sb-borg/iStock via Getty Images

DraftKings Earnings Date: May 6th

Analysts looking for – ($1.23) EPS 4Q and – ($3.92) for 2021.

Revenue: Looking for ~$1.99b +53% y/y for 2021.

What analysts and observers on opposite sides of a sector call do is often the same as legal eagles litigating a case. There are two summary approaches to prove/disprove a bull or bear scenario from the arguments summoned:

The bulls point with confidence, the bears view with alarm.

Somewhere in between the lines, a truth endures: the case is either made or not, and from it, you push the button to buy, sell, or hold. It’s time for all investors in DKNG to put on their big boy or big girl pants and stare the DKNG future squarely in the face as we head toward their latest earnings call.

DraftKings Inc. (NASDAQ:DKNG), a sterling example of a stock made for the “court of investment appeals,” we now present.

The decision before the “jury” as it were is this: Okay, there is so much accumulated conjecture about the sports betting sector and the companies that inhabit it, both bullish and bearish, that it’s come time to marshal the key arguments in a single place and present the evidence to the jury. You are the jury. Prior to the earnings release do you buy, sell or hold?

All rise. Here comes the judge.

The bull case: Presented by DKNG management and the likes of Cathie Wood & her followers who see sunshine ahead

Sports betting, now fully legal/operative in 27 states, has generated a cumulative win since the SCOTUS decision (May 2018) of $8.2b in win divided among 13 companies with a hold of 7.1% off of $116b total wagered.

The sustaining win percentage against handle (amounts bet) runs to around 7.1%. So, should the business continue its rapid growth arc ahead, here’s what various analysts have estimated to be the gross revenue goal of the US sector by 2025.

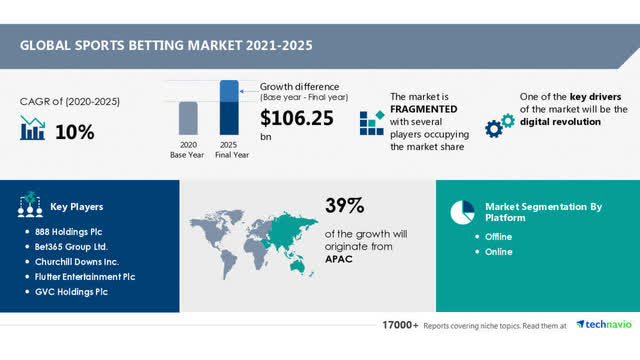

The global estimate by Technavio forecasts revenue of USD$106b by 2025. That means that the US segment as noted in the forecasts below would produce anywhere between 15% to 35% of the global total business by 2025.

The win to date off the $116b wagered means that in order to reach the forecast $25b in win by 2025 at a 7% hold, the handle would need to come in at around $350b. Ironically, that is tiny compared to what a study by the American Gaming Association estimated was the amount legally wagered in the U.S. prior to the SCOTUS decision. $1.7T, yes that’s trillion.

If you believe that legal sports betting has entirely put illegal bookies out of business, I have a bridge I’d like to sell you. But what it does tell us is that the legal betting coming to life after the SCOTUS decision is coming from new bettors. These tend to be more tech-savvy, younger people who love their smartphone apps. They are customers who find the ability to lay down a few shekels on their favorite teams just a few buttons away great fun and diverting – especially during a siege of pandemic.

And that is why DKNG and their competitors are still throwing billions in promotional deals their way four years after SCOTUS. Where DKNG had and still has the edge is in the conversion of its superior daily fantasy sports customers to sports bettors. So, to better understand why DKNG stock skyrocketed in 2021 to $71.98 on March 19th of that year, investors need to realize the excellent job DKNG has done in that conversion.

So what lies ahead and how well equipped is DKNG to emerge by 2025 as a sector leader?

A cross-section of US sports betting revenue forecasts by 2025

Ark Investments: $37b

G&M News survey: $18.b

Macquarie: $30b.

Morgan Stanley: $25b

For purposes of the bull case presented here, we will cite the Morgan Stanley estimate as our base market revenue assumption at $25b since it falls somewhere in the mid-point between the Ark high and the G&M low.

Market share: DKNG is among the top three

Without question, DKNG is among the top three platforms in US sports betting with a sustainable market share we believe can range around 15%, assuming it reaches 2025 still independent, neither acquired nor merged with another major platform. That would bring its annual revenue base to ~$3.7b, or near double where analysts expect it reached at the close of the 2021 gaming year.

