Artur

Learning a language can be incredibly rewarding. Not only is there the potential monetary and professional benefit that this type of skill set has; there’s also the feeling of personal accomplishment that comes with being able to communicate with people who are not of your native language. One company dedicated to helping consumers achieve some degree of fluency in a foreign tongue is Duolingo (NASDAQ:DUOL). Over the past few years, the company has demonstrated an amazing propensity for growth. That growth looks set to continue through at least the current fiscal year. Long term, the company could well become a major business that generates attractive cash flow for its investors.

However, the picture today looks somewhat less appealing. I say this because, despite the rapid growth management has achieved, cash flows still seem to be more or less break even. And the price assigned to the company at this time looks to be unrealistically high compared to what the business could possibly justify with its current fundamental performance. It’s not impossible for the firm to eventually grow into its valuation. But that would take multiple years with a significant rate of expansion on both its top and bottom lines. Because of the speculative nature of making an investment on the premise of such rapid growth, I have decided to rate the enterprise a ‘hold’ at this time.

A play on global language learning

The management team at Duolingo describes the company as, first and foremost, a technology business that’s focused on promoting education to the masses. In addition to having its own website, the company also provides its technology via app. As of the end of its latest completed fiscal year, the company boasted over 500 million downloads for its flagship Duolingo language app. Through it, the company provides courses in over 40 languages to the tens of millions of monthly active users on its platform. Collectively, the learners on its app complete over 500 million exercises every day, with the vast majority of these exercises taking away a few minutes to accomplish. Using the data collected from this, the company powers its high-volume A/B testing and novel artificial intelligence that it uses to continually improve how well it teaches.

For the vast majority of learners, the Duolingo experience is free. However, the company does have a premium subscription that customers can subscribe to in order to get an ad-free experience and access to additional features. Roughly 6% of its monthly active users were paid subscribers as of the end of its 2021 fiscal year. The company also has other features, such as the Duolingo English Test, which serves as an online on-demand assessment of English proficiency that Serves as an alternative to consumers paying hundreds of dollars to go take a test in a physical testing center. Today, over 3,000 higher education programs around the world utilize this test as proof of English proficiency when evaluating international student admissions. The company also has other technology, such as the Duolingo ABC app, which teaches early literacy skills to young children.

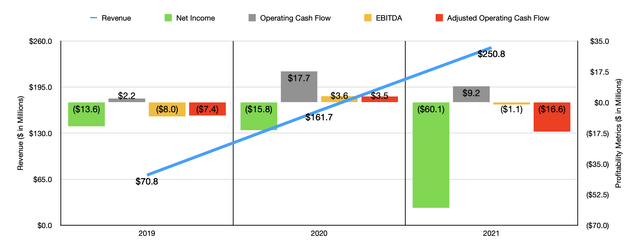

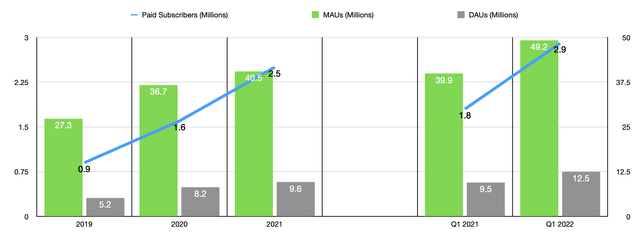

Over the past few years, the management team at Duolingo has done a fantastic job growing the company’s top line. Revenue went from $70.8 million in 2019 to $250.8 million last year. This increase in sales came as the number of monthly active users on the platform grew from 27.3 million to 40.5 million, with the number of daily active users climbing from 5.2 million to 9.6 million. A key revenue driver for the business has been the rise in paid subscribers on the platform, which ultimately rose from 0.9 million in 2019 to 2.5 million last year.

Although the revenue trajectory for the business has been great, the same cannot exactly be said of profitability. Between 2019 and 2021, the company saw its bottom line worsen, with its net loss growing from $13.6 million to $60.1 million. Fortunately, operating cash flow has been slightly better, staying consistently positive and between a range of $2.2 million and $17.7 million. If we adjust for changes in working capital, however, the metric would have also worsened over this timeframe, going from a negative $7.4 million to a negative $16.6 million. Even EBITDA has been less than ideal, going from a negative $8 million to a negative $1.1 million over the same timeframe.

