ablokhin/iStock Editorial via Getty Images

Company Overview & Thesis

Dollarama Inc., (DOL:CA) (OTCPK:DLMAF) headquartered in Montreal, is the largest discount dollar store chain in Canada, with over 1,400 stores nationwide. The company offers over 4,000 products to consumers at a cap of $4 per item – though that will change to $5 within the next year. The company also owns a majority stake of 50.1% in Dollar City, a Latin American discount dollar store brand. I believe there is some upside in the stock given the current macroeconomic headwinds. The company continues to navigate an inflationary environment and previously announced price increases should help offset this pressure.

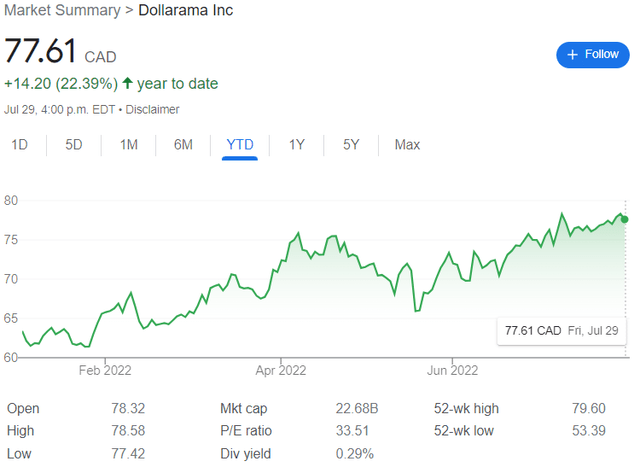

Management has done a tremendous job of leading the company and has seen stock appreciation exceed the broader Canadian market consistently over the past half-decade. DOL reported earnings in early June that beat estimates, and saw the stock pop 5% over the past six weeks. The company has remained resilient throughout the first half of the year, rising over 20%, while the broader Canadian market has been negative. DOL consistently beats estimates and has been a quiet leader in the Canadian retail landscape since it went public in 2009.

The company has also announced clear ESG goals & initiatives, which will start to be a focus in the near future. It is worth being cautious on buying the stock, as other large competitors such as Walmart, Dollar Tree, Giant Tiger and Circle K (Couche-Tard) have complex merchandising strategies (i.e., promotions, loyalty/points programs) to drive store traffic. DOL also has regional competitors, like 99 Cent Depot, and sports a hefty valuation with a current P/E of ~30. Nonetheless, DOL remains a good choice as inflation remains elevated. I initiate a cautious buy with an 18-month view of $82/share, with a 27 P/E ratio on EPS of $3.00 in CY2023, with an EPS estimate of $2.71 in CY2022.

DOL Outlook & ESG Focus

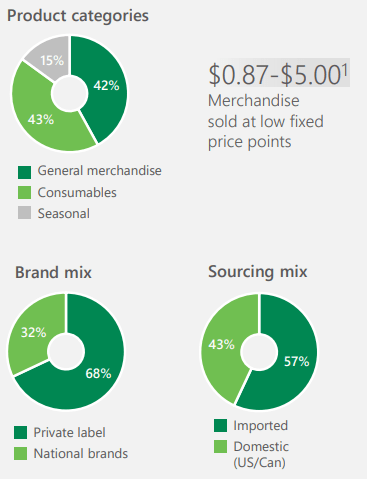

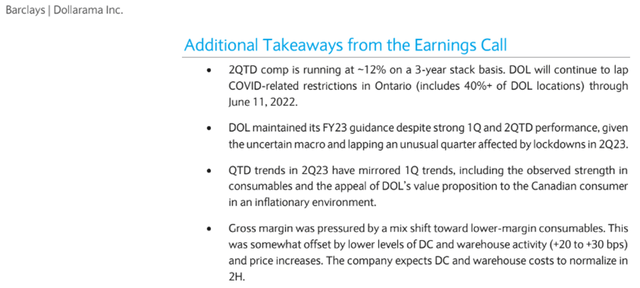

DOL reported strong Q1 numbers in June, in which highlights included same store sales growth of 7.3% and EBITDA of $300MM, while also re-iterating full year guidance. The company opened ten new stores and repurchased 1.4MM shares. These updates were well-regarded by the market and the company has continued to chug along in the first half of 2022. DOL’s margins dragged 200 basis points to 42.1% due to consumables becoming a larger part of the sales mix. Management noted that inventory would be rightsized by the end of the year, and given the small reduction, I believe they will hit their targets. Neil Rossy, CEO, highlighted in the Q1 conference call that the “situation will normalize and we don’t expect to miss a season” regarding inventory sell through.

