Thomas Barwick

1. Misunderstanding the recent Earnings Call may have partly caused the recent price action

As of the time of writing, the stock price of E2open (NYSE:ETWO) is $6.48, after a post-earnings 14% slump on July 12th. It is not uncommon for a stock price to drop after its earnings day, but in the case of ETWO, the market may be overreacting due to certain misunderstandings. Before we examine the company’s fundamentals, let’s first discuss what the media’s coverage of the company’s earnings may have gotten wrong:

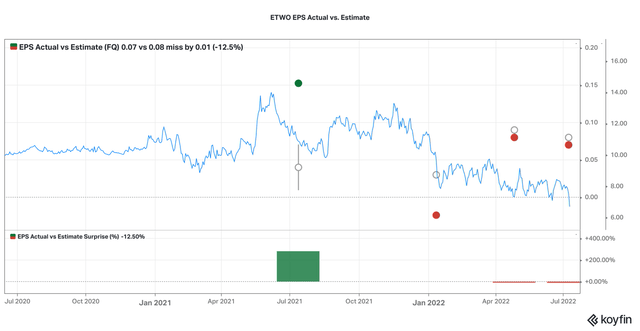

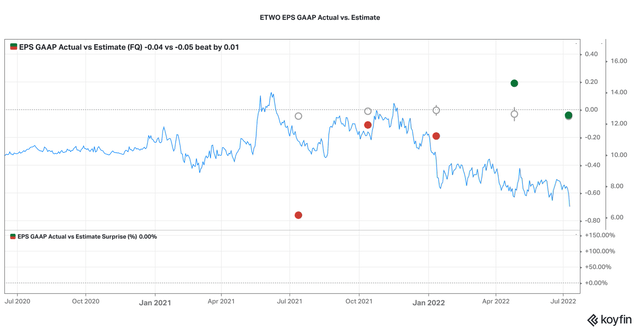

First, news headlines are confusing ETWO’s earnings surprise. Some say “ETWO has met their projected EPS by $0.01/share” while some say “E2open misses by $0.01.” The equivocality comes from the difference between two metrics: EPS and EPS GAAP. In the brief earnings history of ETWO (2021-present), its EPS and EPS GAAP vary, for instance, the FY22 EPS was $0.24 but EPS GAAP was $-0.68. The below shows estimates and actual numbers for each metric, respectively.

For Q1 of FY23, the estimates were $0.08 for EPS but $-0.05 for EPS GAAP. The current ESP was $0.07 for EPS but $-0.04 for EPS GAAP, thus missing EPS by $0.01 but beating ESP GAAP by $0.01. The recent earnings thus look quite decent, but unclear headlines easily confuse investors and thus may cause irrational knee-jerk market reactions.

Having said that, one of the true issues is that the earnings estimates going into the call were too optimistic. The consensus on revenue forecasts was $160.35 M, which was $10 M more than Q4 of FY22 ($150.6 M) but $80 M more than Q1 of FY22 ($88.8 M). We believe that a number closer to the Q1 data rather than Q4’s was likely to be more likely, given that the timing of larger contracts makes E2open’s quarterly year-on-year growth rate vary from quarter to quarter. The analyst consensus therefore set the bar rather high; still, the company beat the estimate with $160.38 M in revenue, an almost x2 growth. Despite this positive signal, the price of ETWO dipped. Therefore, we stand by the view that it was oversold.

Second, the company may be overweighting a new risk factor by lowering its guidance for FY23. They are updating total GAAP revenue to $672-680 M, versus the previous $681-689 M, due to foreign exchange rate fluctuations. The gross profit margin is expected to be lower for the same reason. The company has 15% of its revenues in foreign currencies. The main headwind comes from the depreciation of Euro and British pound. Hence, they are expecting a $9 M negative impact on the revenue. However, it is also possible that this forecasted loss will not happen if the foreign exchange situation normalizes somewhat. In addition, the company has natural hedges in place because some of their costs are also denominated in other currencies. We think that in the mid to long term the growing size of the company’s pipeline is more important than its foreign currency translation. We believe we may be dealing with an issue of representativeness bias: Because the mention of foreign exchange exposure risks appears in their earnings call for the first time, investors overweight new information, giving it more importance than it deserves.