Since the company continues to produce operating margins deep in negative territory, we can only take what is widely accepted among many investors as a reasonable case for an operating margin in a good public company, which is 15%. Now, this may appear to be tight, given the normally more capacious margins on which digital companies operate.

But while we expect considerable consolidation via mergers or acquisitions in the space before 2025, we can’t realistically project the costs of competitive play. That translates to an unknown marketing spend which is the endgame that will determine gross and net margins and, by extensions, projected EPS. We assume that three years from now, consolidation added to a diminishing number of new, large addressable population states will bring stability to DKNG marketing spend at a far lower cost per customer acquisition than today. The company is already nudging in that direction as we see losses per share narrowing each quarter.

DraftKings has the scale to stay among the top platforms

DKNG at writing is operative in 18 states of 27 totally legal. There are three more states currently in late-stage legislative action that could produce full legalization before the year’s end. They are: Ohio, Maryland, and Nebraska. The population combined is 19m, with Ohio alone representing 11m of that total. What this shows is that the gains in addressable population from here forward will begin to diminish as most of the big states are already in the ballgame.

California, the biggest kahuna of them all (39.5m), is edging closer-but there is a caveat. If it does go, it is likely that the business will be handed over to the tribal casinos, none of which are public companies. Nobody yet knows if the tribes will operate the business themselves using tech stack suppliers, or partner with existing platforms.

But at 15%, worse case, DKNG will generate $585m in gross profit by 2025, a decided leap from its expected billion-dollar-plus losses per year it is now piling up. Texas, with 39m in population, has had a bill lingering in its legislature since 2019 with no apparent forward momentum yet.

The slowing pace of new legalizations in states with low populations may be more bullish for DKNG than what may initially be apparent. The company’s Q on Q triple, now double-digit revenue gains have been wrested out of new state betting. But with fewer new state bettors to pursue, and better margins extracted from existing brand-loyal customers in mature states, DKNG is well-positioned to keep reducing its marketing spend and speed the pace toward profitability downstream.

DKNG has its share of sponsorships, partnerships and co-marketing deals with leagues and teams that position its brand as among the sector leaders. The value of these deals lies mostly in the visibility they bring to the brand to everyday sports fans. It also has live sports books in casinos.

The case for DKNG gets down to these basics

It has arrived at and will maintain its close second share of market status to Fan Duel. As the sector gains in its revenue base and addressable audiences, it has the scale to sustain itself among sector leaders. Its brand identity is strong, its geographic spread wide.

Its Daily Fantasy Sports business is solid and well marketed.

Its present financial state remains good:

Cash on hand (mrq) $2.15b

Cash per share (mrq): $5.27

Total debt: (mrq) $1.32b

Current ratio (mrq): 2.96. This is a bit on the high side but well within a safe range in our view at this point in time.

Negative cash flow: – ($419m) Should begin to narrow.

Leveraged FCF: – ($102m) Should begin to narrow.

So in summary here’s the case for DKNG: you have a sector leader with a well-established brand name active in 17 of the 27 now-legal U.S. sports betting markets. You have every expectation that in the three states currently nearing legalization noted above that DKNG will have an early entry in each. The company has proven itself adept at having its ear to the ground day in and day out with knowledge of new legalization statuses and is well prepared to move quickly.

Responding to the big negative: When and if will DKNG make money by curtailing its marketing spend?

The summary case for DKNG offered by bulls is this: At some point within the next three years, DKNG will have followed other sector leaders by reining in marketing spend and begin to turn profitable. And when it does, it will produce dramatic earnings gains and huge gross margins common to tech stocks that produce big earnings gains quarter on quarter.

In the interim, it will continue to burn cash at a high rate. Yet it has a nice cash position on its balance sheet now and its capacity to borrow, if need be, remains. Its current debt load is relatively modest, which tells us it can handle its cash burn in the intermediate-term without piling up huge amounts of new debt. While new state legalizations may tend to be fewer and in less densely populated areas, DKNG will be well-positioned to swoop in and get their share of market among the leaders.

