Adonis page/iStock Editorial via Getty Images

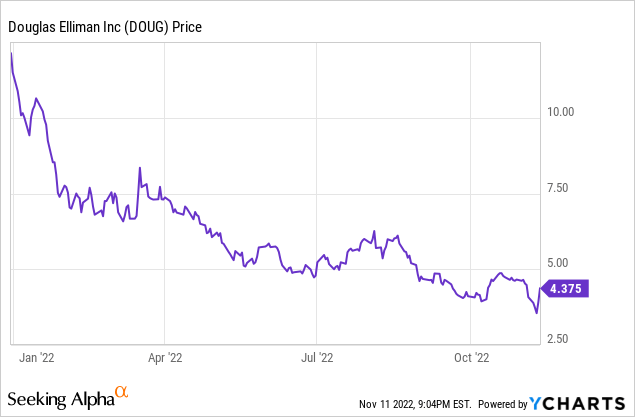

Luxury residential real broker Douglas Elliman (NYSE:DOUG) is an interesting investment at current prices for those patient investors willing to hold it until the economy rebounds from the expected recession while still earning a modest yield of 4.6%. I bought the stock last week while their CEO, Howard Lorber, was being interviewed on CNBC because I did not realize that the stock price had dropped so sharply from earlier this year to such an undervalued price for this premier luxury residential broker that has a reputation for impeccable service. It should do well when mortgage rates eventually decline.

Real Estate Business Model

Douglas Elliman has been around for over 100 years and originally served mostly the New York area, but now serves many luxury markets such as Beverly Hills and Palm Beach ($1.604 million average transaction price for the last 12 months). Ownership has changed a few times over the years. It was spun off from the Vector Group (VGR), which owns discount cigarette company Liggett Group, at the end of 2021 when VGR shareholders received 0.5 shares of DOUG for each VGR share. I looked at DOUG when it first started trading at over $12, but it did not seem to be a bargain, especially when I was bearish on the stock market.

The reality is that their primary asset is their reputation for outstanding service. The risk, of course, is what if their service reputation is negatively impacted by some individual brokers who provide poor service and this news spreads within their target high-income market. In the past Douglas Elliman was the “go to broker” if you wanted to buy a NYC highly restrictive co-op, such as One Sutton Place South. (Currently, they have a listing, for example, at One South for a two-bedroom co-op listed at $5.995 million with a monthly maintenance of $8,558.)

This exclusive co-op market, however, has been impacted by lawsuits and new legislation that has greatly reduced these co-op’s ability to be so extremely restrictive, which may have indirectly had a negative impact on Douglas Elliman’s marketing business model. Many of these exclusive co-ops do not allow mortgages and some have “multiple” requirements. Under the multiple requirement a potential buyer of a co-op needs to own a certain “multiple” of liquid assets (some require 4x) times the purchase price plus being able to meet other standards to get the co-op’s board approval to buy. Actually, these various restrictions, in my opinion, help Douglas Elliman because it reduces the ability of some non-luxury brokers to take some of their business since Douglas Elliman has a reputation of advising potential buyers of how to deal with the co-op boards. The trend in NYC is for almost no new co-ops/co-op conversions and only new condominiums, which usually just require money (lots of money) to buy and no board approvals.

A new type of high-end competitor to Douglas Elliman has emerged in the last few years. There are YouTube/social media individual brokers that have been able to create their own brand that competes with established luxury brokers. Ryan Serhant, for example, frequently posts YouTube videos about very expensive NYC apartments and he currently is the broker for the $250 million penthouse apartment on 57th St.

Besides being a residential broker with about 100 offices and almost 7,000 agents, Douglas Elliman also manages about 360 luxury buildings with 56,500 units in the New York area. They also offer title insurance as agents – not as an actual title insurance company. They are expanding into Las Vegas, Dallas, and many other luxury markets by recruiting local top agents/agencies to become affiliated with Douglas Elliman. They rarely actually buy other real estate firms.

Based on their reported commission revenue numbers and real estate agent commission expenses, it seems that the agents get an average 75% of commissions and Douglas Elliman gets 25%. I am basing this solely on their income statements because 75% is very high by industry standards. This implies, in my opinion, that there is very steep competition to keep their top agents if they have to pay them such a high percentage.

They have a $13.771 million investment in a SPAC, PropTech Investment Corp. ll (PTIC), which is trying to merge with an entity that owns Renters Warehouse. I glanced at Renters Warehouse, and I was not impressed, but since the investment is only about $0.17 per DOUG share it is not a major issue. It seems the parties are having problems completing the deal because they just had another time extension. There could be a very modest impact on DOUG if the merger is actually completed, and the new stock starts trading.

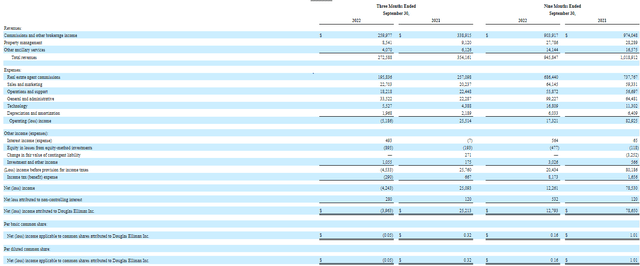

Latest 3Q Results

It was not surprising that commission revenue continued to drop in the 3Q because much higher mortgage rates have really hurt the residential market. They had a GAPP loss of $0.05 for the quarter. A major negative issue is the over 50% increase for the last nine months for general and administrative expenses. Part of the explanation for this is that last year they were still part of the Vector Group. There may have been some synergy with overhead expenses, or they allocated a lower amount of total expenses to Douglas Elliman’s operations than they should have in 2021. They are trying to reduce expenses according to management in their conference call.

