onurdongel

DT Midstream, Inc. (NYSE:DTM) is a somewhat little-followed natural gas-focused midstream company that operates primarily in the Appalachian region, although the company also has some operations in the Haynesville Shale. This is something that sets the company apart from many of its peers, as it is one of the only midstream companies that is serving the Appalachian market. It is also something that could give the company an advantage over many of its peers since the Appalachian region is very well positioned to see enormous production growth in the coming years and DT Midstream could benefit by taking these incremental resources to the market where they can be sold.

In addition to this, DT Midstream enjoys many of the same qualities that other midstream companies do, such as stable cash flows and a respectable dividend yield. With that said, though, the 3.25% yield currently possessed by the stock is substantially lower than what many of its peers possess. This alone does not mean that the company is not worth your investment dollar, though, since it may be able to make up for the low current yield through growth. Let us, therefore, investigate further and see if DT Midstream could be deserving of a place in your portfolio.

About DT Midstream

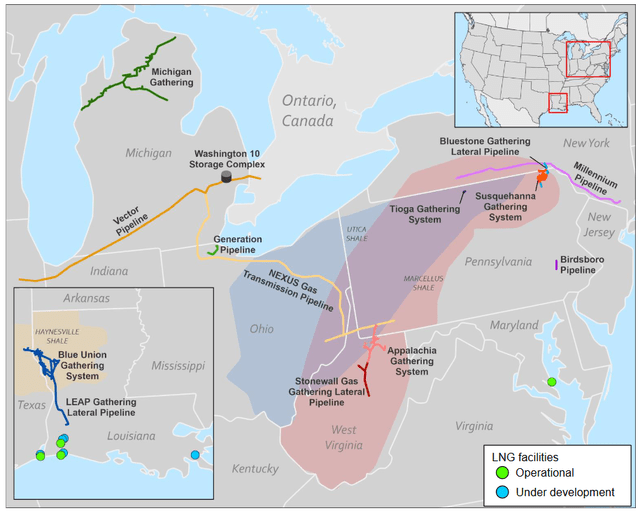

As stated in the introduction, DT Midstream is a little-known midstream company with operations in the Haynesville Shale and the Appalachian Basin:

The Appalachian region is almost always considered to be a natural gas play, although it also produces natural gas liquids. The Haynesville Shale is not a play that we hear about very much in the investment media but it is also one of the most natural gas-rich basins in the United States. As such, we might expect DT Midstream to focus primarily on providing midstream infrastructure to natural gas producers. This is indeed the case as the company boasts over 1,200 miles of long-haul natural gas transportation pipelines, 1,000 miles of natural gas gathering pipelines, and 94 billion cubic feet of natural gas storage capacity.

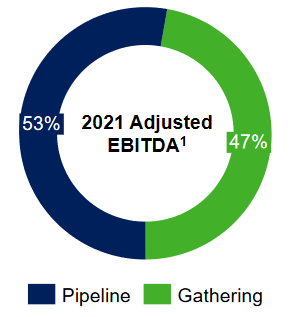

This focus on the natural gas space is a legacy of the company’s formation last year when it was spun off from DTE Energy (DTE), which is a large natural gas and electric utility in Michigan. One thing we note, though, is that the company’s operations are almost evenly split between transportation and gathering pipelines:

DT Midstream

The transportation pipelines are the large, long-distance pipelines that we typically associate with midstream companies. However, the gathering pipelines are completely different animals. These are a specialized form of small, short pipelines that grab resources at the wellhead where they are extracted from the ground and then transport them to the first destination on their journey to the end-user, which is typically either a much larger long-haul pipeline or a processing facility.

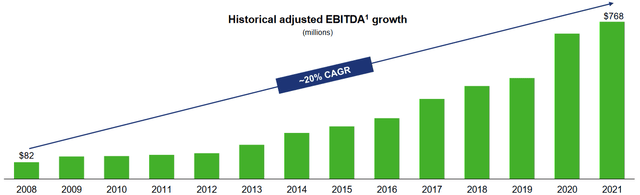

The company’s long-haul pipelines and its gathering pipelines use the same basic business model. DT Midstream enters into long-term, volume-based contracts with its customers that include minimum volume commitments. This provides DT Midstream with incredible stability regardless of resource prices or conditions in the broader economy. As we can see here, DT Midstream managed to increase its adjusted EBITDA (a proxy for pre-tax cash flow) every year since 2008:

This is a period of time that included a global financial crisis, two energy price collapses, and two recessions (one of which was caused by a global pandemic). The fact that DT Midstream was able to grow its cash flows at a 20% compound annual growth rate and never had a year in which cash flows declined speaks wonders to the strength of its business model. This kind of strength and performance is exactly the sort of thing that income-focused investors like to see because stable cash flows through any environment provide a great deal of support for the dividend.

