Leestat

Introduction

When last discussing Dorian LPG (NYSE:LPG) back earlier in 2022, they were buying back 20%+ of the company, despite not committing to any regular dividends, as my previous article discussed. Quite a bit changed since publishment after Russian troops advanced into Ukraine and set off a chain of events that upended the global energy market and thus this article provides a refreshed analysis. Whilst the coal, oil and gas markets always receive the bulk of the attention and form the majority of the global energy market, metaphorically speaking, investors can still grab a very high 10%+ dividend yield from energy sector breadcrumbs as shortages spill over into the much smaller and largely under-followed LPG industry.

Executive Summary & Ratings

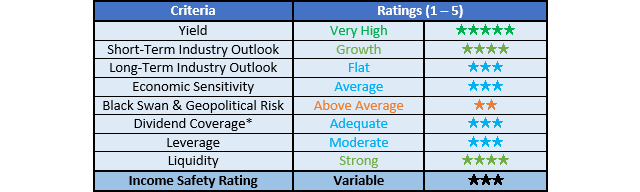

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

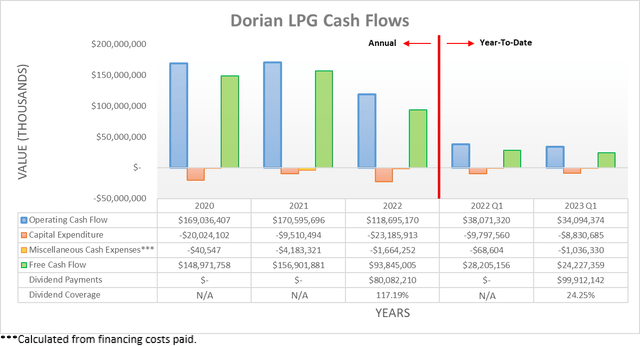

On the surface, their cash flow performance during their fiscal year 2022 appears to have been particularly weak with their operating cash flow dropping lower to $118.7m versus their previous result of $170.6m during their fiscal year 2021. Although, this was partly due to the former seeing a sizeable working capital build of $21.6m that hindered their surface-level result, whereas the latter only saw an immaterial draw of less than $1m. If not for this temporary headwind, their free cash flow of $93.8m during their fiscal year 2022 would have been significantly higher with its underlying result at $115.4m.

When turning to their most recent results from the first quarter of their fiscal year 2023, a similar dynamic was evident. Once again, on the surface their operating cash flow of $34.1m is noticeably below their previous result of $38.1m during the first quarter of their fiscal year 2022. Although, if removing their temporary working capital movements, the former sees an underlying result of $41.3m and thus much higher than their previous equivalent result of $27.7m. At the end of the day, volatility is par for the course when it comes to shipping, regardless of the product being carried, although it was nevertheless still positive to see their latest fiscal year starting with stronger underlying financial performance.

Whilst their dividend payments of $99.9m during the first quarter of their fiscal year 2023 far outstripped their free cash flow of $24.2m, this was simply due to the routine lag between when they are declared and actually paid. This dividend payment is better compared to their underlying free cash flow from their fiscal year 2022 of $115.4m, in the same way as their dividend payments during their fiscal year 2022 partly relate to free cash generated during their prior fiscal year and thus their dividend coverage should revert towards an adequate 100%+ as the year progresses. Meanwhile, the $100m share buyback program they announced following the third quarter of their fiscal year 2022 is seemingly being ignored with nothing conducted during the subsequent fourth quarter and only a relatively tiny sub-$1m worth conducted during the first quarter of their fiscal year 2023. Despite management effectively returning nearly all of their free cash flow, give or take a little depending upon temporary working capital movements, they have still not formulated any concrete shareholder returns policy but at least, they struck an overall positive tone when discussing their outlook, as per the commentary from management included below.

