zimmytws/iStock via Getty Images

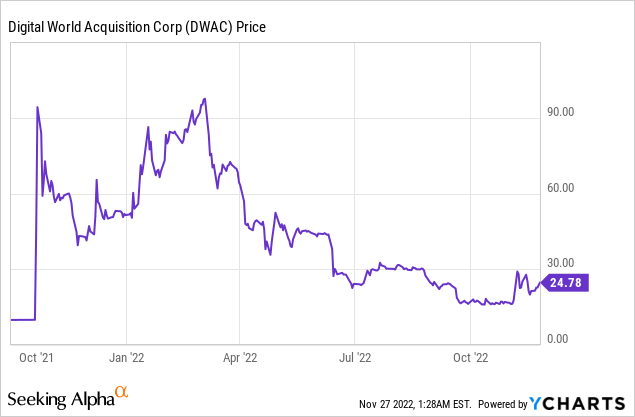

While the twelve-month extension recently approved by Digital World Acquisition Corp. (NASDAQ:DWAC) shareholders overcomes a major hurdle for the proposed merger with Trump’s media company, Trump Media & Technology Group, SEC issues continue to overshadow trading in DWAC stock. This article is another update to my multiple prior articles.

Shareholders Approve 12-Month Extension

On November 22 DWAC shareholders approved a proposal that allows for four three-month extensions for a total of twelve months to September 8, 2023, to complete the merger with Trump Media & Technology Group -TPMG. If this was not approved the merger would have to be completed by early March 2023 or DWAC would be forced to liquidate. This proposal required approval by 65% of shares outstanding and a non-vote was considered a “no” vote. The media and many of those making comments on Seeking Alpha used the fact that a number of shareholder meeting adjournments were needed to reach that critical 65% number as a tool to smear DWAC and Trump asserting that DWAC/Trump was not even capable of getting this proposal passed. They clearly do not understand the proxy solicitation process, in my opinion.

DWAC changed from using a new inexperienced proxy solicitor to using a large respectable one, Alliance Partners. The primary reason for the very long period needed to reach 65% had nothing to do with the actual extension proposal, it was because it was very difficult to directly contact shareholders by Alliance to get shareholders to vote. Often proxy solicitors start at about the 500 share level for direct solicitation, sometimes by telephone, and if that does not get the desired results, they keep lowering the share level until they get that 65%. This takes a lot of time and because many DWAC shareholders may have already sold their shares after the record date it takes some extra effort to explain that they can still vote. Since DWAC has mostly small retail shareholders instead of institutions holding large stock positions, this process was even more time-consuming because a few institutional voting for the proposal would make it much easier to get to 65%. Another problem is that proxy firms can’t get the names of “OBO” shareholders and can only contact “NOBO” shareholders, which I covered in my prior DWAC article.

This extension of time is a major positive because it allows them to potentially resolve any SEC issues in a timely manner instead of being pressured by a shorter time period. It also allows more time for Truth Social to continue their business plan instead of worrying that the merger deal might be cancelled in March.

Ongoing S-4 SEC Issues

Usually when trying to determine the value of a company one looks mostly at financial statements and various ratios, but with DWAC one needs to cover SEC issues. The reality for DWAC shareholders is that it does not really matter how great or poor Truth Social becomes if TMTG and DWAC do not merge. The biggest hurdle is the SEC. The SEC needs to declare their S-4 statement effective so DWAC shareholders can finally vote to approve the merger. Without the SEC approval, DWAC will most likely liquidate because it would be very difficult to negotiate a new merger deal with a different company, create an S-4, get SEC approval of the S-4, and get DWAC shareholder approval before September 8, 2023. Most SPACs just liquidate when their negotiated merger deal falls apart. DWAC shareholders will get about $10.20 per share in a liquidation and DWAC (NASDAQ:DWACW) warrant holders will be wiped out completely.

The S-4 has been sitting at the SEC now for almost seven months. Because of a disclosure statement filed with the SEC by William Wilkerson (copy of the 9-page confidential disclosure), there is even more intense coverage of this issue.

It seems Wilkerson was an active participant in negotiating the merger deal and was a TMPG SVP in charge of operations. He was also fired last month.

I think it is interesting to note a few items in his disclosure:

13. Wilkerson was responsible for identifying possible SPAC investors and presented that research to Litinsky and Moss.

17. Wilkerson was intimately involved in the internal TMTG business strategy discussions and preparation for the meeting between TMTG and Orlando.

28. At all times, Wilkerson was working on the TMTG SPAC transaction from the original BENE-led merger formulation to the ultimate DWAC merger that was consummated.

29. Wilkerson understood that DWAC was not a publicly traded SPAC, and DWAC was still in the process of receiving SEC approval, yet he witnessed substantive communications between DWAC and TMTG in violation of SEC regulations governing SPACs.

I have a number of questions/opinions regarding Wilkerson. First, did Wilkerson just “witness” substantive communications or did he himself participate in the communications in violation of SEC regulations? Second, when did he know/realize that there were SEC regulations regarding SPAC communication prior to SPAC becoming a public company? (I wonder if he personally was the one that first started “substantive communications” and only realized after the fact it was a potential SEC violation.)

As many remember, there were delays in launching the Truth Social platform earlier this year and then subsequently there have been “issues” with the quality of the platform. If Wilkerson was SVP in charge of operations, was he directly responsible for these problems and did he, therefore, worry he might be “fired” by Trump? Was that an incentive to contact lawyers? The date on his SEC statement was August 28, but I have not been able to find out when he first contacted the lawyers who filed that statement because they did not return my call asking about that and other issues. I assume Trump’s lawyer will ask these questions if Wilkerson is ever cross-examined in court.

