Bill Pugliano

Introduction

Following Dow (NYSE:DOW) enjoying a strong start to 2022, it seemed that everything was up apart from their dividends, as my previous article discussed. Although as many investors have experienced during the past few years, their fortunes can turn on a dime with the third quarter seeing headwinds across multiple fronts, but despite this short-term pain, their otherwise weak third-quarter results highlight their desirable value, as discussed within this follow-up analysis.

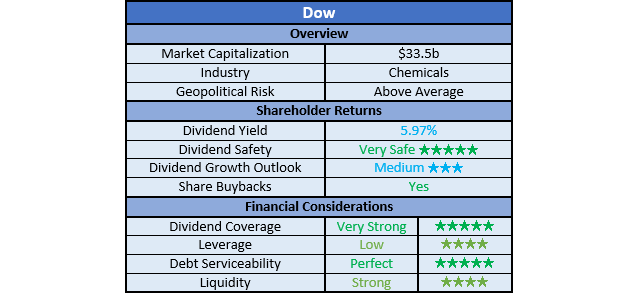

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

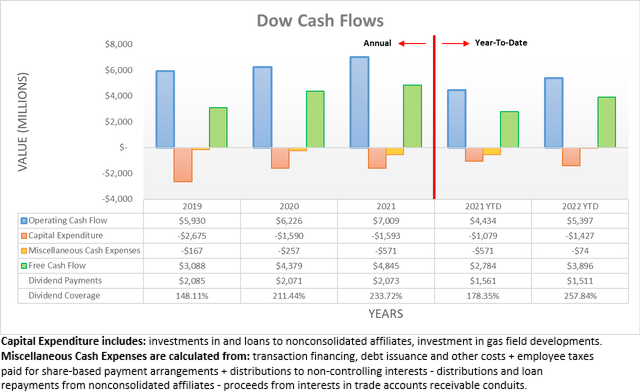

After seeing their strong cash flow performance from 2021 continue during the first half of 2022, it seems the deteriorating operating conditions finally caught up with them during the third quarter as they endured higher energy costs, weaker demand and currency headwinds from a strong USD. On the surface, their reported operating cash flow does not look bad, with a result of $5.397b during the first nine months sitting near 22% higher year-on-year versus their previous result of $4.434b during the first nine months of 2021. This allowed them to generate $3.896b of free cash flow during the first nine months of 2022, which had no problems providing very strong coverage of 257.84% to their dividend payments of $1.511b. Although upon zooming into their quarterly performance, their cash flow performance was not necessarily as strong as it seems on the surface, due to their working capital movements.

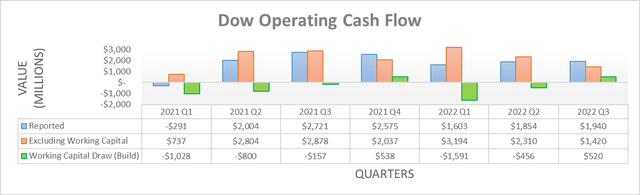

When viewing their operating cash flow on a quarterly basis, their result of $1.94b for the third quarter of 2022 still appears quite decent against their two previous results of $1.854b and $1.603b for the second and first quarters respectively. Although, this quickly changes after viewing their results excluding working capital movements with the third quarter of 2022 seeing an underlying result of only $1.42b, which means their reported results benefitted from a $520m working capital draw as their preceding combined working capital builds of $2.047b during the first half partially reversed. If not for these lumpy inflows and outflows, their result for the third quarter is the lowest result since the first quarter of 2021, when the world was still recovering from the Covid-19 pandemic. In fact, it is down more than half versus as recently as the first quarter of 2022, which saw an underlying result of $3.194b.

On the surface, this may seem like a disappointing quarter and yes, if viewed narrowly this is true, but if viewed via a wider lens, it actually provides further support as to why their shares offer desirable value. Even without their working capital draw, they still generated solid underlying free cash flow during the third quarter of 2022 of $878m, once removing their capital expenditure of $542m from their underlying operating cash flow of $1.42b. If annualized, this equals $3.512b and thus gives rise to a very high circa 10.50% free cash flow yield when compared against their current market capitalization of approximately $33.5b.

The fact that a double-digit free cash flow yield can persist despite their weak financial performance speaks volumes to the desirable value their shares offer in the medium to long-term, as they are still generating plenty of cash to reward shareholders even without booming operating conditions. Admittedly, the concerning economic outlook makes even weaker results quite possible in the short-term, especially given their guidance for the fourth quarter of 2022 but still, desirable value persists.

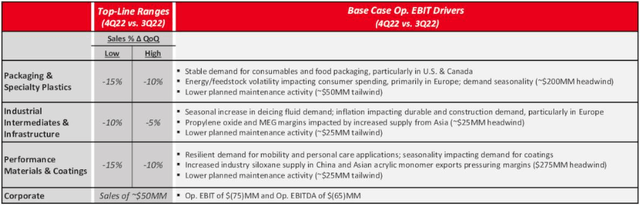

Dow Third Quarter Of 2022 Results Presentation

If aggregating their forecasted EBIT headwinds and tailwinds across their three business segments for the fourth quarter of 2022, they totaled a net headwind of $400m relative to the third quarter. In theory, their free cash flow should see a similar impact given their positive correlation, although they have also reduced their capital guidance to $1.9b for 2022, as per slide twelve of their third quarter of 2022 results presentation. This represents a decrease of $200m versus their previous guidance of $2.1b when conducting my previous analysis and thus given they have already incurred $1.427b during the first nine months, it means the fourth quarter should see slightly lower capital expenditure of circa $473m versus the $542m during the third quarter, thereby representing a $69m decrease.

