jetcityimage

Domino’s Pizza, Inc. (NYSE:DPZ) has a good fundamental story when you examine how its financial and operational performance has evolved in the past three to five years against the backdrop of the Covid-19 pandemic, supply chain disruptions, global geopolitical shocks such as the war in Ukraine, runaway inflation, interest rate hikes, and the prospect of a recession.

The world’s largest franchisor of pizza, with over 13,800 locations in 85 countries, Domino’s Pizza, Inc. has supercharged its growth in the past few years. This exceptional growth is clearly evident if you compare its business performance in the 2018 to 2022 time frame with the prior four year period starting 2014.

I’ve made this comparison in the tables below, which look at how measures such as DPZ’s revenue, net income, levered free cash flow and EPS have trended in the periods reviewed. The data has been retrieved from Seeking Alpha.

|

Financial figures in USD |

Dec 2018 |

Dec 2019 |

Jan 2021 |

Jan 2022 |

|

Revenue |

34.32 billion |

36.18 billion |

41.17 billion |

43.57 billion |

|

Net Income |

362 million |

400.7 million |

491.3 million |

510.5 million |

|

Levered FCF |

211.8 million |

278 million |

304.4 million |

550.3 million |

|

Diluted EPS |

8.35 |

9.56 |

12.39 |

13.54 |

|

Financial figures in USD |

Dec 2014 |

Jan 2016 |

Jan 2017 |

Dec 2017 |

|

Revenue |

19.93 billion |

22.16 billion |

24.72 billion |

27.88 billion |

|

Net Income |

162.6 million |

192.8 million |

214.7 million |

277.9 million |

|

Levered FCF |

129.0 million |

170.2 million |

284.3 million |

146.5 million |

|

Diluted EPS |

2.86 |

3.47 |

4.30 |

5.83 |

Thanks to this strong financial and operational performance that has been successfully sustained over time, DPZ has been able to reward its shareholders with generous dividends through the years.

Growing and loyal base of buy-and-hold investors

DPZ’s dividend payout per share has steadily grown from $1.0 in 2014 to $3.76 in 2021. Its latest payout ratio (dividend relative to net income) was 32.89%, which comes to about $163 million on net income of $510.5 million. To put this in context, DPZ’s latest full-year dividend payout is essentially the same as the net income it made just eight years ago.

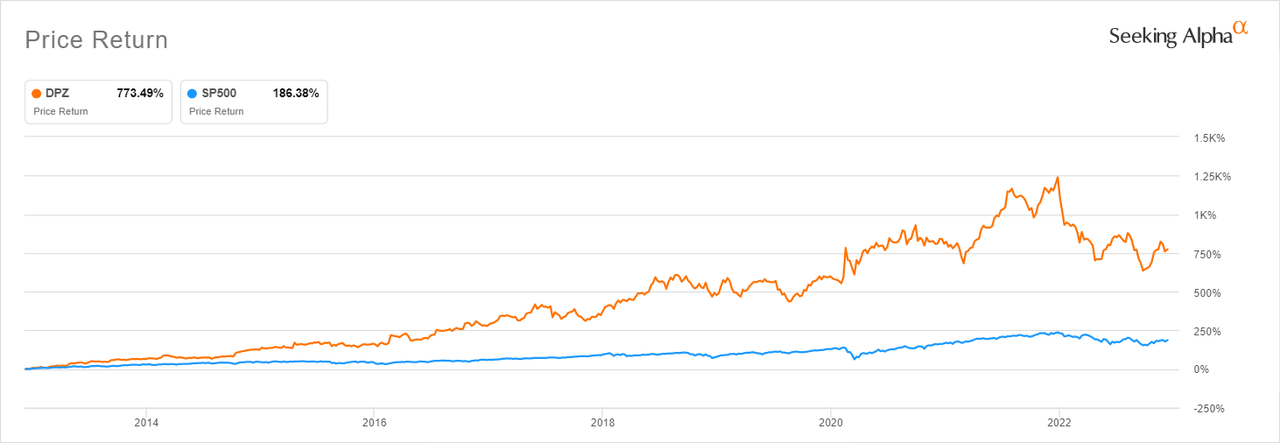

These kinds of returns, especially after considering they are being generated by a stable and well-established company like DPZ, are appealing to investors. As a result, DPZ has, through the years, been able to build a growing and loyal base of buy-and-hold investors. This in part explains why the stock’s 773% return over the last 10 years has outperformed the S&P 500 by as much as 4x.

