jittawit.21/iStock via Getty Images

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

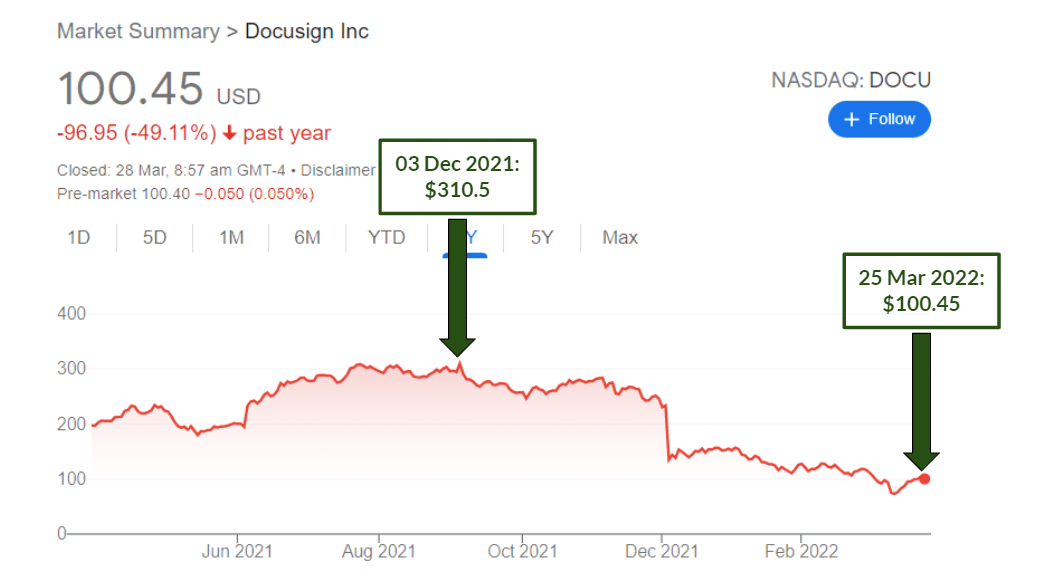

(Google)

It’s crazy to think that just a year ago, DocuSign (NASDAQ:DOCU) was trading at over $300 per share. Today, as we are writing this article, it is priced at a jaw-dropping $100.45.

To put things into perspective, this is a 3x return, gone, just like that!

This makes DocuSign one of the most beaten-down SaaS stocks along with Zoom (NASDAQ:ZM) as the COVID tailwind wears off. But interestingly, when investors are rushing to get out of the stock, CEO Dan Springer just bought more shares after its Q4’22 results. Weird huh?

What are we missing here? What does CEO Dan see that we don’t? Or is it simply him being biased and trying to invoke confidence?

As we are looking at its quarterly results, here are some questions that popped up in our mind:

-

Has DocuSign shown signs of improvement in terms of sales execution?

-

Has DocuSign lost its competitive advantage?

-

Has the investment thesis turned sour?

By the end of this article, we hope it will provide you with a more informed decision as to whether you should continue to hold on. But before we do that, do head to our previous articles on DocuSign’s deep-dive and a recap on its Q3’22 results.

Subpar Performance

Without getting too nitty-gritty, the disappointing results in the past few quarters were attributed to poor sales execution and the absence of the COVID tailwind. Since COVID isn’t under management’s control, we can only monitor its sales execution.

So let’s look at its recently reported Q4’22 results.

