Design Cells/iStock via Getty Images

Introduction:

The leading cause of death in the United States is heart disease. 26.9 million people or 8.2% of the U.S. population have been diagnosed with diabetes, and 41% of the population is categorized as obese. Both trends are expected to rise, leading to a higher susceptibility of heart disease later in life.

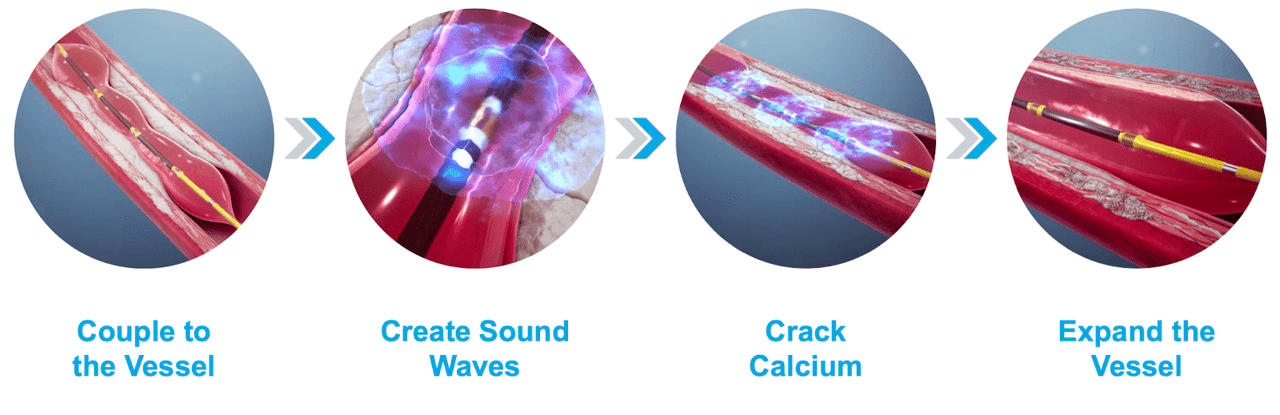

Source: ShockWave Medical

ShockWave Medical, Inc.’s (NASDAQ:SWAV) groundbreaking Intravascular Lithotripsy System (IVL) utilizes high-energy sound waves delivered through a catheter guide-wire that breaks up hard calcium. Excessive calcium buildup in the cardiovascular system threatens blood flow and can lead to serious complications including heart attacks. ShockWave Medical provides promising treatments to patients helping to address the growing number of blockages to arteries that supply blood to the heart. ShockWave’s differentiating factor from the current standard of care is its higher safety, efficacy, and greater ease of use that significantly reduces complications and increases patient outcomes.

