Oselote

Introduction

DRDGOLD Limited (NYSE:DRD) (“DRDGold”) is a South African gold producer which I’ve covered several times on SA, the latest of which was in May 2022. The company has just released its FY22 financial results and I like what I’m seeing.

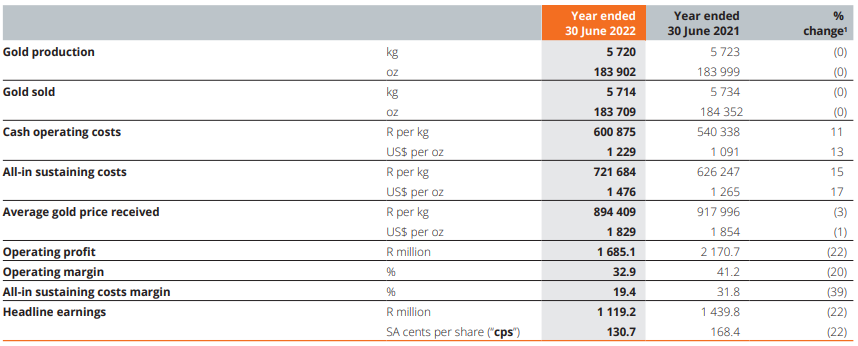

Gold production was almost unchanged at 183,902 ounces and all-in sustaining costs (AISC) remained below $1,500 per ounce despite higher input costs. Production is expected to decline to between 160,000 ounces and 180,000 ounces in FY23, and DRDGold plans to finally embark on an expansion of its Far West Gold Recoveries (FWGR) operation in 2024 after buying it in 2018 from Sibanye-Stillwater (SBSW). This project could be a game-changer.

Overview of the recent developments

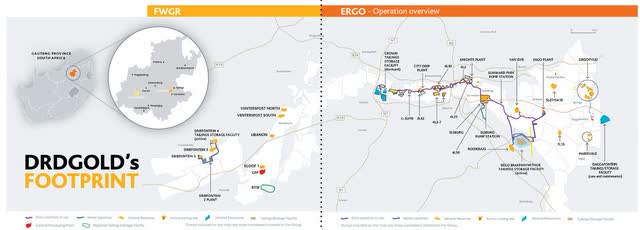

If this is the first time you’re reading about DRDGold, here is a quick description of the business. It’s estimated that about half of the world’s gold was mined from the Witwatersrand Basin in South Africa and there are a lot of abandoned mines there today. Extracting gold from the tailings at those sites is economically feasible, as the grades mined decades ago were several times higher than the grades we have today.

What DRDGold is doing is using water hoses to slurrify slime or sand at old mines, which it pumps through a network of pipes as far as 60 km away for processing. The yields are about 0.2 g/t so this means that you need economies of scale for the whole venture to be profitable. In essence, the company’s operation can’t be replicated. At the moment DRDGold has a footprint of over 1,000 square kilometers in the province of Gauteng where it has two different divisions – Ergo and FWGR.

The two units have combined mineral reserves of 5.35 million ounces of gold so DRDGold can continue producing at a rate of about 180,000 ounces per year for about three more decades. This is very high for a gold producer, as the mine life of most projects today is below 12 years.

