Sundry Photography

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

Here we go again. DocuSign (NASDAQ:DOCU) had another 37% drawdown since our last coverage in Mar 2022, after the management reported its 1Q23 results. There is a series of updates during the quarter, including multiple key leadership changes. Is DocuSign on track for a turnaround, and if not, how should we think about it?

Without further ado, let us dive into the quarter as we share our thoughts on its 1Q23 result.

Disappointing Results & Guidance

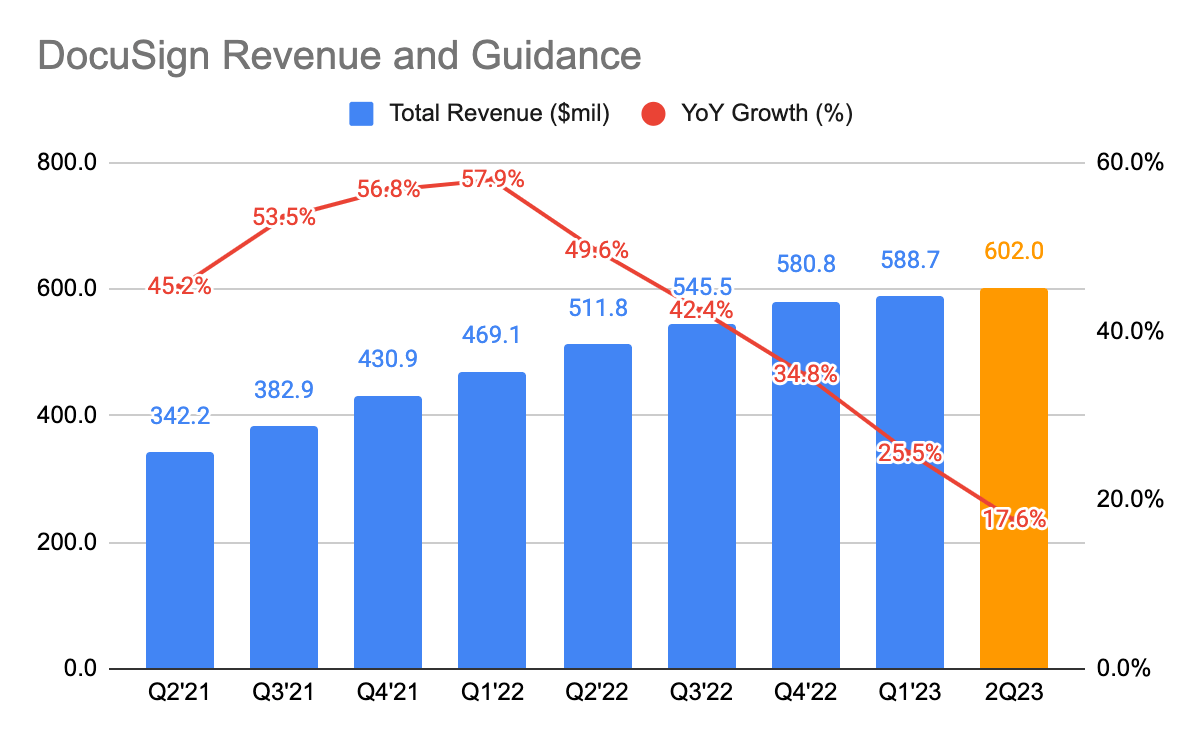

(Source: DOCU IR)

DocuSign’s revenue came in at $588.7 million, a 25.5% growth, which is in line with the management guidance back in 4Q22. And in the next quarter, the company is expected to grow at 17.6% Y/Y. This is a continuous deceleration in the last 4 quarters. And while this is already likely to be priced in, the market clearly did not receive the results very well and the stock came plunging again.

Is there more than meets the eye? Or is the market simply overreacting? Let’s dive deeper into the quarter first.