DOL’s efficient operating processes continue to improve, evidenced by their cash conversion cycle falling to 79 days, which means DOL takes 79 days to convert inventory into cash. Over the past several years, this number has trended downwards, indicating efficiency improvement. This trend was reinforced with 14% increase in store traffic, which better depicts DOL’s brand compared to online sales. The company remains a bit highly levered at 2.74x of 2022 Net Debt/EBITDA, but with an improving sales picture, they are poised to continue to succeed both operationally and in the investor eye.

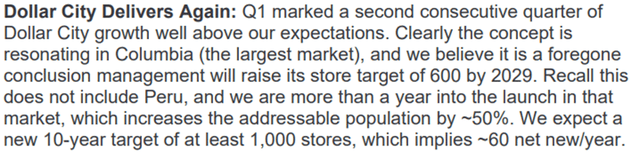

DOL also has a footprint in Latin America, through majority ownership in Dollar City. While profits from the entity are not material to the balance sheet, at just $8.7MM in Q1, the owners own a trigger put option that exercises this year, meaning DOL has an opportunity to purchase more of the company. Dollar City has several hundred stores in El Salvador, Guatemala, Columbia and Peru, and management has an opportunity to understand a consumer that is used to high inflation and better set product mixes. With the head of the BOC all but confirming inflation will remain above 7% this year, DOL has the chance to jump ahead of peers and improve their inventory mix into the second half of the year. Their guidance for 60-70 net new stores in CY2022 remains intact, and Dollar City is likely to increase their store target, according to CIBC.

CIBC Equity Research – Q1 Review

Management has been a key bright spot for DOL and an example of this has been reporting ESG targets to investors. Last year, DOL set a 25% target on emissions reduction in by 2030 vs. a 2019 baseline numbers. While not as ambitious as other large corporates, given DOL’s retail scale in Canada, a large and wide country with concentrated population, these targets seem reasonable and achievable. In June, DOL provided a comprehensive update on their progress. DOL recorded higher year-over-year rate of recovery of material waste at store level, with 77% of recovered materials diverted from landfills and announced a commitment to maintain at least 40% female representation at the management level. The company also detailed where and how emissions were being generated, and outlined a key step by step process to hit their metrics, proving that this initiative was not greenwashing. Through consistent efficient operations and leadership in macro topics, management has continued to show leadership and has remained nimble in this unprecedented time.

Industry & Risks

Walmart (WMT), a bell-weather for the U.S. economy, announced refreshed guidance on July 25, 2022, that saw the company reduce its expected profit over the upcoming year given sticky inflation. While not a direct comparison to DOL, the guidance was intriguing because while negative, it provided a clearer short-term picture on the “trade-down” phenomenon and the sales mix of one the world’s largest retailers. Over the long term, the discount retail channel is expected to grow at a cumulative annual growth rate of 4.4%. Barclays noted on June 9, 2022, that DOL had seen strength in trade-down consumer movement and that by maintaining their guidance, that they were likely to exceed expectations. Jobless claims hit an 8-month high recently, which also reinforces the notion that consumers will continue to remain cost-conscious.

Walmart also noted that consumables were becoming a larger part of the sales mix, while clothing and electronics would lag throughout the rest of the year. Target (TGT) also reduced guidance recently, emphasizing an inventory mismatch, while Dollar Tree (DLTR) posted strong numbers back in May, but cautioned that they must rightsized inventory for the second half of 2022. While DOL does not have fresh food inventory like Walmart or Target, they do have non-perishable consumables that have a shelf life such as beans, chips, and sweets. The company’s non-perishable section also includes smaller travel accessories including cosmetic products, luggage tags and neck pillows, which were highlighted as a strength in the quarter. Overall, given the type of consumables DOL sells, their proven success in inventory management and being a low-price brand, there are tailwinds that infer DOL will continue to outperform peers in the short-medium term.

