funky-data/iStock Unreleased via Getty Images

Investment Thesis

At first glance, Dropbox (NASDAQ:DBX) seems like a great investment. The company is a growing software business trading at a cheap valuation. Yet even with its solid financial performance the stock has had negative returns since its IPO. The company’s share price has only started to meaningfully increase since it began to buy back its shares in 2020.

Before I can invest in a stock like this, I need to understand why returns have been so mediocre over the past few years. I found that Dropbox relies on adjusted, non-GAAP metrics that exclude some key expenses. I feel this may result in an overly optimistic view of the business. Regardless of these issues, I still feel the company is undervalued.

Simplicity and Consistency

Dropbox’s simplicity is its strength. It’s a solid content cloud service that generates its income from monthly paying subscribers. The business then offers auxiliary services for different use cases, such as backups, small businesses, and large enterprises. These upgrades drive higher revenues per user over time.

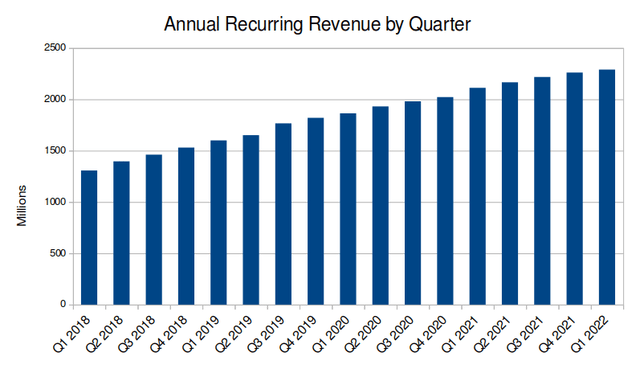

Created by author using data from 10-Q and 10-K filings

This simplicity also applies to the business’s finances. One of Dropbox’s strengths is its consistent recurring revenue. Businesses that sell their software as subscriptions have more predictable finances and are less subject to short term headwinds. This annual recurring revenue also scales well. Dropbox regularly has gross margins in the 80% range. This solid operating leverage allows the business to become more profitable as it grows its top line.

Strategy and Growth

Dropbox is most widely known for its file sharing and backup offerings, but I think management is doing a good job of expanding the company’s core products. On the last earnings call, management discussed how they are working to grow Dropbox’s offerings for both business teams and content creators.

Their focus is on bringing users into their ecosystem by way of partnerships, integrations, and links from existing users. They then plan to convert those free users into paying ones. From there they’ll upsell those users to higher priced services to drive even more revenue.

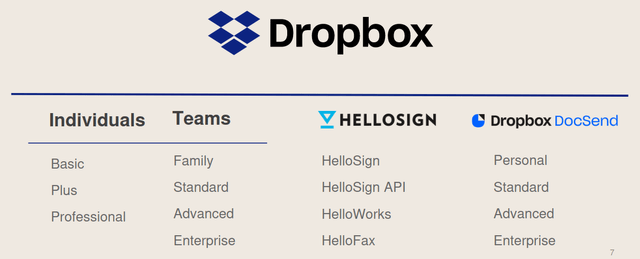

Dropbox’s Ecosystem (Dropbox Q4 2021 Earnings Presentation)

I think the company’s recent entry into the e-signature business is a good example of this. It’s a saturated but valuable service that’s growing in demand. Dropbox’s offering has the competitive advantage of being integrated into their software ecosystem. This may lead existing Dropbox customers to choose it over, say, DocuSign (DOCU).

I believe the company is well positioned to add market share across both smaller companies and individual creators. The company’s focus on its team offerings pushes it further into a lucrative space occupied by companies like Box Inc. (BOX). Dropbox’s last quarterly presentation pointed out that over 35% of its paying users are on its Teams plans, and I expect this number to grow.

Another major shift in the company’s strategy is their permanent shift to remote work. The business was one of the earliest to announce that it was going to do away with most of its offices. I think this move is smart. It will allow the business to hire workers outside of expensive tech hubs like San Francisco. This will drive long term cost savings for the business, further benefiting the company’s already strong margins.

Pricing Model and ARPU

One point of concern is the business’s ARPU (average revenue per user). This number has largely stayed flat over the past year, even as inflation runs hot. I understand some of this is driven by the business’s revenue mix, but the company hasn’t yet attempted to increase any of its prices between the end of 2020 and their most recent quarterly report.

I’m not sure how Dropbox’s business economics may change in the upcoming years. The business (and the content cloud industry in general) have only really existed in a favorable economic environment. There isn’t much available data to predict how a potential recession may impact growth or limit increases in revenue per user.

On its last earnings call management addressed their pricing model in response to an analyst question. The CEO agreed with the analyst’s comment that a “broad-based price increase could be in the cards.” The CFO said the company will have more to share regarding this pricing structure in the upcoming quarters. This relationship between ARPU and total paying users is one I’ll be watching closely over the next year.

Valuing the Business

I believe Dropbox is a strong company and it is a business I’d like to own, but only at the right price. A lot of similar SaaS businesses trade at premium valuations. Dropbox is an exception. By most metrics its shares look incredibly cheap.

Take the business’s earnings from its last quarter of $0.38. At the current share price of $20.70, this would give the business an annual price to earnings ratio of only 13! For a company that has historically grown at double digits year over year, this is an unusually cheap valuation. Dropbox’s earnings aren’t forecast to rapidly decline in the coming years, either.