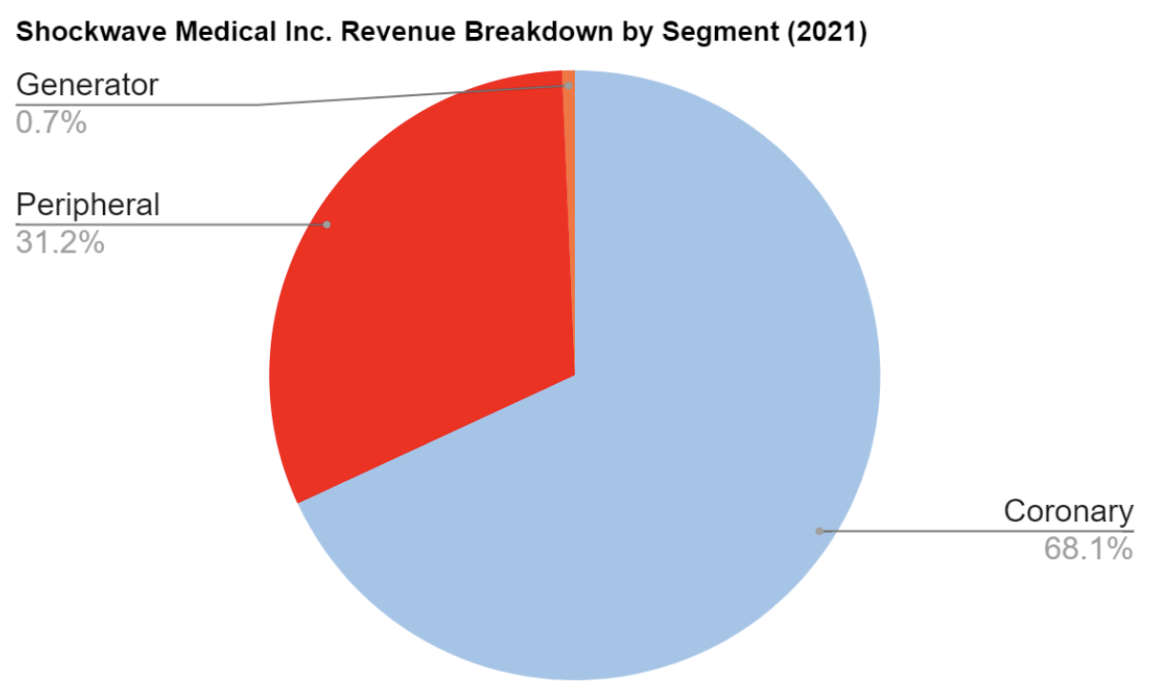

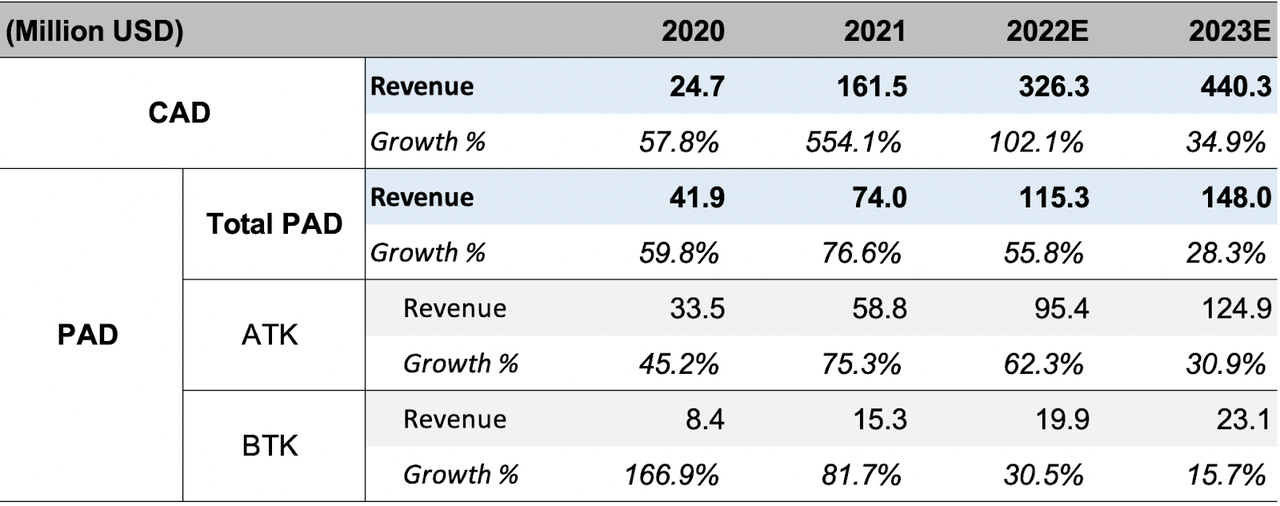

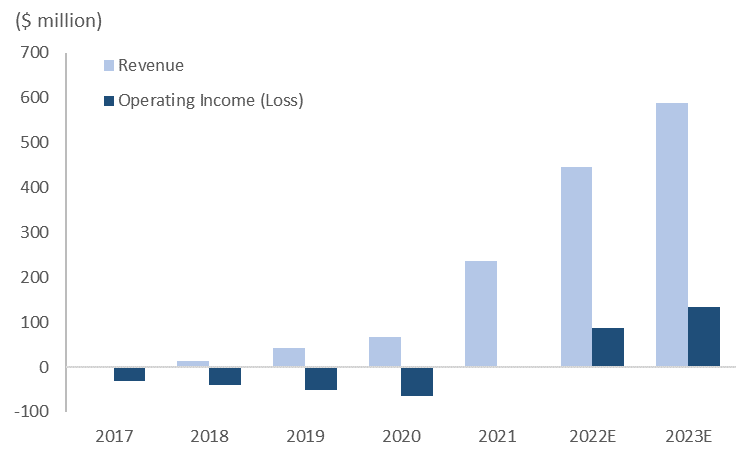

Product Summary: Revenue Estimates

(Source: Euphoric Investments, ShockWave Medical)

ShockWave’s treatment for Coronary Artery Disease (CAD) is primarily for patients who have moderate or severe calcium plaque, which blocks blood vessels. The most common treatment for CAD is Percutaneous Transluminal Angioplasty (PTA) which has a lower success rate, is more invasive, and shows higher associated risks compared to ShockWave’s CAD treatment.

ShockWaves explains that:

“Peripheral Artery Disease (PAD) is the narrowing or blockage of vessels that carry blood from the heart to the extremities, caused by the buildup of plaque within the walls of arteries. It is a common, under-diagnosed, and under-treated disease whose global patient population, estimated at more than 200 million, is driven by an aging population and increased rates of diabetes, among other causes.”