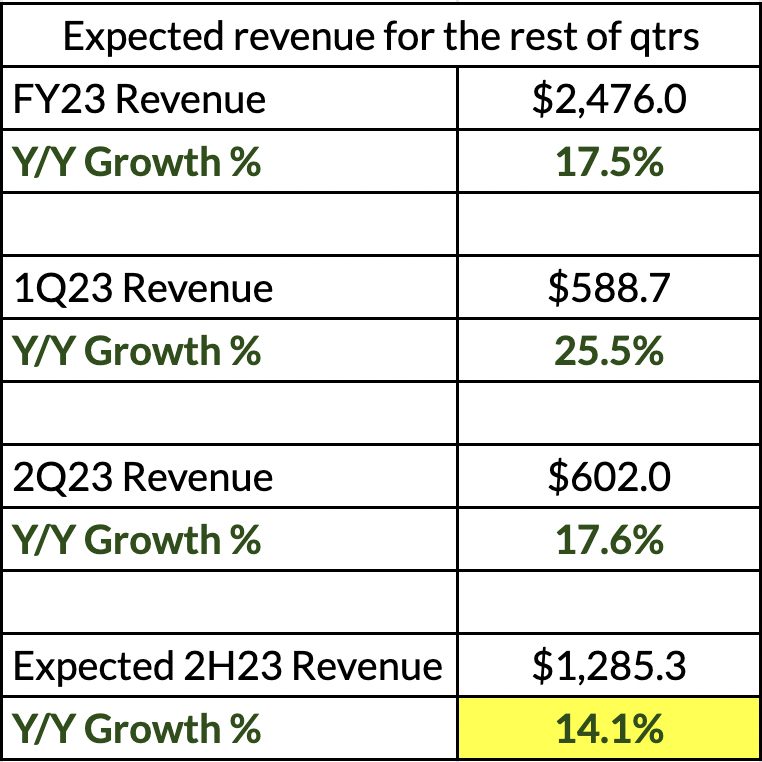

Since we already know its expected 2Q23 revenue, let’s take a peek at what we should be expecting in the second half of FY23 (“2H23”).

(Source: DOCU IR)

For comparison sake, the Y/Y revenue growth for 2H22 came in at 38.4%, and there is an even steeper decline in growth as 2H23 growth is expected to come in at 14.1%.

This marks yet another consecutive quarterly decline in terms of growth rates.

Considering that the company has been restructuring and ramping up its sales organizations since 3Q22, and yet the execution has been lackluster, it is understandable why shareholders are increasingly losing faith that the company is going to turn around going into FY23.

This has led to the market turning pessimistic given the weaker 2H22 result, causing the share price to fall even further.