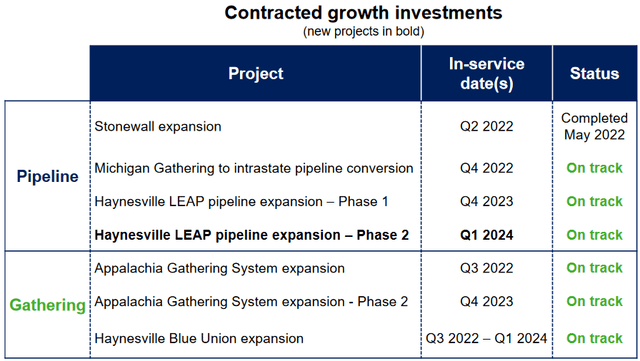

Naturally, as investors, we are unlikely to be satisfied with mere stability. We also want to see growth. As might be suspected given DT Midstream’s volume-based business model, the way that this growth is accomplished is by growing volumes. However, one of the defining characteristics of midstream infrastructure is that it only has a finite capacity of resources that it can handle. Thus, DT Midstream needs to construct new infrastructure in order to increase the volume of resources that it can store or transport. The company is doing exactly this. As we can see here, DT Midstream currently has seven growth projects under construction that are scheduled to come online between now and the first quarter of 2024:

One of the nicest things about these projects is that DT Midstream has already secured contracts from its customers for their use. This provides several advantages for the company. Perhaps the most significant advantage is that we can be certain that DT Midstream is not spending a great deal of money to construct infrastructure that nobody wants to use.

A second major advantage is that DT Midstream knows in advance how profitable a given project will be so it knows that each of them will deliver a large enough return to justify the investment. DT Midstream has not specified exactly what the rate of return will be on any of these projects but midstream projects typically pay for themselves in four to six years, which I mentioned in a recent article. We can, therefore, assume that this is probably a good estimate of DT Midstream’s average payback period.

As all of these projects are already contracted, they will begin generating cash flow as soon as they become active. Thus, we will start to see the impact of each project during the quarter in which it begins operations. This should prove valuable over the remainder of this year since, as we can see, there are three to four projects coming online during the third and fourth quarters of this year. This gives DT Midstream a nice pipeline to continue its historical growth trajectory.

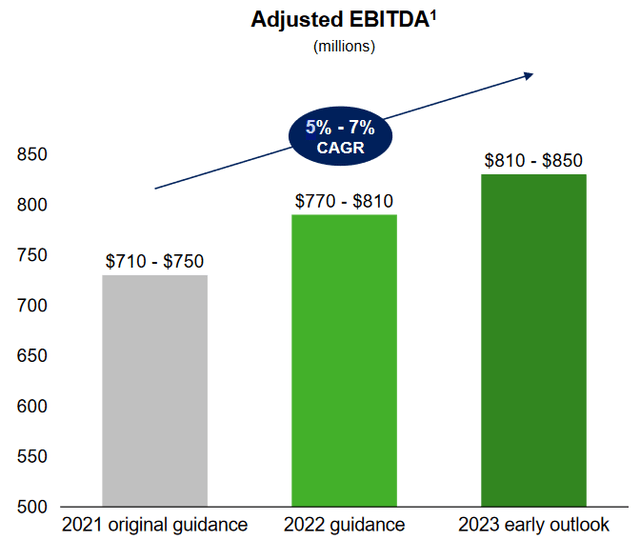

Although DT Midstream has not stated exactly how profitable each of its current growth projects will be, we have been provided with some cash flow growth projections. Based on the projects that are scheduled to come online between now and the end of 2023, DT Midstream should be able to grow its adjusted EBITDA at a 5% to 7% compound annual growth rate over the 2021 to 2023 period:

This is admittedly nowhere close to the 20% historical growth rate that DT Midstream has delivered but it is certainly respectable. DT Midstream has committed to growing its dividend at roughly the same rate as its cash flows. Thus, we are looking at a pathway for dividend growth, which helps to offset the fact that DT Midstream’s current yield is somewhat lower than the other companies in the sector. It is also something that we can appreciate in today’s inflationary environment because it should help us maintain the purchasing power of the dividend.

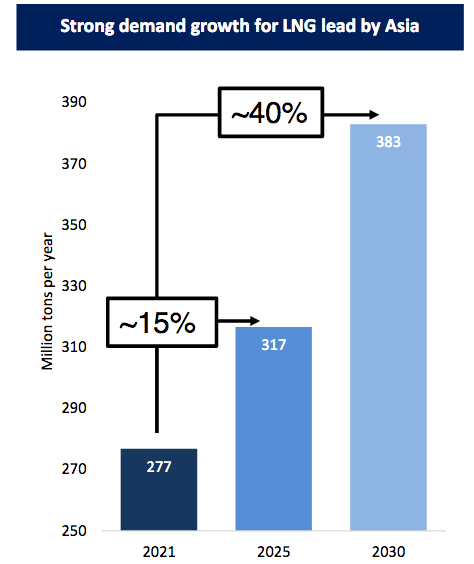

A Potential Opportunity In Liquefied Natural Gas

In a few previous articles, such as this one, I discussed the emerging opportunity in liquefied natural gas. This has become something of a popular investment idea lately due to the recent war in Ukraine that has left Europe frantically searching for new sources of natural gas. However, the majority of the demand growth for liquefied natural gas will come from Asia, which is shifting from coal to natural gas in an effort to clear up its smog problems. Asia is expected to increase its imports of liquefied natural gas by 40% between now and 2030, so clearly, this is an opportunity that we should not ignore:

