efks/iStock via Getty Images

Overview

DraftKings Inc. (NASDAQ: DKNG) is an increasingly high-profile sports betting mobile app. The company was founded in 2012 and became publicly traded (via SPAC) in Q2 2020, henceforth trading under its current name. This merger was actually the combination of 3 distinct entities: DraftKings, Diamond Eagle Acquisition Corporation (the blank-check public acquisition entity), and a much lesser-known technology provider called SBTech.

Each of these 3 entities brought a different piece of the puzzle together for the combined firm. DEAC provided financing and a vehicle for going public, DraftKings provided a US-based fantasy sports betting business that was seeing increased uptake, and SBTech provided a technology platform with a global footprint. The combined entity had over 2,000 employees total upon the merger’s completion; roughly 850 of these came from DraftKings and the rest came along with SBTech.

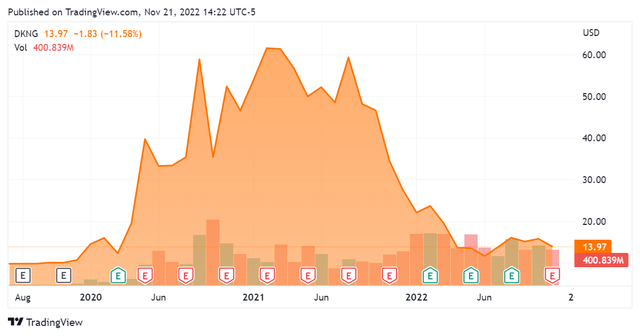

Since then the stock has had a bumpy ride, quadrupling in value and then returning to earth in line with its IPO pricing.

SeekingAlpha.com DKNG 11.21.22

DraftKings is seeing significantly more media coverage lately and particularly so today (November 21st 2022). This is primarily due to 2 reasons: notice of a large-scale hack of company systems that directly affected customers, and scrutiny by the New York Times.

This article will contextualize DraftKing’s business within the present news cycle and discuss the associated idiosyncratic risks that may arise as a result.

Commentary on DraftKings’ Media Coverage & Associated Idiosyncratic Risks

Any tenured investor is well-aware that a company’s representation in the media can, and often does, have a material impact on its valuation.

Nonetheless this notion must always be considered on a case-by-case basis. It is not a simple cause-and-effect relationship, and the universe of companies and their associated coverage in the media is a heterogenous one indeed. It is quite possible for media coverage to have an effect across the full spectrum of possibilities – negative, positive, and even none at all. Another dimension is added when we consider the varying degrees of these effects on a quantified/numerical basis.

With that being said we must first address today’s elephant in the room: the fact that DraftKings has been hacked, and the stock is down in direct correlation with this news item as of today:

SeekingAlpha.com DKNG 11.21.22

After dropping ~10% on market open, however, DraftKings has already regained more than half of the decline. The company made clear in an update to SeekingAlpha that it had not sustained a direct breach of its own systems and that less than $300,000 of customer funds were believed to be affected as of this time. As such the market is moderating its initial reaction, and rationally so.

Thinking further, I actually did not believe this news to be overly significant long-term – even prior to seeing the updates. We live in a day and age where companies are routinely hacked, and the (known) list of affected players ranges from stalwarts such as Equifax to fast-growing upstarts such as Uber. There are literally dozens of additional examples.

In a way, this event is so common so as to be ‘inflated’ – ie, less significant than it would be otherwise. If companies get hacked with such regularity, it is relatively that much less important. Furthermore, it seems that every company that has been hacked ultimately made its way past this and continued on with business as usual. Of course, there is usually some litigation, but I am not able to think of an immediate example wherein a cyberattack crippled a publicly traded entity on any permanent/long-term basis. The implications of this are outside the scope of this article, but the effect (or lack thereof) is clear enough at first glance.

The other news item is of a completely different nature and is one I consider to be much more significant for the long-term valuation of this security.

Published yesterday 11/21/22, this piece in the Times outlines the lobbying efforts of DraftKings and its overseas rival FanDuel. It paints a picture that is far from flattering, yet one rooted in fact. Of concern here is the state-level tax subsidies, the multiple references to addictive behavior and gambling addiction, and the less-than-pleasant realities of getting things done in today’s Washington DC. Additionally, it points out that revenues from DraftKing’s are falling materially short of expectations and assumptions presented during this process.

While it is not the business of an investment analyst to render political opinions, it is nonetheless essential to know how politics can directly affect one’s holdings. I would venture that this is the case here. What a piece of this nature does is open the conversation on a topic. It is not remotely the first time that the Times has done something like this; it is the job of the Times to publish pieces of public interest of this nature. Reading the article, however, it is clear how a concerned citizen – or a few hundred thousand of them – could see something somewhat unsavory. That can turn into a groundswell that changes the regulatory environment into a less favorable one – or one where a company can’t operate at all. History is replete with examples, but that will be left for the discovery of the curious reader.

However, I don’t think this is too immediate of a concern in this instance. This is because the law here was actually determined not via legislation, but by adjudication. In plain English it wasn’t Congress here that changed the law – it was the courts. In 2018 the Supreme Court overturned a long-standing Federal regulation that prohibits sports betting, thus opening the floodgates for DraftKings and businesses of its sort.

This creates a different nature of exposure to the idiosyncratic regulatory risk being alluded to here. While Congress may not be the most responsive mechanism, it can still respond quite readily to public opinion – particularly so if a specific issue becomes a ‘hot button’ one. The Supreme Court, on the other hand, operates on a much slower timeframe; a decade is a fitting unit of measurement for considering its behavior.

As such, this leads me to conclude that the regulatory situation per se is not overly significant here. What’s done is done, and I don’t see it changing by virtue of the very structure of it. If the Supreme Court had not been a direct cause of this, my opinion would be different. That is the case, however.

As such I think there is actually a significant margin of safety for DraftKings and similar entities to continue to operate unabated. Even if there is to be an ongoing politicization of this issue, which is far from a given, it will be a very long time indeed before any change is slated to occur. As such I am comfortable calling this a long-term risk, but definitely not a short-term one and very unlikely to even be a medium term one.

Be the first to comment