DPZ has outperformed S&P by more than 4x in last 10 yrs (Seeking Alpha)

Capitalize on short-term weakness

DPZ has gotten more attractive as an investment in recent quarters thanks to short-term weaknesses in the business that have weighed on the stock price. Like most players in the restaurant business, DPZ ran into a number of industrywide headwinds in 2022 such as higher input costs, supply chain shocks, and labor shortages.

These challenges impacted short-term performance through the year, with Q2 being particularly affected as DPZ missed profit expectations and U.S. same store sales (one of the most important metrics for a restaurant operator) declined 2.9%. While this beat the consensus expectation for a drop of 5.0%, it was unusual given DPZ has maintained steady and healthy growth for same store sales in the U.S. for more than a decade. Internationally, same store sales have grown for 109 straight quarters, according to recent analysis by LRT Capital, which is bullish on the stock.

Against this backdrop, as well as the generally weak market in 2022, DPZ has declined 33% YTD. Now is a great time to start buying or add to your existing position if you were lucky to snap up shares closer to the 52 week lows.

Concerns over input costs and labor shortages, while relevant at the moment, are transitory and manageable. DPZ has strong pricing power and can protect its margins by passing these costs on to consumers. Tellingly, DPZ recently earned an upgrade from BTIG, who cited its pricing power, noting that it would enter the new year with the highest level of menu pricing in more than a decade and could take even more price on the $7.99 carry-out offering.

Crumbling bear case

DPZ’s bear case is similar to the general bear thesis for the restaurant industry and broader consumer discretionary sector. The bear case for the sector, which largely underperforms during recessions due to tighter consumer spending, hinges on the idea that interest rate hikes will prompt job cuts, lead to a chain reaction of spending cuts, and ultimately trigger a recession that slows demand. This will in turn hurt margins in the restaurant business as operators will face declining sales amid high costs because of inflation.

While convincing in theory, this bear case has failed to take root in reality even as the Fed inches closer to its goal of declaring “victory” over inflation given the lower CPI print this month marks the second straight month of cooling inflation. Slower rate hikes, as will likely be the case if the Fed takes the recent CPI data into account for future rate decisions, will not induce the kind of gloomy economic conditions envisaged in the bear case for stocks like DPZ.

Moreover, a quick look at a few key data points on unemployment, credit card usage, and consumer behavior suggests the bear thesis will remain a mirage. I won’t get into a detailed macroeconomic analysis but will point out a few interesting observations.

The first observation is that, historically, the U.S. labor market has never been stronger. Despite Covid-19 bringing the worst job losses since the Great Depression, the U.S. economy recovered all jobs lost in the pandemic in only 29 months. This is faster than any other recession in the last 40 years, according to this article on The Balance. It took almost four years to recover all the jobs from the dot com crash, and seven from the 2007 global financial crisis. It’s certainly not the time to underestimate the strength of the US consumer.

The second observation is that credit cards have become increasingly popular among consumers. There’s a ton of anecdotal evidence that using a credit card typically leads to higher spending per transaction than using a debit card or paying cash. It’s notable that credit card debt in the U.S. climbed to $930 billion in Q3 2022, more than 15% from the same period in 2021 and the largest annual jump in more than two decades, according to the New York Fed.

Last but not least, consumer behavior has in the past few years shifted in ways that favor DPZ. First, online deliveries have become further entrenched, with digital channels representing a strong future growth opportunity. Another interesting shift is that the rise in the price of groceries this year has led some consumers to increase the frequency of eating out, as the price differential with cooking at home is no longer a deterrent. I don’t see these shifts in consumer behavior reverting any time soon, and they are generally constructive for DPZ.

Superior returns

DPZ is well-positioned to continue performing well from a financial and operational standpoint. Despite recent short-term weakness, it will bounce back in an improved economic environment.

If DPZ sustains its attractive dividend policy and keeps generating healthy levels of cash over time, it should be able to deliver superior returns in the long-term.

That said, it is a pricey stock with a P/E (“fwd”) of 29.8x and EV/EBITDA (“fwd”) of 21.54x. It has a Grade of “F” on Seeking Alpha’s valuation ranking. A pullback is not out of the question given how stretched valuations are. These could be opportunities to buy, but I wouldn’t wait too long as the P/E could rise further before it falls. There are times when a high P/E is simply optics and the main question an investor needs to ask is not whether the stock is expensive, but whether it is worth the price. I think Domino’s Pizza, Inc. is a worth it.

Be the first to comment