ollo/iStock via Getty Images

Introduction

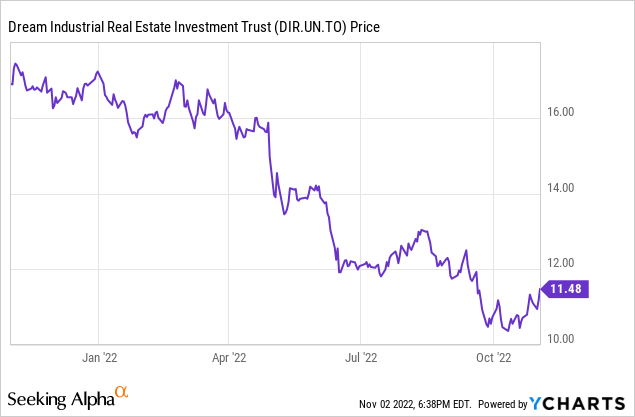

In August, I was quite charmed by Dream Industrial REIT’s (OTC:DREUF) (TSX:DIR.UN:CA) 5.6% dividend yield. The REIT focuses on industrial and logistics properties in North America and Europe, and its share price has been suffering from the reduced confidence in the real estate markets, fueled by higher capitalization rates which, in some cases, puts balance sheets under pressure. Dream Industrial has just released its Q3 results and I wanted to have a closer look at the updated numbers.

The third quarter was pretty robust

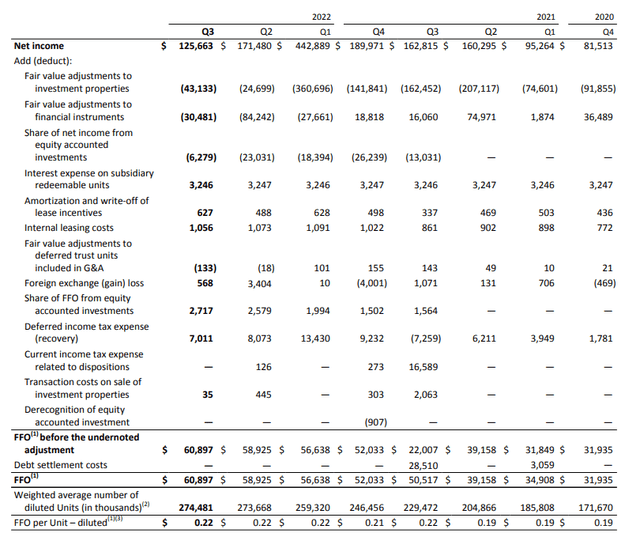

Before diving into the capitalization rates and the impact of higher interest rates, it’s obviously important to first have a look at how the REIT performed in the third quarter. I really do enjoy the REIT’s policy to publish an overview of the eight most recent quarterly results as this helps to understand how the numbers evolve. That being said, 2021 and the final quarter of 2020 likely weren’t the best quarters to use in comparison, given the impact of COVID on the results.

The main takeaway is that the FFO continues to increase on a QoQ basis. Whereas Dream generated an FFO of C$52M in the final quarter of last year, this already increased to C$60.9M in the third quarter of the current year. And that again is a 3% increase compared to the C$58.9M in the second quarter of this year.

The REIT provides the FFO based on the fully diluted unit count, and the FFO/share came in at C$0.22.

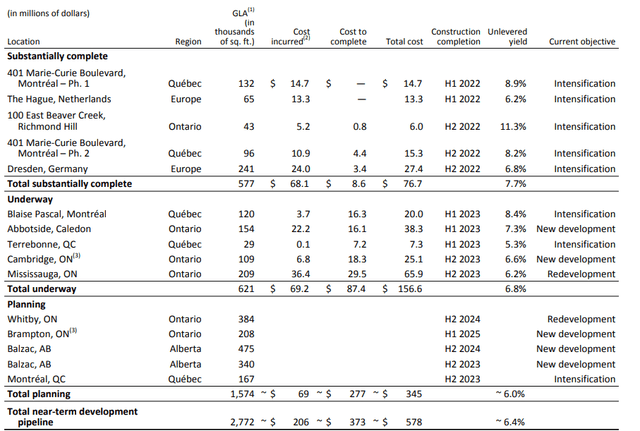

Dream Industrial REIT currently pays an annual distribution of C$0.70, payable in twelve equal tranches. This means the current distribution based on a diluted FFO of C$0.22 per unit is approximately 80%. That’s quite reasonable, and it also means that based on the current unit count (so excluding the securities that haven’t been issued yet), DIR.UN is able to retain a few million Canadian Dollars per quarter to spend on its development pipeline. This will go a long way to complete the substantially complete assets in the development portfolio as well as the developments that are currently ‘underway’.

