Matt Winkelmeyer/Getty Images Entertainment

DoubleLine Yield Opportunities Fund (NYSE:DLY) is a $670 million closed-end fund managed by the well-known CNBC regular Jeffrey Gundlach and DoubleLine’s deputy CIO Jeffrey Sherman. With this fund, they’re trying to seek a high level of total return, emphasizing current income. DoubleLine is known for its fixed-income investing, but theoretically, this fund has a broad mandate per the DoubleLine website:

invest in debt securities and other income producing investments of issuers anywhere in the world, including in emerging markets, and may invest in investments of any credit quality.

The portfolio is constructed through a top-down macroeconomic assessment of global markets. I understand that Gundlach and Sherman decided to overweight or underweight certain sectors based on fundamentals and relative valuation. But they get a lot of input from “sector managers” within the firm to pick the best securities from a bottom-up perspective.

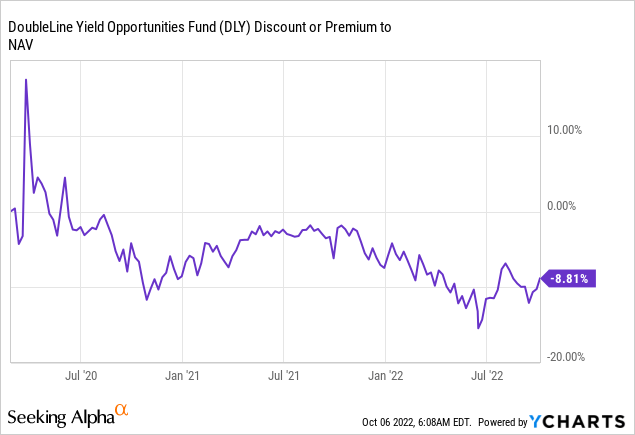

The fund has a leverage ratio of around 29% and its distribution rate is around ~10%. It currently trades at an 8.81% discount to net asset value.

A discount like that isn’t unusual on a closed-end fund. Historically this particular fund doesn’t often trade at such a large discount. DoubleLine is viewed as a savvy fixed-income manager. The discount is likely a result of the fund being down 18.63% based on NAV and 23% based on market price. The fund has now generated a negative total return since inception in 2-25-2020.

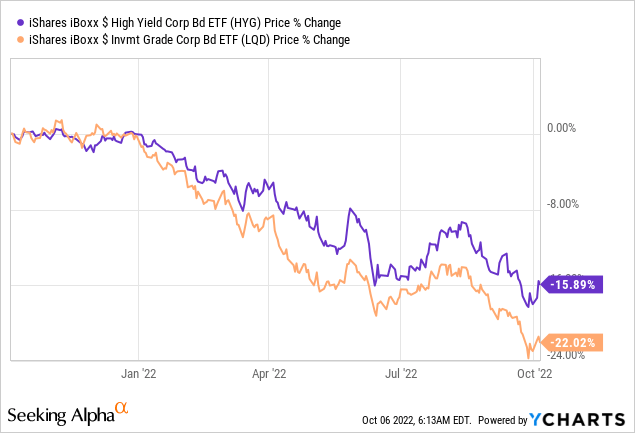

In defense of the team here, the Fed has been taking a wrecking ball to the bond market for the most part of 2022. It’s hard to manage a fixed-income fund and have a great year when interest rates are moving up 75bp a clip. The chart below shows year-to-date performance for the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) for illustrative purposes:

If you’re wondering why investment grade is down more than high-yield that’s because the duration of the investment grade ETF is much greater. The market doesn’t like to loan money to crappy companies for 10 years. However, good credits can easily borrow money for 5 or 10 years. The result is there’s more interest rate risk in the investment grade market. High-yield tends to perform very poorly when a recession is looming because that’s when default risk is jumping. So far, the economy has proven fairly resilient in the face of interest rate hikes. I’d expect HYG to underperform once the economy starts to roll over.

Given that DoubleLine is running this fund with a leverage ratio of 30%+, its performance isn’t that bad. I tend to buy closed-end funds (“CEFs”) at deep discounts. The exact discount depends on the management, strategy, and type of assets in the fund. I’ll buy fixed-income funds at smaller discounts than equity or private equity funds.

I try to hang on to CEFs until the discount to NAV narrows to around 5% or less. When I want to buy a CEF, I always look at the portfolio. There are a few reasons for this: 1) this gives me clues whether the management is closet-indexing; 2) the portfolio gives clues whether management could be very skilled (better managers tend to have very creative portfolios); 3) it gives clues as to how the team is thinking about asset management; and 4) sometimes, I don’t love the fund, but there are still interesting credit ideas in the portfolio.

Gundlach and Sherman are in the media very often. I don’t always agree with their views (probably to my detriment), but I do think they’re very attentive to risk, which is something I like. Sherman just recently did a macro presentation that gives some context to their current views (think recession risk 2023).

Looking through its holdings, this fund is not closet indexing at all. It holds many interesting and creative investments that you don’t easily get access to through a regular bond exchange-traded fund (“ETF”). Some examples of interesting names I noticed are Bain Capital, Carlyle (CG), Dominican Republic, Fertitta Entertainment, Lumen Technologies (LUMN), Petrobras (PBR), Uber (UBER) and even the Republic of Ukraine. These aren’t stock holdings, but some form of credit/bond associated with the above firms/countries.

The fund allocates small amounts to individual credits. That’s typical for bond funds. Usually, there’s a lot to lose and little to gain in a credit/bond position. It makes even more sense to diversify.

The fund has a modified duration of around 4.57. The average credit rating (when rated) is around BBB. But the fund is taking a bit of a barbell approach. There’s quite a bit of AAA exposure and then a lot of BB, B and below B exposure. It averages out to BB when ratings are known.

I bought this closed-end fund a while ago, as it was trading at a steep discount then also. It has a great manager who constructed a very interesting portfolio. I still think it is attractive. I tend to hang on to CEFs until the discount to NAV narrows to around 5% or goes away. I tend to sell when I come across an investment I like more in the context of my portfolio.

Be the first to comment