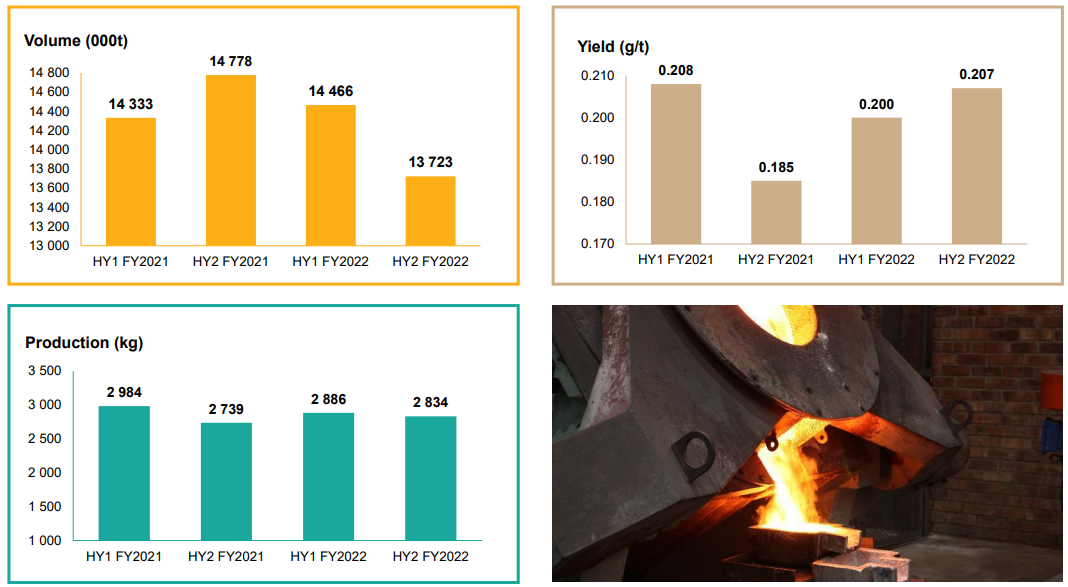

Turning our attention to the FY22 production results, we can see that output remained almost unchanged compared to the previous year as high yield compensated for lower volumes. DRDGold thus managed to exceed the upper limit of its production guidance for FY22, which was 180,000 ounces of gold. I consider this to be an impressive achievement considering the company has been complaining about high summer rainfall levels as well as electricity supply issues. DRDGold has plans for the construction of a 20 MW solar power plant, but permits for power infrastructure in South Africa can take years so I’m not optimistic this facility will be built anytime soon.

DRDGold

The average gold price received barely changed in FY22, but AISC soared by 17% to $1,476 per ounce as the company experienced higher prices for key consumables such as cyanide, diesel, and steel. This led to a decline in headline earnings to 1.11 billion rands ($65.8 million) and DRDGold decided to cut its full-year dividend to 0.60 rands per share ($0.35 per ADR) from 0.80 rands a year earlier.

DRDGold

Turning to the guidance for FY23, it seems that the company doesn’t expect prices for key consumables to decline anytime soon as cash costs are forecast to stand at around 685,000 rand per kg. Production, in turn, is expected to be between 160,000 ounces and 180,000 ounces due to lower yields but I’m not concerned about these figures as this is the same guidance as the one given for FY22.

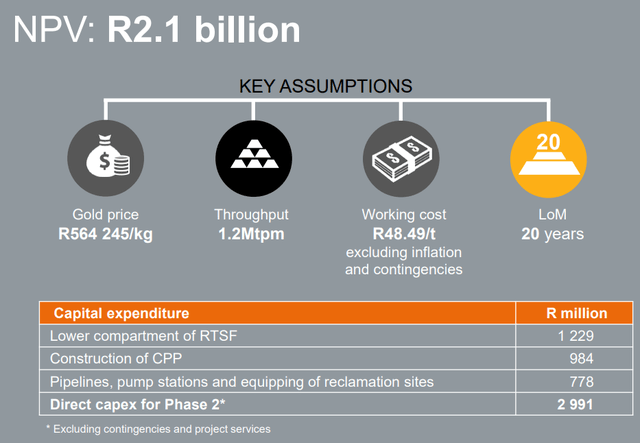

DRDGold plans to make long-term and sustaining capital investments of around 1.4 billion rands($82.3 million) in FY23 as growth and strategic capital expenses are boosted to 700 million rands ($41.1 million) from 584.1 million rands ($34.3 million). The company has been talking about upgrading the Driefontein 2 plant at FWGR from a 500,000 tpm facility to a 1.2 Mtpm facility since 2018 and this is a project that had a net present value (NPV) of 2.1 billion rands ($123.4 million) back then. The FY22 financial report revealed that DRDGold plans to start the upgrade of this plant in 2024 and that the volume throughput will be increased to 780,000 tpm in 2026.

DRDGold

The company should find it easy to secure the funding needed for this expansion as cash and cash equivalents rose to 2.53 billion rands ($148.4 million) as of June 2022 compared to 2.18 billion rands ($128.1 million) a year earlier. DRDGold currently has no debts.

Overall, I think that FY22 was a challenging year for DRDGold due to inflationary pressures and electricity supply issues and that the company managed to achieve production and financial results. DRDGold has a market valuation of $525.1 million as of the time of writing which I think seems low considering the life of mine is about three decades and cash reserves are over $120 million.

Over the past 12 months, gold prices have declined by just over 3% but DRDGold’s share price has slumped by a third. I think this share price decrease seems overdone and I expect the company’s market valuation to recover over the coming months.

Seeking Alpha

Investor takeaway

DRDGold exceeded the upper end of its production guidance for FY22 and AISC remained below $1,500 despite significant inflationary pressures. The production guidance for FY23 is similar to the one for FY22, and this should be another good year for the company unless gold prices decline significantly. The balance sheet looks strong and the expansion of FWGR has a NPV of over $120 million.

Overall, I think that DRDGold looks cheap at the moment and that the share price could return to levels of around $9.00 in the coming months. The company is currently trading at below $10 per ounce of reserves.

Be the first to comment