(Source: Piper Sandler Estimates, Euphoric Investments)

The table above gives growth estimates for ShockWave’s products. PAD is divided into two revenue lines for treatments, Below-the-Knee and Above-the-Knee. As the company matures and approaches market saturation, growth ultimately slows. This, however, is not expected in the near term as ShockWave is still projecting to deliver strong revenue growth through FY23. Wolfe Research estimates that for U.S. coronary IVL cases, ShockWave has only reached 5% penetration and expects 10-25% long term penetration. Coronary comprises the majority of revenue, and higher penetration growth clearly shows there is still room to run.

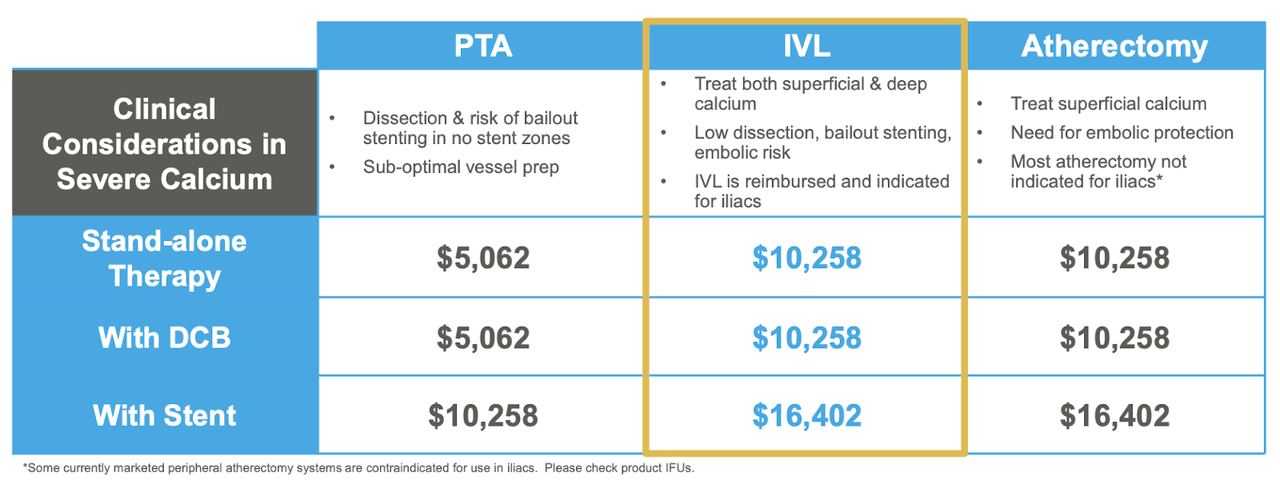

Procedure Reimbursement:

