Zach Gibson

Shares of Dominion Energy (NYSE:D) have been a woeful performer over the past two months, falling from $85 to $65 in virtually a straight-line. Many investors own utility stocks for their dividend income, and for many years with bond yields so low, there simply was no alternative to stocks like utilities if you wanted income. However, with the 10-year at 4%, investors now do have options, and that has weighed on dividend-oriented stocks. Unlike most bonds though, dividend yields can grow over time. With Dominion yielding over 4% today and the capacity for mid-single digit dividend growth, investors have a potential double-digit return potential in D over the medium term.

Importantly, Dominion continues to perform at a high level. During the company’s second quarter, it earned $0.77 excluding mark-to-market movement in its hedges, up a penny from last year despite an unfavorable weather mix. Operating revenues rose $558 million to $3.6 billion due to higher utility rates and energy price pass-throughs.

Dominion operates primarily in Virginia, the Carolinas, Ohio, and Utah. In 2020, the company sold its unregulated assets to Berkshire Hathaway (BRK.A) (BRK.B), leaving it with much more stable and predictable cash flows. This asset sale also allowed it to reduce its debt by over $5 billion, and given the loss of cash flows, led to a rebased dividend of $2.52 per year (a sustainable 65% payout ratio) off of which it is targeting a 6% per year increase.

Dominion Virginia is its most important operation (despite its name it also operates in North Carolina) as it drives 57% of its profits with South Carolina another 14%. Its gas distribution and wholesaling business drive the remainder of profits. Importantly, it operates in states with favorable regulatory environments and demographics trends as more Americans move to the mid-Atlantic and Sun Belt from the Northeast. Just this year, there have been a litany of corporate announcements of headquarters relocating to Virginia, including Boeing (BA) and Raytheon (RTX). Notably, Amazon has also built a large presence in VA with what it calls a “second headquarters.”

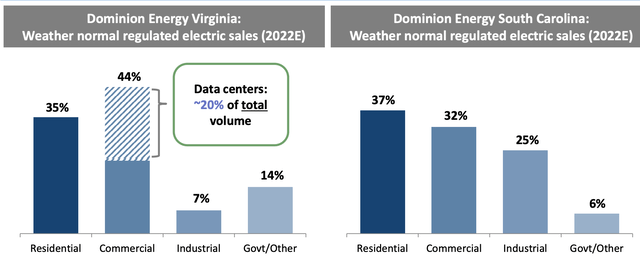

These announcements drive population growth and increased demand for utility services. Dominion also has a diversified mix of customers. In particular, I view its significant exposure to data centers as a positive. The world is only growing more data intensive, and with companies like Amazon (AMZN) and Google (GOOG) having large Virginia presences, data center usage will only increase. Plus, the Pentagon is still planning a massive cloud investment. All of this points to more demand for Dominion services.

Alongside Q2 earnings, Dominion issued guidance. In Q3, management expects EPS to be $0.98-1.13, driving full year earnings of $3.95-$4.25. When the company reports third quarter earnings on November 4, I would expect solid results. Beyond the tailwinds mentioned, it has been nearly 7 years since Dominion missed the midpoint of EPS guidance. This is a management team that consistently delivers.

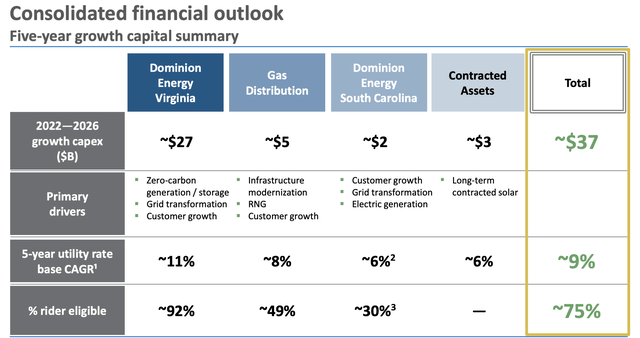

Beyond just any quarter, my optimism in Dominion comes from its multiyear plan. It expects to generate 6.5% EPS growth over the next five years. This should support 6% per annum dividend increases. As a regulated utility, Dominion generates earnings growth by increasing its rate base. In other words, it launches cap-ex projects, which increase the value of its assets off of which it can earn a return on equity. Dominion has built a backlog of $37 billion of cap-ex projects that it is pursuing.

Now in a period of high inflation, large cap-ex projects worry some investors as there is the risk of higher-than-expected costs, which reduce the returns the projects generate. However, 75% of the projects are eligible for inflation-riders, meaning if high inflation persists, Dominion’s utility revenue will also rise more quickly, providing more cash flow and potentially opening the door to faster dividend growth.

This past quarter, Dominion Virginia received approval for a $4 billion investment to extend the life of its four nuclear plants, putting it on a good start to achieve this large cap-ex agenda. 87% of this cap-ex spending is directed at projects that will reduce the company’s carbon intensity. This will triple renewables’ share of Dominion Energy generation from 9% to 26%. The Inflation Reduction Act provides a 10 year credit for wind, solar, hydrogen, and other zero-emission investments improving the economics of this spending program.

Additionally, utility rates in Virginia are 8% below the US average. This provides ample room to invest in the rate base to pivot to cleaner sources of energy without causing utility rates to move to politically unpalatable levels. These investments combined with modest demand growth from rising populations and corporate needs, and Dominion’s five-year plan for mid-single digit earnings and dividend growth is very attainable in my view.

As a regulated utility, Dominion will not be a company that generates exponential returns. That said, it can provide attractive compounded income growth. Higher government bond yields have increased the competition for dividend stocks just as they have increased discount rates, hurting the multiples of high-growth stocks. That said, Dominion offers not just a 4% yield today but the potential for dividend growth. With a large cap-ex pipeline that will generate new revenue which is predominately tied to inflation, Dominion can preserve the real value of your investment in the way that a bond portfolio does not.

In the short-term, it appears that the bond market is the driving force in utility stocks like Dominion, so if 10-year treasury yields continue to move higher, Dominion shares will likely stay under pressure. If rates reverse and start rallying, that would also open the door for shares to rise more quickly. At $64 though, Dominion offers the potential of about 10% compounded returns over the next five years (a 4% dividend with 6% per year growth). For longer-term investors who value income, that makes Dominion stock a buy in my view. I would begin accumulating shares here, and if treasury yields push the stock lower, use that opportunity to buy into this income grower at even better dividend yields.

Be the first to comment