Denis_prof/iStock via Getty Images

Dover’s Prospects And Challenges

Dover Corporation (NYSE:DOV) provides various equipment, component, services, and software used in aftermarket vehicle service, solid waste handling, industrial automation, and related fields. While the supply chain disruptions have long pestered the company, it appears the issues are receding. The end of the pandemic has opened up the demand side, as reflected in the increased backlog and order rate over the past year. Strong U.S. demand for garbage collection vehicles and parts has increased its sales. Higher productivity and improved price-cost spread would be margin accretive in 2H 2022.

However, there is also uncertainty over the economic impact of the current recession. The indicators signal a slightly dimmer outlook for the company in the short term. The supply chain issue also took its toll on the cash flows. It has high leverage, which can be concerning when tagged with low cash flows. Fortunately, it has sufficient liquidity, which should lower the long-term financial risks.

Dover stock is relatively undervalued compared to its peers. The recent share repurchase program and dividend hike also point to management’s confidence in its value. Over the medium term, I think investors might want to buy the stock with expectations of improved returns.

Bookings And Indicators

In Q2 2022, DOV’s total backlog was ~30% higher than a year ago because of extended lead times following supply chain issues and changes in product mix. On a 12-month basis, the backlog is higher than in the past few years. Although it came down in Q2 compared to Q1 (2.8% down), it may also indicate that the supply chain issues are easing. The organic booking growth has also declined in the past quarter. The book-to-bill ratio is higher than 1x and in line with historical trends. The company’s management believes that the steadiness in backlog point to a positive outlook in 2023.

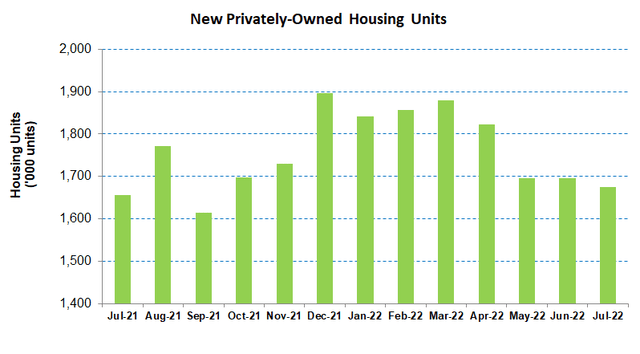

However, the specter of supply disruption and cost inflation is not over. Couple with this is the current weakness in economic activities and the fear of a recession. In August, the ISM Manufacturing PMI was 52.8, indicating low factory growth and softening prices. New orders, however, staged a comeback. According to the U.S. Bureau of Labor Statistics, the U.S. unemployment remained low (3.7%) in August, down from 5.2% a year ago. According to the US Census Bureau, the new privately-owned housing units decreased by 9% in July 2022 compared to the beginning of the year. Overall, I think the indicators signal a slightly dimmer outlook for the company in the short term.

Therefore, the company needs to adapt to a cost and working capital structure that respond quickly to the changes in demand. The company’s backlog and order rate seem comfortable and inflect in 2H 2022.

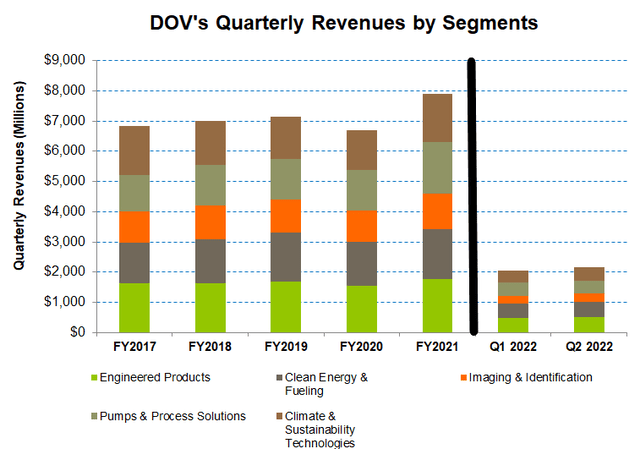

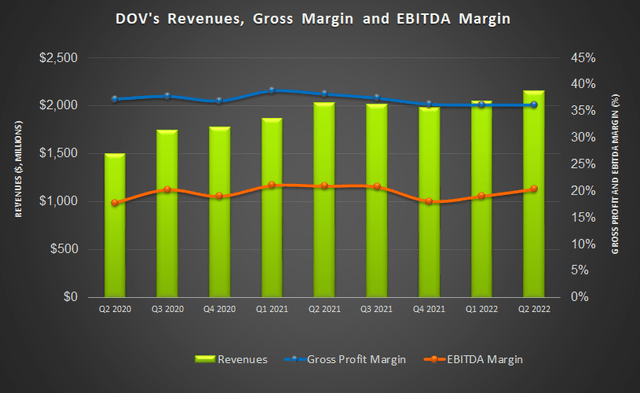

Outlook: Engineered Products And Clean Energy & Fueling

The Engineered Products segment, which has the highest share in the revenue mix (22% of Q2 revenues), will likely remain robust in the short to medium term due to increased backlogs and price hikes. Demand for garbage collection vehicles and parts remains strong in the U.S. The digital business would also do well. Higher productivity and improved price-cost spread would be margin accretive in 2H 2022. In Q2, the segment topline grew by 5% compared to Q1, while the segment EBITDA went up by 13%.

The Clean Energy and Fueling segment, despite a lukewarm performance in 1H 2022, can see the revenue growth pick up in 2H 2022. In Q2, revenues in this segment increased by 8% compared to Q1 as volumes increased. The adjusted EBITDA also expanded 30% from Q1 to Q2 due to improved cost dynamics and product mix. Demand for fuel transport vehicle wash, below-ground retail fueling, and software solutions would keep its topline strong in the near term.