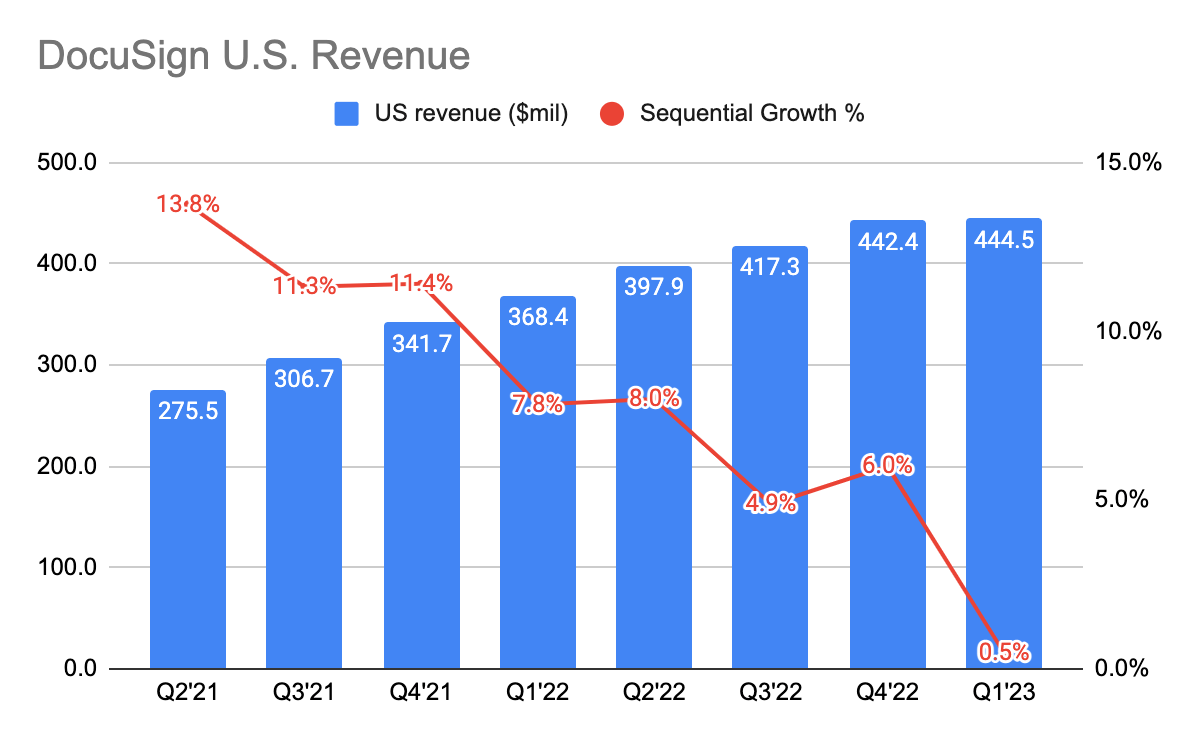

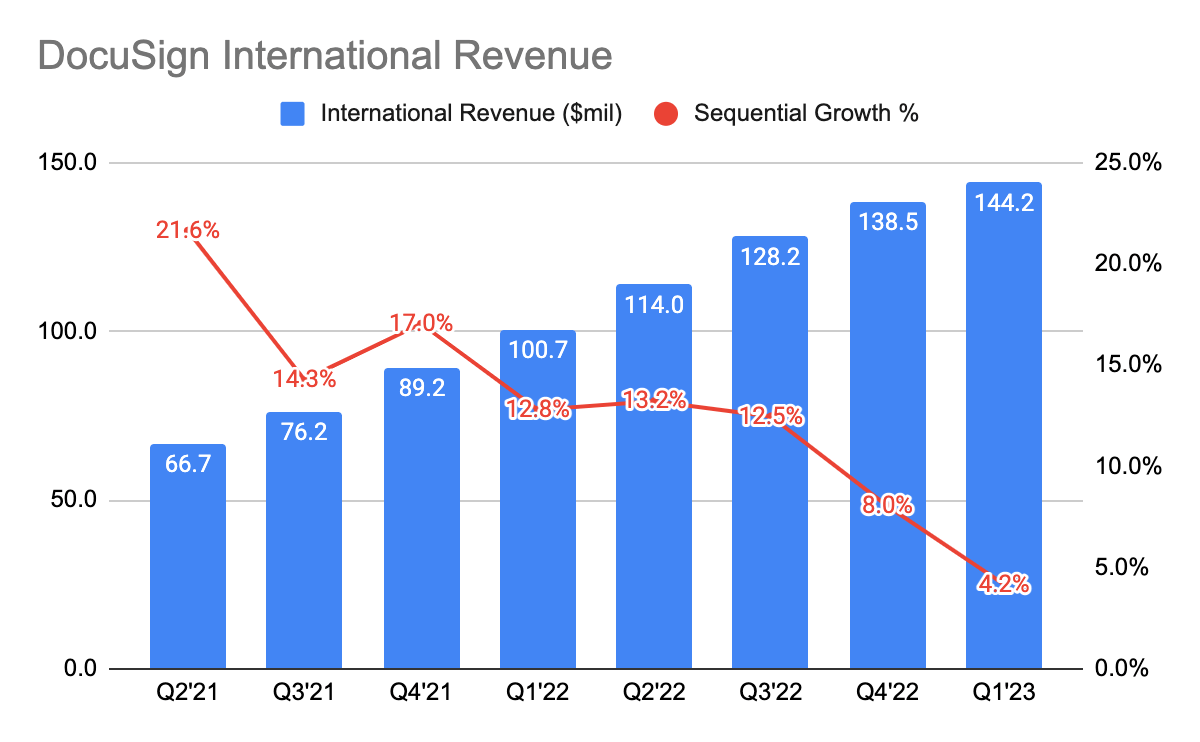

(Source: DOCU IR) (Source: DOCU IR)

Breaking down its total revenue even further, we find it appalling that the U.S. revenue growth has declined drastically to a mere 0.5% sequential growth. On the other hand, its international revenue, which makes up 24.5% of its total revenue, is growing slightly better at 4.2%, although there was still a consecutive decline.

