Scott Olson

Thesis

I have previously voiced concerns about DraftKings’ (NASDAQ:DKNG) financials – specifically with regards to the company’s deeply negative profitability. And following DraftKings’ Q3 results, I am confident to reiterate my bearish stance on the company for said reasons. Moreover, I continue to believe that DraftKings should trade down to about x1 EV/Sales, which would imply more than 50% downside. My target price is $5.43/share.

For reference, DKNG stock has underperformed the market YTD, being down 46% versus a loss of approximately 17% for the S&P 500 (SPY).

Seeking Alpha

DraftKings’ Q3 Results

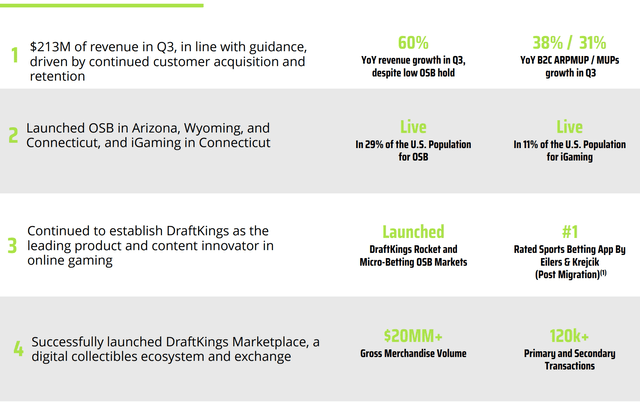

Although DraftKings reported strong sales growth in the September quarter, the results clearly disappointed against market expectation. During the period from July to end of September, DraftKings generated total revenues of $502 million, which compares to $213 million in Q3 2021 (136% year over year growth) and to consensus expectations anchored around $520 million ($18 million miss). The number of monthly users increased by about 22% year over year, to 1.6 million. But again, the growth failed to meet consensus expectations of around 2 million.

DraftKings’ Q3 results

Despite the strong topline growth, profitability remained farfetched. Operating expenses in Q3 2022 increased to $957 million, as compared to $759 million for the same period one year earlier. And as a consequence, adjusted EBITDA for the period was once again deeply negative and came in at a loss of $264.2 million.

Notably, DraftKings’ ‘adjusted EBITDA’ fails to account for $126 million of stock-based compensation. Accounting for all ‘excluded’ expenses, DraftKings’ net loss for the period pushed north of $500 million. And I am surprised to learn that such a quarter, which markets punished with a 28% sell-off, was termed a ‘strong quarter’ – DraftKings’ CEO Jason Robins commented: (emphasis added)

DraftKings had a very strong third quarter. Our team continued to drive top-line growth through highly effective customer engagement and compelling product and technology enhancements while remaining focused on our path to profitability.

And Jason Park, DraftKings’ Chief Financial Officer celebrated the results with a positive tone: (emphasis added)

Our results in the third quarter significantly exceeded the expectations that we provided on our second quarter earnings conference call.

Guidance Fails To Convince

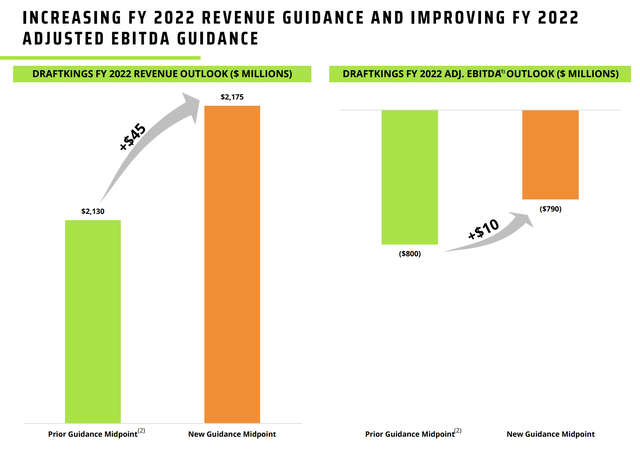

On the backdrop of what – DraftKings management – termed a ‘strong’ quarter, the company updated FY guidance for 2022. DraftKings now expects revenues to be in the range of $2.16 billion to $2.19 billion, as compared to the previous range of $2.08 billion to $2.18 billion. Adjusted EBITDA was updated to the range of $800 million and $780 million, as compared to $835 million and $765 million previously.

(Note that the graph enclosed is not scale-accurate. The graph implies a surge in revenues of at least 25-30%, but the actual improvement is closer to 2.5-3%)

DraftKings’ Q3 results

The company said that business profitability – as measured on an adjusted EBITDA basis excl. stock-based compensation, depreciation, amortization, taxes and interest expenses – is expected for Q4 2023.

With Q3 results, DraftKings communicated that the company expects to launch mobile sports betting in Maryland within the December quarter, and expand operations to Ohio and Massachusetts withing Q1 of 2023. But the failed legalization of online sports betting in California will certainly weigh on investor sentiment and DraftKings’ business expansion.

Target Price Estimation

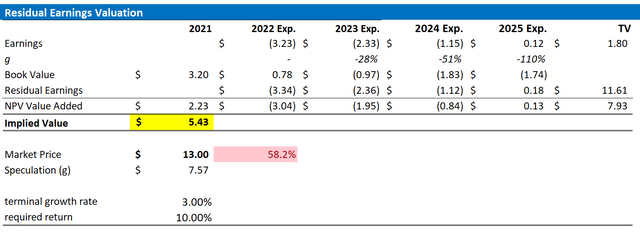

I have modelled a valuation DKNG stock based on a residual earnings model, and calculated a fair implied target price of $5.43/share. This would be in line with a x1 EV/Sales multiple, which I have previously targeted as a price anchor.

With regards to my DKNG stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- I estimate a $0.65/share profit in 2026.

- To estimate the capital charge, I anchor on DKNG’s cost of equity at 10%.

- For the terminal growth rate after 2025, I apply 3%.

Analyst Consensus EPS; Author’s Calculations

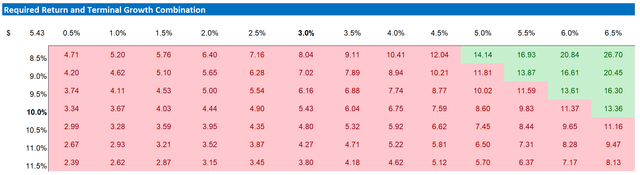

My base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of DKNG’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note that the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus EPS; Author’s Calculations

Risks To My Thesis

As I see it, there has been no major risk-updated since I have last covered DKNG stock. Thus, I would like to highlight what I have written before:

DraftKings stock is popular with retail investors. And as a consequence, the stock’s price action can be considered unpredictable and aggressive. If the market re-discovers its appetite for loss-making companies, and there is a new wave of meme-stock price action, then DraftKings could be well positioned to see strong buying interests.

Secondly, investors might also consider that the online sports betting industry could consolidate, given either M&A activity and/or bankruptcies due to challenging business fundamentals. In such a scenario, if DraftKings would assume a winning position, the company’s business fundamentals would undoubtedly improve.

Conclusion

Following a disappointing Q3 report from DraftKings, I remain worried about the company’s profitability ambitions. The sports betting company is still spending enormous sums on marketing, and management commentary doesn’t indicate that this would change anytime soon.

Moreover, I personally do not see the target of ‘adjusted’ EBITDA profitability by Q4 2023 as attractive – because as an investor I would like to see GAAP profitability. And I would also like the profitability to compare well against valuation, which is currently not the case.

I continue to believe that DraftKings should trade down to about x1 EV/Sales, which would imply more than 50% downside. My target price is $5.43/share.

Be the first to comment