Aslan Alphan/iStock via Getty Images

Many market participants call the US dollar “King dollar” because it is the world’s reserve currency. Since the end of WWII, political and economic stability has made the dollar the most liquid and leading global foreign exchange instrument. The dollar has been the pricing benchmark for most commodities as raw materials transcend borders.

The dollar index has been trading in a mostly bullish trend since 2008. As the world’s reserve currency, the dollar index attracts buying during crisis periods. In 2020, when the global pandemic gripped markets across all asset classes, the index rose to 103.96, the highest level since 2002. Since then, the index made a higher low and has been rallying, posting gains over the past four of five quarters, and is higher at the start of Q2 2022. The index rose 2.89% over the first three months of 2022.

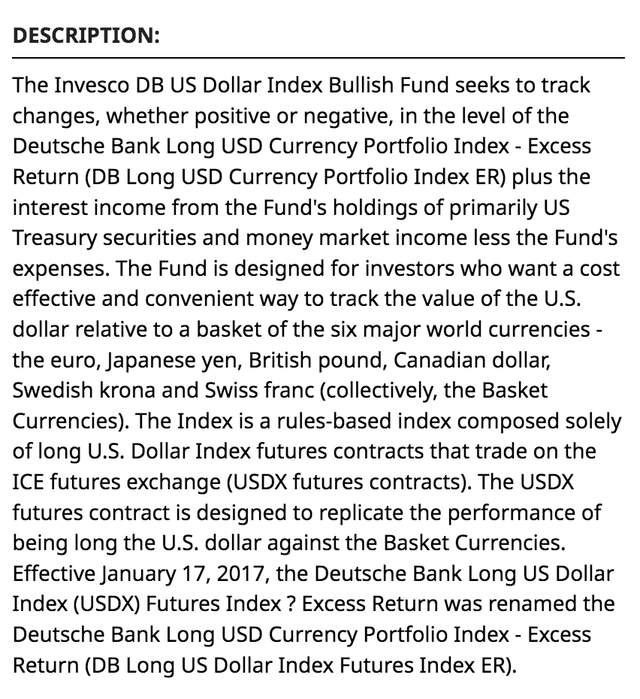

The dollar index’s rise is a bit of a mirage as it measures the US currency primarily against the euro. The index includes the Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. Meanwhile, the dollar’s global position has declined in 2022, making the trend in the dollar index a mirage. The Invesco DB USD Bullish Fund (NYSEARCA:UUP) follows the dollar index higher and lower.

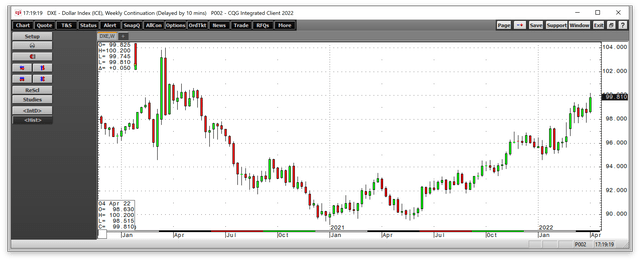

The trend in the dollar index is higher

The US dollar index reached a low of 89.165 during the first week of January 2021. Since then, the index has been climbing a bullish staircase.

Weekly US Dollar Index Chart (CQG)

As the chart highlights, the index reached a high of 100.20 last week, a 12.4% rise from the early 2021 low. The dollar was probing above the 100 level for the first time since May 2020 late last week.

The dollar index’s rise is a mirage for at least three reasons

While the dollar index continues to trade in a bullish trend, three factors point to a decline in the US currency’s purchasing power, making the index’s rise a mirage:

- The index measures the US dollar against a basket of reserve currencies. Global inflation is causing the purchasing power of all fiat foreign exchange instruments to decline, and the US dollar is no exception.

- The dollar index is rising because the Fed is increasing short-term interest rates. However, it is far behind the inflationary curve because the February 2021 CPI was at the highest level in over four decades at 7.9%. The March data will likely be higher because of raw material prices last month as markets reacted to Russia’s invasion of Ukraine. Currency exchange rates are highly sensitive to interest rate differentials.

- Combatting inflation with higher interest rates will be a challenge for the US central bank. As the war in Ukraine weighs on the US and global economies, higher rates threaten an economic slowdown, leading to stagflation. Moreover, each twenty-five basis points costs the US $75 billion to service the $30 trillion debt. If the Fed Funds rate rises to 3.5%, the debt servicing will cost over $1.05 trillion annually, not accounting for the compounding.