Douglas Elliman pays $0.05 dividend per quarter, which results in a current yield of 4.6%. Even if they don’t earn enough currently and in the near future to cover the dividend, I expect them to keep the dividend because they had almost $193 million cash as of September 30 and their token amount of debt was paid off in October.

Income Statements 3Q and 9 Months 2022 and 2021

Income Statement 3Q and 9 months 2022 and 2021 (sec.gov)

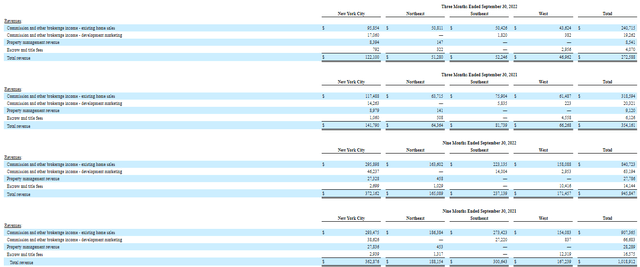

As can be seen by the table below, the NYC market has not been hit as much as other markets by much higher mortgage rates. I wonder if that is partially because many ultra-luxury co-ops in Manhattan do not allow buyers to use mortgages, so the higher mortgage rates do not have a direct impact on that part of the co-op market.

Revenue By Region 3Q and 9 Months 2022 and 2021

Revenue By Region 3Q and 9 Months 2022 and 2021 (sec.gov)

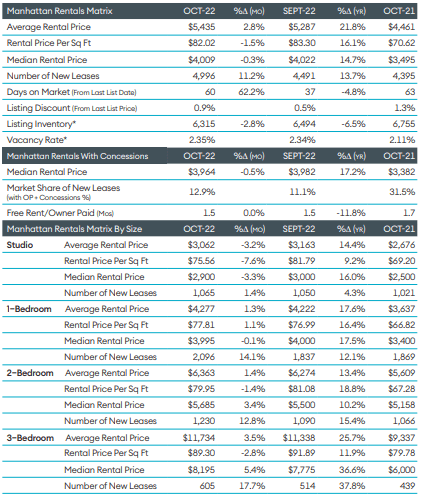

Latest Manhattan Residential Numbers

I think many potential DOUG investors focus on the New York market, especially Manhattan, when valuing DOUG because that has been its historical market. Therefore, the last residential numbers for October for Manhattan, which includes all real estate and not just those associated with Douglas Elliman, are appropriate to consider. Readers need to remember that average Manhattan numbers include those in parts of the borough that are lower income and not just the upper income areas such as SOHO and Tribeca. (No, the average apartment monthly rental rate of $5,435 in Manhattan is not a typo error.)

Manhattan Residential Rental Numbers October

October Manhattan Residential Rental Numbers (www.elliman.com)

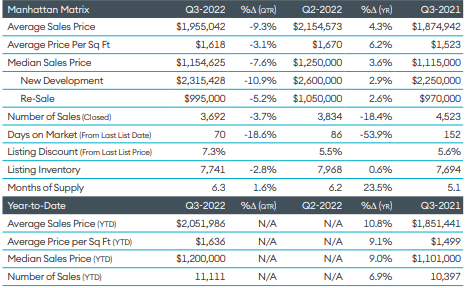

Manhattan Residential Sales 3Q (Includes Co-Ops and Condos)

3Q Manhattan Residential Sales (www.elliman.com)

Since the price per sq ft only dropped 3.1% year over year compared to the average selling price drop of 9.3%, it seems more smaller units were sold in 3Q 2022 than in 3Q 2021 and these smaller units were in mostly new developments.

It seems that some New Yorkers bought residences in Florida but kept their New York City residences. Often when somebody buys a new residence, they sell their former one. At some point I would expect that the New York residence will be on the market, which should be a positive for Douglas Elliman.

Insiders

Insiders have been buying DOUG shares over the last few months. For example, CEO Howard Lorber bought 100,000 shares between $3.875 and $4.08 according to an October 11 filing. There have been many others, including the CFO and directors, buying as well.

This may mean nothing, but as many Seeking Alpha readers know, I do extensive research before writing articles. I will let readers decide if this information influences their DOUG investment decisions, but I think potential investors should at least be aware of this issue. Dr. Phillip Frost owns 7,126,744 DOUG shares, which is 8.77% and makes him one of the largest shareholders. He and multiple other defendants were accused by the SEC in 2018 of “pump and dump” schemes to defraud retail investors. The “Final Judgement As To Phillip Frost” was filed in January 2019. I am not sure why this billionaire got involved in an illegal trading scheme that resulted in him making a $433,181.06 profit, but readers may want to read both the original SEC complaint and final judgement. He received these DOUG shares via the spin-off from Vector Group because he also owns 14,7663,520 or 9.53% of VGR.

Conclusion

My positive opinion of Douglas Elliman is influenced by friends and relatives who have used their services and were very impressed. While there are certain trends such as almost no new co-ops in New York, a market where they have an excellent reputation for dealing with complicated co-op transactions, and increased competition from YouTube/social media luxury brokers, they continue to expand into additional luxury markets. Their reputation allows them to enter these new markets fairly easily.

The DOUG stock price is very depressed, and they may continue to report weak numbers in the near future, but when mortgage rates eventually start to decline transactions should increase. While investors wait for the turnaround, they get a reasonable dividend yield of 4.6% based on the current stock price. I rate Douglas Elliman a buy.

Be the first to comment