We believe that the slower decline in the international market is because they are growing off a smaller revenue base as compared to the U.S., hence, this does not remove the fact the overall sales momentum has been tapering down.

(Source: DOCU IR)

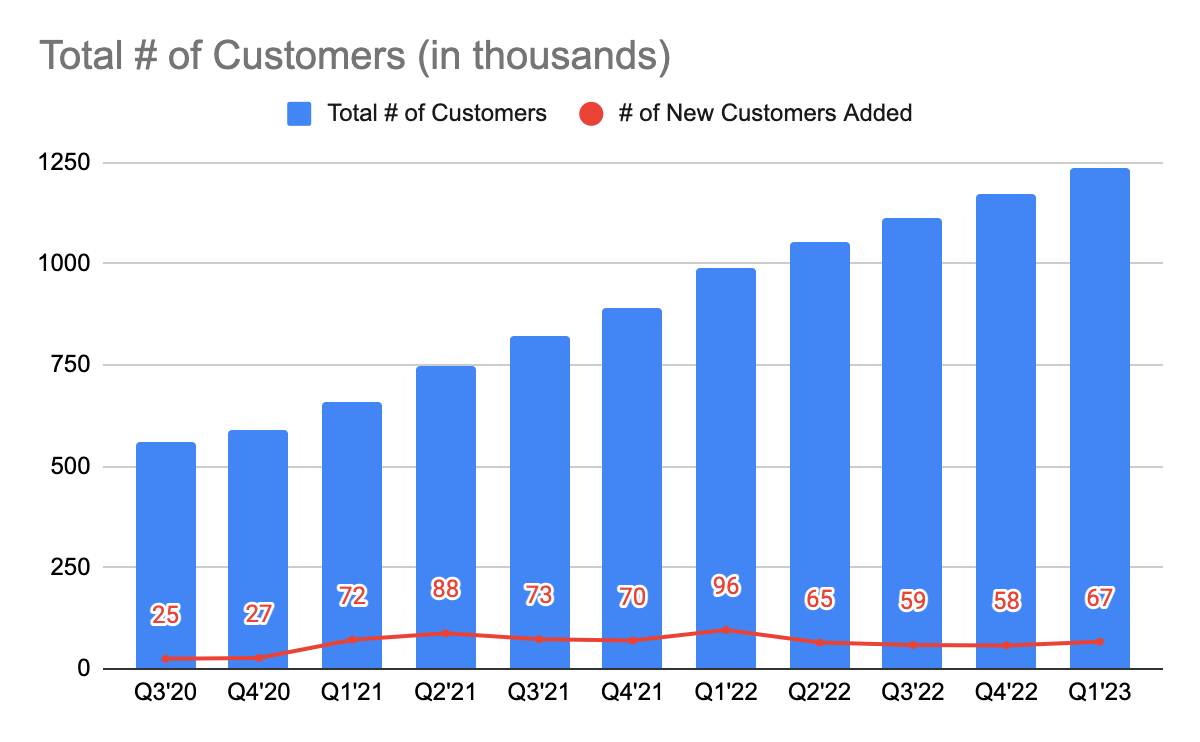

Despite the decline in growth, DocuSign added 67,000 new customers to the platform, and looking at the pace they are adding, it doesn’t seem to have tapered off.

This is increasingly worrying because it shows that customers are not expanding their usage and adopting more products quickly enough. Now, we already know that part of the reason is that one-time use cases have come down drastically post-Covid, which explains the slower expansion in usage, but what about the adoption of its Agreement Cloud and CLM products?

There could be various reasons for this:

-

Sales rep’s inability to cross-sell its existing customers

-

It is not a mission-critical product to instill the sense of agency to adopt these products

-

Long implementation and integration time to use the products

During the 1Q22 quarter’s earnings call, the management disclosed that it was also difficult to successfully onboard the newly hired sales rep. And then CEO Springer was also candid in the fact that he was slow to bring in seasoned leadership like Steve Shute, although this has considerably slowed down the company’s growth. Even more so with a potential recession looming, companies are only going to be more deliberate and prudent on where they are allocating their capital. This is only going to put more pressure on DocuSign’s ability to execute its land-and-expand strategy.