Recently, the largest tailwind has been improvements on the reimbursement front. Center for Medicare Services recently authorized reimbursement for ShockWave’s IVL treatments. CEO Doug Godshall reported that, “above the knee IVL procedures in hospitals are now paid on parity with atherectomy, which puts us on a level economic playing field for the first time” (Q4 Earnings Call). Essentially, this means that hospitals using ShockWave ATK treatment will receive insurance reimbursement at the same rate as atherectomy (current standard of care). This massively increases ShockWave’s competitive profile as hospitals are far more inclined to use ShockWave’s products.

Reimbursement Rates for IVL/Competing Procedures ((Source: ShockWave Medical))

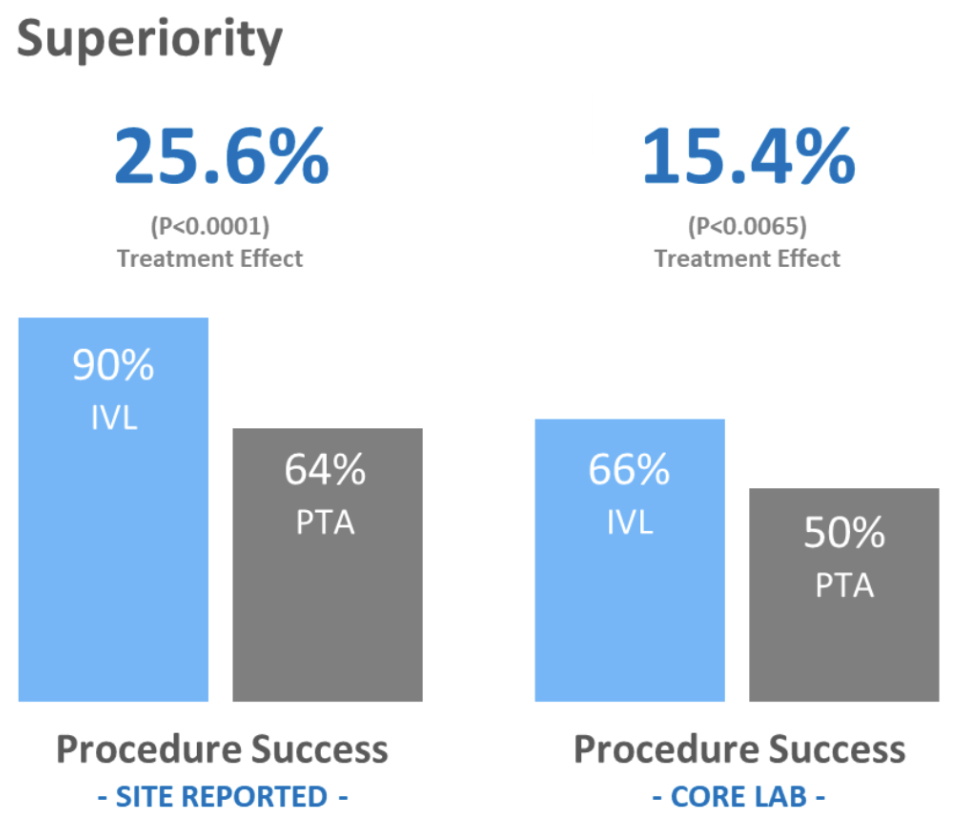

Clinical Trials & FDA Approvals

Clinical trials conducted for ShockWave Medical’s IVL approach to treating calcified cardiovascular disease has concretely shown it is more effective, a less invasive/safer procedure, dramatically reducing complications. The coronary IVL clinical trial studies (Disrupt CAD III & IV) have revealed significantly lower levels of complications and negative patient outcomes. The study summarizes by stating, “CAD III confirms IVL safety with low rates of major peri-procedural clinical and angiographic complications, setting a new bar for safety in complex coronary lesions.”

The peripheral study ((Disrupt PAD III)) shows that “IVL provides superior vessel prep and excellent long-term results in calcified vessels while preserving future treatment options.” The complication rates among patients were also significantly lower compared to other treatments.

