JoeLena

Like every investor should, I love when a company returns large amounts of cash back to the shareholders. One company is currently a major standout in this category, Franchise Group Inc. (NASDAQ:FRG). With a massive 6.9% current yield, the potential for shareholder returns via dividend increases and share buybacks is phenomenal. I believe the company has room to substantially grow the dividend over the next several years on top of the attractive current yield.

The Franchise Group Model

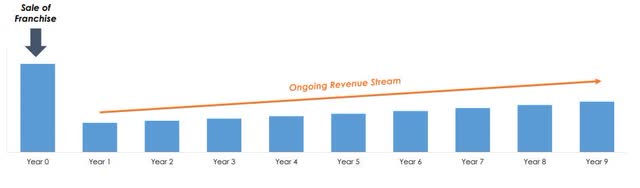

FRG is led by a seasoned CEO in private equity who has now taken his strategy to the public markets. Using experience and influence as a public company, Franchise group strategically purchases undervalued companies with multiple locations and folds them into the larger company while maximizing returns. This plan is carried out by converting newly-purchased companies into franchises, a method in which the real estate is sold to another party and leased-back to liquidate the value locked in the physical properties and collect franchise royalty payments from the new franchisees. In doing so, the company has created an asset-light model that can easily scale its operations. An example of how FRG benefits from such a model is shown below.

Franchise Model (Franchise Group Inc. 2022 Investor Presentation)

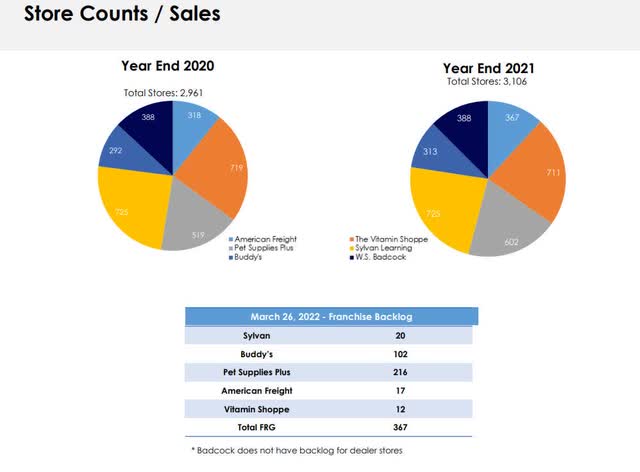

Brian Kahn has successfully incorporated this strategy at Franchise Group, growing the company from a single holding to now holding 6 different companies under its umbrella. Strategically, Mr. Kahn has diversified the holdings across several industries and has capitalized on synergies across the operations of each of the companies. The backlog of locations pending a transition to the franchise model or becoming a new store has continued to pile up indicating a runway for sustainable profit growth.

Franchise Backlog (Franchise Group Inc. 2022 Investor Presentation)

The Dividend

Those who have been invested in FRG over the past 18 months are extremely familiar with the huge dividend increases that have been sent their way. Growing from $1.00 per share in 2020 to $2.50 per share in 2022, management has shown a commitment to maximize returns to shareholders. As stated in the 2021 Investor Presentation, the company aims to return value equaling 25% of EBITDA in the form of dividends to shareholders. With 41 million shares and a 2022 fiscal year EBITDA prediction of $450 million, the huge increases are still responsibly inline with the company goals.

Recently, FRG announced an unfathomable buyback plan of $500mm over the next 3 years, at a $1.5 billion market cap at the time of announcement this would equate to the repurchasing of 33% of all outstanding shares. Using the company historical EBITDA growth numbers and projection for 2022, we can begin to estimate the potential size of the dividend at the end of the three year period.