Therefore, it seems like there is lesser visibility going ahead and we prefer to monitor its execution in the coming quarters for more certainty.

Poor S&M Efficiency

(Source: DOCU IR)

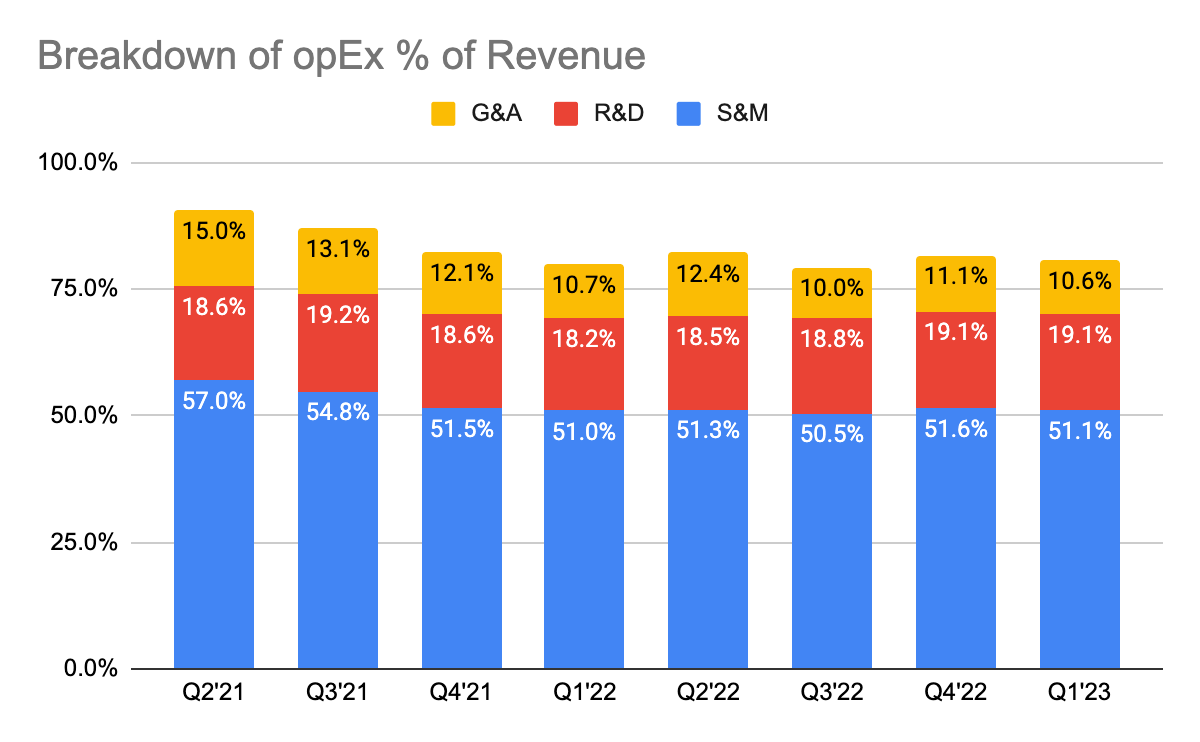

If you look at DocuSign’s sales and marketing (“S&M”) expenses over its total revenue, it has remained relatively high at over 50% in the past 4 quarters. However, despite such high re-investments, they are not translating into revenue growth. This is a demonstration of poor S&M efficiency.

Hiring at such a rapid rate is only going to deter the profitability and cash balance of the company, and moreover, this strategy doesn’t seem to be working out for the company thus far.

However, it was pleasant to hear that they are looking to slow down its hiring process in light of the rising interest rates:

While we continue to invest in our employee base to capitalize on the considerable opportunities ahead, we are moderating the tempo of our hiring plans to appropriately balance growth and profitability….We’re not doing layoffs. We’re not reducing our workforce…The vast majority of those would be in North America…But our concern was that the number of new people we were hiring to try to drive that growth rate was just very difficult to onboard them successfully into the company.

In addition, they are also looking to change their go-to-market (“GTM”) strategy.

This is great to hear as the management seems to be re-accessing its hiring strategies. We also hope that there could be resources allocated towards onboarding its sales rep rather than the focus on hiring. With the key sales leadership in place and the change in GTM strategy, we want to monitor whether the company can better execute on its land-and-expand strategy as it seems to us that customers are only adopting its e-Signature solution.

