janiecbros/iStock via Getty Images

Overview

Domo, Inc. (NASDAQ:DOMO) is a cloud services provider focused on data tooling & analytics. Their suite of services allows customers to integrate data across disparate sources, create dashboards, and create automated workflows for data pipelines.

Unlike a cloud provider such as AWS, Domo’s core business is not providing cloud infrastructure – although they do provide this as well. By cloud infrastructure, I am referring to core elements of computer processing delivered via the cloud; abstractions such as compute and storage. Instead, their software is again focused on enabling data processing via the cloud.

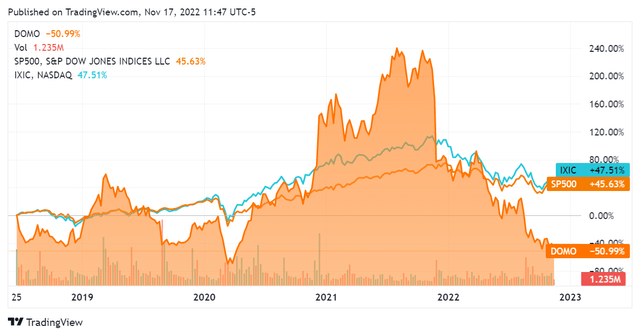

Founded in 2010, Domo continued to grow apace and conducted an initial public offering in Q2 2018 at $21 a share. The stock went through a notable boom-and-bust cycle wherein it outperformed the core S&P 500 (SP500) and NASDAQ Composite (COMP.IND) indices, but saw a reversal in its appreciation and has since significantly underperformed both.

SeekingAlpha.com DOMO 11.17.22

Nonetheless, the DOMO business has certainly changed quite a bit since then. This article will review its fundamental positioning through its accounting statements and determine whether it may be a good investment.

Financials

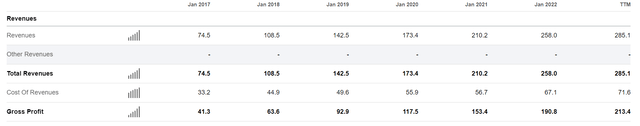

Domo has seen growth in revenues over the last 5 years, with its trailing twelve months figure 382% that of its 2016 fiscal reporting period. Note that the company releases fiscal year financials in January as per the statements listed. This is a decent level of growth overall.

SeekingAlpha.com DOMO 11.17.22

Looking into quarterly results for the last 10 periods reaffirms this. Nonetheless, these numbers are not particularly exciting for a technology stock and actually warrant a degree of concern in my opinion. Quarter-over-quarter growth for the last 10 periods is often in the high single digits or low teens.

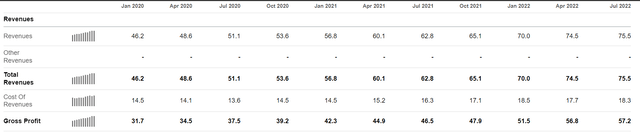

SeekingAlpha.com DOMO 11.17.22

Along with this, the company has seen a steady rise in its cost structure throughout the last 10 quarters. Notably, it appears that Domo’s growth in expenses has occasionally outpaced its revenues, leading to a structural increase in its operating loss; comparing the 2022 quarterly reports to 2021’s illustrates this.

SeekingAlpha.com DOMO 11.17.22

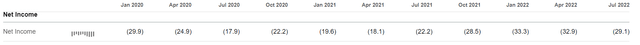

We see the same trendline on net income.

SeekingAlpha.com DOMO 11.17.22

Off the bat, I am not liking what I see for this technology stock; let’s take a look at its cash situation.

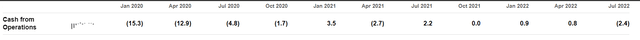

Cash from operations does not look so great either. While 4/10 of the last quarters may have come up positive, these numbers are still small. Note the break-even Q3 2021 figure and the largest cash from operations loss since Q1 2021 in its latest filing. This means that the company can’t continue operations from its own cash flows – which means it is paying interest service in order to do so.

SeekingAlpha.com DOMO 11.17.22

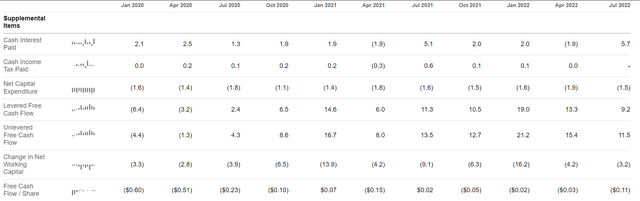

This is confirmed further in its cash flow statement. As per its latest reporting period, Domo actually paid more for interest than it has at any point over the last 10 reporting periods. In short, its capital efficiency is heading downwards.

Nonetheless it is posting positive free cash flow and it has been for some time. See again the disparity between levered free cash flow and unlevered free cash flow in its latest quarterly report, reflecting its interest payments.

Since cash from operations has been negative or close to 0, it is not immediately clear how the company is generating positive free cash flow. This must be chalked up to the complexity of accounting for technology entities and their financing situation. Nonetheless, since it is evidently not cash coming from operations, it is fair to discount this variable. Free cash flow per share is still negative and apparently increasingly so; this makes the free cash flow figures all the more suspect. I am inclined to believe the accounting team at Domo is relatively creative, but a deeper dive into this is beyond the scope of this article.

SeekingAlpha.com DOMO 11.17.22

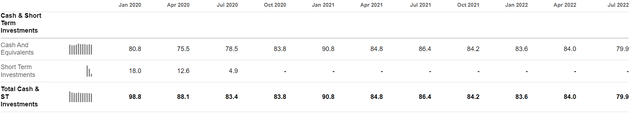

Overall we see that the company is treading water on its cash position. This isn’t exactly adding up.

SeekingAlpha.com DOMO 11.17.22

Overall this is a mediocre financial picture at best, and not one I am inclined to act upon.

Additionally, we must consider that this is a software company selling a relatively undifferentiated product. It is staring down competing offerings from Amazon’s (AMZN) Web Services (“AWS”), renowned private company Databricks, and certainly at least a half dozen more.

Cloud data processing isn’t the most simple product to be selling, but it isn’t rocket science; other cloud vendors can (and have) readily emulated and also surpassed their offering. The company itself mentioned the loss of enterprise customers on its latest earnings call, but did not specify which or the metrics around this. It is actually more concerning to see the scant level of detail that they provided.

This market context around the company’s technology echoes the slow revenue growth that Domo has been seeing, and it is not something that will change for the better. Ultimately its competitors are significantly better capitalized and have a significantly better track record of innovation. Anecdotally, I have not heard anyone sing praises for its product whilst they have certainly done so for competitors AWS and Databricks.

Conclusion

Domo, Inc. does not look like a good investment at this time. Facing increasing interest costs, continuingly negative cash from operations, and a weaker-than-average product, it is not well-positioned fundamentally. The trendline in the market appears aligned to this belief and I agree with the direction that things are headed. Simply put, there are no positive indicators and an accelerating quantity of bad ones for Domo. I am calling Domo, Inc. a sell.

Be the first to comment