The Outlook In Other Segments

The Pumps and Process Solutions segment can see headwinds in demand growth. On the energy side, the crude oil price weakened in Q3 after the highs in early 2022. While the completed wells have increased rapidly since 2022, the DUC (drilled by uncompleted) wells have declined. In biopharma, the manufacturers are fast transitioning from COVID-related businesses to other growing biologic therapies, which can affect their product portfolio adversely in the near term.

The supply chain-related issues are being worked out. DOV’s Imaging & ID segment volumes can increase in 2H 2022 as component shortages recover in China. Recently, the company saw approved order rates for large-scale printers and digital textile printing. So, margins can improve in 2H 2022 following better volume and cost containment measures adopted by the company. The expected improvement in result would be crucial given the stagnant performance in Q2 when revenues remained unchanged and adjusted EBITDA remained unchanged.

The Climate & Sustainability Technologies, which saw the highest revenue and EBITDA growth among its segments in Q2, would continue to do well in 2H 2022, posting double-digit organic growth. Pricing traction in food retail and removal of input shortages would result in deferred shipments in the year’s second half.

Steady Dividend

In August, DOV increased its quarterly dividend marginally, by 1%, to $0.505 per share, or $2.02 annualized, translating into a 1.58% dividend yield. Snap-on Incorporated’s (SNA) forward dividend yield is 2.66% while Fortive Corporation’s (FTV) dividend yield is lower (0.45%).

Cash Flows And Debt

In 1H 2022, DOV’s cash flow from operations (or CFO) decreased by 54% compared to a year ago. Despite a mild year-over-year revenue rise, the deterioration in working capital led to the CFO’s fall. Investments in inventory due to high backlog following the supply chain infused input shortages caused higher working capital requirements in 1H 2022. Receivable balances also increased, creating more strain on the cash flows. Capex, excluding the acquisition part, raised in 1H 2022, leading to a 72% lower free cash flow (or FCF) in the past year.

DOV’s liquidity (cash plus undrawn revolving credit facility) totaled $1.5 billion as of June 30. Its debt-to-equity ratio (0.67x) is higher than its competitors (SNA, FTV, and IR) average of 0.33x. In Q2, it acquired Malema Engineering Corporation and paid $224.0 million. In late August, it announced a $500 million share repurchase program. It will refinance the share repurchases with commercial paper.

Returns Potential And Relative Valuation

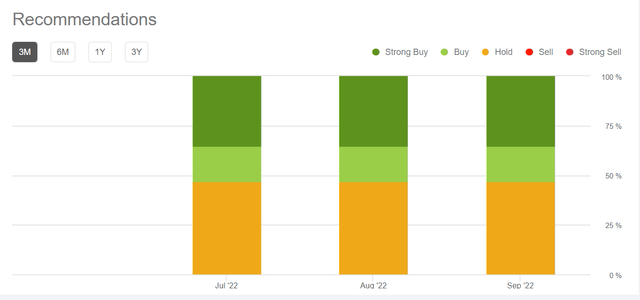

According to Seeking Alpha, nine sell-side analysts rated DOV a “buy” in the past 90 days (including “strong buy”), while EIGHT recommended a “hold.” None of the analysts rated it a “sell.” The Wall Street analysts’ estimates suggest a 20% upside at the current price.

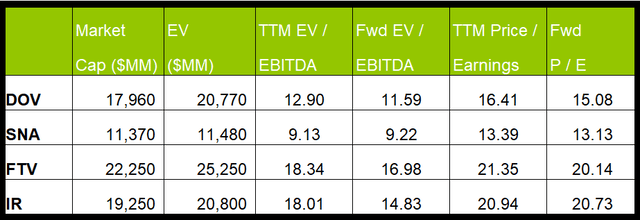

DOV’s forward EV-to-EBITDA multiple compression versus the current EV/EBITDA is steeper than its peers. This implies the company’s EBITDA can increase more sharply than its peers in the next four quarters. This would typically result in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple (12.9x) is lower than its peers’ – SNA, FTV, and Ingersoll Rand (IR) – average of 15.2x. So, the stock is relatively undervalued versus its peers.

What’s The Take On DOV?

Dover Corporation’s backlog and order rate have increased over the past year as demand for collection trucks and its software business remained strong. Fuel transport vehicle wash, below-ground retail fueling, software solutions, and increased order rates for large-scale printers and digital textile printing will keep the topline busy in the near term. I expect the focus on productivity will keep the price-cost spread high in 2022.

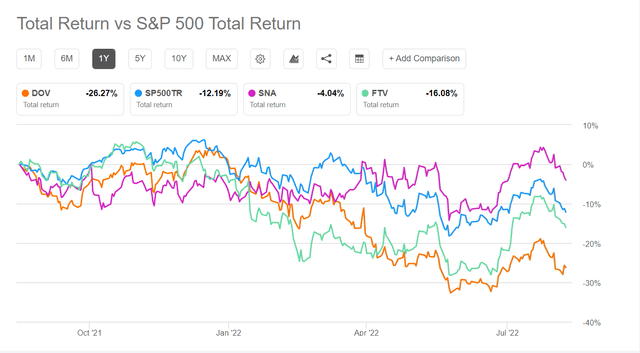

However, the supply chain issue also took its toll on the cash flows. Investments in inventory due to a high backlog caused deterioration in working capital and led to the CFO’s fall over the past year. The balance sheet is also leveraged. So, it underperformed the SPDR S&P 500 Trust ETF (SPY) in the past year. Nonetheless, increased backlog and a soft-landing of the recession would encourage investors to buy the stock.

Be the first to comment