Scott Olson/Getty Images News

Digital World Acquisition Corp. (NASDAQ:DWAC) finally filed their 10-K report on April 13 after an almost two week delay. There are some interesting items in the filing, but many investors, including myself, were disappointed that any specific updates regarding the merger with former President Trump’s media company, Trump Media & Technology Group, were not included. Because the S-4 filing is taking so long, DWAC is burning cash and may need a loan from their SPAC sponsor. There does not seem to be a SEC investigation that the media made a major issue about last year. There was not enough new information in the filing to give an updated recommendation. I, therefore, continue to have a neutral/hold for DWAC.

Potential Cash Issue

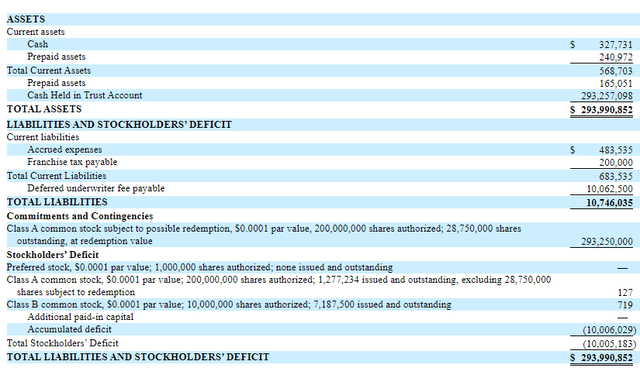

As can be seen by the December 31, 2021 balance sheet, DWAC has a cash problem. Their cash ending on September 30, 2021 was $1,494,632 and it declined to $327,731 on December 31, 2021. Total current liabilities increased from $214,117 to $683,535. It is interesting to note that they are accruing their expenses instead of recording them as accounts payable, which means various lawyers and others have not actually billed DWAC yet. These figures were as of December 31, 2021 and I would expect that DWAC has burned even more cash and accrued even more expenses in the last 3-4 months.

DWAC December 31, 2021 Balance Sheet

DWAC Balance Sheet December 31,2021 (sec.gov)

It was disclosed in the 10-K that the SPAC sponsor “committed to provide loans of up to an aggregate of $1,000,000 to the Company through September 8, 2022, which loans will be non-interest bearing, unsecured and will be payable upon the consummation of a business combination”. This may seem like cheap financing, but it is absolutely not cheap because the loan “may be convertible into units, at a price of $10.00 per unit, at the option of the lender”. So a $1.0 million loan could result in the lender/SPAC sponsor getting 100,000 DWACU units (1 DWAC share + 1/2 DWACW warrant), which are currently worth about $5.7 million for payment of the $1.0 million loan. (This is an example, in my opinion, of why the SEC is looking into SPAC deals.)

According to the 10-K: “We do not believe we will need to raise additional funds in order to meet the expenditures required for operating our business”, but the 10-K also states up to $1.5 million of loans can be converted into units at $10.00. It further states “Management believes that the Company has sufficient working capital and borrowing capacity to meet its needs through the earlier of the consummation of a business combination or one year from this filing”. Are we to assume that the “additional” would mean funds besides the SPAC sponsor’s loan or does the “additional” include the sponsor’s potential loan? These statements are rather confusing.

We are not talking about a lot of money, but not having sufficient cash/liquidity is an issue this merger does not need to encounter. DWAC had a loss in 2021 of $1,391,593, which was primarily formation and operating expenses. They can’t draw on the money in the $293.26 million in the trust account-the cash has to remain in the trust account. The cash spent so far is only regarding DWAC-it is not being used to fund Trump. Trump and his partners have to currently fund TMTG and their Truth Social.

Timetable

First, there still was no specific mention of their S-4, except they keep stating “please see the Form S-4 which the Company intends to file after the filing of this Report”. There has been a lot of confusion about their S-4 filing. I would have thought that if DWAC already filed their S-4 on a confidential basis this information about the confidential S-4 filing would be contained in their 10-K.

A SPAC that is less than one year old can file a confidential S-4 with the SEC under Rule 406 §230.406. During a forum in March, Patrick Orlando talked about this issue, but he did not actually state that DWAC had used this Rule to file a confidential S-4. He only stated, “I mean, everything’s possible”.

Another issue regarding the SEC; it was critical to note that there was no mention of any SEC investigation. If there was a SEC investigation, it would have had to be disclosed in the 10-K. At this point, it seems all the media attention last year about a SEC investigation was just “much to do about nothing”.

Second, they still “anticipate that the TMTG Business Combination will be consummated on or before the Outside Date”, which is September 20, 2022. That date is subject to extension and they would have to solicit shareholder approval before the merger becomes effective. So the clock keeps ticking.

Third, the problem is that if the merger deal with Trump isn’t completed, DWAC would have to immediately pivot to merger with another company. DWAC would have until September 8, 2022, which can be extended up to March 8, 2023 to complete a different merger deal. That does not leave much time to find and negotiate a deal, followed by waiting for their S-4 to become effective. Then DWAC shareholders would also have vote. So the longer the wait for S-4 filing for the Trump merger deal, the less likely there will be any deal, which could mean the eventual liquidation of DWAC at about $10 per share.

Conclusion

This article was only intended to cover their 10-K filing and was not intended to cover other recent events, such as reports that Fox News was joining Truth Social. There was a “relief” rally in DWAC stock because of two critical issues. First, that the actual 10-K was finally filed after a delay. Second, that there was no bad news contained in the report.

I was disappointed that there was absolutely no mention of the timing of the S-4 filing or any timing comments on the merger, except that was expected to be completed before the “Outside Date”-September 20, 2022. Since there was not enough new data/information in the 10-K, I continue to have a neutral/hold recommendation for DWAC.

Be the first to comment