Finally, some of the post-earnings reaction may be influenced by algorithmic reading. The “negative indicators” in the earnings call that are spotted by machine reading techniques may have misled investors. Management used words like “macroeconomic and geopolitical turbulence” and “volatility” many times. Such expressions related to risk factors are precisely what algorithms are trained to pick up. As a result, machine reading of the earnings call transcripts naturally gives media coverage a negative spin. But in reality, management uses “macroeconomic and geopolitical turbulence” to emphasize the continuation of supply chain problems and to highlight the need for companies to invest in supply chain management (SCM) solutions, all contributing to strong demand, a growth factor of E2open’s business. Taking these words without analyzing the whole context of the transcript can cause bearish overreactions.

These three matters together may relate to yesterday’s selloff. One could thus argue that the current price point may actually present a good entry point. Let’s dig deeper into the company’s fundamentals.

2. E2open Operates a Solid Business in a Growing Industry

We have a fundamentally bullish view on E2open for the next 24 months. The company is a competitive provider of cloud-based supply chain solutions, riding a growth trend due to unprecedented demand across industries for agile supply chain management. Yet, ETWO, a stock overshadowed by its SPAC-to-public approach, is under-recognized and lagging behind its peers. Our thesis is that in time the company’s solid business should be reflected in the company’s stock price.

Supply chain issues have been more challenging, essential, and visible in recent years as they affect top-line revenue by disrupting sales flow and operating profits. In addition, there is a need for modernization of current SCM technology, which requires a digital transformation that will last for the foreseeable future. All brings greater opportunities for companies like E2open and its peers, which have a secular overlay with supply chain issues.

E2open is both a tech and SaaS (Software-as-service) company at the intersection of three different businesses: enterprise software, network solutions, and transportation management system. This serves the SCM market, a market that is made up of multiple industries, each with different needs. Consequently, services need to be customized, and each component of the supply chain needs to be addressed. A good source of moat is that once sold, customer retention rates tend to be very high because of the high switching costs. It is also an industry with relatively high entry barriers because it takes time to build partnerships with data providers, warehouses on the ground, transportation systems such as fleet and ocean deliveries, and customer compliance platforms. All of this gives the company and the stock a source of moat and protection that is not always seen in the tech space.

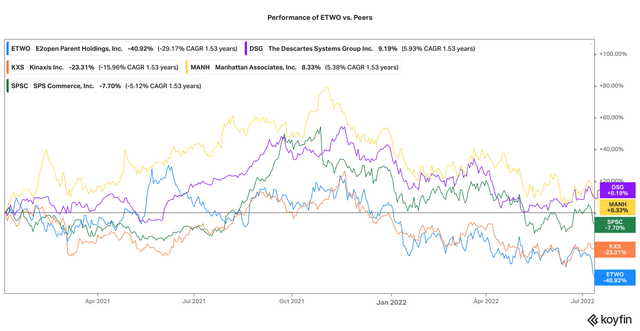

In this fragmented market, leading players include SAP (SAP) and Oracle (ORCL). Both of these big players have more difficulty in attracting new customers partially due to their high fees. Consequently, other players have a large room to grow. Competitors to E2open include public companies, such as Manhattan Associates (MANH), Descartes (DSGX) (DSG:CA), Kinaxis (OTCPK:KXSCF) (KXS:CA), and SPS Commerce (SPSC), and private companies, such as Blue Yonder (acquired by Panasonic) and Infor (acquired by Koch Industries).

So what makes E2open stand out? Compared to its peers, the core products and services provided by E2open have three distinctive features: A unified system of record for planning the supply chain; a trading partner network to incorporate suppliers, vendors, trading partners, and customers into one; and a demand sensing suite to forecast and reflect current market trends with real-time data and AI automation. This is being noted. For example, Gartner reports’ margin quadrant recognized the company as a challenger in transportation management systems, a visionary leader for supply chain planning solutions, and the one with the highest ability to execute the vision in multi-enterprise supply chain business networks.

The main revenue source for E2open comes from service subscriptions. Their customer base is diversified across dozens of industries, including aerospace and defense, food and beverage, ocean carriers, oil and gas, semiconductor manufacturing, pharmaceutical, and more. Among their 600 customers, 125 are companies with $10 B in revenue; the rest is comprised of mid-sized and small-sized companies. According to E2open, their top 100 customer has an average annual subscription of about $1.5 M, an average customer tenure is 15 years, and their overall customer retention rate is over 95%. Subscription revenue also generates 80% of gross margins. The rest comes from professional services and other revenue. All of this suggests that the company’s client base is of high quality and should continue to support ETWO’s growth.