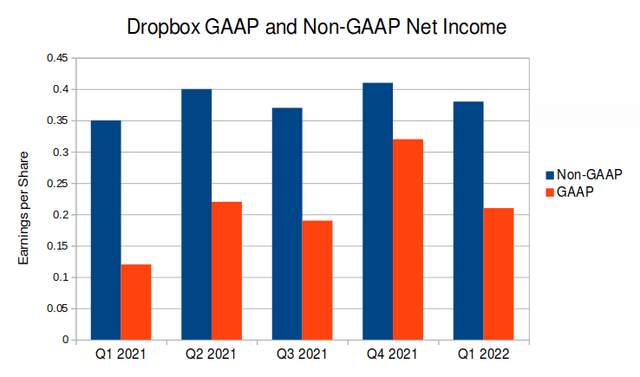

Non-GAAP Net Income

Dropbox’s audited financial statements paint a somewhat different picture. The GAAP net income numbers reported on the company’s 10-Q filing are only 21 cents per share. Performing the same calculations on these GAAP numbers I get a price to earnings ratio of 25. This is closer to what I would expect for a company like Dropbox.

I know that many businesses report earnings numbers that have been adjusted for minor expenses. But there’s a consistently large gap between Dropbox’s GAAP and non-GAAP earnings.

Created by author using data from 10-Q and 10-K filings

The business’s GAAP earnings are often as little as half of the non-GAAP ones. So let’s look at how these non-GAAP measures reconcile with the GAAP ones.

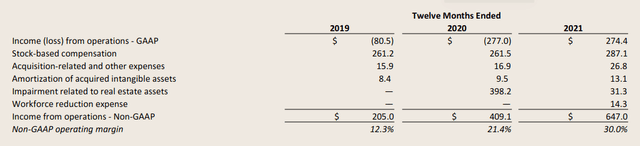

Dropbox Q1 2022 Earnings Presentation

As you can see, there are a variety of expenses management wants to exclude from their headline numbers. Some of these make sense when assessing long-term performance. For example, the business has incurred several hundred million dollars in real estate impairment related to their remote work shift. As I discussed earlier, I think this is a good move. These are one-time impairments directly related to a strategic business move, so I think it makes sense to exclude them when valuing the business.

But that leads to the most significant item excluded from the headline numbers: Stock-based compensation.

Stock-Based Compensation

For the past three years, Dropbox has paid out over a quarter billion dollars annually in stock-based compensation. Around 20% of operating expenses are paid out in the company’s shares. I don’t like how the business excludes that from its headline results. That style of SBC is a real, reoccurring cost used to pay for part of employees’ salaries.

Yes, stock-based compensation is technically a non-cash expense. But the business uses share buybacks as the primary method of returning money to shareholders. In practice, its stock-based compensation offsets the total number of shares reduced. This has a direct effect on the company’s returns to shareholders.

Discounted Cash Flow

When I’ve decided I want to buy a company and I need to do a more detailed valuation I often use a discounted free cash flow analysis. But because of the high stock-based compensation I’ll need to make some adjustments to my usual model.

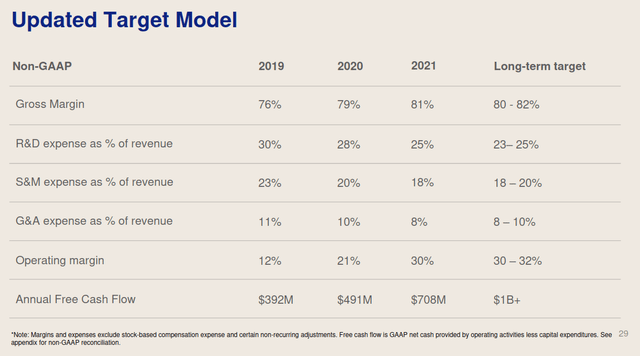

Dropbox Q1 2022 Earnings Presentation

I’m basing my main model off of the company’s guidance of $1 billion in free cash flow by 2024. That’s a tough target to meet, but Dropbox’s management has been consistent in meeting expectations. They’ve beat analyst expectations on the top and bottom line for 16 of the past 17 quarters.

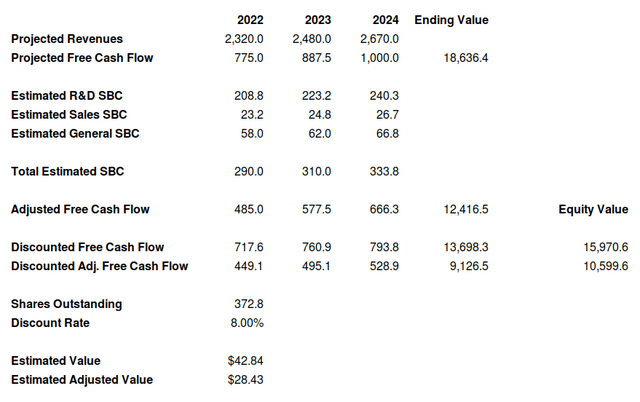

From there I’m going to take analyst expectations for revenue and then discount the free cash flow by my expected stock-based compensation as a percent of the company’s revenue. Over the past fiscal year stock-based compensation has increased Dropbox’s research and development expense by 36%, its sales and marketing expense by 5%, and its general and administrative expense by 25%. I will use a Gordon growth model to calculate the ending value.

The company’s estimated free cash flows alone indicate a fair value of $42.84. Removing estimated stock-based compensation, the same model calculates a fair value of $28.43. So even accounting for SBC the company is still cheap, with an implied upside of as much as 40%.

Final Verdict

Dropbox is a solid, profitable business in the growth technology sector, an opportunity that’s been scarce over the past few years. I have some concerns about the company’s long term revenue growth and it’s accounting of stock-based compensation. I’m especially going to watch out for any update on the pricing of Dropbox’s main offerings. But even so, I feel the business’s valuation and consistent revenue are enough for me to say it is undervalued at these prices.

While I’m being more cautious about my purchases amid the current market volatility, I would consider buying and holding this company for the long term.

Be the first to comment