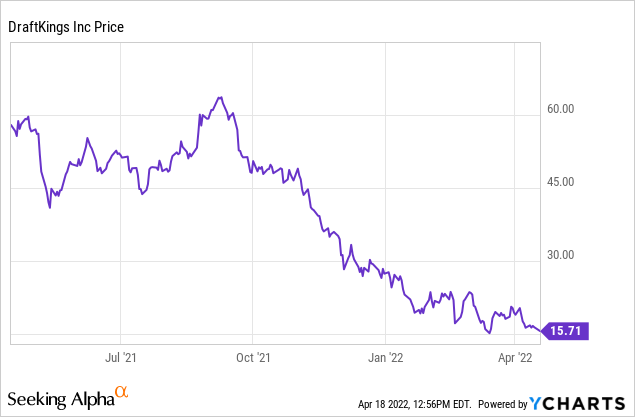

The stock: DKNG stock continues to take a beating for the same reasons the entire sector has lost some of its 2021 gloss. The cost of customer acquisition dampens profit prospects. In a sense, DKNG shares have been victimized by its own success, having traded in an upside frenzy that was not justified by any measure. The stock is now selling at its lowest price-to-sales ratio since it became a public company.

Sector developments will work to DKNG’s favor. First, key competitor, Caesars Sports Book, has announced a dramatic curtailment of its marketing spend to the end of this year, citing the goal of getting profitable faster. WynnBET, the late entry of Wynn Resorts, Ltd. (WYNN), has put the for-sale sign up on its sports betting entry for $500m. Its thesis: The cost of marketing against a slim margin business is a non-starter.

This same thinking was echoed by Churchill Downs Incorporated (CHDN), which announced it was leaving the sports betting business entirely because it saw no light at the end of the profit tunnel for its own expanded sports book business.

With potentially strong competitors leaving the field and others cutting down their marketing spend to bring a new rationality to the sector, DKNG remains a steadfast leader among the top four operators in the space.

So, the bull scenario, if you buy it, is saleable: DKNG has the financial heft to keep buying market share despite the losses they produce, hold on to its ~2m average monthly users, and be among the leaders in every new state legalized going forward.

At $16.49 a share against a consensus PT of $33, it is clear that much of the luster built into the stock during its high-flying days was an unjustified frenzy. But at its current price, with the company seeing double-digit revenue growth in sequential quarters and slowly diminishing EPS losses as marketing spend begins to come under control, we are looking at a value buy.

The bear case: DKNG may never be profitable

At writing, DKNG’s short interest stock position is 9.55% of the outstanding. This tells us that there are a ton of investors who see a further fall coming when the company releases its earnings a few weeks from now. That is not an unreasonable assumption.

At the same time, Cathie Wood’s Ark Investments is telling the world: we’re believers in DKNG. She recently added to her position, buying 279,441 shares and thereby boosting her stake to 1.4% or $424m-making her the second-largest holder of the stock. The natural question is: clearly she’s been price averaging since so much of her holdings have been acquired at much higher prices. So, what magic does she see in DKNG that seems to evade Mr. Market’s eyes?

We have no flies on the wall in her office, but it seems rather obvious to us that, given her longstanding bullish outlook on DKNG, she has bought into the basic premise that the company is capable of continuing to eat losses, build its customer base as the overall market expands, and at some point, it will begin to slowly drain the trough of giveaway deals.

At that point, when incremental revenue gains are acquired at a cost-effective basis, and DKNG commands its top-tier share of the market in the sector, there is no place for the stock to go from where it now trades but back to double or more.

It’s that simple. You can go through exhausting exercises of metrics, technical analysis, historical trading studies, deep dives into the world of sports gambling, etc., and still come up puzzled about DKNG. Only one enduring reality should count and that is this: the profit margin in sports betting is so thin to begin with, that the prospect of a pure-play operator in the space ever making significant profits on the business is problematical.

Most recently, the privately held sports merchandise ecommerce giant, Fanatics, closed a $100m deal with Amelco, a supplier of sports betting tech stacks to deliver a complete package – bettor ready – to the merchandiser for its long-expected entry into active sports wagering. Fanatics says it has 80m customers, and CEO Rubin is telling the world he expects it to be among the leaders in the betting sector. He may be in for a rude awakening, or not. But the point here is that anyone else coming into the sector, especially with so massive an existing customer base and valuation, has to give heartburn to DKNG management going forward.

There is clearly hubris going on here. While some old-line gambling operators leave the space, we have Rubin lining up his artillery aiming at the crowded field. Is it any wonder the stock sloshes around with no certain direction?

This is not to say that at its current price DKNG might not well be worth a toe-dip prior to what could be good news on May 6th. And, of course, if there is bad news, you could say, how much lower could DKNG go? Well, the short money is betting a lot lower.

Verdict

Our conclusion after our own latest appraisal of the stock remains about where it was the last time we reported. We think there is one really good reason to own DKNG now: the possibility, if not the probability, that it will be bought by a very deep-pocketed acquirer at a nice premium above its current price. That could be worth a shot here with not a lot of downside risk.

Place your bets.

Be the first to comment