Wpadington

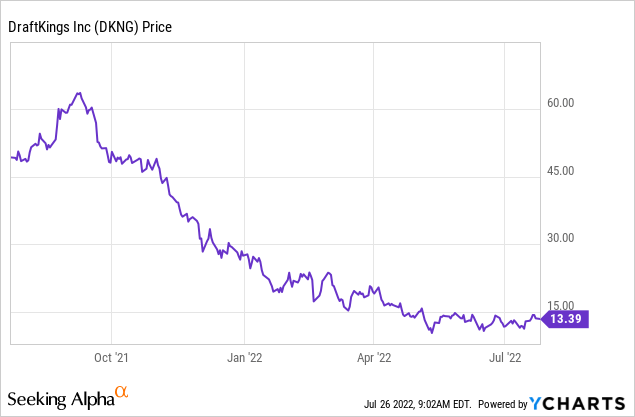

There are no self-inflicted wounds with greater impact on the value of DraftKings Inc. (NASDAQ:DKNG) shares than the company’s seeming inability to get their arms around its runaway promotional and advertising media expense. Management has been on the record through many earnings calls to present a case for its runaway spend that is among the principal reasons it continues to bleed money.

Taken apart, judged equal to peers in product, execution, market share, DKNG surely deserves a stronger valuation. We’re not talking anywhere near the all-time high in the $70s. That was part of the delusional early frenzy among investors who believed many analysts who were forecasting an eventual market size as high as $200b.

Many thought DraftKings’ irrational business model, built off the premise that eventually, eventually, the “investment” (read overspend) in building market share in new and mature markets against its metrics of long term customer value, would pay off big time, making DKNG a strong buy. This was and is a flawed thesis.

DKNG is one of four or five top tier sports betting platforms who will be in hand to hand combat with peers for market share from now till the end of the decade. Fan Duel, who leads

Flutter Entertainment (OTCPK:PDYPY) and BetMGM (MGM) aren’t going anywhere. They have unleashed rip roaring media spend as well since the 2018 SCOTUS decision. And behind them, the tier two and three sports betting sites are hanging tough as well. Among them is the Barstool sports book owned by Penn National (PENN) which has opted to find its ultimate profitability in modest market share aspirations around 10%.

Bigger yet is the Caesars Sports Book which occupies a place in the top tier. But the company has already begun to act on a policy to start dramatically reducing its ad spend. In general, what investors are waiting to see is if and when common sense eventually enters the thinking in the sector and ad spend comes falling down. Judicious spend in new states is a given. Beyond that the battle for market share in mature markets can become a dead end street.

We might get some insight or news of shrinking losses at DKNG when the company reports earnings ~August 4th. A sharp reduction in promotion/media costs for the quarter should give heart to gallant fighter bulls on the shares and move the valuation. If not, the cavalry may be headed investors way from across the pond. Whether it’s a topic that will rise in the earnings call beyond the usual corporate happy talk or not, one thing is certain: The UK report on digital betting is nearing its long awaited debut. I believe the implications of what we expect to see in it will have immediate impact on US regulators.

So it’s the old saw-nobody likes-namely, government to business: If you won’t do it voluntarily, we’ll step in and do it for you. This will be a core takeaway of the report.

DKNG archives

Background

UK regulators commissioned a group led by a pair of academics with experience in gaming research, to determine to add to a deeper understanding of the online behavior of bettors. The results are expected to trigger a legislative reform that could hit many aspects of sports and iGaming problem gambling behavior. We already have some advance indications.

The questions posed by the study group among many are:

1.How to spot behavioral tendencies of at-risk online gamblers.

2. Are there definable differences in betting behavior that are common to both iGaming and sports betting?

3.Are consistent patterns of play among people in differing demographic groups?

4.What are the most typical play patterns in online action?

The research team analyzed 140,000 gambling accounts pulled equally from 7 online platforms which included the biggest brands on the globe. The data accumulated was developed in pre-pandemic July 1, 2018 to June 30th 2019. Follow up interviews and deep dive reviews with gamblers followed.