“The significant dividend payments in the last year underscore our board’s commitment to a sensible capital allocation policy that balances market outlook, operating capital needs of the business, and an appropriate level of risk tolerance given the volatility in shipping. With a solid freight market backdrop, we remain cautiously optimistic about our cash flow generation over the coming months.”

-Dorian LPG Q1 FY2023 Conference Call.

Even though they refuse to commit to a shareholder returns policy, the dividends keep flowing every quarter at a variable rate and thus in my eyes, they have a variable dividend policy in effect. It would have been preferable to see a well-articulated shareholder returns policy but if nothing else, at least they have not ruled out further dividends and seemingly struck an overall positive tone regarding their outlook. As virtually every investor would have heard by now, the world is facing a structural energy shortage, especially amplified by the Russia-Ukraine war that is depriving Europe of much-needed gas supplies and leading to never-before-seen prices across the continent as Russia reduces their exports in retaliation to sanctions. Naturally, this shortage also spilled over into other energy markets, such as coal that surged in price throughout 2022 as countries scramble to secure their energy needs.

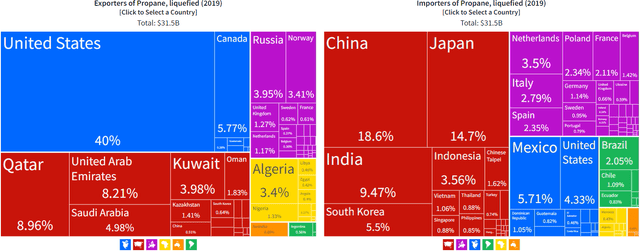

Whilst coal, gas and oil will always receive the bulk of attention when it comes to fossil fuels, investors can still capitalize on the global energy shortage via the much smaller and largely under-followed LPG industry. The shortage of the main three fossil fuels is very likely to continue well into the future and thus by extension, I expect it will spill over into boosting LPG demand as consumers favor the most cost-effective source of energy and switch where possible, especially as LPG can also be utilized for heating and cooking, just like natural gas. This creates a rising tide that lifts all boats and should in turn boost demand for their LPG vessels because most exporters are separated from importers by oceans, as the graph included below displays.

Even before the Russian invasion of Ukraine upended the global energy market, the LPG industry still saw a desirable outlook for growth of circa 7% per annum until 2028. Only the future will tell the extent that this translates into higher shipping earnings but equally as importantly, it should help place support in their industry and thus reduce downside risk.

The outlook for shareholder returns is still very desirable even without any benefit from the global energy shortage because if looking back across their last three financial years of 2020 to 2022, their free cash flow varied between $93.8m and $149m. When compared to their current market capitalization of approximately $575m, this translates to an estimated free cash flow yield of between a very high circa 16% and a massive circa 26%.

Since management is seemingly returning all of their free cash flow to shareholders via dividends, this creates scope for shareholders to expect plenty more cash heading into their pockets. Even if my positive outlook for future LPG demand does not translate into stronger shipping demand, it still seems reasonable for investors to expect a very high 10%+ dividend yield at a minimum, thereby significantly reducing the downside risk of making a poor investment.

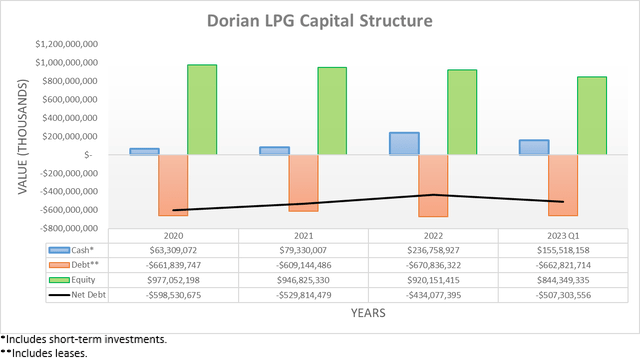

Due to the lag between their free cash flow and dividend payments, their net debt surged to $507.3m following the first quarter of their fiscal year 2023, which is materially higher from its previous level of $434.1m at the end of their fiscal year 2022. When looking ahead, the lack of formal guidance around their shareholder returns policy makes it difficult to ascertain the future direction of their net debt, although based upon their recent history of returning essentially all of their free cash flow, it seems most likely to broadly trend sideways.

