx – depreciating more than it’s investing.

Currently, the company has an EBIT margin at 16.4% and a FCFF margin slightly higher at 19.4%.

Chart 5. Inditex’s TTM Profitability Margins (Image created by author with data from FMP)

While historical EBIT margins have been below 20%, we may be able to make the case for higher future margins based on the higher profitability of the online distribution business and the future optimization strategies.

Risks

I estimate the company to be 10% less risky than the market portfolio on account of its defensive product line, diversified product portfolio, 7% debt to market value of capital, and risk associated with the apparel industry. However, we need to be mindful of future developments, and we see two potential key risks that may impact the business.

Marketplace Apps

The rise of marketplace apps like Facebook’s marketplace (META), Pinterest (PINS), Etsy (ETSY) and merchant enablers like Shopify (SHOP) and Amazon (AMZN) keeps transferring market share from centralized retailers to smaller and local sellers. While large retailers like Inditex are trend-setters and have efficient production chains integrated in their business, the higher availability may constrain the top-line growth, and diminish the potential of profitability margins. Fast fashion also means easy to make, which is great for marketplace arbitragers, as they can buy clothes from white-label vendors and sell locally at comparable quality.

Circular Fashion Trends

A report by ThredUp (TDUP) estimates that the U.S. secondhand market will rise from $35 billion in 2021 to $82 billion, mostly accounted for by resale activity. While fast-fashion retailers like Zara are deemed to be safer from this trend, investors may want to take into account the increasing accessibility of second-hand solutions. As we mentioned in the beginning – shopping is part therapy, and finding bargains may be substituted with responsible spending.

If management estimates that this is becoming a significant factor, they may attempt to offset it by establishing their own branded version of the approach. However, history indicates that older companies tend to react too slowly to disruptive trends and sometimes end up permanently losing market share.

Possible Investment Approach

While I estimate that the stock is undervalued and in a good position to continue growing, it may be a good strategy to think about Inditex in a bundle with some competitors or disruptors. These companies are beyond the scope of this analysis, but I would consider companies like SHOP, ETSY, PINS, META for a deeper dive on their market potential.

Other than that, investors should expect the return to be delivered roughly 50% as dividends and the other half as price appreciation from increased free cash flows. The stock looks to be a good option for balanced and dividend investors because of its 4.15% dividend yield.

Be the first to comment