3. ETWO is Under-Recognized

The company has an interesting on and off history with public financing. Founded in 2000, E2open survived the dot-com tech bubble and the following recession in 2001. They went public through IPO in July 2012 under “EOPN” and was acquired by a PE and VC firm Insight Venture Management LLC in 2015. On February 5th, 2021, the company went public again through CC Neuberger Principal Holdings 1, a SPAC put together by Neuberger Berman and CC Capital, with the current ticker “ETWO.”

It was an effective strategy to use a SPAC to swiftly capitalize on the market opportunity, especially in a long-term bull market like the one of late 2020 and 2021. Bypassing the traditional IPO process enabled E2open to quickly finance its growth strategies. Facing the unprecedented demand for SCM solutions, E2open was flexible, adaptive, and the fastest among its peers to gain access to capital. This move in fact shows a pragmatic style of management that should bode well for future growth in potentially turbulent markets.

However, the downside of this SPAC move is that ETWO may have been regarded as a mere opportunistic play. SPAC companies do not do well, especially when the economy takes a downturn. ETWO has been trending down, lagging behind its peers. This is interesting as SCM stocks have generally been up, owning to news headlines on the supply chain issues since last year. This suggests that their SPAC stock association may be causing the stock to unreasonably underperform compared to its peers. Their performance is shown below.

We think that ETWO also has the potential to shine as the company’s growth strategies take effect. First, they are continuously expanding SCM networks by integrating Uber Freight and building new partnerships with KPMG and Accenture. Professional services could become a new revenue driver for E2open in the future. In addition, they are seeking market penetration through upscale and cross-sale to existing customers, which is overall easier for SaaS companies as they can always add features, upgrade customization, etc. They also gain new customers through acquisitions. The two acquisitions of BluJay and Logistyx are being translated into a new customer basis as both have an overlap of 10% only. Besides, E2open is rebranding and aligning their activities with ESG emphasis. The new slogan “Move as one” highlights the attractiveness of their omnichannel solutions and holistic platform.

Financially, E2open has a healthy profile. By Q1 of FY23, E2open has a debt to equity ratio of 30.8% with total debt of $1.06 B and total equity of $3.44 B. Considering its $129.10 M cash and short-term equivalents, the net debt to equity ratio is 27%. Despite that current income and EBIT are negative, which may continue for the following FY, EBITDA-related coverages show a total EBITDA to interest expense ratio of 3.9x, and after adjusting Capex, the ratio is still 3.2x. Cash flow, a very significant metric during a potential recession, looks relatively stable and safe for E2open: They have current cash runaway enough to sustain the operation for at least 3 years. Overall, the solvency of the company seems safe. Their Altman Z-Score is 0.84, 0.02 higher than one month ago.

Finally, company insiders also seem to believe in the company: no one is selling, and stock purchases are relatively common. During the SPAC transaction in February 2021, then private shareholders including Insight Partners received 38% of the new public company. When acquiring BluJay in September 2021, E2open issued 72,383,299 shares of Class A Common Stock to the BluJay sellers. The lock-up period for previously existing shareholders involved in both transactions ended in February 2022, but no selloff occurred then. Insiders aren’t just staying put, but in fact they’re buying more. This is not very common among the flurry of 2021 SPAC companies. Management also then mentioned a possible repurchase program in April. Insiders’ faith in ETWO is a good sign and can also act as a sign to reassure investors during turbulent times.

4. Near-Term Extrinsic and Intrinsic Risks

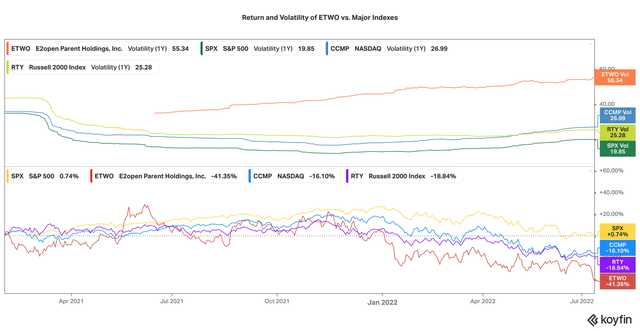

However, for the next 1-6 months, we remain cautious. The price of ETWO will likely be continuously subjected to swings given current market volatility, higher probability of recession, rising credit risk for small-to-mid-sized companies, and potential difficulty to finance growth-style stocks. Although most of these risks are not particular to E2open, its stock is not immune to the upcoming headwinds.