As Yogi Berra may have said, “the US dollar ain’t what it used to be.” The world has gone from one crisis to the next. All fiat currencies are losing value, which is not readily evident by looking at the dollar index, making the US currency the healthiest horse in the glue factory.

Levels to watch in the dollar index

Currency trends in the leading world foreign exchange instruments tend to be slow and steady. Governments, central banks, and monetary authorities manage the price movements to provide stability to markets.

Monthly Chart of the US Dollar Index (CQG)

The monthly chart highlights the slow and steady ascent of the US dollar index since January 2021. The upside target stands at the March 2020 103.96 high. The spike high in 2020 as the pandemic gripped markets took the index to the highest level since 2002. In 2001, the index peaked at 121.29. Support is at the January 2021 89.165 low. The index is closer to the 2020 high.

Technical factors show that the total number of open long and short positions has increased with the price, which is a technical validation of the dollar index’s bullish price action. Price momentum and relative strength indicators are rising. The slow and steady rally pushed historical volatility to just over 3%, the lowest level in the past decade and a half.

Reserve currency status is in jeopardy

The geopolitical, ideological bifurcation between China-Russia and the US-Europe could weigh on the US dollar’s status as the world’s reserve currency. China and Russia have increased their gold reserves, relying on the precious metal over the dollar over the past months and years.

Saudi Arabia and Nigeria have begun selling China petroleum for payment in Chinese yuan, further threatening the US dollar’s reserve currency position and benchmark pricing mechanism for raw materials. The dramatic shift in the geopolitical landscape over the past weeks has significant ramifications for the global financial landscape and the dollar’s position. The first leader of the former Soviet Union, Vladimir Lenin, once said, “There are decades where nothing happens, and there are weeks where decades happen.”

The February 4, 2021, meeting between Chinese President Xi and Russian President Vladimir Putin will go down in history as a watershed event. The $117 billion trade agreement was a sideshow to the “no-limits” support pledge. Just twenty days later, Russian troops crossed the border into Ukraine, starting the first major war in Europe since WWII. The agreement could set the stage for Chinese reunification with Taiwan. The bottom line is the Chinese-Russian alliance threatens world peace and the US’s position as the leader of the free world. China’s economy is growing and will surpass the US. The US dollar’s reserve currency status could be one victim of the substantial shift in geopolitical dynamics.

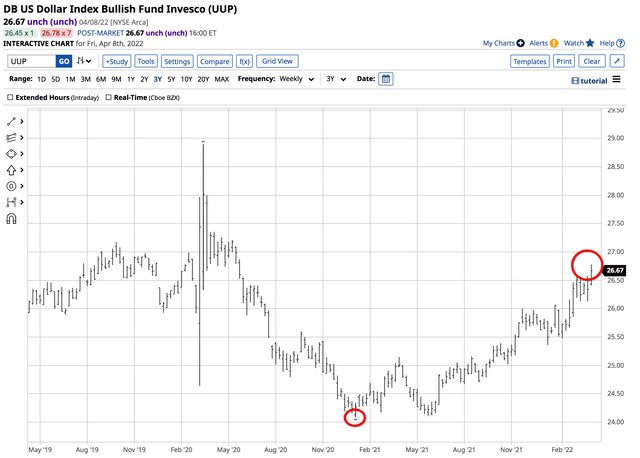

The UUP ETF follows the dollar index higher and lower

While the dollar’s reserve currency status could be in jeopardy, the trend in the dollar index remains higher. Technical factors point to a test of the March 2020 high. The 100 level is a psychological resistance point, but the technical target stands at 103.96. Meanwhile, with a war on European soil, the euro, pound, Swedish Krona, and Swiss franc could experience further weakness, boosting the dollar index. Japan’s geography near Taiwan and close to North Korea could do the same for the other currency in the dollar index.

The fund summary for the Invesco DB USD Bullish Fund states:

At $26.67 per share on April 8, the UUP product had $994.791 million in assets under management. UUP trades an average of over 1.546 million shares each day and charges a 0.78% expense ratio. The dollar index rose from 89.165 in January 2021 to a high of 100.20 last week or 12.4%.

Chart of the UUP ETF Product (Barchart)

Over the same period, UUP rose from $24.09 to $26.78 per share or 11.2%. The lower return is a function of the 0.78% management fee.

UUP’s converse product is the UDN, which appreciates when the dollar index declines. The trend is always your best friend in markets, and the dollar index looks headed for a challenge of the March 2020 high. However, the US currency continues to decline in value, and its reserve currency status could be in jeopardy as decades have happened over the past weeks.

Be the first to comment