Klaus Vedfelt

Thesis highlight

I believe investing in Dutch Bros (NYSE:BROS) would yield decent upsides. The market for takeout beverages is attractive and the size of the market is estimated to be over $50bn. BROS has optimized its operations for speed and convenience, and its business model can be easily replicated into other new markets. The company plans to open at least 4,000 locations in the United States, and it is expanding into new markets.

Company overview

Dutch Bros is a drive-through franchise that focuses on serving specialty coffee and other beverages made from scratch. Espresso drinks are their forte, but they also have a wide selection of other hot and cold drink.

Takeout beverage is a fairly attractive market

Throughout the day, BROS provides its customers with a diverse and customizable product offering, including a wide variety of hot and cold beverages. Therefore, I think they can take a piece of any market where people are looking for great beverages to take with them wherever they go.

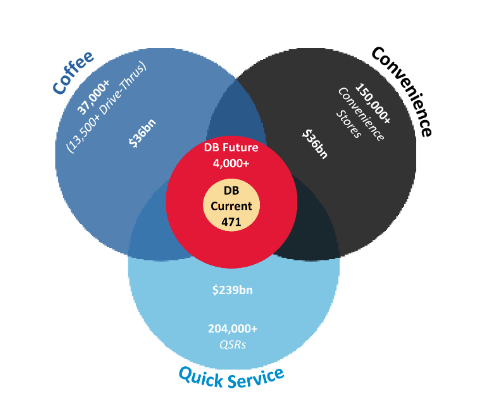

The size of the market is a major plus. The BROS prospectus claims that the total addressable market for the company is well over $50 billion ($36 billion for the coffee market and $36 billion for the convenience store industry). And I think there’s a good reason for that, too: customers want to be able to personalize their drinks with a wide range of flavors, and they want to be able to try out lots of different ones before settling on one they like. Just look at all the new flavors Starbucks (SBUX) comes out with every other month. Thus, I think BROS has a strong possibility of keeping its present market share in this area.

S-1

Operations are optimized for speed and convenience

After nearly three decades of dedicating themselves solely to beverages and drive-thrus, I think Dutch Bros has mastered the art of operating them. They are able to deal with a large number of customers throughout the day by efficiently processing them through the line while still establishing and maintaining friendly rapport. In my opinion, there are two main causes for the current state of BROS.

It’s obvious to me that BROS places a premium on ease of access when it comes to promoting their brand and providing a distinctive value proposition for their customers. In my opinion, this highly effective business model, which centers on beverages, ensures a fast, convenient, and individualized service for customers on the go. In order to maintain its position as the industry leader, BROS invests in digital capabilities to provide its customers with the fastest service and most convenient options available. Due to its dependability, Dutch Bros. is able to become a regular part of their routines, which in turn fosters brand loyalty.

As a second point, the “broistas” who work at BROS ensure that your time spent at Dutch Bros is one you won’t soon forget (this could be due to bias from my own experience). In my opinion, the broistas care most about making a personal connection with each customer and delivering a delicious, expertly crafted beverage. I think BROS’s drive-thru emphasis and line-busting models are what set them apart from the competition, both as an investor and a customer.

Business model can be easily replicated into other new markets

Though it all started in a rural area of Oregon, Dutch Bros has expanded to become a national powerhouse, with a proven track record of success across a wide variety of markets. Dutch Bros. has found success in over ten states with varying populations and landscapes. BROS, in my opinion, has been able to achieve volume parity between its new and established markets due to its consistently evolving drive-thru model and market expansion strategies (source: prospectus).

A key growth driver is the opening of new locations, but because the United States is so vast and home to such a wide variety of cultures and communities, success in one state does not always translate to success in another. As far as I’m concerned, BROS’s success in more than ten states demonstrates the company’s prowess for entering new markets and scaling up operations.

BROS predicts that, in the future, there will be at least 4,000 Dutch Bros restaurants open in the United States. That’s a threefold increase from FY22, and if BROS can sell that many in the next decade, it’ll be a 10% CAGR. These new stores will likely open in both underserved and emerging markets where consumers are eager to give BROS a try.