When wrapped together, this broadly indicates the fourth quarter of 2022 could see its free cash flow dip by around $331m versus the third quarter, which would leave their result at circa $547m. Whilst much less, it still annualizes to $2.188b and thereby sees a free cash flow yield on current cost of circa 6.50%, which still represents desirable value given it would arise from what seemingly amounts to a significant downturn with weak operating conditions across multiple fronts. Furthermore, as this surpasses their current dividend yield of near 6%, it indicates their coverage would still remain adequate despite the weaker financial performance, thereby supporting their safety.

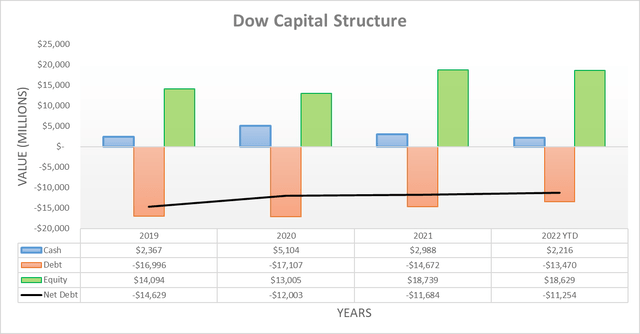

Despite their financial performance coming in rather weak, their net debt still dropped slightly lower to $11.254b during the third quarter of 2022 versus its previous level of $11.354b following the second quarter, which is particularly desirable as it was accompanied by $800m of share buybacks. When looking ahead into the fourth quarter as well as 2023, their net debt should remain broadly unchanged as management will likely continue scaling their share buybacks, capital expenditure and so forth to match the prevailing operating conditions.

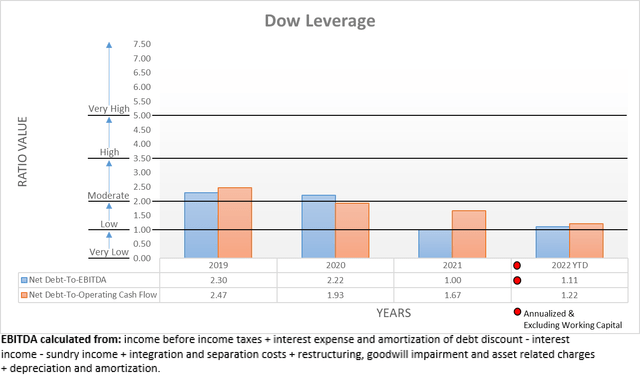

Even though their net debt dropped slightly lower, the third quarter of 2022 still saw their leverage increase due to their weaker financial performance. As a result, their respective net debt-to-EBITDA and net debt-to-operating cash flow increased to 1.11 and 1.22 versus their previous respective results of 0.48 and 0.52 following the second quarter. Whilst a large increase proportionally speaking, their new results are still only sitting at the bottom end of the low territory of between 1.01 and 2.00. This provides ample safety not only right now but even more importantly, they could see their financial performance halve versus the first nine months and still only result in moderate leverage, which means they are well positioned to endure any turbulence whilst still supporting their dividends.

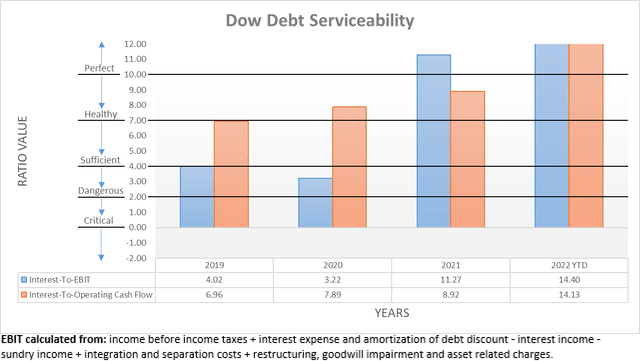

Thankfully, their weaker financial performance did not materially degrade their ability to service their debt, which is becoming increasingly important to consider as interest rates climb rapidly. To this point, their interest coverage is perfect regardless if taking an accrual or cash-based approach with results of 14.40 and 14.13 compared against their EBIT and operating cash flow, respectively. Similar to their leverage, this provides a sizeable margin of safety and thus ensures they should not have any issues going forwards, regardless if they see even tougher economic conditions that cause even weaker financial performance during 2023.

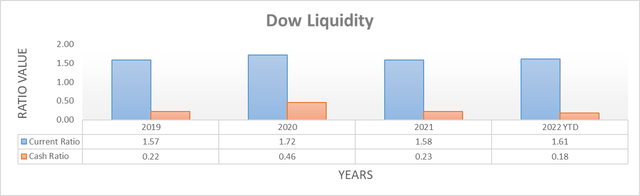

Despite seeing a working capital draw, their liquidity barely changed during the third quarter of 2022 with their respective current and cash ratios at 1.61 and 0.18, thereby very close to their previous respective results of 1.64 and 0.18 following the second quarter. As a result, their liquidity remains strong and when looking ahead, as one of the largest companies in their industry, they should always have superior access to debt markets to source liquidity or refinance debt maturities as required, even if central banks further tighten monetary policy.

Conclusion

There is no way to sugarcoat their latest results, the third quarter of 2022 was weak and sadly, the fourth quarter appears to be even weaker as the increasingly downbeat economic conditions hinder their financial performance. Notwithstanding this short-term pain, I still believe that my buy rating is appropriate for the medium to long-term as their shares still offer desirable value with a high single-digit to low double-digit free cash flow yield, despite this weaker financial performance. Although at the same time, investors should be braced for a potentially bumpy road as the world navigates the concerning economic outlook and thus, it would be prudent to keep risk management in mind via limiting position sizes.

Notes: Unless specified otherwise, all figures in this article were taken from Dow’s SEC filings, all calculated figures were performed by the author.

Be the first to comment