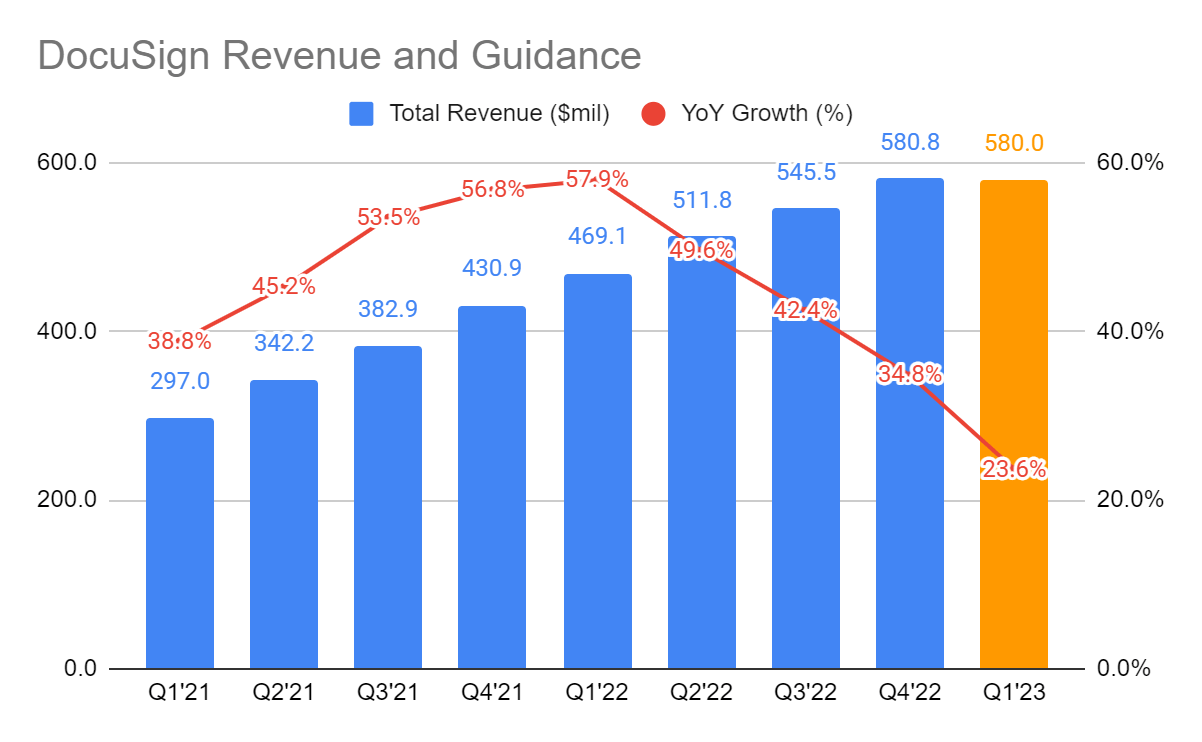

(DocuSign’s Investor Relation)

This was a rather disappointing quarter as the management reported revenue of $580.8 million, a YoY growth rate of 34.8%.

This was anticipated, but the main culprit of its share price decline lies with its Q1’23 revenue guidance of $580 million, a growth rate of only 23.6% YoY. And for FY23, the management is guiding a mere 17% YoY growth. This is a massive, massive step-down in terms of its previous growth rates, and it is not hard to imagine why investors are rushing to get out of the stock.

Recall that management did not anticipate the quicker-than-expected drop in demand. Thus, in this quarter, they have taken steps to rectify the sales execution issue.

To quote from the Q4’22 earnings call:

As our customers scale their usage across departments and new use cases, our field approach is also evolving. To that end, we’ve been bolstering our field leadership with strong leaders with GMs in EMEA, APJ and LATAM, along with recent additions across North America in the commercial and SMB segments.

In fact, if we head over to the company’s LinkedIn job opening, you can see how aggressively they are hiring on the sales side. This gives us reassurance that they’re making progress.

While the outlook for FY23 is unpleasant, we definitely appreciate the fact that management was candid about its mistakes and has communicated with shareholders openly in terms of progress in improving the sales execution.