Once these issues are solved, we believe that the resumption in revenue growth and operating leverage will be well underway.

CEO Springer’s Resignation

Weeks after DocuSign announced its 1Q23 results, the company announced the resignation of the former CEO Springer.

This was despite the fact that he was rather optimistic and confident about DocuSign’s turnaround, backing up his words by purchasing $5 million worth of shares back in Mar 2022. He had also brought in several key leaders to the team in 1Q23 to scale the company from $2 billion to $5 billion.

Under his helm, from FY18 to FY21, here’s how DocuSign has performed financially:

-

DocuSign’s revenue grew at a CAGR of 40.8% from $318 million to $2.1 billion, a 5.5x increase.

-

Gross profit grew at a CAGR of 42.5% from $279 million to $1.6 billion, a nearly 6x increase. Gross margin expansion of 73.1% to 77.9%.

-

Non-GAAP operating profit grew from -$70 million to $419 million, and non-GAAP operating margin rose from -18.4% to 19.9%.

At least to say, he has done exceptionally well during his time in DocuSign. However, this may perhaps call for a change as there is a need for a different CEO to scale the company from $2 billion in revenue to $5 billion and larger. Unfortunately, based on Docusign’s current performance, the board has clearly lost faith in ex-CEO Springer’s execution and he wasn’t the one to lead DocuSign to the next phase of growth.

Here is another concern from us.

So far, we talked about how the management was slow in bringing in Steve Shute as well as the difficulty of onboarding its sales reps. Will appointing another CEO further delay the success of the turnaround?

This remains to be seen.

Now, let’s dive a little deeper into the profile of the new interim CEO Wilderotter.

She has held multiple CEO roles:

-

Former CEO of Frontier Communications (FTR) (FYBR) from 2004 to 2015. The company grew its revenue from $3 billion to $10 billion, a 3.6x increase.

-

Former CEO of Wink Communication from 1997 to 2002

She is (or was) also a current board member of multiple multi-billion dollar companies, including

-

Costco (COST): $220 billion market cap (“MC”), since Oct 2015

-

Hewlett Packard Enterprise (HPE): $17.15 billion MC, from Feb 2016 to Apr 2022

-

Cadence Design Systems (CDNS): $44.24 billion MC, Jun 2017 to Apr 2019

-

The Procter & Gamble Company (PG): $347 billion MC, from 2009 to Oct 2015

Based on the track record of interim CEO Wilderotter, we could tell that she is a seasoned executive. And more importantly of all, as a board member of DocuSign, she knows the ins and outs of the company.

One may wonder, with such a person of high caliber, why is DocuSign on the search for a new CEO? We believe that given she is 67 years old this year, heading into retirement age, it is unlikely to see her transition into a permanent role.

Thoughts On DocuSign Moving Forward

Earlier on, we touched on the disappointing revenue guidance in 2Q23 as well as the expected revenue growth in 2H23. This is despite the multiple quarters of ramping up its salesforce with little to nothing to prove as growth continues to taper down in the last 4 quarters.

There was an abrupt leadership change as ex-CEO Springer stepped down for interim CEO Wilderotter. This may not be a bad sign after all as she has had respectable track records, holding multiple CEO roles and board members of multi-billion dollar companies.

For shareholders and investors waiting on the sideline, you have to be prepared if the turnaround may take longer than anticipated. In our previous article, we brought up the case studies of Fastly (FSLY) and Zscaler (ZS). It has been 4 quarters since the turnaround began and there is barely any visibility of improvements.

In the case of DocuSign, the combination of multiple leadership changes within a short span of time, and the difficulty of onboarding its sales rep may further delay the turnaround process.

Furthermore, we are living in a particularly tough macro environment, and we were glad to see that instead of growing at all costs, they have decided to slow down the hiring and re-access its GTM strategy. This is a prudent step from the management team and it shows that they are aware of what is working and what is not. After all, continuing such a high reinvestment rate with no results to prove is only going to further deteriorate its profitability and eat into its cash pile.

Finally, we are curious about your thoughts on DocuSign’s turnaround and its 1Q23 results. Let us know in the comment section below!

Be the first to comment