onurdongel

On Friday, October 28, 2022, natural gas-focused midstream company DT Midstream, Inc. (NYSE:DTM) announced its third-quarter 2022 earnings results. The initial headline numbers here were quite positive as the company beat the earnings expectations of its analysts and raised its full-year guidance. This continues the trend that we have been seeing across the industry of companies reporting fairly strong earnings figures as the energy industry continues to recover from the problems that it encountered during the depths of the COVID-19 pandemic. DT Midstream is quite well positioned to take advantage of the current fundamentals due to its presence in two of the richest natural gas basins in the United States as well as the growing international demand for natural gas. Unfortunately, though, DT Midstream’s low yield relative to many of its peers is likely a turn-off to many of the traditional investors in this sector as its 4.28% current yield is well below the Alerian MLP index’s (AMLP) 7.09% yield. That certainly does not mean that DT Midstream is without merit though and in fact, it may have a lot to offer investors, which we can see in these earnings.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from DT Midstream’s third-quarter 2022 earnings results:

- DT Midstream brought in total revenues of $235.0 million during the third quarter of 2022. This represents a 10.85% increase over the $212.0 million that the company brought in during the prior-year quarter.

- The company reported an operating income of $121.0 million during the reporting period. This compares quite favorably to the $107.0 million that the company reported in the year-ago period.

- DT Midstream acquired an additional 26.25% of the Millennium Pipeline in New York. This brings the company’s total ownership of the pipeline up to 52.5%.

- The company reported an adjusted EBITDA of $207 million during the current quarter. This represents a slight increase over the $205 million that the company reported in the equivalent period of last year.

- DT Midstream reported a net income of $113 million in the third quarter of 2022. This represents a 24.18% increase over the $91 million that the company reported in the third quarter of 2021.

It seems certain that the first thing anyone reviewing these highlights will notice is that DT Midstream showed improvement in terms of every major measure of financial performance. However, we do not see nearly as much growth here as what the various producers of oil and natural gas, such as Exxon Mobil (XOM), delivered during the quarter. This is due to the overall stability of the company’s business model. As is the case with most midstream companies, DT Midstream enters into long-term (usually five to ten years in length) contracts for the transportation of natural gas. The customer sends resources through DT Midstream’s pipelines and then compensates DT Midstream based on the volume of resources transported, not their value. This has the effect of greatly insulating DT Midstream from changes in energy prices. As a result, the company’s cash flows do not really go down much when energy prices do. While that is certainly a good thing for risk-averse investors, it also has the reverse effect in that the cash flows do not go up very much when energy prices are high. We see that illustrated in these results.

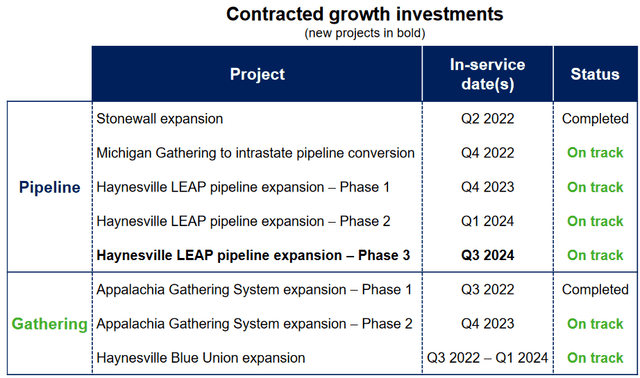

There is one benefit that comes from rising energy prices, however. That benefit is that producers tend to increase their output of hydrocarbons. Thus, there will frequently be a higher quantity of goods that need to be transported so midstream companies see higher volumes and by extension higher cash flows. However, there is a limit to this because a pipeline only has a finite quantity of resources that it can transport. In order to truly take advantage of this, midstream companies will need to construct additional pipelines so that they can move higher volumes of resources through their infrastructure. DT Midstream is doing exactly this. The company currently has six growth projects under construction that will be completed between now and the end of 2024:

One of the nicest things about all of these projects is that DT Midstream has already secured contracts from its customers for their use. This is nice because it ensures that the company is not spending a great deal of money to construct projects that nobody wants to use. In addition, the company knows in advance how profitable the project will be before the construction begins so it knows that it will earn a sufficient return to justify the investment. DT Midstream does not actually state what rate of return it is expecting but growth projects undertaken by various other midstream companies typically pay for themselves in four to six years so we can assume that this is a reasonable guess for DT Midstream’s projects as well. That is certainly an acceptable figure that results in the company getting its money back fairly early in the pipeline’s overall lifespan.

We can see that one of the company’s growth projects, Phase 1 of the Appalachia Gathering System expansion, was brought online during the company’s most recent quarter. This was one of the things that were responsible for the growth that the company reported during this quarter. This illustrates another reason that the company obtaining advance contracts is advantageous. The company begins earning money from a given project as soon as it comes online. Thus, it will nearly always see growth in a quarter in which it completes the construction of a project. Thus, we can see that these various projects give DT Midstream a solid pathway for growth over the next few years.