These studies including previous clinical trials have been the basis for demonstrating high safety rates and proving a need for this approach.

ShockWave received FDA approval for the C2 Coronary IVL catheter in 2021. For the peripheral IVL catheter ShockWave first received FDA approval in 2017 and has since gained approval for new products in 2019 & 2021.

(Source: ShockWave Medical)

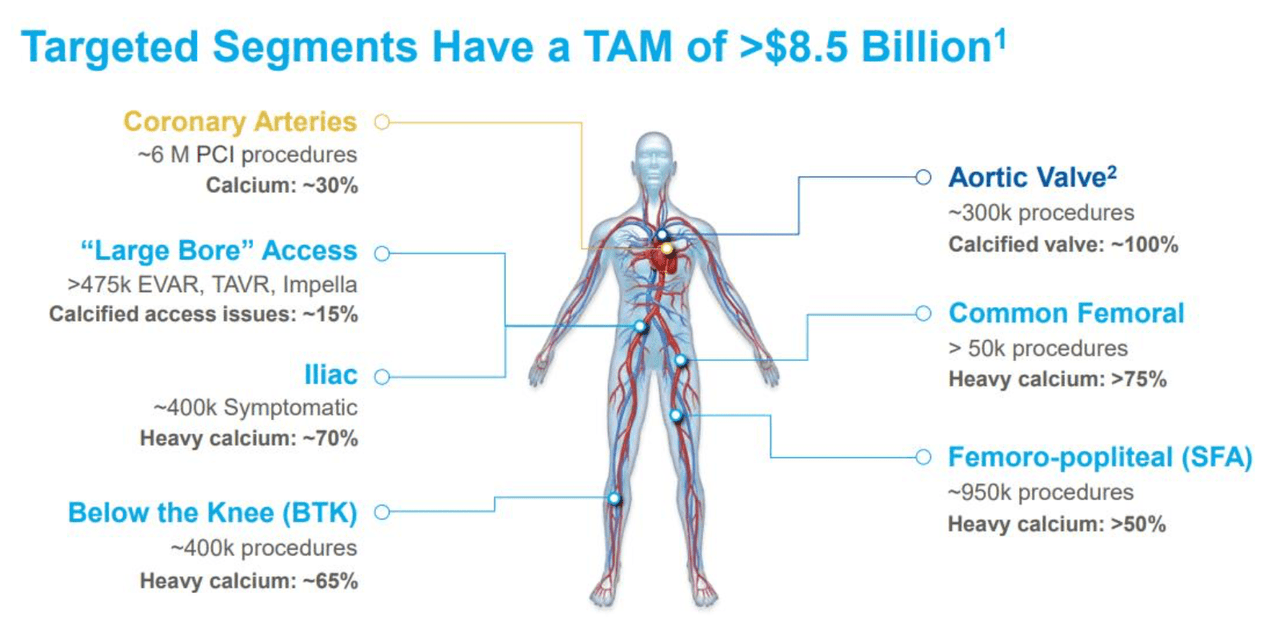

Total Addressable Market & Growth Strategies:

Source: ShockWave Medical

ShockWave expects meaningful growth to be fueled largely from:

-

Aging global population

-

Projected uptick in diabetic & obesity rates

-

Further clinical evidence that supports ShockWave’s approach

-

Increasing physician adoption of less invasive treatment options

-

Complications and costs associated with current surgical treatment of cardiovascular disease.

(Source: ShockWave 10-K).

Expansion into foreign markets will present a massive tailwind to revenues. ShockWave currently has regulatory approval in Japan for its C2 device (coronary) and expects to gain regulatory approval in China for their C2/M5+ devices (coronary & peripheral) shortly.

Physician use of ShockWave devices will hit stronger adoption if IVL becomes the standard of care for treating calcium plaque. ShockWave’s future growth and ability to capture total addressable market (“TAM”) hinges on entry and expansion in foreign markets, higher penetration rate among U.S. hospitals, and developments of new product lines.

