Marco Bello

The ARK Innovation ETF (NYSEARCA:ARKK) exchange-traded fund may set new lows after J.P. Morgan chairman Jamie Dimon and the International Monetary Fund warned of rising recession risks that will hurt high-multiple growth stocks.

The ARK Innovation ETF has also seen increased fund outflows since August and has made no significant changes to its risk management practices in recent months, resulting in ETF buyers accepting a high degree of concentration risk.

Further to my recent views on the exchange-traded fund, the majority of the ARK Innovation ETF’s core holdings remain money-losing, overpriced tech stocks that are especially vulnerable in a downturn.

Devastating Performance Continues

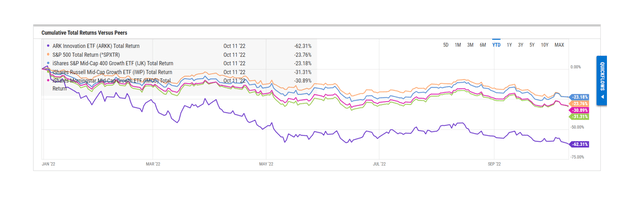

If you invested $10,000 in Cathy Wood’s ARK Innovation ETF on December 31, 2021 and held onto your exchange-traded fund shares until today, your investment is now worth only $3.8K. In other words, an investment in the ARK Innovation ETF has wiped out roughly 62% of the original investment value.

While the ARK Innovation ETF was lauded for its outsized returns during the Covid-19 pandemic, the fund has since lost all (yes, all) of its pandemic gains.

A simple indexing strategy would have been far better for most investors this year, preventing significant capital losses. The ARK Innovation ETF has lost 62% of its stock value, while the S&P500 is down only 24% year to date.

I believe ETF investors will continue to see new lows in the ARK Innovation ETF as management has failed to learn from previous risk management mistakes and continues to deploy an ill-advised, high-risk concentration strategy that doubles down on stocks that have seen brutal selloffs.

A New Problem For ARKK: Fund Outflows

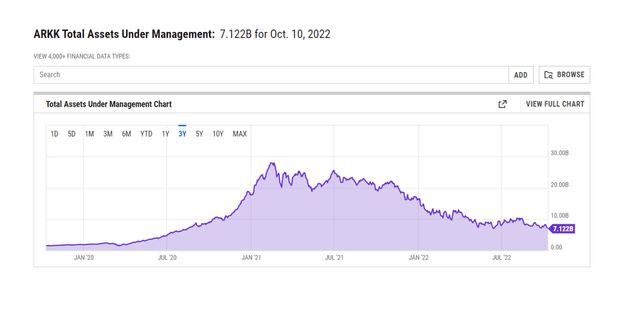

Since the peak of the Covid-19 pandemic, a significant amount of capital has been withdrawn from the ARK Innovation ETF. Cathy Wood’s flagship fund now has less than $8 billion in assets under management, a significant decrease from the peak of $28 billion in early 2021.

ARKK Total Assets Under Management (YCharts)

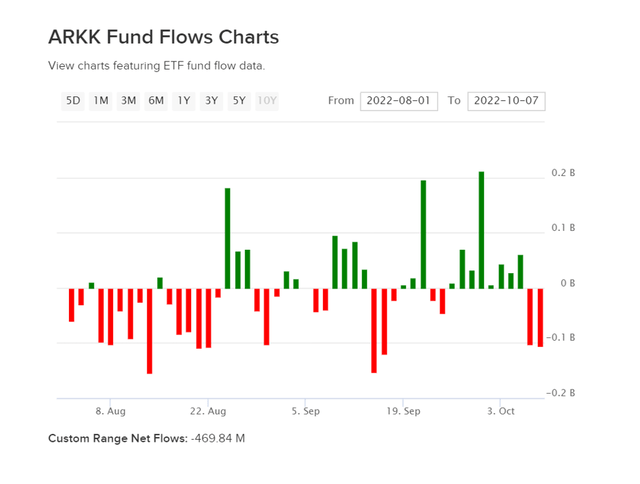

Furthermore, investors have begun to withdraw funds from Cathy Wood’s flagship fund, indicating that even ETF investors are skeptical of the fund’s asset allocation.

ARKK Fund Flows (ARK Innovation ETF)

Still Over-concentrated In A Few High-Multiple Stocks

As of October 12, the ARK Innovation ETF’s largest holding is still Tesla (TSLA), with a weighting of 9.1%.

Zoom Video Communications (ZM) has an 8.9% weighting, while Roku (ROKU) has a 6.6% representation.

The top three holdings of the ARK Innovation ETF account for roughly a quarter of the fund’s total assets, while the top ten holdings account for 57.1%.

ARK Innovation ETF Top 10 Holdings (ARK Innovation ETF)

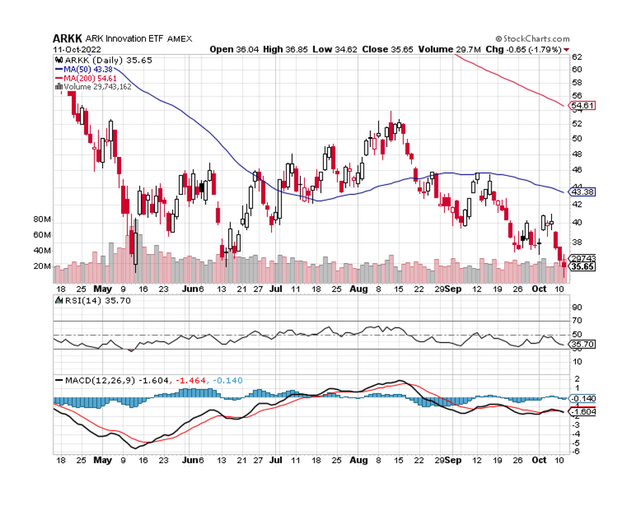

ARK Innovation ETF’s Chart Picture Looks Awful

The technical situation for the ARK Innovation ETF is also unimpressive. The ETF is trading just 1% above its 52-week low of $34.62, suggesting that the stock may become oversold in the near term.

The exchange-traded fund is not yet oversold, according to the Relative Strength Index, but it may enter the oversold zone if the ETF makes a new low.

Given that economic risks are rising, outflows have increased since August, and the ETF remains overweight in unprofitable stocks with high multiples, which is true for the majority of the fund’s top ten constituents, ARKK is in a precarious position.

Why ARKK Could See A Higher Valuation

To lift the entire technology sector, the market as a whole would have to make a U-turn, which I believe is unrealistic given the increased risk of a recession in recent days and weeks.

The International Monetary Fund forecasts slower growth (2.7%) for 2023, and J.P. Morgan chairman Jamie Dimon warned that the United States could enter a recession within 6-9 months. I don’t think the U.S. economy will avoid a recession, but if it does, the ARK Innovation ETF could see a strong valuation recovery.

My Conclusion

As the exchange-traded fund hits new lows, the ARK Innovation ETF is likely to see more fund outflows. New fund outflows could force stock sales, putting additional pressure on the fund’s net asset value.

Withdrawals have increased since August, when the market became gripped by fears of a more serious recession.

Investors should avoid buying the lows because, despite poor performance and withdrawals, the exchange-traded fund has not changed its risk management and has not diversified its portfolio more.

Be the first to comment