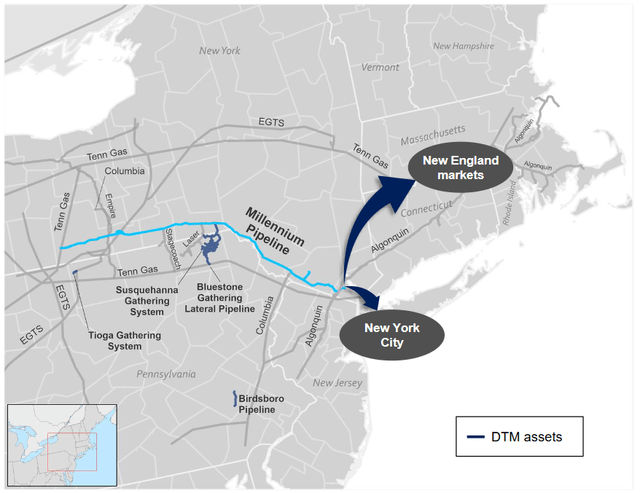

As stated in the highlights, DT Midstream increased its ownership stake in the Millennium Pipeline in New York during the quarter. This is yet another thing that could result in near-term growth. The Millennium Pipeline is a 263-mile pipeline running across much of the Pennsylvania-New York border:

The pipeline is designed to deliver approximately two billion cubic feet of natural gas per day from Appalachia to the highly-populated markets of New York City and New England. This is a pretty good place to be since the demand for natural gas in both New York City and New England is surging but both markets are undersupplied with gas. New England uses approximately 85% of the home heating oil that is consumed in the United States but the region’s policymakers are very aggressively trying to reduce the region’s carbon emissions. The logical source is to increase the use of natural gas for both heating and electric generation purposes as natural gas burns much cleaner than coal and is far cheaper and more efficient than electricity for providing heat. DT Midstream bought 26.25% of this pipeline during the third quarter for $552 million. Unfortunately, it arguably overpaid fairly substantially. That is because this price represents about 10x adjusted EBITDA, which is roughly double the usual return that peers typically get on similar acquisitions. This acquisition will double the amount of cash flow that DT Midstream gets from this pipeline but I would have preferred to see the acquisition be made at a much lower price. The pipeline is already fully contracted and operational though so we did see it impart a slight increase in DT Midstream’s financial performance during the third quarter and we will see a bigger impact during the fourth quarter as DT Midstream will own the majority of the pipeline for the entire quarter as opposed to simply part of the quarter.

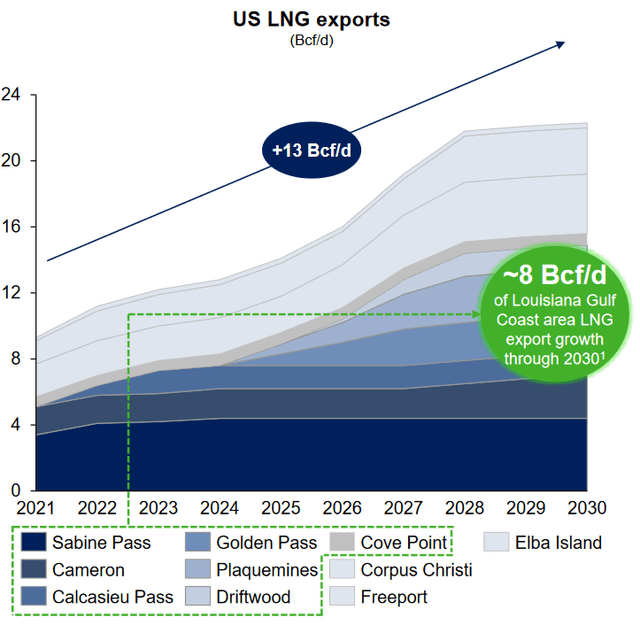

One of the major trends in the American energy industry over the next decade is likely going to be a surge in natural gas exports. This is exemplified by the construction of numerous natural gas liquefaction plants around the country as the only effective method to transport natural gas across large bodies of water is to convert it into a liquid and ship it on specially designed vessels. This is because natural gas is, as the name implies, a gas and so it will expand to fill any container that it is placed in. As I pointed out in numerous previous articles, the global demand for natural gas is expected to increase by 29% over the next twenty years due to various reasons, including international concerns about climate change. The United States is one of the few nations in the world that can significantly increase its consumption of natural gas because of the mineral wealth of areas like Appalachia and the Haynesville Shale. In response to this demand for exports, the industry has begun constructing numerous liquefaction plants along both the Gulf Coast and the Eastern Seaboard. These facilities are expected to require about thirteen billion cubic feet of natural gas per day to operate by 2030:

This stands to benefit DT Midstream because it has assets in place to serve all but three of the liquefaction plants scheduled to come online over the decade. As we have already discussed, DT Midstream’s cash flows are directly correlated to volumes so the company so if it begins carrying natural gas to satisfy the demand from these facilities, the company’s cash flow could grow dramatically. It is indeed quite likely that at least some growth in the company’s volumes will occur due to the sheer volume of natural gas that will need to be transported to meet this demand, which will require pretty much every midstream company in the industry to satisfy. Thus, we will likely see DT Midstream deliver considerable growth as this story plays out.

