stockcam

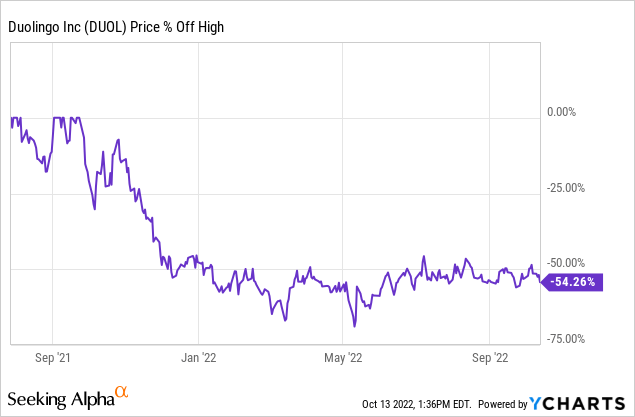

High-growing Duolingo (NASDAQ:DUOL) is the most popular language-learning platform. The online education market keeps growing and Duolingo is growing with it. Duolingo was founded in 2011 and already has over 49 million monthly active users. Duolingo’s stock is down over 50% from its all-time high in September 2021. The company has one of the best balance sheets I’ve ever seen. Thanks to very high margins, Duolingo is on its way to massive profitability. In my opinion, DUOL shares can represent an interesting opportunity for long-term investors.

The Story Of Duolingo

Duolingo’s mission is to “to develop the best education in the world and make it universally available”.

Most of you have probably already heard of Duolingo, as their app has over 575 million downloads.

For those of you who don’t know what Duolingo is simply put: Duolingo is a platform where users can learn over 40 languages effectively, and in a fun way. Over 13 million users use the app daily. Right now, the company doesn’t have a competitor that even comes close to it in terms of market capitalization and number of downloads. When someone asks about learning languages online, most people think of Duolingo. This is a really great competitive advantage that Duolingo has.

The company was founded in 2011 by Severin Hacker and Luis von Ahn. Severin Hacker is still with the company and is the CTO. Luis von Ahn is also still with the company as CEO.

Both run the company on a day-to-day basis and both own over 8% of the company, which is very positive.

Users really love Duolingo. This is also shown by the reviews on the App Store, where Duolingo has 4.7/5 stars.

The Business Model

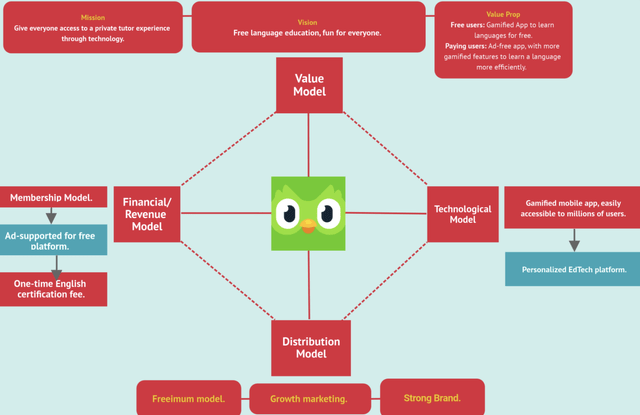

Now let’s focus on how Duolingo makes money.

The company has several sources of income. The first way DUOL makes most of its money is the premium version of Duolingo. The company also has a free plan, but it has significantly fewer features than the premium plan.

The premium plan is called Duolingo Plus and it costs $6.99 per month for individuals. The company currently has 3.3 million subscribers. DUOL also offers a family plan where you can have up to 6 accounts and it costs $9.99.

Next, there are advertisements. Advertisers pay DUOL to have their ads appear on the Duolingo app.

If you use the app for free, you will see ads in Duolingo. The premium version does not have ads, which is another advantage. DUOL has over 49 million monthly active users and most of them do not have a premium version. Thanks to this, Duolingo can serve ads to tens of millions of users, and the company is already making good money from it.

Another way the company makes money is through events.

Hosts run paid classes where users can practice the language they are learning with other Duolingo users. Users discuss various topics with each other in the language they are currently learning. These classes are led by hosts.

Classes are mostly held via Zoom and often cost between $10-$15. Most of the money paid by users for the classes is for the host but Duolingo takes a small fee from the paid amounts. That is another way they make money.

And last but not least, there is The Duolingo English Test (DET), which is an online English proficiency test that you can take from home. DET covers four basic English skills: Speaking, Listening, Writing, and Reading. It is a very detailed test of your knowledge of English. This exam is mainly for job and college applicants. It is also for people who want to prove their knowledge of English. DET costs $49 and has a lot of potential in my opinion.

Business Model Duolingo (Four Week MBA)

Duolingo & Growth

Now let’s look at what strategies will the management use to grow the business.

The first strategy is simply to grow the monthly active users. The market opportunity is still there because there are 1.8 billion+ language learners globally. The active monthly user growth is absolutely key for DUOL. When you become an active user, you can then buy several products from Duolingo, which is very important for the company.

Another strategy for company growth is simply a better product.

Thanks to a better platform – by which I mean mainly more content that users can learn, there will be a greater chance that a user who has already paid for the premium version will remain a regular customer for many more years. This will mean more revenue for DUOL. Improving the product is very important for the growth of the company.

Then there is the Duolingo English Test.

