DNY59

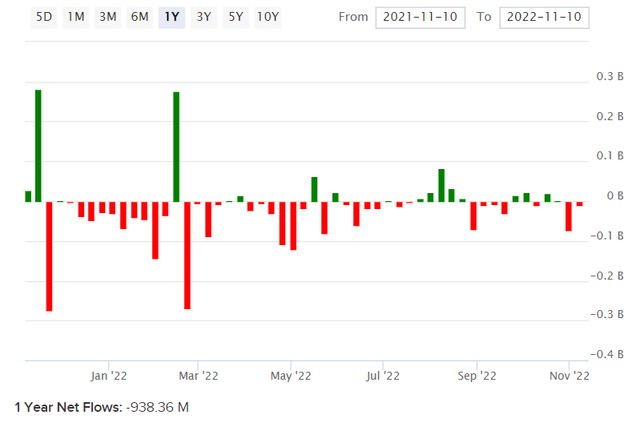

Invesco S&P 500 High Beta ETF (NYSEARCA:NYSEARCA:SPHB) is an exchange-traded fund whose investment mandate involves investing in accord with its chosen benchmark index, the S&P 500 High Beta Index. This is an interesting strategy which enables investors to get access to a volatile (by design) ETF which is built on a portfolio of U.S. stocks that exhibit greater price volatility than the broader U.S. equity indices. The fund had 100 holdings exactly as of November 10, 2022, with net assets under management of about $410 million and a total expense ratio of 0.25%. This follows negative net fund flows over the past year of about -$938 million, which makes sense in a down market.

Nevertheless, despite the large outflows SPHB has fallen by “only” -15.06% year-to-date, at the time of writing, as compared to the S&P 500 U.S. equity index’s fall of -16.71%. The out-performance is modest, but any out-performance at all is surprising given the significant outflows and high-beta strategy.

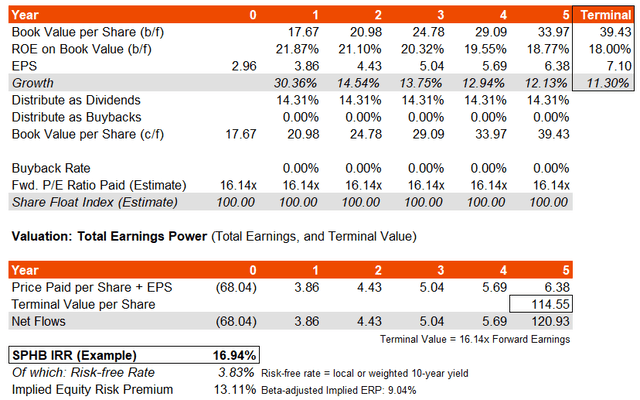

Valuing SPHB inherently feels like an odd task, given the volatility-oriented strategy as compared to a bottom-up, value-oriented approach. Nevertheless, valuing ETFs provides a useful perspective no matter the strategy. The fund’s benchmark’s most recent factsheet as of October 31, 2022 reflects trailing and forward price/earnings ratios of 21.04x and 16.14x, respectively, with a price/book ratio of 3.53x. That implies a forward return on equity of 21.87% and a forward earnings yield of 6.20%. Both these figures are strong.

Assuming a relatively stable return on equity around 20% over the next several years, and a stable rate of dividend distributions of about 14% (based on the above data), my basic model would imply 19-21% average earnings growth, which compares to Morningstar‘s forecast of 18.15% on average for SPHB’s portfolio over the next 3-5 years. In order to bring this into balance with the forecast average earnings growth, I will assume that the underlying portfolio return on equity gradually falls to 18% by year six. The implied IRR is still large at almost 17% (see below).

The historical beta of the fund is 1.45x, which is not actually especially high. My model, with a risk-free rate of 3.83% at present (that is, the prevailing U.S. 10-year yield) would imply an underlying equity risk premium of 13.11%. On a beta-adjusted basis that is still 9.04%, which is much higher than a fair range of 4.2-5.5% for U.S. equities. SPHB looks like it is undervalued. Yes, it may be more volatile/risky, but the underlying portfolio offers strong returns even adjusted for risk levels. The earnings multiple is also relatively tame at about 16x forward earnings.

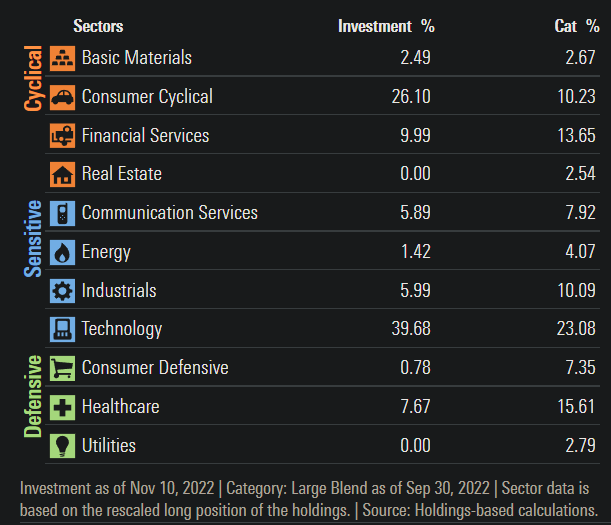

Bear in mind that the fund is exposed mainly to technology (40%) and cyclical consumer (26%) stocks. This makes the fund even more impressive given recent out-performance, and also likely makes SPHB well-positioned at present.

Morningstar.com

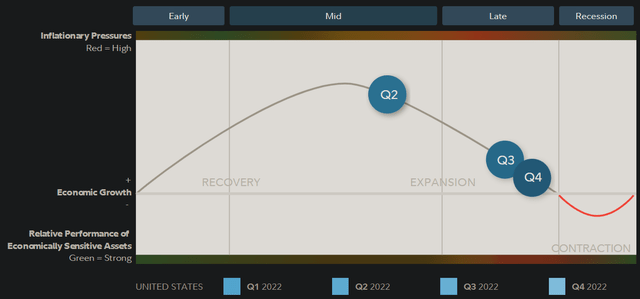

That is because, as per Fidelity research, the United States is likely heading into a contractionary period in its present business cycle (as of Q4 2022).

That makes high-beta equity funds well-positioned, because markets tend to lead the real economy. Should growth and inflation fall, interest rates will likely also begin to turn (albeit gradually). If equity markets can get ahead of the economy by 6-12 months, ideally by about 12 months, then SPHB is very much likely to out-perform, as the average recession lasts circa 10 months.

While SPHB is an unconventional ETF strategy, I like the simplicity and the portfolio composition. With 100 holdings, the fund is not too concentrated either, with the largest positions still safely representing less than 2% of the fund each. SPHB is a strong bet for those bullish on the economy beyond 12 months from now.

Be the first to comment