It’s been a hectic month for M&A thus far in the gold sector, with a near-record three deals in just over one month. The most recent acquisition, announced Monday morning, is the takeover of Alio Gold (ALO) by mid-tier producer Argonaut Gold (OTCPK:ARNGF). The deal isn’t much of a relief to Alio Gold shareholders, as it was done at the market, meaning that those accumulating the stock hoping for an eventual pay day won’t be getting their day in the sun.

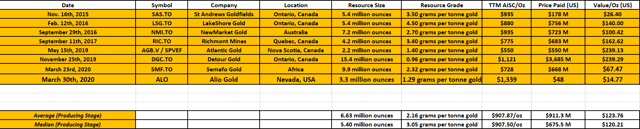

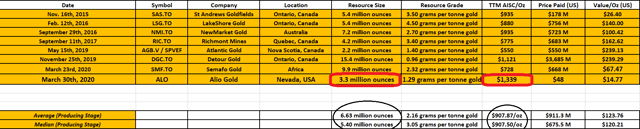

Adding insult to injury, the deal isn’t great for investors in the gold space that were hoping for hefty premiums for gold producers in their portfolios either. Done at a mere $14.77/oz, the deal has confirmed a new downtrend in the price paid per ounce for gold producers. Based on this deal, and the newly established downtrend in the price paid per ounce for producers, I believe investors would be wise not to pay more than $125.00/oz for gold producers if they want to have a margin of safety in their investment.

(Source: BNN Bloomberg)

As those trading the gold sector may be familiar with, we’ve seen a flurry of M&A in the past five weeks. First, we had Excellon Resources (OTCPK:EXLLF) buying Otis Gold in late February, then Endeavour Mining (OTCQX:EDVMF) picked up SEMAFO Gold (OTCPK:SEMFF) last week, and the most recent deal to finish the month is Argonaut Gold taking over Alio Gold.

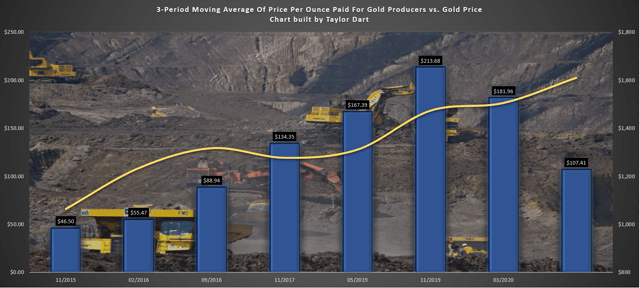

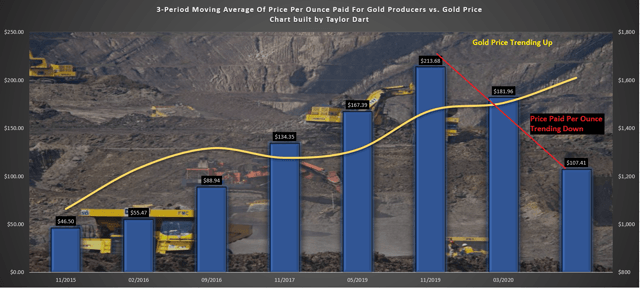

While investors may have been used to significant premiums for deals and a more-than-reasonable price paid per ounce in 2019, this trend has come to a screeching halt in 2020. Not only are we seeing smaller premiums paid by suitors for deals on average, but we’ve seen the price paid per ounce for gold producers drop off a cliff. As we headed into 2020, the average price paid per ounce for gold producers was sitting at $151.31/oz, with the 3-period moving average at $213.68/oz. Fast-forward four months, and we’ve got the average down to $123.76/oz and the 3-period moving average of the price paid per ounce at $107.41/oz. Before digging in further to these comparisons, let’s take a look at the Alio Gold and Argonaut merger below:

(Source: Mining-Journal.com)

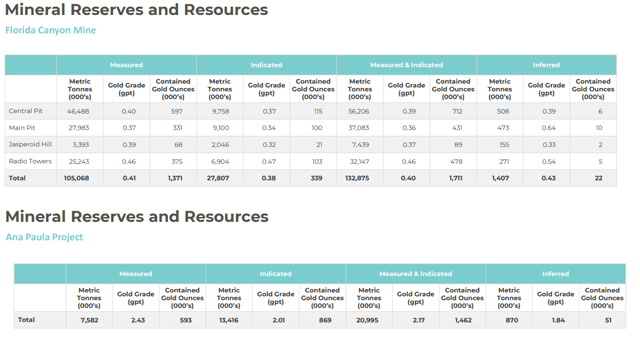

Argonaut Gold has chosen to merge with Alio Gold, and shareholders of Alio will own 24% of New Argonaut, the pro forma company. Based on this ratio, Alio Gold is being valued at US$48 million as a gold producer, despite having a global gold resource of 3.2 million ounces. This works out to $15.48/oz for Alio Gold’s ounces, with half of these assets at the Florida Canyon mine in Nevada and the other half at the Ana Paula Project in Mexico. The Ana Paula Project hosts a gold resource of 1.51 million ounces at 2.10 grams per tonne gold and is Alio’s exploration asset. Meanwhile, Florida Canyon is home to 1.74 million ounces of gold as well, at an average gold grade of 0.40 grams per tonne gold. On a weighted average basis for companywide ounces, Alio Gold is adding 3.25 million ounces of gold to Argonaut’s inventory, at an average gold grade of 1.29 grams per tonne. Therefore, Argonaut Gold has managed to scoop up assets in Tier-1 jurisdictions for less than 1% of the gold (GLD) spot price currently, an absolute steal even after accounting for the $1,200/oz mining costs expected in FY-2020 at Florida Canyon.

