Firn

Investment thesis: The latest news in regard to the EU energy crisis points to a high probability of natural gas rationing this winter, with odds of improvement beyond the immediate crisis being very low. BASF (OTCQX:BASFY) will most likely be asked to shut down at least some of its EU operations this winter. That on its own might not be a huge blow to the company, but the problem is that things are looking bleak in terms of energy prices on the EU market, as well as rising odds of continued outright shortages beyond this winter, with no end in sight as things stand right now. BASF will ultimately have to respond most likely by moving some of its EU operations, or permanently shutting down some of its production facilities in the EU, in my opinion. This will be a decade of significant repositioning for BASF if it occurs, which will be very costly in terms of higher CAPEX, even as revenues and profits are set to suffer a severe downturn. Its dividend payments may have to be suspended in order to cope, while its overall debt situation may deteriorate as it may have to increase borrowing in order to meet higher investment needs. As long as the EU energy crisis shows no sign of abating this winter, or beyond, there is no point remaining invested in the hope of a rally in this stock.

BASF’s financial situation is starting to deteriorate, with worse to come if the EU energy crisis continues

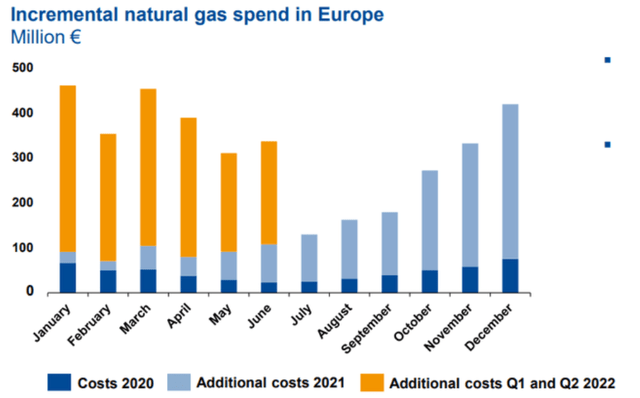

Though BASF continues to report positive financial net earnings, even as it faces hundreds of millions of euros in extra input costs every month since Europe’s energy crisis began, it does not mean that all is going well in regard to its overall financial health. For the first half of the year, its net income only declined by 2.9%, from 3.6 billion euros in the first half of 2021 to 3.5 billion. Revenues increased by almost 18%, meaning that there was a sharp deterioration in profitability, even as revenues increased. The massive increase in natural gas cost experienced from the beginning of the third quarter of 2021 is the most likely culprit.

We should keep in mind that in the first half of 2021 revenues were probably affected by the effects of COVID disruptions, therefore the increase we saw in the first half of this year is due to base effects. It should be noted that revenues did not increase in Q2 of this year compared with Q1, in fact, they declined by about .5%, so arguably once the base effect is accounted for, revenues are actually seeing a slight decline quarter on quarter, thus things might not necessarily be looking as bright as the yearly comparisons might suggest.

Aside from increased revenues and profits that did not decline as dramatically as one might have expected, there are some worrying signs in terms of BASF’s overall financial performance. Its non-current financial debt for instance increased from 13.8 billion euros at the end of last year, to 15.6 billion as of the end of Q2. Its current debt liability increased from 3.4 billion euros to 7.9 billion in the same period. Interest expenses increased by almost 13% in the first half of this year compared with the same period of 2021. The situation is by no means critical when looking backward, but it may become very serious going forward unless some unlikely turn in events will prevent Europe from entering a prolonged period of energy scarcity and unsustainable prices.

BASF is almost 100% certain to be asked to cut its natural gas and electricity use significantly this winter, with the outlook being no better beyond the immediate seasonal challenge, for the foreseeable future

From the beginning of the conflict with Russia over the Ukrainian issue, in other words, since 2014, certain assumptions were made that turned out to be deeply flawed. For instance, in 2014, the EU assumed that it can drastically cut its dependence on Russian energy and more specifically on natural gas, with no significant economic consequence as a result. The global market was seen as being oversaturated with energy supplies, while EU demand was seen as declining. The latter was mostly due to the eurozone crisis, but it was assumed to have been due to the green transition. As it turned out those assumptions were wrong, and the EU ended up actually increasing its Russian gas imports from 2014 to 2021. In 2018, Russia bailed out the EU with extra gas, as a longer than expected winter left its stocks depleted, and the EU was close to introducing rationing measures. That happened in the best of times, in a year when Russia’s gas exports to Europe were reaching new record highs.

