TU IS/iStock via Getty Images

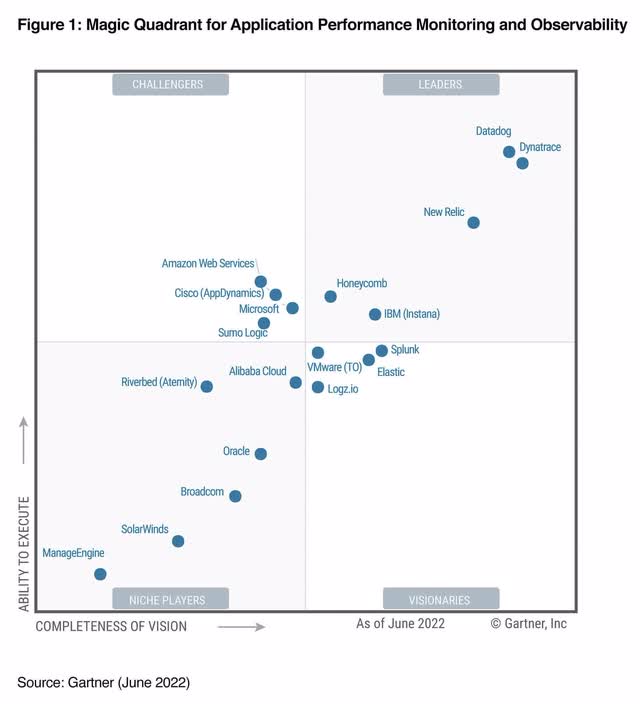

How much technology do you use in a day? From your cell phone, to web applications, video conferencing to IoT (Internet of Things) devices such as Alexa. Now imagine a modern organization with thousands of employees remotely working across 25 countries, using on-premises equipment, different cloud providers (AWS, Google Cloud, Azure), databases, SaaS App’s and much more. Tracking or “observing” all of these technologies is extremely challenging for any IT team, as they tend to have their data “siloed”. Thus, as organizations are “digitally transforming”, a platform such as Dynatrace (NYSE:DT) is vital, as they are a leader in IT observability, as you can see from the Gartner Magic Quadrant below (top right quadrant).

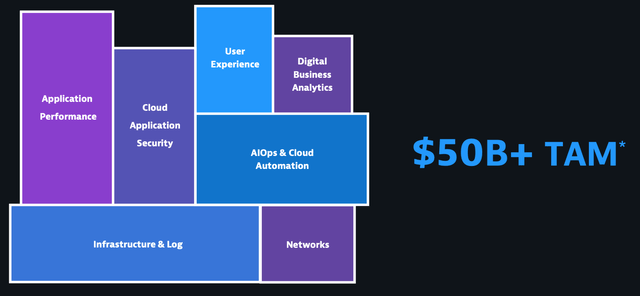

According to one research paper, 93% of IT leaders believe “Observability” is a foundational part of running a successful modern enterprise. Thus, it’s no surprise, the Cloud Monitoring Market was valued $1.3 billion in 2020 and is estimated to be worth at least $4.5 billion by 2026, growing at a blistering 22.66% CAGR. Organizations are also leveraging Artificial Intelligence with IT Operations (AIOps) in order to track and rapidly respond to issues. The AIOps industry was valued at $7.1 billion in 2021 and is forecasted to grow at a rapid 17.7% CAGR, reaching $27.3 billion by 2028. If we include User Experience, Networks, Security, Performance and analytics, the Total addressable market expands to a staggering $50 billion.

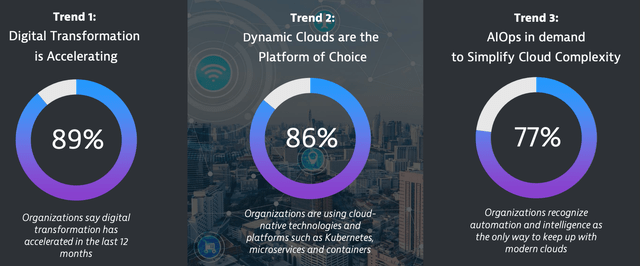

Dynatrace is poised to ride at least three major trends outlined below; Digital Transformation, Dynamic Clouds and AiOps.

