Mario Tama/Getty Images News

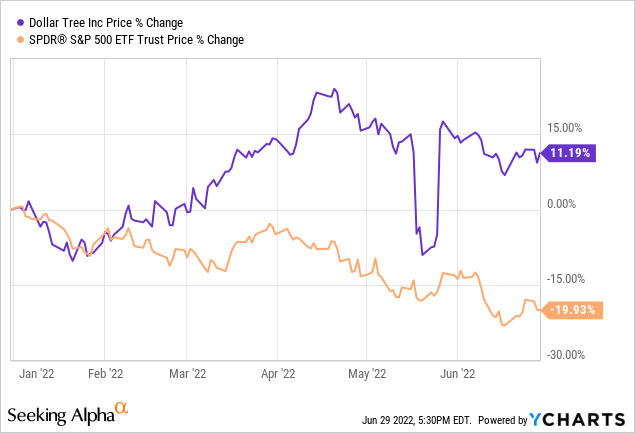

Dollar Tree’s (NASDAQ:DLTR) stock price has increased by about 11%, despite the relatively high volatility, compared to the 20% decline of the broader market year to date.

Although DLTR has a strong track record of outperforming the broader market in times of low consumer confidence, in our opinion the stock is significantly overvalued at the current price level.

In light of the current macroeconomic environment, and the high valuation, we believe that Dollar Tree’s stock is a sell now.

In this article, we will dig deeper into why DLTR could be an attractive addition to your portfolio in times of low consumer confidence, and why we still believe that the valuation is too high.

Let us start with taking a look at the U.S. consumer confidence.

Consumer confidence

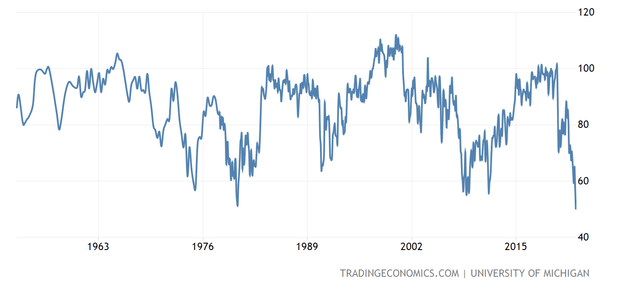

Consumer confidence is often used as a leading economic indicator, as it can signal potential trend changes in consumer spending in the near term. Therefore, it could be used to gauge, where we are in the current business cycle and form expectations about the spending behaviour in the near future.

U.S. Consumer confidence (Tradingeconomics.com)

The U.S. consumer confidence has been declining steadily in the past months, declining to levels even lower than observed during the financial crisis in 2008-2009. Although consumer spending has remained strong in 2022, we expect the low consumer confidence to have severe implications in the near future.

Low consumer confidence is likely to lead to a change in the consumer spending behaviour. This change is likely to impact firms, which are selling durable goods first. Customers often tend to cut or delay the purchase of durable goods, when confidence is low. After durable goods, non-essential, consumer discretionary products are impacted and last the services.

Firms in the consumer staples sector are likely to remain relatively unaffected, as they are selling essential goods. Although DLTR is in the consumer discretionary sector because it sells a wide variety of products, discount retailers are actually positioned favourably during such times, as consumers are looking to reduce their spendings and they often switch to lower cost alternatives in cheaper stores. One of these lower cost alternatives could be Dollar Tree.

Let us actually take a look at, Dollar Tree’s stock price development during times of low consumer confidence in the last 20 years.

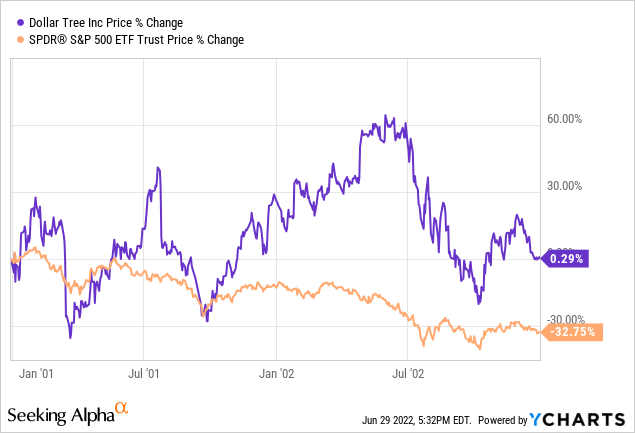

2001-2002

In this 2 year time period, despite the high volatility of DLTR’s stock price, it significantly outperformed the overall market. While DLTR remained flat, the broader market (SPY) has declined by as much as 33%.