This year, the EU seems to have grossly underestimated the tightness in global energy markets, as it opted to go on a crash diet meant to eliminate Russian energy from the EU market. It seems strange that they would misread the situation, given the fact that it has been grappling with an energy crisis for many months before the flare-up of the Russia-Ukraine conflict in February, as evidenced by BASF’s own natural gas cost increase, as shown in the chart I provided above. Clearly, the market was not up to making up for the shortfall caused by the weather-related shortfall in EU energy generation last year. I am not sure why it expected to see enough extra flows of natural gas and other energy for the EU to be able to replace Russian resources.

As things stand right now, it seems that the EU is facing a worse energy crisis than anyone could have imagined a few months ago. A recent Goldman Sachs (GS) report suggests that the costs of energy to EU households in the EU may increase by $2 trillion. Another recent report by Rystad suggests that the 15% voluntary cut in natural gas demand will not be enough to ensure adequate supplies for the winter. If by any chance the wind will fail to blow hard enough this winter, leading to a wind power generation shortfall, or if temperatures will plunge lower for longer, things could get outright tragic for the EU, not just this winter, but any other winter thereafter. Things will not be great in between winters either. The situation might not recover even if there is to be a cessation of the war in Ukraine, because there might be no way back to the old EU-Russia energy relationship.

Investment implications

I wrote an article on BASF recently, pointing to my divestment from half of my position in this stock, which was itself only about 1% of my overall portfolio. Now I sold the rest, taking a slight loss, albeit in a relatively modest position. I always saw this as a high-risk bet, even though its stock was so battered, even as the company itself is solid. As the summer ended, giving way to the early pleasant fall weather that most of the continent usually gets to enjoy, there is now only a roughly 2-month window of relative stability for BASF investors to enjoy and take advantage of as they see fit, before things risk getting very interesting.

Once we go into November, BASF’s financial performance will become dependent on the weather. A mild winter, with plenty of wind and sunshine, will be somewhat bullish for BASF, as well as for Europe’s overall industrial complex. A prolonged, harshly cold, winter, with little sunshine and low wind activity on the other hand could produce a calamitous outcome. The downside risk is a lot higher in my view than the upside potential for its stock, while the odds of it going either way can be considered to be about 50/50.

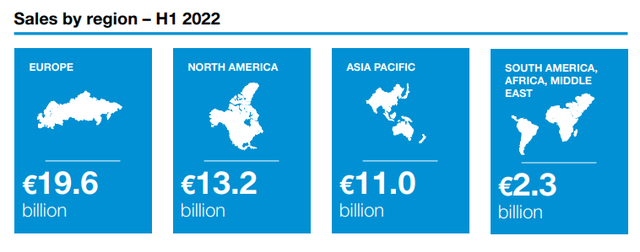

BASF is not exclusively a European company. About 60% of its sales are taking place outside of Europe, and so is a very significant portion of its production.

Europe is nevertheless its most important region in terms of both production and sales. Those operations can only survive and thrive for the long-term if BASF can have access to reasonably-priced and reliable supplies of natural gas and electricity.

Since things are not looking very positive in regard to EU energy supplies for the foreseeable future, BASF is likely to have to start divesting from Europe and start building new facilities elsewhere. What this means is diminished revenues and profits, even as CAPEX costs will probably increase by billions of euros or dollars every year for perhaps the rest of the decade. The prospects of this particular outcome seem to be still a distant thought for the market, at best, perhaps because the long-term implications of the events of this year for Europe are yet to fully register. We are overly focused on this one winter coming up, with little thought being given to what is likely to follow thereafter.

Given short-term risks, with the weather outlook in Europe between November and April being perhaps more important than any other factor, there is a high degree of risk to BASF’s stock price this winter, with the downside arguably being far larger than the possible upside in case that weather patterns will help to spare the EU from a worst-case scenario this winter. The upside is arguably limited by the next logical question that the market needs to ask, namely what next for Europe’s energy woes, and for BASF’s operations there. Because there is currently no positive scenario emerging in regard to Europe’s energy situation beyond this winter, we have to assume that BASF will most likely start divesting next year out of Europe, while it will also spend significant amounts of money to build new facilities elsewhere. In other words, a lot of new CAPEX spending, without a significant, if any improvement in revenues and profits. There is therefore no logical argument to be made in favor of a bullish outlook for BASF stock. Perhaps, it will become a buying opportunity once we will have reason to believe that Europe’s energy woes will subside, and we will see that the damage to BASF’s operations in Europe has not been as battered as feared, but at the moment there is simply no way to formulate a positive outlook. Not even the stock price level that is already trading at only 1/3 from all-time highs.

Be the first to comment