Trends (Investor presentation 2022)

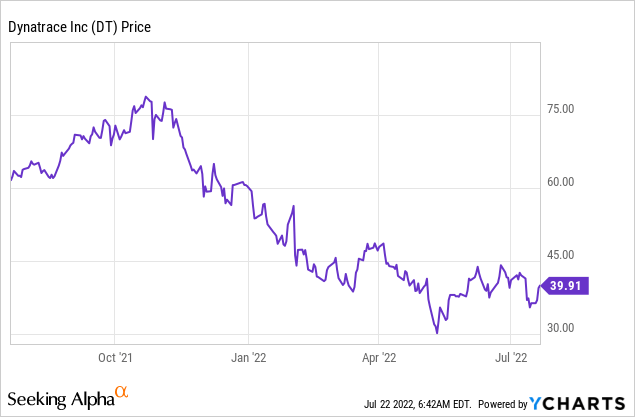

The company has seen its stock price nose dive by 47% since the high inflation numbers came in November 2021. However, the company has still been growing revenues at over a 30% clip, has high retention and a $50 billion market opportunity. Thus let’s dive into the Business Model, Financials and Valuation for the juicy details.

SaaS Business Model

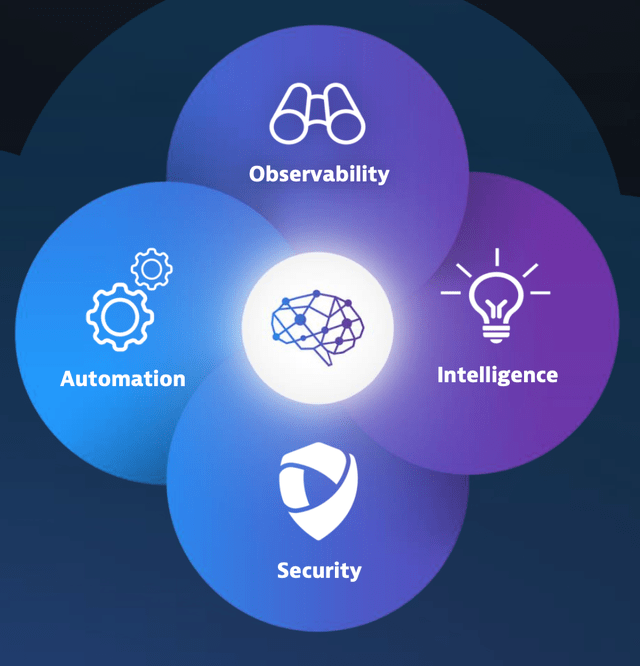

Dynatrace’s products can be segmented into four main segments; Observability, Intelligence, Security and Automation.

Dynatrace Product Segments (investor presentation 2022)

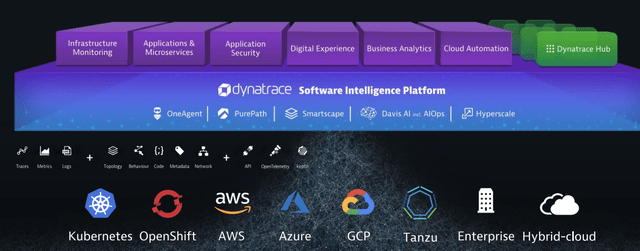

As you can see from the graphic below, Dynatrace is leveraging its technology to help with a variety of applications from traditional IT infrastructure monitoring to Security, Digital Experiences, Business Analytics and even Cloud Automation. The platforms software intelligence platform then ties all these together and enables usage across multiple environments from legacy on premises to multiple clouds (AWS, Azure, Google Cloud etc).

Dynatrace platform (Investor presentation)

A typical customer example, is a 200 year old library which “Digitally transformed” its services from on-prem to a hybrid, multicloud architecture which included Kubernetes (used for rapid “container” based software development). After the transition, its IT team realized the system was overly complex and difficult to monitor and secure due to the siloed nature of the applications, as mentioned previously. Here is a customer success quote below;

“Before Dynatrace, keeping up with our complex infrastructure was like putting our hands out and trying to catch smoke. Now, we can automatically capture every source of observability and user experience data in a single place.”

The IT team also saw a 36% decrease in manual tasks. Dynatrace has also helped a US state government with similar issues. Companies with international operations which require “Localization” of services also find the usage of a “single pane of glass” for User experience monitoring to be essential. Other well known customers include; Kroger (KR), SAP (SAP), Dell (DELL), Experian (OTCQX:EXPGY) and many more. Given the number of organizations “digitally transforming” and the large total addressable market, I see no reason why Dynatrace can’t continue to offer this service to many other enterprises, which means a long growth runway ahead.

In order to capture this market, Dynatrace is using a “Land and Expand” strategy which starts with a low friction free trial through a network of direct sales and cloud partners. This leads to the “Initial Land” and then the company “Expands” the account through the Upsells of multiple modules such as Digital experience or Business analytics. Dynatrace’s strategy is working so far as they have a Net Revenue Expansion rate of over 120% which means customers are finding the product “sticky” and spending more through the module upsells.

