DOW JONES, NIKKEI 225, ASX 200 INDEX OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 closed +0.53%, +0.65%, and +1.12% respectively

- 10-Year Treasury yield retreated slightly to 1.609% from an intraday high of 1.646%

- The Nikkei 225 and ASX 200 indexes may move higher. US retail sales figure in focus

| Change in | Longs | Shorts | OI |

| Daily | -9% | 9% | 2% |

| Weekly | -20% | 24% | 3% |

Reflation, Volatility, Yields, Vaccine, Asia-Pacific at Open:

Wall Street equities closed broadly higher on Monday as reopening hopes boosted sentiment, sending the Dow Jones and S&P 500 indexes to their record highs. Gains among S&P 500 sectors were led by defensive-oriented utilities (+1.36%), real estate (+1.18%) and consumer discretionary (+1.17%), while energy (-1.25%) fell alongside crude oil prices.

The VIX volatility index extended declines to a multi-month low of 20.0, suggesting that the stock market has probably returned to a status of complacency. This renders equities susceptible to a sudden surge in volatility should this Wednesday’s FOMC meeting deliver surprises. Separately, news crossed the wires that Germany jointed Italy, France and other countries in halting the use of the AstraZeneca Covid-19 vaccine because of safety concerns. This may further delay the Eurozone’s vaccine progress.

VIX – Volatility Index

Chart by TradingView

The 10-year Treasury yield pared some gains while the US Dollar index (DXY) climbed for a second day after Treasury Secretary Janet Yellen said in a TV interview that “US inflation risks remains small and manageable”. This echoed Fed Chair Jerome Powell’s latest comments arguing that the current set of monetary stimulus measures is “appropriate”, hinting that the Fed may hold its policy rate and bond-purchasing program largely unchanged at the upcoming FOMC meeting. A brighter economic outlook alongside accommodative monetary and fiscal policy may underpin a stock market rally in the medium to long term.

Asia-Pacific markets look set to open stronger on Tuesday following a decent US lead. Futures across Japan, Australia, Hong Kong, Taiwan and Malaysia are pointing to trade mildly higher. Australia’s ASX 200 index opened up by 0.27%, led by real estate (+1.02%), consumer discretionary (+01.03%) and information technology (+0.85%) sectors, while energy (-0.66%) lagged behind. Japan’s Nikkei 225 index opened modestly higher as investors awaited a speech from BoJ Governor Haruhiko Kuroda.

Looking ahead, the Eurozone and German ZEW economic sentiment data headline the economic docket alongside US retail sales and industrial production figures. Find out more from DailyFX calendar.

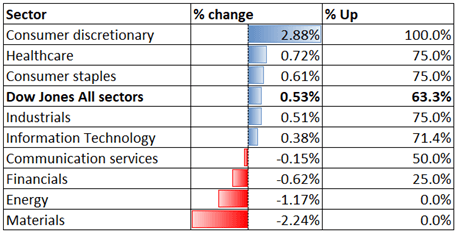

Looking back to Monday’s close, 5 out of 9 Dow Jones sectors ended higher, with 63.3% of the index’s constituents closing in the green. Consumer discretionary (+2.88%), healthcare (+0.72%) and consumer staples (+0.61%) were among the best performers, while materials (-2.24%) and energy (-1.17) lagged behind.

Dow Jones Sector Performance 15-03-2021

Source: Bloomberg, DailyFX

Starts in:

Live now:

Mar 16

( 10:03 GMT )

Learn about trading global equities

Trading Sentiment

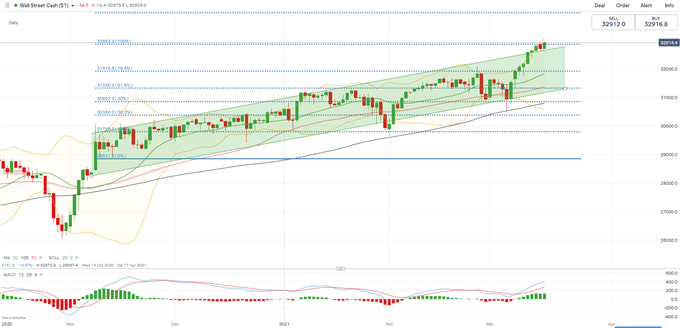

Dow Jones Index Technical Analysis

The Dow Jones indexbroke above the ceiling of the “Ascending Channel”, underscoring strong upward momentum. The index is attempting to test an immediate resistance level at 32,863 (the 100% Fibonacci extension. A successful attempt would probably intensify near-term buying pressure and bring the 127.2% Fibonacci extension level (33,954) into focus. The overall trend remains bullish-biased as suggested by the upward-sloped moving averages and the MACD indicator.

Dow Jones Index – Daily Chart

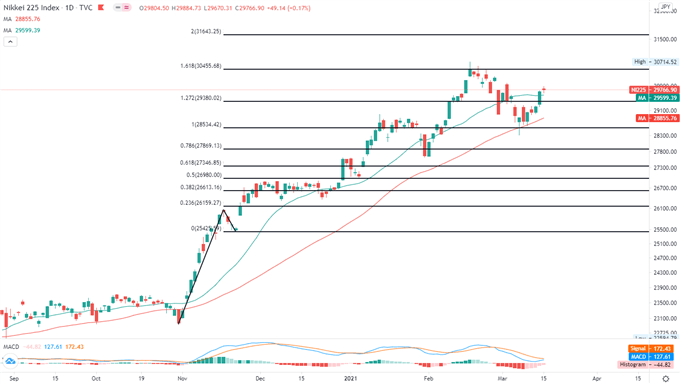

Nikkei 225 Index Technical Analysis:

The Nikkei 225 index breach above the 20-Day SMA line with renewed upward momentum. An immediate support level can be found at around 29,380 – the 127.2% Fibonacci extension level. The MACD indicator is about to form a bullish crossover, suggesting that near-term momentum has turned upwards.

Nikkei 225 Index – Daily Chart

Chart by TradingView

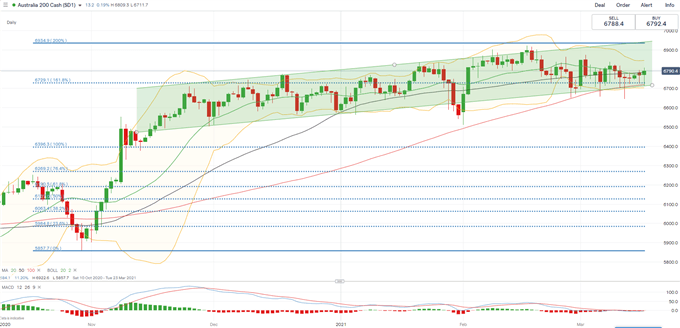

ASX 200 Index Technical Analysis:

The ASX 200 index remains in an “Ascending Channel” but upward momentum appears to be fading as suggested by the downward-sloped MACD indicator. The overall trend remains bullish as suggested by upward-sloped 50-day SMA line, but a minor correction seems to be underway. Holding above 6,730 – the 161.8% Fibonacci extension level – may pave the way for further upside potential towards 6,935 – the 200% Fibonacci extension.

ASX 200 Index – Daily Chart

Recommended by Margaret Yang, CFA

Improve your trading with IG Client Sentiment Data

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter

Be the first to comment