One of the most attractive things about DT Midstream has always been its relatively low debt load. This is attractive because debt is a riskier way to finance a business than equity for a number of reasons. One of these reasons is that if the company’s cash flow falls too far, the company may become insolvent due to not having enough money to make the mandatory debt payments. We can see that DT Midstream has a relatively low debt load by looking at its leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio basically tells us how long (in years) it would take the company to completely pay off its debt if it were to devote all of its pre-tax income to that task. As of September 30, 2022, DT Midstream had a leverage ratio of 3.4x based on its trailing twelve-month adjusted EBITDA. This is well below the 5.0x that analysts typically consider to be acceptable. However, I am more conservative and like to see this ratio below 4.0x, which is the level that a number of companies in the industry have set as their long-term debt ceiling. We can see that DT Midstream is considerably below even that more conservative figure, which is overall very nice to see as it should ensure that the company will have no real trouble carrying its debt even if its cash flow declines for some reason. Such cash flow declines tend to be rather rare in this industry, though.

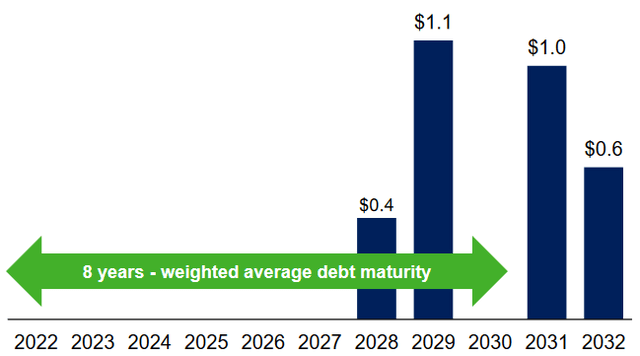

Another nice thing about the company’s debt is that it has no near-term debt maturities. In fact, it has no debt maturities until 2028:

This is generally attractive as well since it gives the company a great deal of time for its growth story to play out as well as to generate cash in order to pay down its debt prior to maturity. One of the major risks of debt comes when that debt matures. This is because the company will usually pay off its debt by issuing new debt to raise the needed capital to pay off the maturing debt. This can cause the company’s interest costs to increase following the rollover depending on the conditions in the market. We admittedly do not know what the market conditions will be in 2028 when DT Midstream’s debt begins to mature. However, we can be relatively confident that the company will have significantly higher cash flow than it does now so it may be able to pay off some of this debt early and offset some of the risks by ensuring that it has less total debt to roll over. Overall, this is a good situation for the company to be in.

One of the biggest reasons why investors purchase shares of midstream companies like DT Midstream is because of the high yields that they tend to pay out. DT Midstream yields 4.28% at the current price, which is substantially lower than most of its peers. However, the company still beats the 1.59% yield of the S&P 500 index (SPY). As is always the case though, it is critical that we ensure that the company can actually afford its dividend. After all, we do not want to be holding the stock when it is forced to reverse course and cut the dividend. This is because such a scenario will reduce our income and almost certainly cause the stock price to decline. The usual way that we judge a midstream company’s ability to pay its dividend is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the common stockholders. During the third quarter, DT Midstream reported a distributable cash flow of $186 million, which represents a fairly significant increase over the $139 million that the company had in the year-ago quarter. The company’s dividend is only $62 million per quarter considering the current outstanding share count. This gives it a 3.0x coverage ratio. Generally, analysts consider any ratio over 1.20x to be reasonable and sustainable. We can clearly see that DT Midstream achieves this without any trouble. Overall, there is very little to worry about here as the dividend appears to be quite safe.

In conclusion, we continue to see a lot to like in DT Midstream’s latest results. The company posted some year-over-year growth but still showcased the stability that we have come to expect from its business model. In addition, we see a great deal of potential here as the company has a number of projects coming online over the next two years that should serve to stimulate its growth further. The company could end up with more projects underway with time, particularly as the liquefied natural gas industry gets ramped up. It is very well positioned to do this as it boasts a remarkably strong balance sheet and robust cash flow. Overall, this company continues to look like a winner.

Be the first to comment