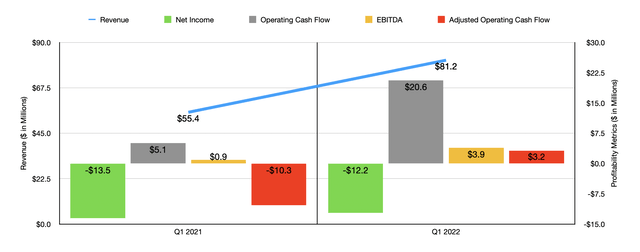

When it comes to the current fiscal year, the picture for the business continues to improve from the top line, and we are seeing some improvement on the bottom line as well. Revenue in the first quarter of the year totaled $81.2 million. That represents an improvement of 46.6% over the $55.4 million generated the same quarter one year earlier. This significant increase came as the number of monthly active users on the platform rose from 39.9 million the first quarter of last year to 49.2 million the same time this year. Daily active users rose from 9.5 million to 12.5 million, while the number of paid subscribers increased from 1.8 million to 2.9 million year-over-year. This plays in well with management’s current rhetoric that 2022 is going to be another explosive year for the business in terms of growth. Sales should ultimately come in at between $349 million and $358 million. At the midpoint, that would translate to an increase of 40.9% compared to what the company achieved last year.

On the bottom line, we have also seen some improvement as well. The firm went from a loss of $13.5 million in the first quarter of 2021 to a slightly less bad loss of $12.2 million the same time this year. Operating cash flow jumped from $5.4 million to $20.6 million. If we adjust for changes in working capital, it would have gone from a negative $10.3 million to a positive $3.2 million. Even EBITDA has exhibited a nice improvement, with the metro climbing from $0.9 million to $3.9 million over the same timeframe. The only profitability guidance that management gave involved EBITDA. At present, they think that this will come in between breakeven and positive $3 million.

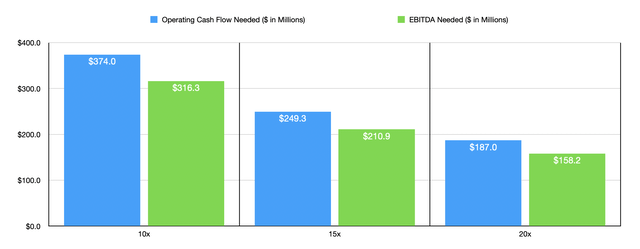

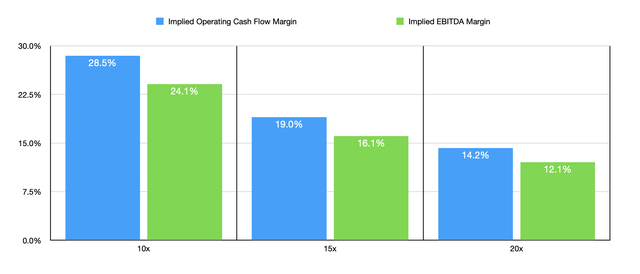

Unfortunately, it’s not easy to value a company that is achieving virtually flatline or even negative results. Normally, I would just assign a company like that a ‘sell’ or ‘strong sell’ rating. However, the rapid top line growth of the company does seem to suggest that there is some monetization potential moving forward. So instead, I’ve decided to ask the question of what kind of profitability would be needed in order to achieve the kind of valuation the business is currently going for. For instance, if we were to assume that revenue would continue to grow at a rate of 30% per annum for the next five years, we would then need to ask what kind of multiple on its current valuation would be appropriate at that time. In the chart above, you can see precisely what I mean. And in the chart below, you can also see the implied margin of these figures expressed as a percent of the company’s revenue at that distant point in the future. As you can see, operating cash flow and EBITDA margins of between 14.2% and 28.5%, respectively, and 12.1% to 24.1%, respectively, would be needed. And I would argue that those numbers, while a stretch, are not unrealistic in the long run. However, the growth needed to get there almost certainly is.

Takeaway

Based on all the data provided, Duolingo strikes me as an interesting company that has attractive upside potential. I fully suspect that revenue will continue to expand for the foreseeable future. But at the same time, I am cautious about its bottom line. You can’t really value a company like this if it’s not doing well on that front. Now, to be clear, if growth does continue for the foreseeable future, it is possible that the company could grow into its current valuation. But given the speculative nature of this, particularly having to rely on tremendous revenue upside for multiple years, I cannot help but to rate the business, at best, a ‘hold’.

Be the first to comment