During its short market life, ETWO has been underperforming the market, especially during this year. As the following graph shows, the price return of ETWO is below every index and its volatility keeps increasing.

Market oscillations are a forceful extrinsic factor, and the stock seems to be quite hypersensitive to market downturns. Right now, the market is tilting towards value and large caps; and we are in a midst of a re-valuation cycle. The market is likely to remain unsettled, and the probability to slip downwards is high. None of these factors work in favor of ETWO, a growth-style and small-to-mid cap stock with negative earnings. Continued market volatility in the next few months could hurt the stock further.

Furthermore, E2open may have to compete for public capital with its strongest peer Blue Yonder. When Blue Yonder was acquired by Panasonic Holdings Corp. for $ 7 B in 2021, the CEO of Panasonic reportedly indicated a subsequent IPO most likely in the US. The public debut is uncertain, but whenever Blue Yonder does go public, it could erode ETWO’s attractiveness and threaten its growth.

Finally, an internal challenge comes from the uncertainty in materializing organic business growth. E2open usually gains inorganic product expansion and reduces duplicative costs through M&A, but organic growth seems harder. Management claims that the company’s overall accessible market stands at over $54 B and is expected to grow 12% through 2024. Fully capturing such an unrealized market share is in question though. The company has had a high net subscription retention rate so far, but that has already included upsells, renewals, and price increases as well as down sales and churn. Thus, we believe that only through new customer acquisition will investors’ confidence in the profitability of ETWO increase.

5. While not Overvalued Now, Upward Valuation Depends on Growth Potential

The analysts’ price target for ETWO is $13-14. However, our analysis suggests a conservative range of $5-8 and a floor price of $4. We take a cautious approach because financial data for ETWO valuation is quite limited due to its brief trading history and ongoing acquisitions. Forecasts based on the FY22 report can lead to very different results after adjustments to expenses, taxes, and equity. Considering these factors, we present three perspectives on ETWO’s valuation:

First, we use the company’s history of actual transactions to consider its enterprise value today. When E2open initially went public in 2012, the company had revenue of $60 M and market cap of $194 M. The price range then for EOPN was $15. In 2015, Insight Venture Partners acquired E2open for $273 M at a 41% premium. After scaling up about 9x with a series of acquisitions, E2open was valued at about $2.57 B at about 10x of the prior transaction when combined with the SPAC in 2021. Adding up the enterprise value of recently acquired BluJay ($1-1.5 B), the enterprise value of E2open is $3.5-4 B. In contrast, the enterprise value based on today’s share price of $6.48, which is less than half of its 2012 price of $15, is only $3.04 B. In this sense, the current market makes ETWO cheaper than its historical prices.

To what extent does the scaling-up enterprise value translate into stock price? Since 2012, major market indexes have increased 2-4x and the US GDP has nearly doubled. But the price of ETWO has not.

Second, ETWO is again undervalued given relative valuation. Compared with its peers, ETWO trades at reasonable multiples, partially attributable to its underperforming stock price. These metrics translate into a potential bargain for an investor to pay for the value driver. Below shows the valuation of ETWO compared with its peers.

|

Symbol |

Price |

EV / Sales (LTM) |

EV / Sales (Q1 FY23) |

EV / Sales (FY22) |

P / Sales (LTM) |

P / Sales (Q1 FY23) |

P / Sales (FY22) |

EV / EBITDA (LTM) |

EV / EBITDA (Q1 FY23) |

EV / EBITDA (FY22) |

|

ETWO |

$6.70 |

6.3x |

6.8x |

7.8x |

4.3x |

4.9x |

5.8x |

N/A |

N/A |

33.3x |

|

DSG:CA |

$62.50 |

11.5x |

11.2x |

13.8x |

12.0x |

11.7x |

14.3x |

27.1x |

26.3x |

32.8x |

|

KXS:CA |

$107.70 |

9.6x |

8.9x |

11.7x |

10.2x |

8.5x |

12.4x |

67.7x |

62.9x |

226.1x |

|

MANH |

$115.50 |

10.4x |

11.6x |

12.4x |

10.6x |

11.0x |

12.8x |

44.9x |

50.4x |

54.9x |

Source: Y. Chen, data from Koyfin

Third, a DCF analysis seem to support out thesis. Given the diverging forecasts of future cash flows, we build the valuation based on the actual number LTM, and we use revenue, gross profit, and EBITDA as three types of proxy for cash flow. The goal is to look for an intrinsic “value-added” of ETWO by measuring the economic effect generated per share.