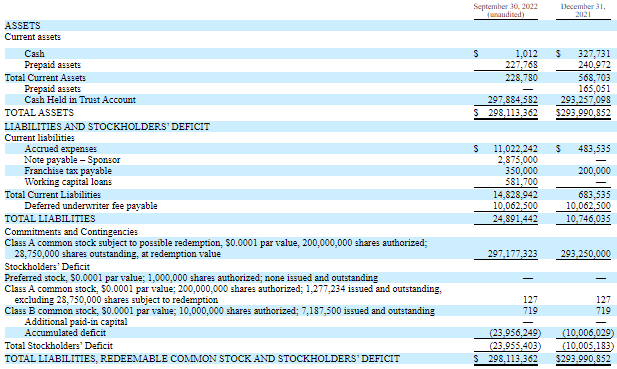

As the SEC delays a decision on the S-4, DWAC’s legal fees continue to increase. Based on their 3Q balance sheet it looks like some of the fees are just being classified as “accrued expenses”, which increased about $4.9 million during the 3Q. Since notes payable amount increased by $2.42 million during the 3Q and the cash amount is about the same, some of their expenses, which are mostly professional fees and a modest amount of rent, have been paid. There are no figures filed showing specific professional/legal fees. These legal expenses may continue to increase because I think this SEC S-4 issue will eventually be decided by a federal court that focuses on the meaning/level of “communication”. I also think DWAC stock price will react to SEC developments going forward.

It is unclear what action the SEC or a federal court would take if it was in fact determined that there was communication between various parties prior to DWAC going public. I could not find any SPAC case law that would be a precedent for this violation. It may not mean an automatic denial by SEC for S-4 to be effective, which would indirectly terminate the proposed merger.

(Note: TMTG’s initial SPAC merger choice Benessere Capital Acquisition Corp. (BENE) recently liquidated after their proposed merger with eCombustible Energy LLC was terminated.)

Cash Issues Caused “Going Concern Warning”

DWAC does not have any operations and is just a shell company that is running up legal fees. The SPAC sponsors already loaned DWAC $2.875 million as of September 30 and subsequently loaned DWAC another $1.0 million cash. These notes will be paid by the merged companies, but if there is no merger transaction the sponsors can’t get paid from the cash in the trust account so the sponsors could get stuck not being repaid on these notes. Because DWAC may need additional cash over the next twelve months management included an ASU 14-15 “going concern warning”. DWAC management stated in their latest 10-Q: “these factors raise substantial doubt about the Company’s ability to continue as a going concern.” The company only had only ~$1 thousand in cash as of September 30, which was before the $1.0 million new loan. They can’t use the large cash balance in the trust account until after the merger is completed.

3Q and December 31, 2021 Balance Sheets

3Q and Dec. 31, 2021 Balance Sheets (sec.gov)

Misleading Press About Truth Social

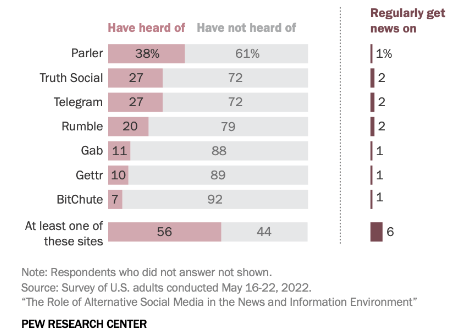

A serious problem impacting Truth Social and therefore, DWAC, is the news media has had some rather negative coverage about this new social media platform. For example, a November 18 article published by the Pew Research Center titled “Key facts about Truth Social as Donald Trump runs for U.S. president again” might be considered by some Truth Social supporters as “fake” news. This article, in my opinion, has a very serious flaw and that is the assertions in the article are based on a survey conducted May 16-22 by Pew. That was six months before the article was written and only shortly after Truth Social became operational. There has been a lot of publicity and news about Truth Social since last May that most likely makes their old metrics almost worthless as the public becomes more aware of this new social media platform. If one did not read the “fine print” about the survey time period, one might accept the assertions are accurate.

Pew Research Survey Results

Name Awareness and Usage (pewresearch.org)

You have to wonder if these misleading press articles have a negative impact on the current DWAC stock price. I think DWAC and TMTG need to be more proactive releasing various metrics that reflect current and potential future operating results. I covered potential valuations for the merged companies in prior articles and there have not been any recent updated financials filed to allow for investors to value DWAC based on new TMTG numbers. They are not required to actually file new numbers for TMTG during the pending S-4 approval time period and many SPAC deals do not update their numbers, which is a major problem with the SPAC merger transaction process, in my opinion.

I think there are just too many unknowns regarding Twitter’s impact on Truth Social. At this point, I think everyone’s opinion is just a guess and can’t really be based on actual facts. I am going to just pass on this issue and let readers post their opinions in the comment section below.

Conclusion

First, I hope readers remember that Seeking Alpha is an investment website and not a place to rant about former President Trump. Please keep your comments just about DWAC.

Second, I again tried to avoid politics in this article, but the reality is that it may play an important role in SEC actions regarding declaring DWAC’s S-4 effective so shareholders can finally vote on the proposed merger with Trump’s media company.

Finally, I am keeping my “hold” recommendation because the SEC issues might be decided by a federal judge and not the SEC. This may allow the merger to be completed before September 8, 2023.

Be the first to comment