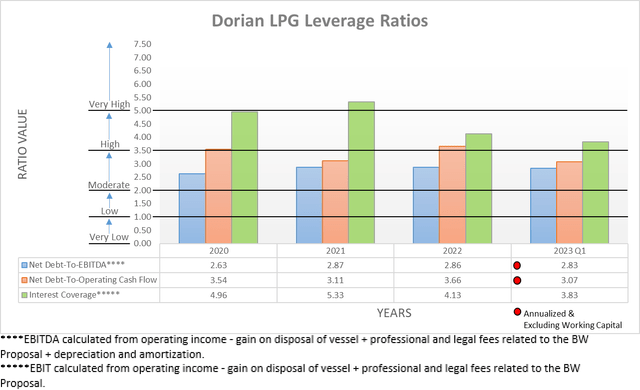

Thanks to their stronger underlying financial performance during the first quarter of their fiscal year 2023, it effectively offsets their materially higher net debt. This resulted in their net debt-to-EBITDA of 2.83 being practically unchanged versus its previous result of 2.86 at the end of their fiscal year 2022. Meanwhile, their net debt-to-operating cash flow of 3.07 was actually a decrease versus their previous result of 3.66 across these same two points in time, largely due to the latter result seeing a working capital build because if removed, their previous result at the end of their fiscal year 2022 would have been 3.09. Thankfully both of their latest results now reside within the moderate territory of between 2.01 and 3.50, which is not concerning from a solvency perspective and thus does not inhibit their ability to safely return all of their free cash flow.

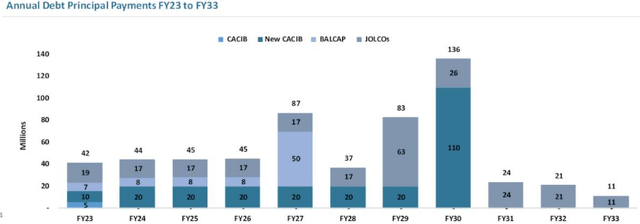

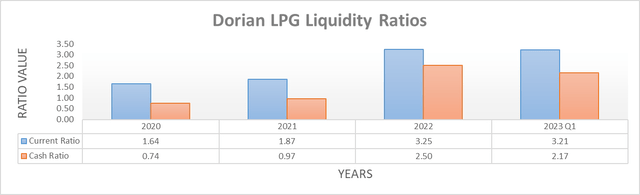

When turning to their liquidity, its strength is abundantly clear with a strong current ratio of 3.21 and equally as impressive cash ratio of 2.17. Since their recently opened credit facility sees a cap of only $20m, it makes retaining their sizeable cash balance very important but given their current cash balance of $155.5m roughly equals an entire year of operating cash flow, they are not at risk of running short in the foreseeable future. Following their debt refinancing during the first quarter of their fiscal year 2023, they now see a smoother debt maturity profile with only modest sums for the coming four years, as the graph included below displays. This makes managing their finances easier and thus helps provide shareholder returns during the coming years, whilst also helping reduce making them more resilient to any unexpected downturns.

Dorian LPG First Quarter Of Fiscal Year 2023 Results Presentation

Conclusion

When it comes to capitalizing upon seismic changes in the global energy market, instead of going after the whole pie via coal, oil or gas, metaphorically speaking, investors can also consider the much smaller and largely under-followed LPG industry. Thanks to their low share price, even without their company benefitting from energy shortages, investors could still receive a very high 10%+ dividend yield at minimum, thereby significantly reducing downside risk. Following this article and their positive outlook, I believe that upgrading my buy rating to a strong buy rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Dorian LPG’s SEC filings, all calculated figures were performed by the author.

Be the first to comment