|

$ amount is in million |

actual data LTM |

|

number of common shares (million) |

334.9 |

|

Revenue as a proxy for FCF |

$519.6 |

|

Gross profit as proxy for FCF (66.49% gross profit margin LTM) |

$345.48 |

|

EBITDA as proxy for FCF (25.96% EBITDA margin LTM) |

$134.89 |

Source: Y. Chen, based on data from Koyfin

Meanwhile, we set up three scenarios, each with an assumption for the discount rate, and short-term (2-year) and long-term (constant, perpetual) growth rates for a two-stage DCF model.

|

Inputs |

base case |

upside case |

downside case |

|

The revenue growth rate during the high-growth stage |

15.00% |

21.90% |

12.00% |

|

long-term growth rate |

10.00% |

12.00% |

8.00% |

|

discount rate (risk-free + market risk premium, assuming beta=1) |

8.85% |

6.00% |

9.00% |

|

market risk premium (current implied MRP as the base case) |

5.60% |

3.50% |

4.50% |

|

risk-free rate (current yield of 5-y US bond as the base case) |

3.25% |

2.50% |

4.50% |

Source: Y. Chen, based on data from Statista

For a base-case scenario, the consensus for the industry growth is at 30-50% because of the strong demand for SCM software, and the best-fit of sell-side analysts’ forecasted revenue growth rate is 21.9%. We are cautious here because E2open may not ride the same growth rate due to competition. Hence, 21.9% is set as an upside case assumption for the 2-year revenue high growth, 15% is set for the base-case scenario, which has been achieved by the company, and 12% is the current organic subscription revenue growth rate and is used for the downside case.

The discount rate is calculated using CAPM, assuming the beta for ETWO is 1. The base-case scenario uses actual numbers in July: 5.6% for market risk premium and 3.25% is the current yield of a 5-year US bond. Hence, the base-case discount rate is set at 8.85%, which is already higher than 8.26%, the one in 2008. Again, our valuation is generally conservative.

The following shows the result of the two-stage DCF valuation. They represent measurable additional economic effects that each share of ETWO can bring to investors. This could be a proxy for “new value” to ETWO investors.

|

The economic effect per share |

base case |

upside case |

downside case |

|

Revenue per share |

$6.67 |

$7.56 |

$6.41 |

|

Gross profit per share |

$4.44 |

$5.02 |

$4.26 |

|

EBITDA per share |

$1.75 |

$1.98 |

$1.68 |

In the absence of a positive earning or EBIT, we consider revenue per share, gross profit per share, and EBITDA per share in a broader sense as proxies for the “value-added” that each share can bring to investors. They are not representing the enterprise value or equity value, but they focus on what the profitability of E2open means particularly to investors. We call them intrinsic value-added. They can answer the question: What is the new value in the stock? As a non-dividend stock, how much economic gain can it generate for investors? A cautious answer based on the average of the above scenarios is $4-8 per share.

These three approaches bring out a fairly priced and even undervalued ETWO, which is not often the case for a growth-style stock. Compared to its own transaction history and its peers in the sphere of public companies, ETWO turns out to be relatively undervalued. Admittedly, this result is partially attributable to the overall underperformance of ETWO. Our calculation of its absolute value suggests that the current market price is fair. Since E2open is on the edge of a strong growing trend that can last longer than the 2-year horizon used in the model, there could be upside room for pricing the growth imagined by investors.

6. Conclusion: Neutral in the short-term, bullish in the long run.

To sum up, our fundamental view on ETWO is bullish in the mid to long term for the next 24 months, but we remain cautious in the short term for the next 1-6 months. ETWO is subject to swings given current volatility and negative sentiment in the market. It has been underperforming its peers, and the pressure does not seem likely to go away soon. However, we believe the stock has been harmed by its SPAC stock status among other misunderstandings. The industry it’s in has a promising future driven by unprecedented and lasting demand, and E2open is a competitive player riding the strong growth trend. As their growth strategies gradually take effect and future earnings increase, the company’s solid business should be reflected in its stock price.

At the time of writing, the stock is $6.48, trading lower following its earnings call on July 11th. However, this could represent a potential entry point as our valuation is $5-8, with a floor price of $4. There is therefore an upside potential worth exploring. We would like to thank Y. Chen for her contribution to this piece.

Be the first to comment