Case Scenario: Zscaler and Fastly

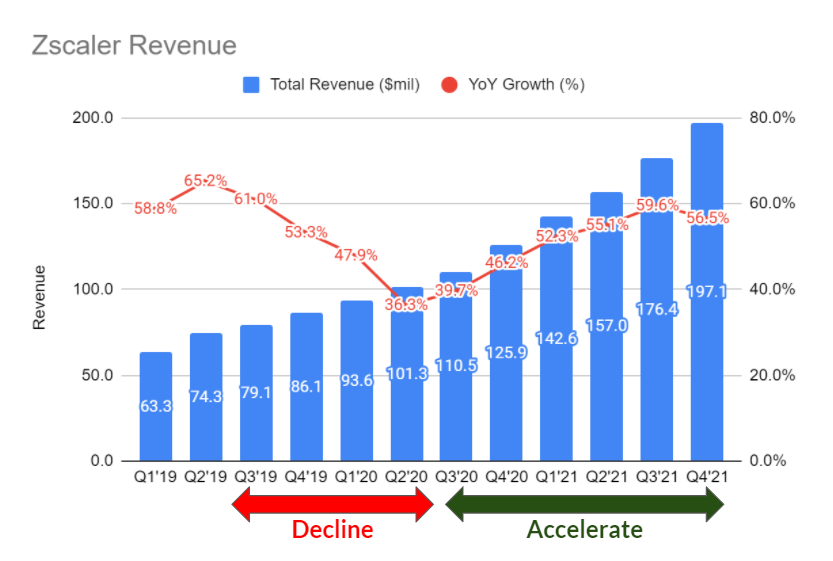

(Zscaler Investor Relation)

This brings us to Zscaler (NASDAQ:ZS), which ran into sales execution issues back in 2019 and 2020.

To quote CEO Jay Chaudhry during his Q2’20 earnings call:

So we accelerated sales leadership hiring and actually are ahead of what I thought it would be. Knowing that the priority, so yes, today we are behind on the sales plan where we wanted to be, but knowing that the leaders are in place, knowing that they have been trained on actually hiring and training, we are pretty confident that we will get to our 60% hiring numbers.

You will see that it took roughly a year for Zscaler’s management to solve its sales execution before they saw a resumption and then acceleration in growth rates from Q3’20.

So, who is to say that DocuSign cannot repeat the same success story?

Over the past six months, CEO Dan Springer has also undertaken similar steps to solve the sales issue – hiring aggressively and investing in sales enablement, although this will take a few quarters to play out.

But does the management have what it takes to execute? Here’s how we think about it.

What most people seem to miss out on is the fact that management has a track record of executing. While you may attribute its past success to COVID, you cannot ignore the fact that management has executed brilliantly to cement itself as the market leader in the eSignature industry.

When we think about companies like CrowdStrike (NASDAQ:CRWD), who are leaders in their own respective fields, there are bound to be competitors competing ferociously for market share. But today, they remain the market leader. In the case of DocuSign, one of its most commonly talked about peers is Adobe (NASDAQ:ADBE), but Adobe is nowhere near DocuSign in terms of market share.

When you have such massive consumers’ mindshare, the market tends to tip in your favor, and that’s what is happening to DocuSign. Could Adobe try to compete for a slice of a pie? I bet it can, but DocuSign is definitely not going down without a fight.

Like any other company, they are facing a temporary speed bump, and if executed well, things may turn around.

