OntheRunPhoto/iStock Editorial via Getty Images

Despite air travel demand snapping back this year, American Airlines Group (NASDAQ:AAL) continues to trade in the teens and close to covid lows. The airline is on a path to report record numbers in 2023 when capacity likely tops 2019 levels. My investment thesis remains ultra Bullish on the stock, as the market gets distracted by one-off issues likely set to disappear.

Labor Day Surge

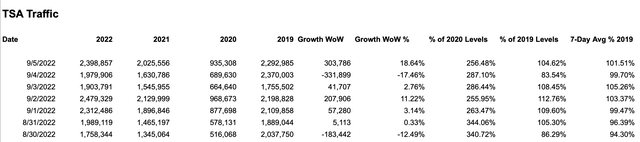

When airline traffic doesn’t face restrictions, such as Labor Day weekend when air travel is focused on domestic travel, traffic already tops 2019 levels. The TSA showed average traffic exceeded 2019 levels on all but September 4 with a total of 8.76M travelers screened from September 2 to September 5.

Source: TSA/Stone Fox Capital calculations

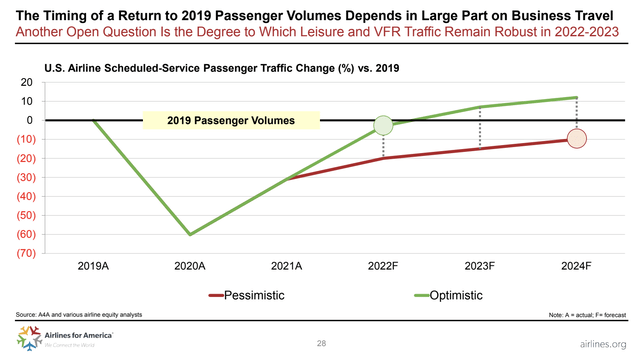

On top of this, IATA continues to suggest 2023 global air traffic is on pace to top 2019 levels. Even now with covid constraints still around, intra-Europe traffic is now forecast to top the 2019 levels in Q4’22 at 101%. With airline traffic set to top 2019 levels, the possibility for 2023 traffic to return to historical trends would place traffic closer to 110% of 2019 levels after 4 years from the peak.

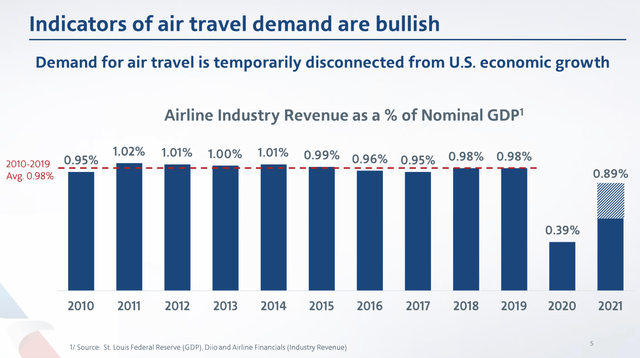

As American Airlines highlighted at the J.P. Morgan Industrials conference earlier this year, airline industry revenue tends to average ~1% of nominal GDP. With strong GDP growth since 2019, airline revenue should easily top those levels similar to how Q3’22 revenues for American Airlines were guided to increase at least 10% from 2019 levels.

Source: J.P. Morgan Industrials presentation

At the Cowen transportation conference, new American Airlines CEO Robert Isom covered how traffic remains strong following a big summer recovery. Domestic business travel has already topped 2019 levels with only covid restrictions holding back a full recovery while revenues are already topping 2019 levels.

Historically Cheap

For a long time, my thesis has pushed the idea of air travel returning to historical levels. The stock hasn’t held any rallies during this period as higher oil prices buried the revenue growth and raised irrational fears that airlines wouldn’t survive.

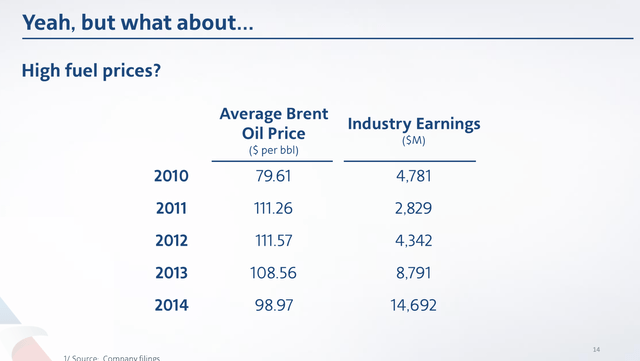

The airlines easily profited with higher oil prices back in the early 2010s. In fact, the sector had industry profits of nearly $15 billion back in 2014 when Brent Crude prices averaged $99/bbl.

Source: J.P. Morgan Industrials presentation

The sector has greatly improved efficiencies in the last decade with more fuel efficient airplane in place now. For this reason, analysts forecast American Airlines to generate solid profits going forward with a big jump in the years ahead as debt is repaid and high interest expenses are cut.

The current revenue estimate for 2023 of $50.7 billion is the first year the airline will top the $50 billion level. American Airlines reported 2019 revenues of only $45.8 billion.

The key difference between 2022 and next year is a more normalized cost structure with the airline flying at full capacity with the majority of new hire costs absorbed in 2022 and fuel costs under control. Analysts have American Airlines earning $1.55 next year and $2.93 in 2024

With the higher revenue base next year by ~$5 billion from 2019 levels, one should assume the ability of American Airlines to generate the same type of profits, if not higher, as in the original estimate for 2020 of $2.2 billion. The higher share count cuts the EPS to an ~$3 EPS stream before the higher debt levels, which should be offset by the structural reduction in costs by $1.3 billion.

While the market wrongly spent most of 2022 worried American Airlines and the other legacy airlines might go bankrupt, the reality is that the major question is how quickly the airline can reduce debt back to normalized levels.

Takeaway

The key investor takeaway is that American Airlines should see a big boost with robust demand and lowered unit cost next year. The stock only trades at 4x to 5x normalized EPS targets going forward with the worst case scenarios no longer on the table.

Be the first to comment