Reducing the number of outstanding shares by 33% would leave us with roughly 27 million shares in FY2024. The company currently projects EBITDA of $450mm in 2022, a 32% increase from FY2021. To be on the more conservative side, a 12.5% CAGR in EBITDA over the following three years would equate to $570mm at the end of FY2024. If the company were to hold to the dividend payout ratio, we would see dividends per share of $5.28, nearly 2.1x larger than the current payout. Even if EBITDA witnessed zero growth beyond 2022, the estimated dividend per share would come out to $4.17, a 67% increase from today.

| FY2022E | FY2023E | FY2024E | |

| EBITDA | $450mm | $506mm | $570mm |

| No. of Shares Outst. | 36.3 million | 31.6 million | 27 million |

| Projected Div./share | $3.10 | $4.00 | $5.28 |

Valuation

As a company operating in a unique sector with a unique business model, the best way to find market averages for multiples applied to the stock would be to look at the fast food industry. The business model in quick-service restaurant stocks is similar as the majority of locations are maintained as franchises. Below we can see the 5y averages for several multiples among large quick-service food providers.

| Multiple | FRG | (WEN) | (MCD) |

| Current EV/EBITDA | 9.32 | 18.20 | 22.15 |

| 5y avg. EV/EBITDA | 18.82 | 18.14 | 19.26 |

| Current P/FCF | 14.49 | 16.04 | 21.28 |

| 5y avg. EV/EBITDA | 21.07 | 17.55 | 22.27 |

If we are to use a EV/EBITDA multiple of 18.8x as the industry average, we see that FRG is currently significantly undervalued at 8.2. Using P/FCF we see a similar story of an average 20.0x multiple across the industry with FRG currently valued at only 14.4x. Let’s combine the reversion to this exit multiple and the estimated EBITDA in FY 2024 with an estimated $2.5bn in debt to obtain a price target.

| Condition | Fair Value Price |

| EV/EBITDA Average Reversion | $304.30 |

| P/FCF Average Reversion | $274.75 |

| Average Between Both Reversions | $289.53 |

| 13.0x EV/EBITDA Reduced Reversion | $181.85 |

As shown above, there is potential for a share price return of 886% without dividend reinvestment. This is clearly a lofty projection, but well within the realm of opportunity at current valuations. The enticing part of this estimate for myself is the margin of safety on experiencing positive returns over the next three years. With zero growth in EBITDA over the next several years and an exit multiple only halfway to the industry average at 13.0x for EV/EBITDA, we still arrive at a share price appreciation of 529% to ~$182.

Risks

Risks with FRG involve a significant slowdown in consumer spending, a reduced ability to franchise locations, and competition. To address the first risk, I actually believe Franchise Group is well positioned in an economic turndown due to the fact several companies within its portfolio are targeted towards lower-income and cost-conscious households.

The risk for a reduced ability to franchise locations is mitigated I believe due to the popularity of sale-leasebacks and the growing demand for each of the sectors for each of the spaces that FRG operates in. Lastly, competition is likely to be the biggest risk to the growth of Franchise Group. As they themselves continue to purchase companies along with other conglomerates, the options available to add to the business model will begin to dwindle. However, even without inorganic growth, there are several lever growth levers available with expansion of current companies and conversions of company-owned locations into franchised locations.

Summary

There appears to be a rare opportunity to exhibit great returns from an investment in FRG at current prices. With likely significant growth in the dividend alone, it is an attractive position for dividend growth investors like myself. The projections discussed also do not take into account any accretive acquisitions over the next three years, something that is uncharacteristic of both Brian Kahn and Franchise Group.

Most likely, the company will perform some sort of secondary offering to the market, increasing the share count. This increase in share count would partially offset the 33% reduction exhibited by the buybacks and reduce the potential growth of the dividend per share along with the projected share price as the EV multiple is spread across a greater number of shares than modeled in this article. Also, it is possible that FRG will remain at lower than industry average multiples due to the lack of brand power that is associated with the other companies involved in my comparison. Both of these possibilities could have a large impact on share price, however I believe there are more than enough opportunities for share price appreciation and a healthy safety factor in estimated multiples to make this investment worthwhile.

Be the first to comment