Land and Expand (Investor presentation)

Growing Financials

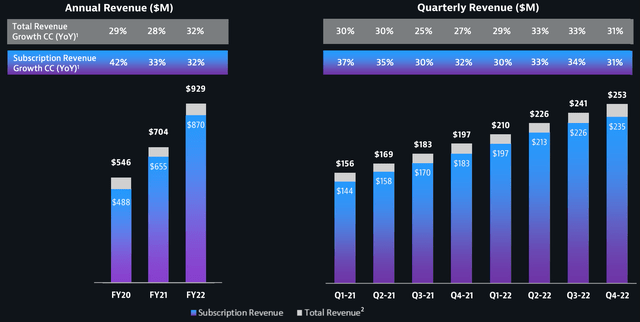

Dynatrace generated strong earnings for the quarter ending March 31st 2022. Total Revenue for the quarter was $253 million, up 31% year-over-year beating analyst expectations by $6 million. Its total revenue was primarily driven by Subscription Revenue of $235 million, also 31% year-over-year. I previously wrote a post on why subscription business models are my favorite, due to the customer benefits such as low upfront costs and business benefits such predictable cash flows. For what the company refers to as FY2022, Annual Revenue was $929 million, up a rapid 32% year-over-year.

Revenue (Earnings report 2022)

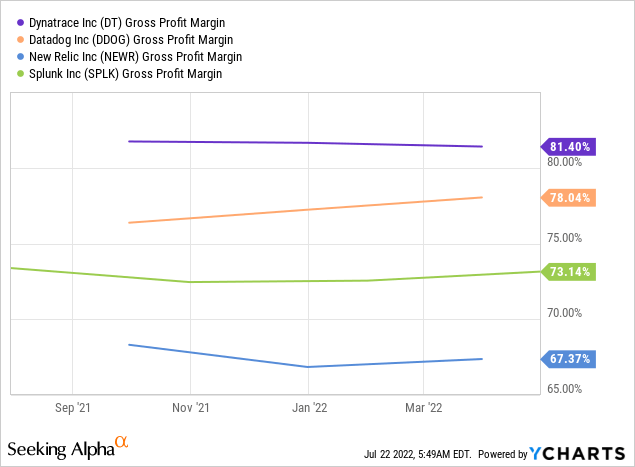

Dynatrace has an extremely high gross margin of 81.4%, which is higher than industry peers such as Datadog (DDOG) at 78%, Splunk (SPLK) at 73%, and New Relic (NEWR) at 67%.

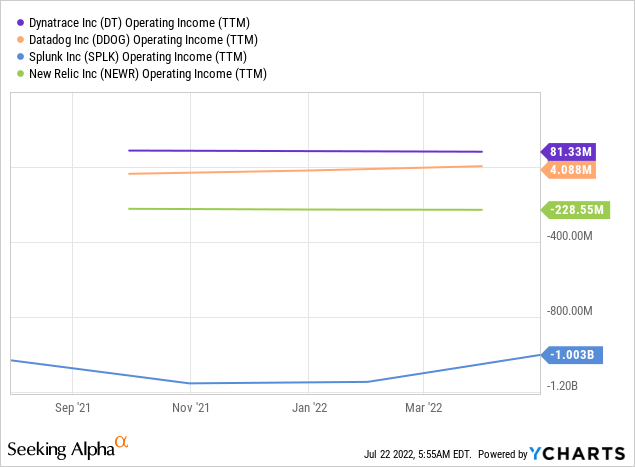

Dynatrace generated Normalized earnings of $0.17, which beat analyst expectations by $0.02 in the quarter ending March 31st 2022. The company is also generating Operating Income of $81 million, which is higher and more positive than industry peers.

Unlevered Free Cash Flow more than doubled to $117 million in the quarter, up from $56 million in the March 2021 quarter.

Dynatrace has a robust balance sheet with $463 million in cash and short term investments and just $339 million in total debt. Management has conservatively reduced the debt level from $440 million in the equivalent period last year.