(Source: Alio Gold Company Presentation)

Based on FY-2020 guidance, Alio Gold expects to produce just over 60,000 ounces of gold in FY-2020, and this would allow Argonaut Gold to become a 225,000-ounce annual producer with less hurdles in place for getting its development assets in production. This is because not only do the current development assets require significant capital, but they’ll also require a year or more of construction before they pour first gold. For example, the Cerro del Gallo Project, one of Argonaut Gold’s development assets, would require US$134 million in initial capex to go into production. Therefore, this deal is a no-brainer for the company, which is a low-grade producer already. Not only has this deal given the company an asset in a more attractive jurisdiction in the United States, but it’s also given it re-rating potential as a larger producer, and Ana Paula, a high-grade open pit project in its stomping grounds of Mexico.

However, while the deal is good for Argonaut, it’s not great for valuations in the sector, as it tells us that suitors are snapping up assets for fire-sale prices and getting away with it. Let’s take a closer look at what I mean below:

(Source: Author’s Table and Data)

Given the $14.77/oz price tag for Alio Gold’s ounces, we now have a confirmed downtrend in place for the price paid per ounce, with two consecutive deals coming in miles below the prior average. Basically, the Alio Gold and SEMAFO deals have wiped out all the progress made in 2019 for gold producers in takeover scenarios, as we were seeing hefty premiums and respectable amounts paid for names like Detour Gold (OTCPK:DRGDF) and Atlantic Gold (OTCPK:SPVEF). As we can see in the below table, the price paid per ounce in the SEMAFO deal was $67.47, and the price paid in the Alio Gold deal was $14.77/oz. This has dropped the long-term average paid for gold producers from $151.31/oz to $123.76/oz. Worse, however, the 3-period moving average is no longer correlated to the gold price at all, as the gold price rise has done nothing to improve the price paid for producers.

(Source: Author’s Chart and Data)

As we can see in the above chart comparing the gold price (gold line) to the 3-period average of price paid per ounce for gold producers (blue bars), the price paid per ounce has been halved in the same period gold has risen 10%. As of the Detour Gold deal in Q3 2019, the three-period average price paid per ounce was sitting at $213.68/oz. This was a new all-time high for this indicator, and equivalent to roughly 15% of the spot price of gold ($1,500/oz). Currently, we are sitting at $107.41/oz, a figure closer to 7% of the spot gold price, a massive step in the wrong direction. Therefore, it should be clear to investors that while a strong gold price should dictate a price of $200.00/oz or higher paid for producing assets, this is not the case. Based on this, it makes no sense to pay up for mid-tier and intermediate gold producers above $125.00/oz if they are being snapped up for less than this amount.

(Source: Author’s Chart and Data)

Some investors may argue that Alio Gold and SEMAFO Gold are deviations from the world-class assets acquired in the past, like Atlantic Gold, Detour Gold, Newmarket Gold, and Richmont Mines. There is certainly some truth to this, and I would argue that the past two gold producer acquisitions have been of inferior quality. This is because Alio Gold’s all-in sustaining costs are well above the median of past takeovers of $908/oz. Meanwhile, the resource size is also inferior, with the average takeover having a median resource of 5 plus million ounces compared to Alio Gold’s 3.25 million ounces. Having said that, the inferior quality justifies a discount of 20% or so to the prior average price paid per ounce, not the 60%-plus discounts we are seeing. Therefore, while this argument holds some weight, it does not change the fact that suitors are not interested in paying up for ounces in 2020.

(Source: Author’s Table and Data)

Based on the fact that we have a new downtrend confirmed in the price paid per ounce for gold producers, I see no reason to be overpaying for assets currently. In a perfect world, gold producers would be fetching over $200.00/oz, and even up to $300.00/oz given the gold price. However, things aren’t always as they should be, and the reality is that we’re seeing producers bought up for $125.00/oz or less on average. There’s no reason this trend has to continue, but I believe investors should be looking for a margin of safety when buying gold producers given this new trend. Therefore, takeover target or not, I see no reason to be paying more than US$125.00/oz for gold producers in the current market environment. Given the risk of an acquisition at a lower level than this figure, the reward-to-risk is no longer in favor of overpaying for gold producers and relying on large premiums in M&A deals to generate portfolio returns.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment