gorodenkoff

By any measure, DraftKings (NASDAQ:DKNG) is the good news bad news stock of its sector. Unswerving bulls on the stock, including a blue ribbon list of institutions, have a single mantra: quarter-on-quarter revenue growth is outstanding. We agree — with a caveat. DKNG’s revenue growth has reached 47% y/o/y. But that begs this question: Is the massive marketing and promotional spend that is creating this growth producing real muscle in the database or empty calories? It reminds me of a durable, but always questionable, marketing ploy in the casino industry:

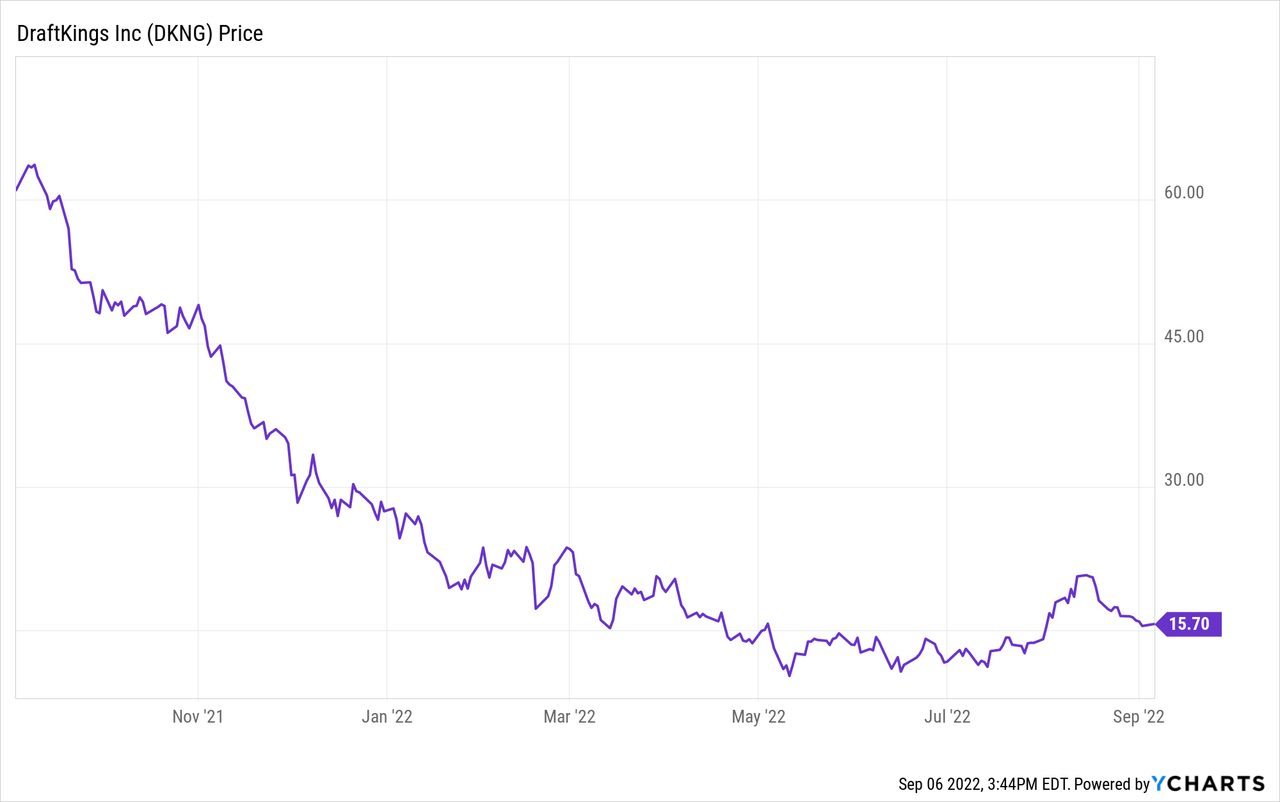

Above: An NFL spike is possible, be prepared to sell half your holdings at least when it comes — if you have gains.

When in doubt about foot traffic, run a sweepstakes. Briefly this consisted of giving away a snazzy car, or cars usually hoisted above slot carousels on the casino floor. The idea was simple sweepstakes. Entry is free. All you need do was fill out a card and dump it in a Plexiglas bin. The promotion reliably drew thousands of entries from drive-by visitors to our casinos as well as established customers. But the object always was gleaning a rationale to step inside and harvest names for upcoming promotions.

To some extent, the standard promotional deals all sports betting platforms now use are sweepstakes. The hook is x amount of free play to those willing to register and join the database. What sweepstakes promos taught us was that you always got ten tons of chaff for every grain of wheat in the entries. So DKNG’s massive promotions aimed at garnering new play with tempting free money has its value, but I suspect also culls tons of empty-calorie low-value registrants.

So yes, promos do have some value inflating the quarter by quarter “sales growth” which may have staying power, or may not.

So if the single most compelling, if not only compelling, reason to own DKNG is its impressive sales growth as it bleeds hundreds of millions, we must ask ourselves when will all that investment pay off in profitability? We examined DKNG and its key competitors to date and have come to the unavoidable conclusion that at best we could be looking at 2025/7 before the company turns profitable. So if profits and highly positive EBITDA eventually drives valuations perhaps five years away, why would anyone continue to sit on their positions?

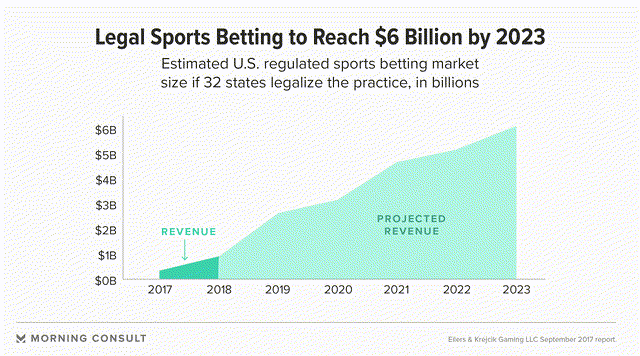

Above: This is a realistic case but we are more bullish, looking for $25b by 2025/7. But the $200b some analysts forecast is dreamland.

A revenue story can only go so far in building long-term conviction. But call it recency bias if you will, but here are a few ugly facts:

TTM:

Revenue: $1.57b. Promised: $2b 2023. Doable.

Profit margin: — 9.9%

Operating margin: — 108%

EBITDA: — (1.568B)

DILUTED EPS: — (4.05)

EV/EBITDA: — (4.22)

Earnings estimates: Analyst consensus

2022: — ($3.21)

2023: — (2.26)

At this rate of shrinking losses, our view that DKNG is far away from profitability appears to be realistic.

Cash on hand: $1.57b. Fine, but unless revenue growth continues to generate more cash at an increasing rate as new, expensive launch states come on board, the nice cash kitty will diminish and either force raising debt or diluting equity.

Cash per share: $3.78, okay but not great.

Current ratio (mrq) 2.35. A bit high but comfortable, so no problem there as long as revenue increases can generate the cash in to support cash out. DKNG has said it is reducing promos. However, Massachusetts is coming on like shortly and DKNG and others are spending tons in California lobbying as that state nears referendums — neither of which bode that fertile than many think. Both propositions put the tribal casinos in the driver’s seat. No matter the volumes, margins will be anemic there if and when.

So what about DKNG stock now?

Price at writing: $15.49. The stock had a nice little run-up to around $21 recently and has fallen back. Analyst targets are running ~$25.

I reiterate my prior guidance: DKNG has plusses without question, but the only reason to hold it is to await the arrival of either an activist to stir the pot or an out and out corporate buyer.

But upon re-considering that view, it occurred to me that if there wasn’t even any rumored evidence of tire kicking we could find, there was no appetite at the moment to jump on a deal even with the possibility of attaching a real nice premium for holders.

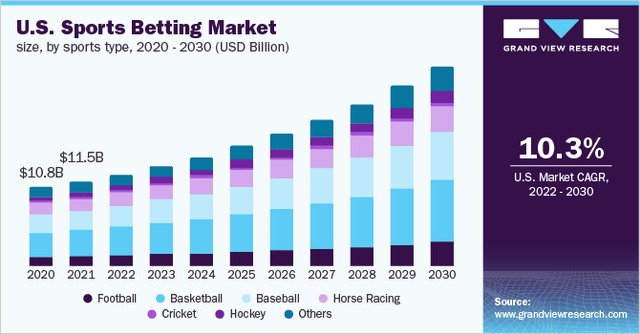

Above: This forecast seems reasonable regarding CAGR but like most it is an educated guess at best because it does not factor in new big time entrants like ESPN and Fanatics when they finally move. Dilution will hurt.

We also have to consider that DKNG’s board may not have put any such deal off the table for reasons of their own. They are, after all, hardly amateurs in ways and means of feathering their personal equity nests without noisome questioning from parent companies. Look the key people in the company built a formidable entry in the sports betting space and are toddling merrily along with their cadres of pompom twirling stockholders in both the retail and institutional segments (DKNG is over 60 institutionally owned).

So it is abundantly clear at this time than any number of would-be acquirers or activist mischief makers have looked at the company and at least, for the time being, have taken a pass before making a phone call. Their reasoning takes this standard kind of weighing of the bad and the beautiful.

We invite readers of this space to don their banker’s caps and follow the bouncing ball, agree or not.

The Pros

DKNG is a top tier market share company and is likely to stay that way long term. Along with FanDuel (DUEL) and BetMGM (MGM), they control 60% of the total market revenue at present. A reasonable projection of the sports betting market by 2025 is that it will be ~a $25b to $30b industry. Let’s forecast DKNG as holding a 20% worse case share among leaders which translates to $5b in revenue at least.

If we can ascribe a 30% operating margin with promo spend fully under control, you have a pre-tax generator of $1.5b in operating profit. By most measures to a well-managed parent, this would be highly accretive to group EBITDA.

Financials: DKNG at present would appear to have sufficient cash to finance its ongoing business without having to resort in major refinancing or additional burdens of debt. Its long-term debt at $1.3b should suffice to keep it solvent easily.

The brand value is strong among players and it is moving to increase its revenue stream from iGaming and continue leadership in DFS. Can we assume floating an offer now what would be an attractive enough premium to bring both retail and institutional investors into the tent? We think the discounted cash flow valuation is a good benchmark here. We see a $24.50 to $28 offer as being very attractive if the stocks stays in the mid-teens during the NFL season. A deal brings a fully sprung, market leader into a corporate family. Synergies and cost disciplines can add to broadening operating margins.

The cons

A competitive set review reveals that DKNG competes in most states with as many as 10 rival platforms. While consolidation is inevitable, it may be too far off to be considered an overall plus for all competitors. Two potential giant competitors loom. One, out in the open, privately-held Fanatics, the sports apparel merchandiser valued at $27b, has filed for trademarks for Betfanatics. They claim to have 82m active customers. An IPO is likely, possibly a SPAC. The second is of course ESPN. Disney (DIS) is feeling pressure to create a platform.

While we believe neither of these two companies with immense access to millions upon millions of sports fans may face tougher roads ahead to establish a betting platform that would hit DKNG hard, it remains a factor as a potential dampener of valuations. There are no moats of any kind in this sector and the entry of these two major entities are most likely to dilute, but not destroy, the market share position of leaders.

The primary contingency here in valuing an offer for the company is the intense competition state by state that pressures marketing spend no matter how disciplined platforms may become. Even at significantly lowered costs of promotion, there will still be new states coming. Each of these will require launch programs. In addition, the nature of loyalty comes into play if and when new entries decide to overwhelm players with ultra rich deals.

Conclusion

Our standing guidance on DKNG was a ‘Hold’ primarily due to our conviction that sooner rather than later, either a corporate or activist investor would see real value for the company at its recent trading range. It could add a nifty premium and still take the company at a price that would provide a relatively cheap entry into what will be a very good business operating with generous digital margins going forward.

Thus far we see no takers. But we don’t entirely rule it out either. It is also the beginning of the NFL season where reports of handle are bound to be ebullient and sentiment on all online sports betting stocks will improve — at least if the comps to 2021 are strong.

Yet, we are concerned that until this day what we can see is that DKNG management has still not exhibited a level of spending discipline and operational creativity that would prompt us to guide ‘Buy’ on the stock even though the price would appear attractive at the moment.

I do not think we will ever see this sector trading at the levels it achieved in 2021 when enthusiasm was unbridled. Some analysts back then were forecasting growth to a $200b market by 2025 — which seemed to us way out of the realm of reality.

It’s time to take some money off the table if you are ahead of the current trade. And hold onto the rest in case the tire kickers show.

So I believe a sell down of anywhere between 30% to 50% of an existing position on DKNG makes sense under the idea that the NFL pop may bring a nice spike and that the idea that a corporate or activist may come out of the woodwork soon is not to be totally dismissed.

Be the first to comment