DOL Q1 Investor Deck

As with any retailer, there are inherent risks to the business that cannot be fully mitigated. Chief among them for DOL is the management of cost-effective inventory and supply chain risks. The ability to provide quality merchandise at low price points is subject to several factors outside of DOL’s control, including merchandise costs, FX fluctuations, and shipping costs. For a company whose key differentiator is price, it will be interesting to see if customers balk at the new $5 price point for certain products. The company also can be adversely affected by COVID-19 flare-ups, which can impact in-person traffic. While the company has an online site, the brand is known as a retailer and the competition for online sales is fierce compared to their well-positioned retail locations. DOL is also highly leveraged, with net debt of almost $1.9B. While the company has mostly fixed rate debt, the ability to refinance at a cheaper rate will be likely impossible in the near future. DOL has over $70MM of cash on hand, but to re-guide their store growth numbers higher, they may need to raise capital.

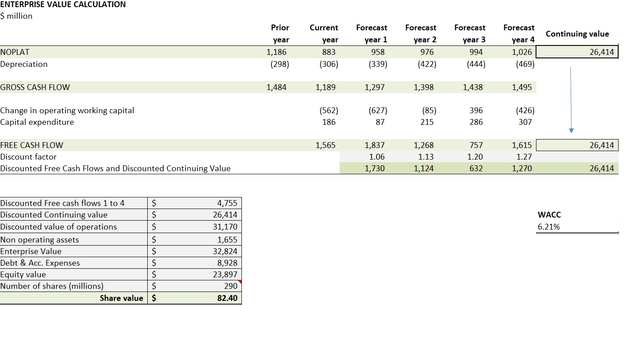

Model – Fairly Valued With Some Upside

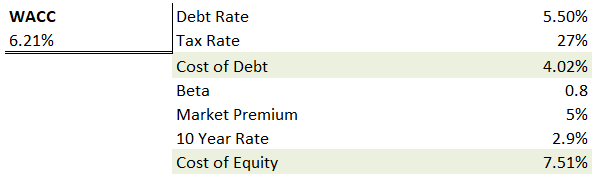

DOL has had a strong run up in the first half of the year, buoyed by strong quarterly results and an expectation that customers will continue to look at discount retailers in the face of high inflation. While the company’s net cash position dropped given management’s interest on buying back stock, the company has sufficient cash balances to fund current growth plans. The model forecasts a WACC of 6.2%. With rising rates, I anticipate the cost to raise rising above 5% should they attempt to leverage in this environment, given their previous fixed rate debt is between 1.5%-3.6%.

Author – WACC Forecast

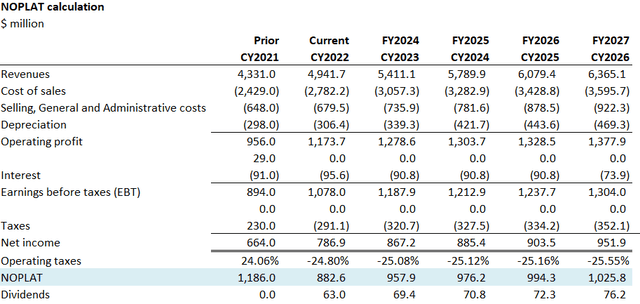

I forecast the continuing value of $26.4B, given a 14% revenue increase this year and blended revenue growth of ~6.5% for three years as same store sales growth continues to impress. I see the margins ending up near the top of guidance, at 43.7%, for the year. I hold other cost ratios mostly equal to guidance, as it was conservative given the strong Q1 numbers. Given an estimate on share repurchases, an $82 share price (see below) can be supported with fundamentals. The share price is supported by a 27 P/E ratio on EPS of $3.00 in CY2023, with an EPS estimate of $2.71 in CY2022. This value showcases a 22.1 EV/EBITDA ratio, in line with industry peers and analyst estimates. In today’s price target, I estimate shares outstanding of 290MM, down from 294MM in Q1, given DOL bought back 1.4MM shares last quarter, and continue to highlight this initiative as a focus.

Author – NOPLAT Author – EV Calculation

DOL remains the leader in discount retail throughout Canada and should benefit from high inflation. The company sports robust operations and continues to expand in South America. While fairly valued, I think DOL is worth a cautious buy, and their performance over the past decade plus is reassuring.

Be the first to comment