Given the centrality of drive-through to BROS’s business model, the company’s four thousand units must be situated in highly trafficked areas and equipped with convenient amenities like a double drive-thru and an emergency exit. Because there are usually several site options in each market that can provide the target economics BROS is looking for, these characteristics also allow BROS to be flexible and adapt to local real estate market conditions.

Internal culture that encourages internal promotions

Brands like Domino’s Pizza are examples of companies that have used this approach effectively (DPZ).

Similarly, BROS prioritizes its team by seeking out high-caliber individuals who represent the Dutch Bros ethos in all that they do. By appointing only seasoned Dutch Bros broistas as store managers, BROS is able to maintain their distinctive brand identity in both emerging and established markets.

In my opinion, this course of action is vital to the future success of BROS. These human resource policies and procedures are meant to preserve the Dutch Bros culture as the company expands into new markets and offers employees greater opportunities for professional growth. I think it will be easy for BROS to find property if they can maintain and expand their pool of enthusiastic broistas.

Margins still have plenty of room to expand

The EBITDA margin for BROS is 12% as of LTM3Q22, and I think it can improve even further. As a quick example of a company with a high EBITDA margin, we can look at Starbucks with 24% EBTIDA margin. While both business models have their advantages, BROS stands to gain more profit because of its emphasis on drive-throughs and less on sit-down service.

To stay ahead of the sales growth curve, Dutch Bros. has been investing in corporate infrastructure for the past few years. Also, we have created a procurement system that is both flexible and scalable, so many of their input costs are within their control. BROS production capacity can be expanded in a scalable and cost-effective manner thanks to BROS’s solid relationships with a number of co-manufacturers. Since SG&A and G&M costs tend to expand at a slower clip than store counts and revenue, I believe BROS will be able to leverage their corporate costs over time to boost BROS margins. Overall, I think BROS can increase profitability as the number of locations increases by optimizing infrastructure and leveraging scale efficiencies.

Valuation

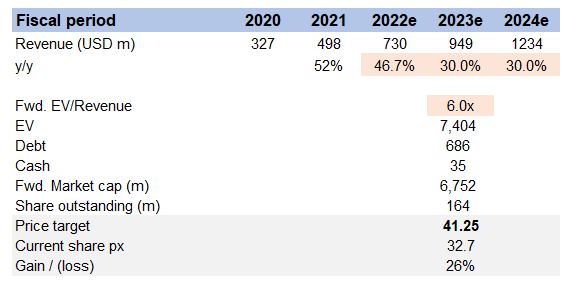

My model suggests a price target of $41.25 in FY23. This assumes that revenue will continue its high growth rate, and the forward revenue multiple will be 6x in FY23e.

Own estimates

I used management guidance for my FY22 estimates, and I believe that due to the large TAM, BROS can continue to grow at historically high rates in FY23e and beyond. In terms of valuation, BROS currently trades at 6x forward revenue, and I assumed that it would continue to trade at this level in the future. That being said, I believe that once we get past this weak macro environment, BROS could see a positive re-rating of its average trade back to its 10x average, implying additional upside.

Risks

Low barriers to entry

While there are some barriers to scale in the industry (time and capital are required), there are few barriers to entry. Anyone who wants to start selling coffee and takeout beverages can do so in a matter of weeks, which means the industry will be flooded with new competitors.

BROS offerings go out of taste

Every F&B player faces the risk that their product offerings do not align with changing consumer preferences. However, BROS has been innovating to launch new product lines, which I believe will mitigate this risk to some extent.

Conclusion

BROS is undervalued, in my opinion. The takeout beverage market is large and attractive, with a total addressable market of over $50 billion. BROS has optimized its operations for speed and convenience, and its business model can be easily replicated in new markets. The company plans to open at least 4,000 locations in the United States, with a focus on underserved and emerging markets.

Be the first to comment