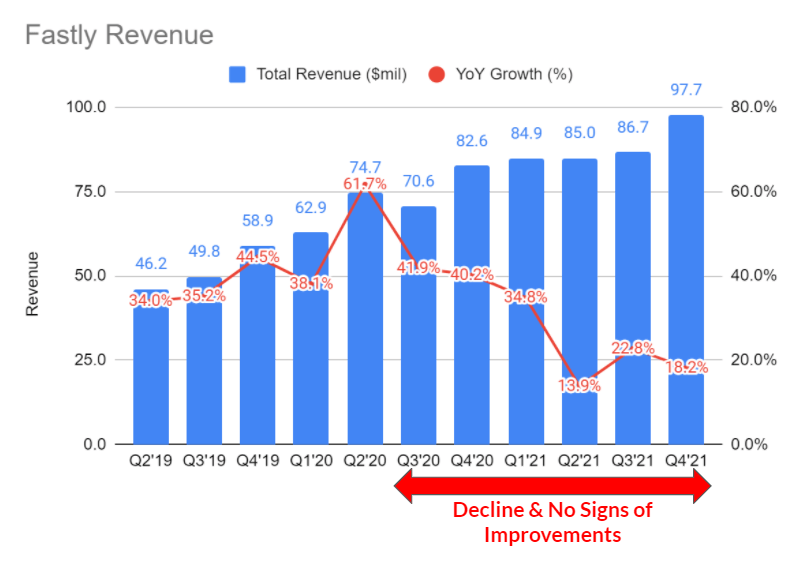

(Fastly Investor Relation)

On the other hand, you could argue that there are companies who have failed or have taken longer to resolve their poor sales execution.

A prime example is Fastly (NYSE:FSLY). In the graph above, you can see that it has not displayed signs of improving revenue over the past six quarters despite onboarding a new Chief Revenue Officer and Chief Financial Officer in Q1’21. Over time, investors lost confidence in the management team and the stock lost almost 70% of its value. If the same were to happen to DocuSign, it may continue to experience further drawdown as investors lose confidence in management’s ability to navigate these challenges.

Therefore, a more appropriate question to ask ourselves is, do we trust the company’s management team to execute? Unfortunately, that is a question that you have to answer yourself.

Let’s move on to other aspects of the business.

Growing Number Of Customers

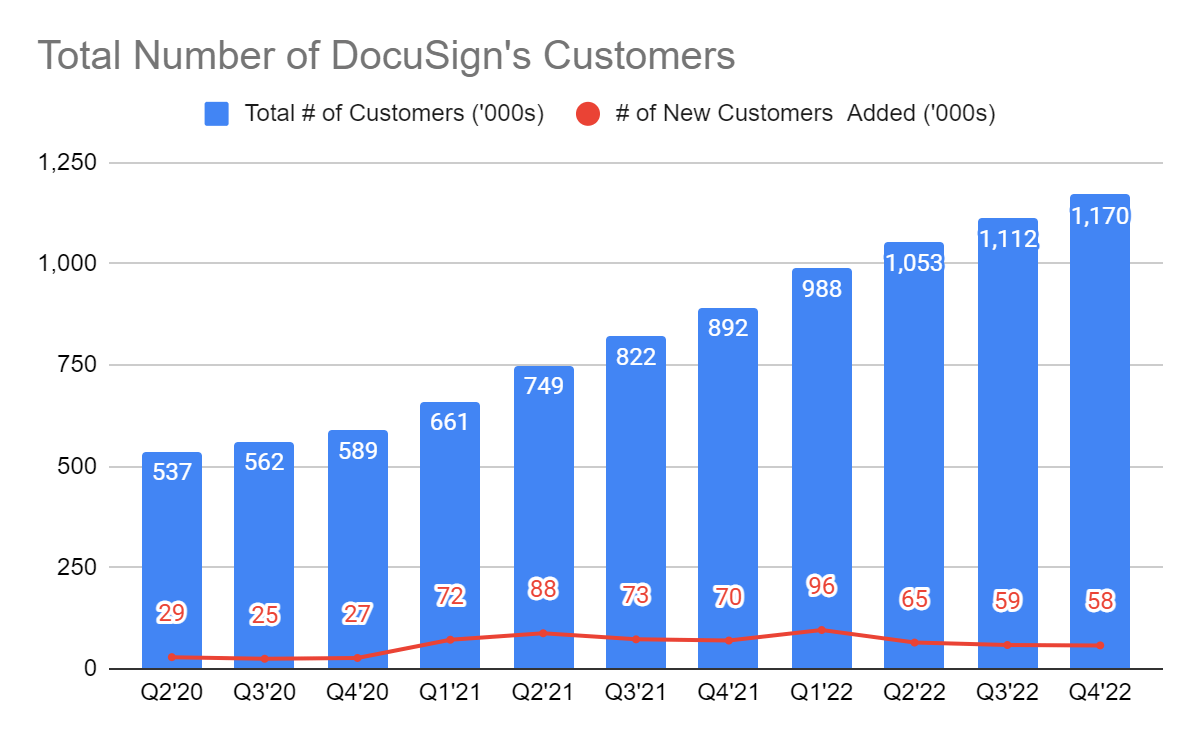

(DocuSign Investor Relation)