Advanced Valuation

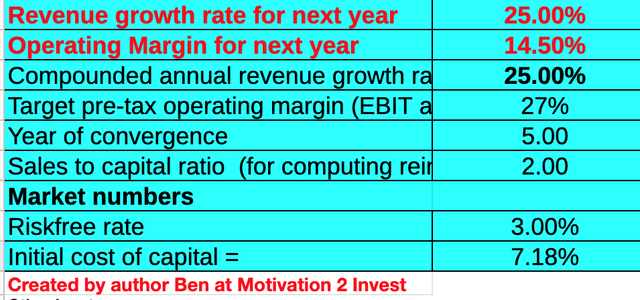

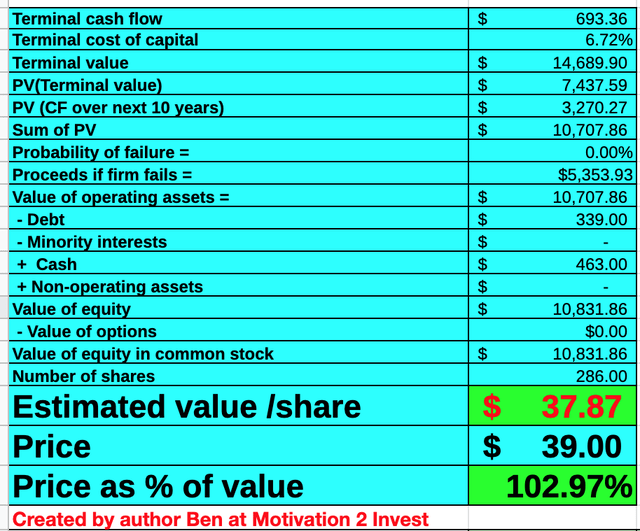

In order to value Dynatrace I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 25% revenue growth for next year and 25% for the next 2 to 5 years, which is aligned with management’s initial guidance.

Dynatrace stock valuation 1 (created by author Ben at Motivation 2 Invest)

In addition, I have forecasted Dynatrace’s strong margins to continue to increase to 27% over the next 5 years as its “land and expand” strategy continues to work well. In addition, I have capitalized its R&D expenses to increase the accuracy of the valuation.

Dynatrace Stock Valuation (created by author Ben At Motivation 2 invest)

Given these factors I get a fair value of $37/share, the stock is currently trading at $39/share and thus is fairly valued.

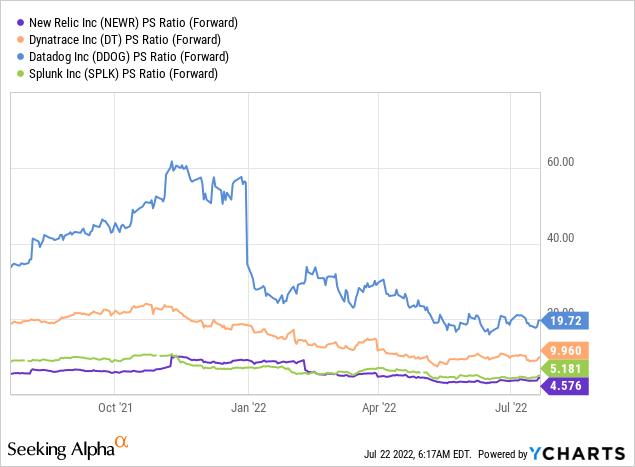

As an extra datapoint, Dynatrace is trading at a Price to Sales Ratio (forward) = 9.96 which is close to the pandemic lows in 2020. In addition, the stock is trading at a cheaper multiple than close competitor DataDog, PS = 19.72.

Dynatrace and DataDog are both “Leaders” on the Gartner Magic Quadrant for IT observability. However, DataDog is taking a more aggressive approach to revenue growth (55% to 85%+) but is sacrificing its operating margin in the process. Thus, Dynatrace is operating with a much more conservative strategy and thus a slightly “safer” investment. DataDog has high Wall Street expectations of growth baked in, whereas Dynatrace’s management is much more conservative in its estimates. This means should either company have a bad quarter, the potential downside for DataDog is much greater with its Price to Sales Ratio of 19.72 vs 9.96 for Dynatrace.

Risks

Competition

As mentioned prior, there are many players in the IT Observability industry. From DataDog, to NewRelic, Splunk and even AppDynamics by tech giant Cisco. The good news for Dynatrace is Gartner’s customer review portal gives them the top spot, as they won the Customers Choice award for 2021 for Observability. I also noticed they have more reviews than other platforms on the Garter Website. For example, Dynatrace has (1,264) reviews at 4.5/5 stars whereas DataDog has just 426 reviews at 4.5/5 stars.

CFO Left

Dynatraces Chief Financial Officer (CFO) has recently left which is never a great sign for a company, but not a deal breaker.

IT Spending Slowdown

A temporary slowdown in IT spending may occur in 2022/2023 as some analysts are forecasting a “shallow but long” recession starting at the end of 2022.

Final Thoughts

Dynatrace is a fantastic company which is a true leader in IT observability. As more companies are “Digitally Transforming” the need for them to track, monitor and secure their data in a unified manner is becoming a necessity. The market opportunity is huge and the company’s “Land and Expand” strategy is working well. The recent pullback in share price means the stock is now fairly priced intrinsically and its high margins give it less downside risk than more aggressive industry competitors. Thus, this looks to be a great investment for the long term.

Be the first to comment