A briefing of results we know thus far:

- A majority of the participants were negative about the platforms on which they played. They saw harm to the vulnerable and these were the key suggestions they told researchers that could reduce problem gambling:

- Legislate hard betting limits. Such limits left to the individual were considered “weak”.

- Limit advertising of in-play wagers.

- Multi-operator self-exclusion.

- Overall restriction of certain types of play.

- 94% of responders were men. Sports betting is a contributing factor in frequency of wagering and betting amounts per play.

- More than half of the responders ranged in the key age group of 25-44 years. They contributed over half the revenue. This echoes what we know so far of US online bettors.

- Mastering the nuances of sports betting is tough, according to the responders. Because it is it has bred a massive number of touting services promising “mortal lock” type results..

- The top 10% of bettors account for 79.1% of total win. (As we have often noted, this is Pareto’s Law in action across the entire spectrum of gaming).

- Bettors with the highest losses had an average age of 40 and tended to come from lower income areas.

- Online slots, as expected, are a far bigger piece of the online pie than they are in the US, grabbing 60% of all spend.

- The rapidity of slot play was viewed as a risk factor in heavy losses. The most frequent use control on play was deposit limits which around 20% of players set for themselves.

- Self-limits and time outs were not widely used.

During the study period less than 4% of players got a check-in alert from the platforms. The check-in is employed by platforms to alert possible problem gamblers who have already shown harmful play tendencies.

The interim results noted here in capsule takes, is the forerunner of a White Paper from the UK Gambling Commission which is expected to regulatory recommendations ahead. It is widely expected, dominant among the changes, will be limits on promotional and media spend imposed by governments.

The final White Paper is expected to be published sometime this year, perhaps as early as 3Q22. The entire effort has attracted the eyes of US state gaming regulators, who have long been on record expressing concern about possible rises in problem gambling-particularly among the young-in the states where sports betting is legal.

US state gaming officials have come under increasing pressure from anti-problem gambling groups to act in curbing the huge media spend of sports betting platform and intensify efforts to expand warning copy in their ads beyond current copy. One state regulator we spoke to told us,

Just saying bet with your head not over it, or directing at risk players to help organizations is fine but it does not cut it. Frankly, many legislators will be inclined to adapt rules that may come out of the UK report that bring state imposed limits on ads and promos. Nobody wants to get into the nanny business but they may have no choice. We’re all watching for the White Paper.

Overall gambling is among the most regulated businesses in the US. Nobody wants government to keep poking its nose into private enterprise. The platforms are already using resources to stress the dangers of problem gambling in their ads as part of larger initiatives to support non-profits dealing with the issue.

But if the final UK report ends up producing a stringent set of curbs on ads and promotions, it is pretty clear that the US will not be far behind in adapting similar curbs.

Our point: We are no fans of government involvement anywhere at any time. But in this case there is an irony. It is that if governments do bring down the hammer on sports betting and online gaming advertising, such mandates will provide cover for platforms like DKNG to get down to the serious business of limiting that spend and in time, becoming profitable earlier than what is now anticipated.

It would be a rare instance where government will enact regulations that will ultimately have a beneficial effect on a private enterprise’s performance.

DKNG has rested its case to the market based on its q on q revenue gains, which have been impressive. On a TTM basis, DKNG has generated $1.4B in revenue, producing an EPS loss of ($4.05) per share.

Its cost of revenue TTM is $924m, up from $794m in 2021. Its operating income was at -$1.75b and EBITDA stood at -$1.62B.

Clearly this can’t go on forever which is the primary reason the stock has been battered since it 2021 highs.

DKNG at $13.34 a share should be a normal attractive entry point for investors long after the steam of a huge run up has run out of momentum. But it is not simply because the company has yet to show a strong pivot away from excessive buying of business to a more rational business model.

Perhaps we will see some movement in this area during the upcoming earnings call at least in a dramatic shrinking of its quarterly loss against revenue gains.

If DKNG won’t trim promo costs itself, the states in which they operate could do it for them. Ironically, that would be bullish for DKNG and its peers.

Be the first to comment