Justin Paget/DigitalVision via Getty Images

SunPower Corporation (NASDAQ:SPWR) is a specialized semiconductor company in the Information Technology sector. According to the Wall Street Journal, the firm engages in the design, manufacture, and delivery of solar panels and systems. It operates through the Dev Co. and Power Co. segments.

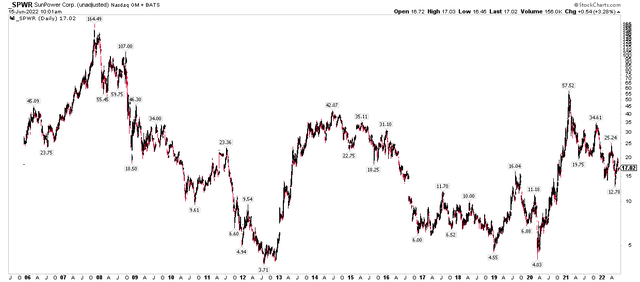

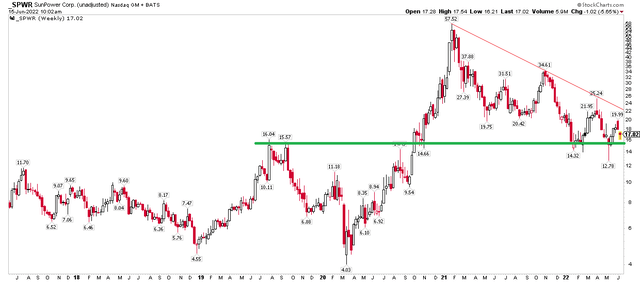

A $3 billion small cap with a volatile earnings history, the California-based company has a history of going through tremendous booms and bust cycles. New investors might be surprised to find that SPWR peaked all the way back in 2007 – that was the true boom in solar energy speculation. Shares fell more than 95% to the 2012 low of under $4. A revival in the company led to a 10x return to 2014 before a broader energy bust began. The stock plummeted once more to $4 before booming to $60 in the early-2021 stimulus-led recovery. Now here we are at $17. What a ride through the chart!

SunPower Stock Price History: A Tumultuous Past

Stockcharts.com

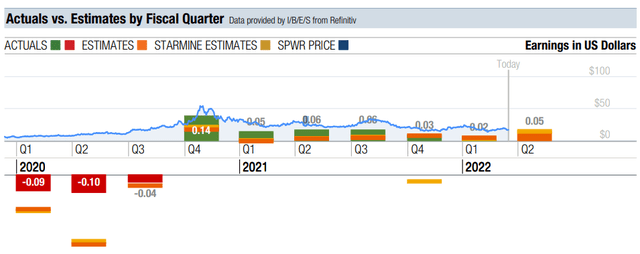

Fundamentally, SunPower has seen a recent stretch of quarterly profits, according to Fidelity’s third-party research report. That comes after net losses per share in both 2020 and 2021.

SunPower Earnings History: A Slew of Profitable Quarters

Fidelity Investments

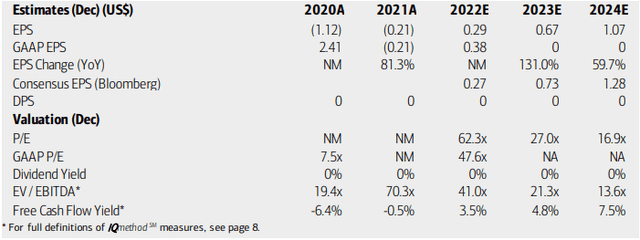

Analysts at Bank of America Global Research forecast an EBITDA inflation during the back half of this year. BofA is optimistic that the company can find areas of growth to boost earnings. Still, there are question marks regarding the management team’s execution and margin expansion prospects. EPS is seen as turning positive for 2022 and increasing further through 2024, according to BofA – and they are even below consensus EPS forecasts. The company’s P/E ratio is expected to improve, and its free cash flow yield is forecast to improve significantly by 2024.