Risk Factors to ShockWave:

ShockWave has demonstrated unparalleled growth and seen great benefits on fronts like regulatory approval, adoption rates in clinical settings, CMS reimbursement, and little to no competition. It’s easy to get caught up in the story, but investors must also acknowledge risk, namely market competition and regulatory risk.

Market Risk

-

Risk of losing patent protection and monopoly status

-

$CSII has already invalidated 2 of their patents

-

$CSII competing technology expected to market by 2024-2025

-

ShockWave dependence on third-party suppliers & price fluctuations in the manufacturing process

ShockWave has iterated a strong belief in their ability to litigate against patent infringement. CEO Doug Godshall holds that:

“[B]y 2025, we expect to have at least six different designs and everything we will be selling then will be different and better than what we are selling today. Being first has its advantages” (Q4 Earnings Call).

Further, any competing product would have to face the same rigorous clinical trials and FDA approval that is a massive barrier to entry.

Regulatory Risk

Receiving approval by a regulatory institution such as FDA is essential for successfully commercializing biomedical products. Future opportunities for growth will be restricted in the event the new product lines cannot be approved due to unsuccessful clinical trials or are significantly delayed. Moreover, to commercialize medical products, ShockWave must gain approval from the relevant government of every single country that they are targeting to market their products. Approval process takes time and money, and any hindrance or delay in penetrating foreign markets will prove detrimental to ShockWave’s success.