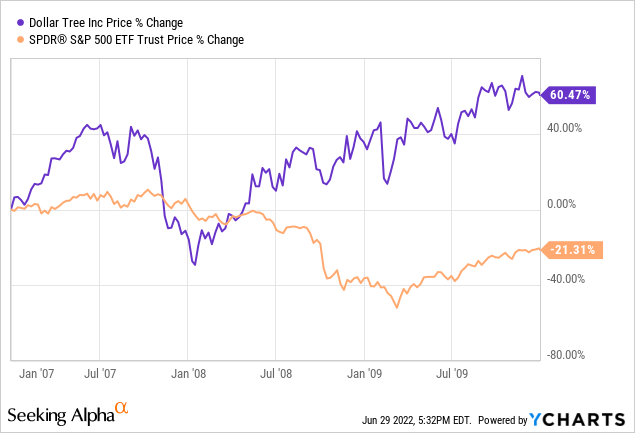

2007-2010

Between 2007 and 2010, DLTR’s outperformance was even more impressive. While SPY has lost about 21%, Dollar Tree’s share price has surged by more than 60%.

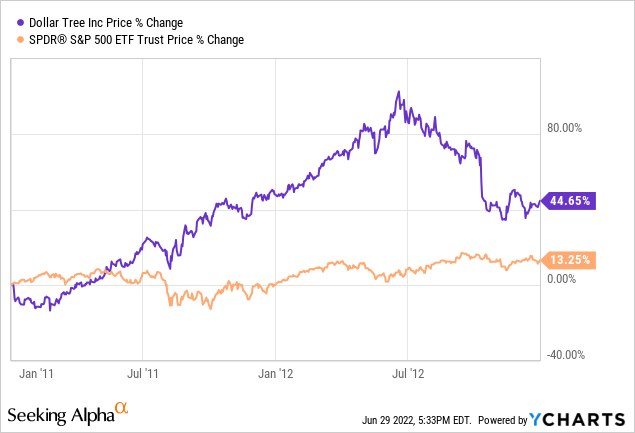

2011-2012

While in this time frame, both DLTR and SPY have produced positive returns, once again DLT has substantially outperformed the market.

Although past performance is not always a good indicator of the future performance, we believe that in the current low consumer confidence environment, the firm is well-situated to outperform the broader market.

Even though we like the stock from this perspective, we believe that the macroeconomic headwinds are likely to create significant downward pressure on the firm’s margins and earnings. Due to the high uncertainty with regards to commodity prices, transportation costs, supply chain disruptions and tight labour market we expect the firm to face substantial challenges in the near term.

Valuation

DLTR’s stock appears to be trading at a significant premium compared to the consumer discretionary sector median.

The firm’s P/E Non-GAAP (FWD) is 18.8x, compared with the sector median of 11.1x. This indicates a premium of about 70%. In terms of EV/EBITDA and P/CF, a similar trend can be observed.

In our opinion, such an overvaluation is not justified, despite the strong financial performance in the first quarter.

In the first quarter, DLTR has managed to open a significant amount of new stores and expand some of its already existing locations. The firm has also expanded its operating margin, despite the macroeconomic headwinds and achieved record diluted earnings per share for the first quarter.

Although we expect the demand for DLTR’s products to remain high and even increase in the near term, in our opinion the margins are likely to decline due to the elevated energy prices, increased freight costs, supply chain disruptions and the tight labour market. Many firms in the first quarter have struggled with these macroeconomic headwinds, including other larger retailers. We expect that DLTR will face the same problems.

Further, DLTR does not pay dividends, which make the stock an unattractive choice for many investors, who are looking for regular quarterly income in the volatile market environment.

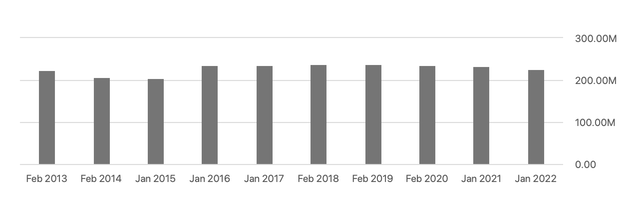

Last, but not least, Dollar Tree also has not returned any value to its shareholders by reducing the number of outstanding shares in the last decade.

Shares outstanding (Seekingalpha.com)

Although DLTR has not diluted its shareholders by issuing even more shares, we prefer to invest in firms, which have a strong track record of consistent share buyback programs.

Before concluding, we also have to point out the recent announcement for leadership change in the company. The change of CFO and COO could also have implications for the performance of the firm in the near term.

Due to the highly uncertain macroeconomic environment in the near term, we believe that the price multiples should contract before we could rate the stock as a buy.

If you are interested in other stocks, which have been outperforming the market during times of low consumer confidence, and we also rated them as “buy”, check out our previous article on Colgate-Palmolive (CL).

Key takeaways

Despite Dollar Tree’s historic outperformance during times of low consumer confidence, we believe that the stock is not a buy at the current valuation.

According to a set of traditional price multiples, DLTR is trading at a significant premium compared to the consumer discretionary sector median.

In our opinion, despite the strong first quarter financial performance, this premium is not justified, due to the highly uncertain macroeconomic environment, including elevated energy prices, a tight labour market and supply chain disruptions.

Last, but not least, DLTR does not pay dividends and has not been reducing its number of shares outstanding in the last decade.

Be the first to comment