Golar LNG

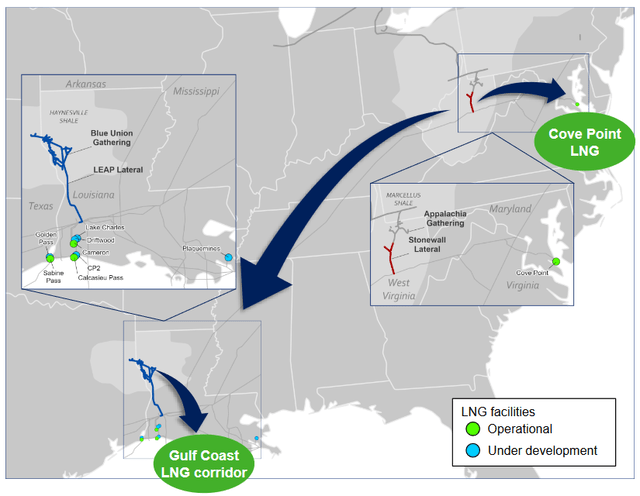

DT Midstream could be in an excellent position to take advantage of this growing market, even though the company produces no natural gas itself. This is partly due to the areas in which it operates. There are two places in the United States where energy companies that are constructing liquefaction plants are focusing their efforts. One is along the Gulf Coast near the border between Texas and Louisiana. The other area is along the East Coast near Philadelphia, Pennsylvania. The two closest natural gas-producing basins to these areas are the Haynesville Shale and Appalachia:

This is what creates the opportunity for DT Midstream since these happen to be the two areas that the company serves. The growth of this industry is expected to be immense, with new capacity currently being constructed that will require at least thirteen billion cubic feet of natural gas per day. As DT Midstream already has some of the infrastructures in place to transport natural gas from these two basins to the new liquefaction plants, it is going to have an easier time increasing its capacity to transport more gas than many of its peers. Since DT Midstream earns its money based on transported volumes, we can very easily see the strong growth potential here by transporting more of the needed gas to fuel the new liquefaction plants.

Dividend Analysis

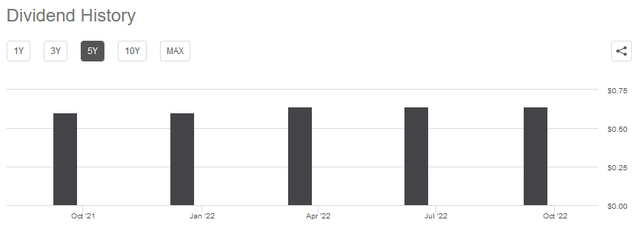

One of the biggest reasons why many investors buy stock in midstream companies like DT Midstream is because of the high yields that these companies tend to possess. As mentioned in the introduction, DT Midstream is not an exception to this as its 3.25% current yield is significantly higher than the 1.45% yield of the S&P 500 index (SPY). With that said though, DT Midstream’s dividend yield is lower than many of the other companies in the sector. However, it is attempting to make up for that through growth. As DT Midstream only began trading as an independent company last year, it does not have a particularly long dividend track record to look but we have already seen one dividend hike:

The company plans to increase its dividend further as its cash flow increases. This is something that is very nice to see during inflationary periods, such as the one that we are in right now. This is because inflation is constantly reducing the number of goods and services that we can purchase with our dividends. This can cause an investor to feel as if they are getting poorer and poorer. The fact that the company is increasing the amount of money that it pays us helps to offset this effect and maintains the purchasing power of the dividend. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut the dividend. That scenario would reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we analyze a company’s ability to maintain its dividend is by looking at its free cash flow. The free cash flow is the amount of cash that is generated by the company’s ordinary operations and is left over after it pays all its bills and makes all necessary capital expenditures. This is therefore the money that it can use to reduce debt, buy back stock, or issue a dividend. In the trailing twelve-month period ended June 30, 2022, DT Midstream had a levered free cash flow of $324.0 million. However, the company only paid out $178.0 million in dividends over the same period. When we consider that the company enjoys remarkably stable cash flows, we can see that it can easily afford its dividend with a great deal of money left over. Thus, there do not appear to be any real concerns here about its ability to afford this dividend.

Conclusion

In conclusion, DT Midstream appears to have a lot to like despite having a lower yield than many of its peers. In particular, the company has tremendous growth potential, as the demand for natural gas is certain to increase and its assets are very well positioned to take advantage of this. The firm has committed to growing its dividend along with its cash flow so it should be able to provide us with a growing source of income going forward. In addition, the company’s cash flow stability could be a source of comfort as the economy falls into a recession. Overall, there could be some very real reasons for an investor to consider purchasing DT Midstream today.

Be the first to comment