One of the key performance indicators (“KPI”) we’re monitoring is the rate of users added to the platform.

The reasons are, it tells us about its sales execution, its growing consumers’ mindshare, as well as the upsell and cross-sell opportunities. Here, we’ve noticed that there was a gradual step-down in new customers added, which is most likely due to COVID fading away in 2H22 (Q3’22 to Q4’22). If you take COVID into consideration, the absolute pace that they are adding is still pretty enormous in 2H22 – close to 60,000 new customers added in each quarter.

This shows that DocuSign continues to be on top of customers’ minds amidst the broader shift towards digitization. With the implementation of the new sales organization, the company may be on track to generate more demand over time.

However, we should not also ignore the fact that as growth starts to normalize, we may experience a further slowdown in users’ growth rates. This will mean fewer opportunities for upselling and cross-selling, which implies a slowdown in revenue growth.

The Broader Opportunity

Adding customers is great, but what’s more important is to increase the average revenue per customer (“ARPC”).

When new customers are onboarded, they don’t provide immediate meaningful revenue. Instead, through a land-and-expand strategy, DocuSign will gradually increase the ARPC by upselling existing products to more departments and cross-selling other Agreement Cloud products, such as Notary and CLM, which they haven’t done particularly well at.

To quote CFO Cynthia Gaylor during her Needham Conference:

…the one thing we haven’t done as well on the execution front is really fill that with new use cases within the existing customer base. So kind of in our traditional model of selling, we’d be talking to customers within verticals or within different GOs about all the different things they can be doing with DocuSign across Signature is mainly where we’re seeing this phenomena and that wasn’t happening as much as it much as it should.

Through the restructuring of their sales organization and go-to-market strategy, there was an increase in use cases across the Agreement Cloud in Q4’22. Today, its other products (excluding eSignature) are only a small subset of total revenue. There is clearly a lot of work to be done, and taking into account its forward FY23 revenue guidance of 17% YoY, there may not be substantial revenue built into it.

Nonetheless, the opportunities are there for DocuSign to take, but it will take time for results to surface.