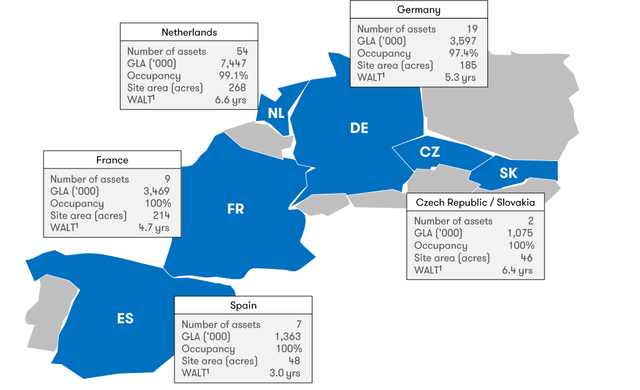

The completion of these new developments in 2022 and 2023 should increase the net rental income by C$16-17M. The development pipeline above is focusing on Canada with just one German property under construction, but keep in mind, DIR is pretty active in Europe which represents about 40% of its asset portfolio.

All eyes are on the capitalization rates

So why did Dream Industrial REIT see its share price slide along with so many others? The market seems to be realizing the ‘aggressive growth model’ in the logistics space is likely dead. The cause of death? Suffocation by high-interest rates.

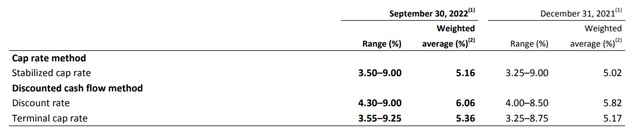

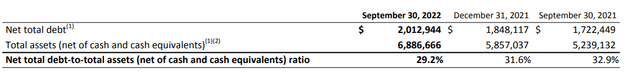

I think DIR is just being thrown on the pile of logistics REITs despite Dream Industrial having a much safer balance sheet than most of its competitors out there. As of the end of September, its LTV ratio was actually less than 30% which means the balance sheet should be able to survive the headwinds the entire sector is facing. While capitalization rates will for sure increase, let’s not forget Dream Industrial REIT’s properties are valued at a stabilized cap rate of 5.16%. That still sounds (and is) low, the cap rate has already increased compared to the end of last year and I think we will continuously see a gradual increase in the cap rates to reflect the current higher interest rate environment.

I don’t expect the capitalization rates to change too abruptly, as that would just upset the market in general. A slow but gradual ‘walk-up’ of the capitalization rate would also help Dream Industrial to prepare itself as it could simply stop developing assets and start hoarding the cash it isn’t distributing to its unitholders.

First of all, let’s establish the current parameters. We know the REIT has a net total debt of C$2B on a total portfolio of almost C$6.9B in assets, resulting in an LTV ratio of 29.2%. Those are facts.

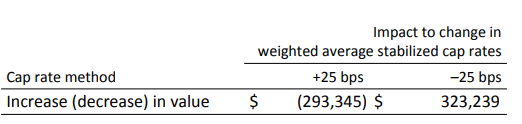

Dream Industrial also provided a sensitivity analysis, which allows it to figure out what the updated value of the investment properties would be, in increments of 25 basis points in the capitalization rate.

DIR Investor Relations

A 25 bp increase in the cap rate would reduce the value by C$293M, which means a 100 bp increase to 6.16% would likely reduce the asset value by C$1.2B. And just a quick side note here: using a 6.16% cap rate on most of its European peers would result in the latter having to complete capital raises or asset sales as virtually all of DIR’s peers start out with higher LTV ratios and lower cap rates. Another reason to appreciate the conservative way DIR is run. And yes, while DIR.UN is externally run which results in management fees payable to the manager (which was one of the main concerns in the comment section below my previous article), we can’t really accuse the managing party of just rapidly increasing the size of the balance sheet to rake in more fees.

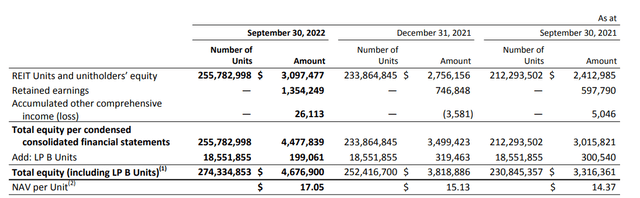

But back to the valuation. Applying a C$1.2B value decrease on almost C$6.9B in assets results in an updated total asset value of C$5.69B and an LTV ratio of just over 35%. Meanwhile, the NAV per unit would obviously also be impacted:

Keeping all other parameters unchanged, the equity value would decrease to C$3.48B, and divided by the 274.3M units, the NAV/share would still come in at approximately C$12.7. That’s approximately 10% above the current share price.

Investment thesis

While I agree REITs will be facing increasing capitalization rates, DIR.UN is actually in a good position to take advantage of other REITs that may be forced to complete asset sales to shore up the balance sheet. With a low LTV ratio, Dream Industrial REIT could easily add more assets to its portfolio without stretching its balance sheet too thin. Just as an example: Brussels-listed VGP failed in selling assets to long-term joint venture partner Allianz, which sent the share price nosediving on balance sheet concerns. Dream Industrial could easily take advantage of opportunities if they would present themselves.

I have a small long position in Dream Industrial REIT and plan to add to this position in the near future, but I am in no rush.

Be the first to comment