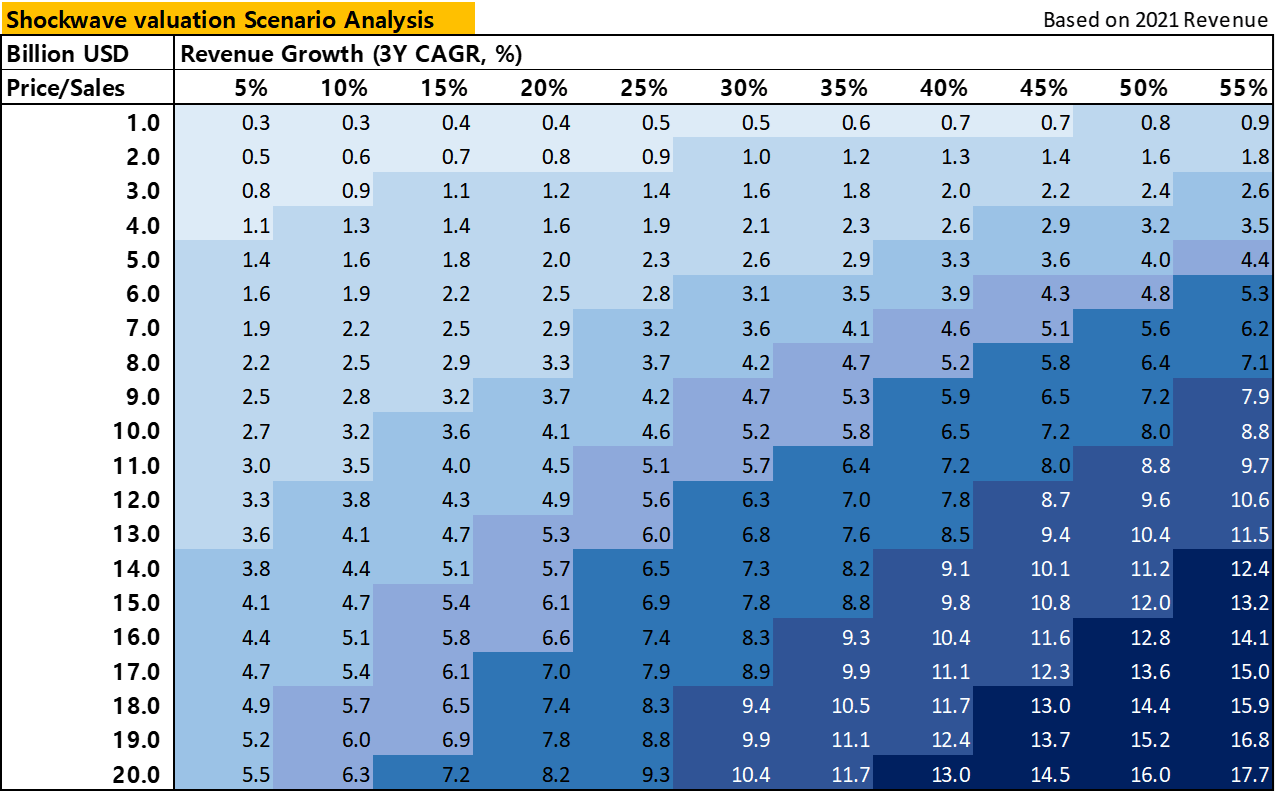

Valuation:

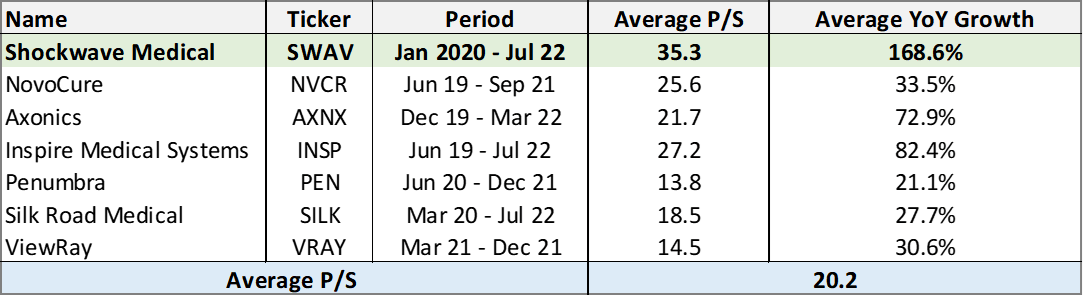

(Source: Euphoric Investments, Company Reports)

Looking at the financials of ShockWave explains why this company sports a rich valuation. ShockWave’s growth has been parabolic, with FY 21 revenue growth of 250%, and FY 22 guidance projecting 84% YoY revenue growth. The 3-year revenue CAGR of 154% shows explosive growth as they rapidly roll out products to market and have since focused on gaining higher penetration in foreign and domestic markets. A gross profit margin of 84%, with a ROE of 12.28%, demonstrates best-in-class performance and high management effectiveness.

(Source: Bloomberg, Euphoric Investments)

ShockWave has also recently turned profitable having posted a positive net income over the past three quarters.

ShockWave has a strong balance sheet, with only $17 million in debt and cash on hand of $201 million (MRQ). Their credit facility is rated investment grade by Moody’s and Standard & Poor’s Credit Ratings, with a current 3.5% interest on debt.

(Source: Euphoric Investments, Macrotrends data)

Though ShockWave currently trades at a higher price-to-sales (p/s) multiple compared to companies in the medical device sector during their period of high growth (>25%/yr), ShockWave offers a stronger forecast for growth relative to their peers while having reached profitability sooner.

ShockWaves currently trades at 25x sales with forward guidance of 16.7x sales. We believe that the higher valuation is warranted due to their growth history and recent profitability, but at the point growth begins to wane, the valuation should then normalize.

Bull Case:

-

History of outperforming guidance

-

Faster than expected penetration into foreign markets

-

Insurance Industry (CMS) designating SWAV as the new standard of care treatment

Bear Case:

-

High p/s multiple

-

Fast paced revenue growth is difficult to sustain long term

-

Competing products emerging sooner than anticipated

-

Unexpected regulatory hurdles (specifically foreign)

As valuations across the sector and broader markets contract, it is our position that the current valuation would have to fall closer in line with peers to present an entry point and iterate a near-term Hold on ShockWave Medical. We believe the fair market value would represent a ~19x forward p/s multiple with a $227 price target.

Though we expect long-term higher valuations for ShockWave Medical, investors could expect near term weakness given that the stock is up 22% TTM relative to the medtech index iShares U.S. Medical Devices ETF (IHI), which is down 15%.

Be the first to comment