Valuation

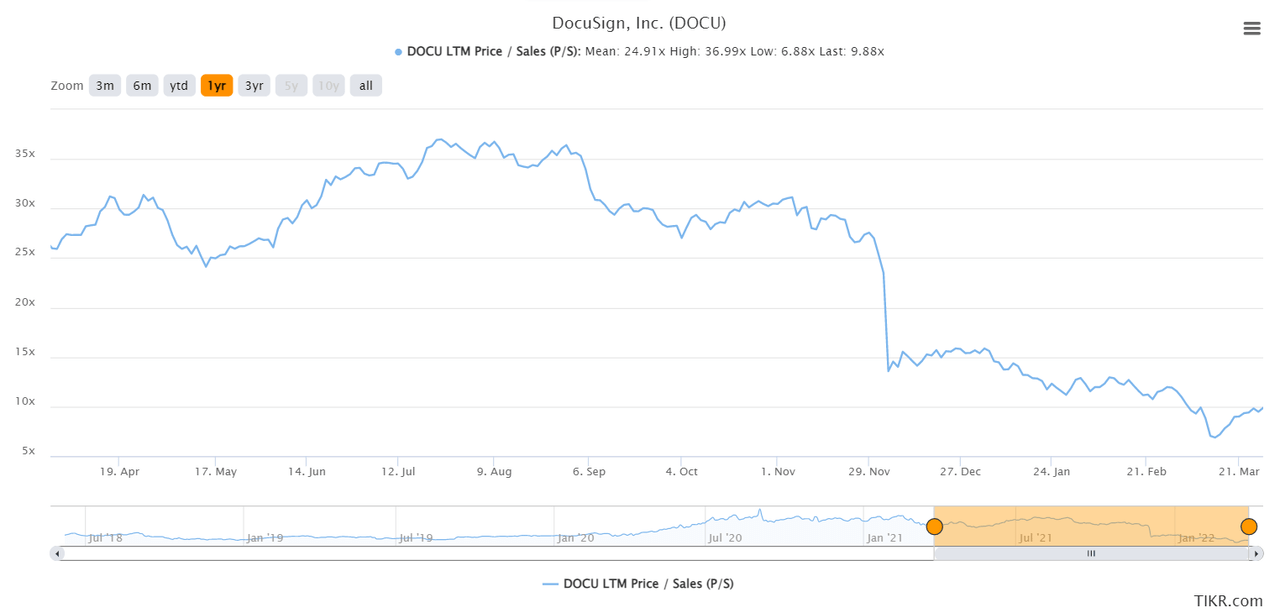

(TIKR)

You can see that DocuSign had a steep decline in its valuation multiple, coming down from a high of 24x to a multiple of roughly 10x today.

Is this a reasonable valuation? Let’s try to model it out.

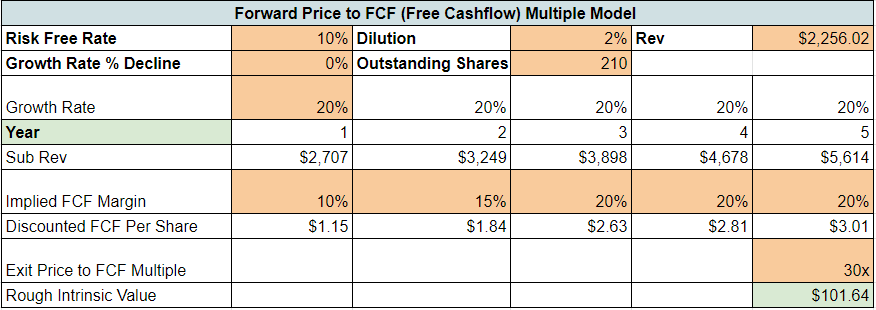

(Author’s Valuation)

Taking the management guidance of $5 billion of revenue, this means that DocuSign has to achieve a revenue CAGR of 20%. With a multiple of 30x and share dilution of 2%, this gives us an intrinsic value of $101.64, which is close to the current share price of $100.45.

Note that the management only guided 17% YoY growth rates for FY23.

From our point of view, the market is attaching a premium valuation to DocuSign as investors expect the company to resolve its sales issue, thus, re-accelerating its growth rates. If that succeeds, multiples may get re-rated higher. However, if the sales issue remains, the share price may continue to be volatile.

Concluding Thoughts

Despite the COVID tailwind disappearing for DocuSign, the shift to digitalization will create a sustained need for its products. I mean, once you move from paper to digital, it’s hard to revert back, like a one-way valve.

However, this has created some sales issues for the company, which they are in the midst of resolving. Will it be another successful Zscaler turnaround story or a disappointing Fastly story? Unfortunately, it remains to be seen, and we will be closely monitoring its progress.

But this is not all doom for DocuSign.

There are also other aspects of the business that they have done well, particularly its strong user growth. With such a huge and diversified customer base, there are huge upsell and cross-sell opportunities. If executed successfully, the company may re-accelerate its growth rates.

If you trust the management’s ability to execute and are confident that DocuSign will be one to stay in the next decade, at current valuations you may be able to generate decent returns still.

What are your thoughts are on the current quarter? Let us know in the comments section below!

Be the first to comment