I already mentioned this and the reason why users should choose this test to prove their knowledge of English is the price. Duolingo English Test costs $49 while most similar tests cost over $200. Due to the fact that Duolingo has hundreds of millions of users, there is a good chance that they will buy DET due to its cheap price. Users take the test from home, which is also an advantage.

In my opinion, DET represents a really big opportunity for Duolingo.

An as-yet-unmentioned strategy that management wants to use to grow the platform is education in more subjects than just language learning. Like math for example. Duolingo already has an application for learning other knowledge such as learning letters and reading, thanks to which Duolingo could also be used by children aged 5+ years, who do not usually use Duolingo at that age. The opportunity for Duolingo for multi-subject education is really huge, and we’re talking about an opportunity in the tens of billions of dollars here.

The Financials Are Perfect

Now let’s take a look at Duolingo’s financials.

In Q2 2022, DUOL had revenue of $88.39 million, up 50.3% YoY. That is very fast growth. As for gross margins, they are really high, as they were 73% in the 2nd quarter of this year. Overall, the company lost $15 million in net income. DUOL can afford such quarterly losses, as it has a very strong balance sheet. What many investors don’t realize is that Duolingo spends twice as much money per quarter on research and development than on marketing. Last quarter, the company spent $34 million on R&D, while only $15 on S&M. Most companies do the exact opposite. Duolingo’s CEO himself said, “the reason they stand out themselves from the competition is that they focus on the product”. And that’s exactly what the company’s management does and what I love so much about Duolingo. Duolingo’s balance sheet is truly one of the best I’ve seen. The company has total assets of $701 million and has $591 million of that in cash. Overall, they have $172 million in total liabilities and $0 in long-term debt. If management wanted to, it could pay off all its liabilities tomorrow and still have $419 in cash. Duolingo has a really great balance sheet.

Valuation

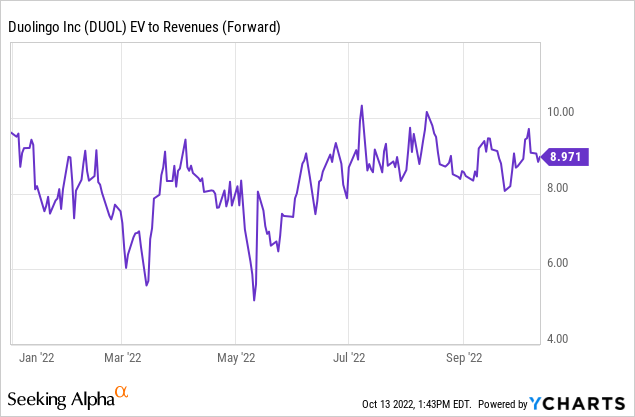

Now let’s focus on the company’s valuation. Right now, Duolingo has a market cap of $3.8 billion. Subtracting the company’s cash position Duolingo has an enterprise value of about $3.2 billion.

This means DUOL is currently trading at an FY 22 EV/Revenues of 8.9x.

I personally recognize that the company’s shares are not cheap. But you have to keep in mind that DUOL is growing really fast as it is expected that the company will grow by 45% in FY 22. DUOL is currently trading at an FY 23 EV/Revenues of 6.8x.

That is much more reasonable. I don’t own DUOL shares yet, and I don’t plan to buy Duolingo at the current valuation. But if the stock falls below $75, then it will be much more attractive for me personally and I will start seriously thinking about buying.

Risks

Now let’s take a look at the risks of Duolingo. The first risk entailed by investing in DUOL is the company’s current unprofitability. Duolingo loses about $60 to $70 million a year. DUOL is not yet expected to be profitable between 2022 and 2024. Despite the fact that Duolingo is on track to make a profit, the company is still losing money and that is a risk. That’s why I’m going to monitor the company’s bottom line closely. I’m going to keep an eye on the fact that Duolingo is getting closer to being profitable every year. The other risk I have to talk about is the current valuation of the company. That’s why I won’t buy DUOL shares just yet despite how much I like the company itself. Currently, Duolingo has a market cap of $3.8 billion. Enterprise value is about $3.2 billion.

DUOL is currently trading at FY 22 EV/Revenues of 8.9x. Due to the fact that Duolingo is not yet profitable, this valuation is really not cheap. If a company misses earnings for example even by a few percent or the guidance gets cut, stocks may well fall by a few tens of percent in a matter of days on the market’s current sentiment. Even after a drop like that, stock won’t be completely cheap and that’s probably the biggest risk Duolingo has right now.

Catalyst

What many investors do not realize is that Duolingo could be acquired by another company.

The 3 companies that could potentially buy DUOL in my opinion are Apple (AAPL), Microsoft (MSFT), and Google (GOOGL). For each of the companies mentioned, Duolingo would be a good addition to their business. I certainly wouldn’t buy DUOL just because it’s possible that some company might acquire it, but the chance that one of these bigger companies will buy Duolingo is not entirely negligible.

Conclusion

Duolingo is a fast-growing founder-led business. The company has one of the best balance sheets I’ve ever seen. The business model of Duolingo is great and what I like about the company is that it’s very focused on making the best product. This is also why the company is so successful. The only reason I’m not going to buy DUOL shares right now is because of its valuation.

Right now I don’t find risk/reward very attractive. But if the stock goes below $75, then I’m going to start thinking very seriously about buying. But in the meantime, I will monitor Duolingo closely, and I certainly think that if the shares are purchased at the right price, they can produce very attractive returns for long-term investors.

Be the first to comment