Fundamental Earnings and Valuation Outlook: Improving EPS and FCF

BofA Global Research

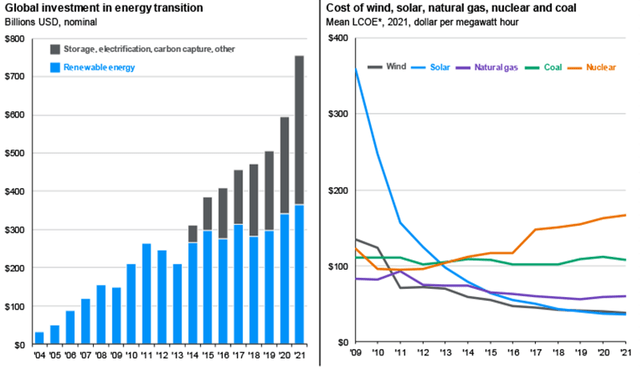

Broadly, there are tailwinds. The global energy generation mix continues to shift toward renewables, though many questions remain as to what the future will look like in wake of surging oil and gas prices and a drift away from globalization. Still, the levelized cost of energy shows that solar is more viable now than ever, according to J.P. Morgan Asset Management and Bloomberg NEF data.

The Global Energy Transition: A Shift to Solar

J.P. Morgan Asset Management

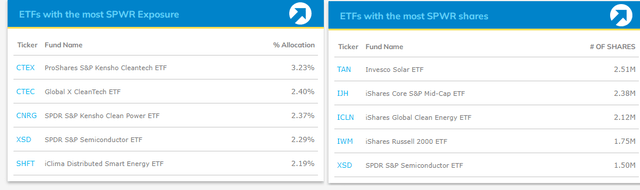

Where might you find SPWR in the ETF world? Cleantech and semiconductor funds hold the stock. The Invesco Solar ETF (TAN) has the most shares of any fund, according to ETF.com. Clearly what’s going on with energy, semiconductor chips, and trends in small- and mid-caps matter for SPWR shares’ supply and demand.

ETFs Holding SPWR Shares

ETF.com

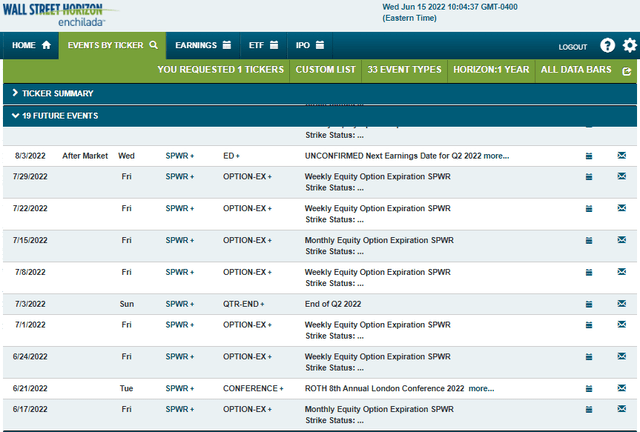

Looking ahead, there could be market-moving news at the Roth 8th Annual London Conference 2022 when SPWR management is expected to present along with many other industry executives. Moreover, the next earnings date is slated for AMC on August 3, according to Wall Street Horizon.

Key Dates: June 21-23 Conference, August 3 Earnings

Wall Street Horizon

The Technical Take

Turning to the charts. The stock finds itself in an interesting spot. SPWR is clearly in a downtrend off the early 2021 peak, so right there is a primary bearish factor. There appear to be buyers in the $12-$16 area. That has been a significant range dating back to 2016. I would like to see a breakout above the downtrend resistance line, currently at $22 before getting long. Price action must lead the way here.

Wait for the Breakout: Downtrend Line at $22, Broad Support Range: $12-$16

Stockcharts.com

The Bottom Line

There are fundamental tailwinds for SunPower, but the technical outlook isn’t encouraging right now. That could change on a breakout above the downtrend that began early last year. Profit growth is expected in the coming quarters along with positive free cash flow, but catching this shiny falling knife right now is a risk.

Be the first to comment