imaginima

In August, I wrote an article recommending readers to hold DMC Global (NASDAQ:BOOM) as an oil call option. However, upon further researches in its business history and operation structures, I realized that the business is capital-light and has fairly deep moats, which strongly support the bull case scenario. I now rate the stock as “strong buy” for the reasons below:

Thesis

DMC Global is a turning-around industrial conglomerate. It acquired an exterior/interior framing company Arcadia at 12x PE, which I believe is a huge bargain. DMC has been successful in maintaining a strong balance sheet, even during bad years. This acquisition transformed DMC into a capital-light industrial conglomerate that has conservative management, adequate leverage, and promising ROE. DMC is also a very cheap call option on rising oil due to its large exposure to E&P activities, whose downside is diversified by the Arcadia acquisition. The stock was trading at ~$70 in 2019 vs. $19 today (after a successful acquisition). Before the acquisition, 70% of DMC’s revenues were from DynaEnergetics, whose performance was disrupted by Covid and depressed oil prices. DynaEnergetics’ earnings went up 60% in 2Q22 but the stock didn’t move much. The opportunity exists because the market 1) still focuses on the disappointing performance in the past decade due to depressed oil (70% of its legacy revenue is directly from oil E&P), 2) doesn’t appreciate the Arcadia acquisition, and 3) doesn’t factor in the tailwinds DMC gets from rising oil, which is caused by underinvestment in the oil field during the past decade. The market values DMC as if its legacy business DynaEnergetics and NobleClad are worth only $172mm (This will be elaborated on later). However, in 2019 when oil was at $50-60s, they generated $68mm EBITDA, including a $19mm restructuring expense which was completed in 2020. My valuation indicates a 170% upside if DynaEnergetics’ profitability went back to the 2019 level.

Business

Post-acquisition, DMC has three major segments:

Arcadia

Arcadia is “a supplier of architectural building products, including exterior and interior framing systems, curtain walls, windows, doors, interior partitions, and highly engineered windows and doors for the high-end residential market.” The commercial segment, which “designs, engineers, fabricates and finishes aluminum framing systems, windows, curtain walls, storefronts and entrance systems comprising the exterior of buildings”, accounts for 73% of Arcadia’s revenue as of 2021. The Residential segment which manufactures windows and doors for luxury homes accounts for 17% of net sales. In Dec 2021, DMC acquired a 60% controlling interest in Arcadia for $262mm in cash and $20.5mm in stock. DMC also received a three-year put-and-call option to purchase the remaining 40% interest, with a floor valuation of $187.1mm. The total implied transaction value is ~$470mm. I will use the total transaction value to analyze this acquisition because the management has expressed the intention to exercise the option. I think Arcadia is a bargain for the following reason (numbers below can be found here):

- Market leadership: Arcadia is a market leader in a fragmented market with a 10% market share in addressable western and southwestern markets, and 5% in TAM.

- Sticky/Stable Revenue: Arcadia’s revenue exhibits a recurring pattern: average customers place 25 orders per year with an average invoice of $5,000, with a ~90% of retention rate. Arcadia has a diversified customer base with ~2000+ unique customers.

- Customer satisfaction: While the market is fragmented and most players are local, Arcadia has successfully built a nationwide distribution system with four manufacturing plants and 11 regional facilities. Arcadia has virtually the best lead time in the industry, which contributes to the high retention rate mentioned in #2. Since Arcadia focuses on the high-end market, customers would pay more for better service, larger product selections, and better product quality, which creates moats for Arcadia as a national player.

- Capital-light and high FCF conversion: Arcadia only has $14.6mm PPE and $41mm inventory, against ~$45mm net income, $253mm net sales, and $166mm COGS (3.5x inventory turnover, 35% gross margin). 2019 Capex was $2.4mm vs. $1.4mm depreciation. 2019 FCF conversion rate was 91% ($41.3mm FCF vs. $45.2mm NI). All figures above are 2019 ones; the performance pattern in 2020 and 2021 was similar to 2019. management also indicated that the 34% EBITDA margin is “long term” and “pro forma”.

- High growth and minimal macro effect: From 2010 to 2020, Arcadia’s sales grew from $71mm to $246mm(13% CAGR), and Adj. EBITDA grew from $7mm to $51mm(23% CAGR). Note that even in 2020, Arcadia still earned a solid $44mm NI, only $1mm lower than in 2019. In 2021, Arcadia quickly went back on track with growth and earned $41mm NI in the first nine months only (according to the last financial statement of Arcadia as an independent entity). This shows that Arcadia is very resilient to macro events (low correlation to the RE market).

- Ability to raise prices: Despite higher aluminum (raw material) prices, Arcadia was able to raise prices without losing business. In 2Q22, Arcadia’s gross margin grew to 34% from 30% in the first quarter driven by a price increase. During the meantime, Arcadia’s revenue was up 12% sequentially and still received “uncomfortably high” bookings. According to the management (Kevin Longe), “as far as an organization and their (Arcadia) ability to manage inventory, manage pricing, pass pricing along at fair prices to our customers, they are second to none, quite frankly, in companies I have been associated with.”

- Also, I am very impressed by the fact that the management can pull off such a great deal in the last half of 2021 when inflationary sentiment was at its peak. I speculate that the family that sold Arcadia might need cash or personally know DMC’s management, which makes it a classical Berkshire-style acquisition. I have no evidence for it, but it more or less indicates the management’s capital allocation skill. The CEO of Arcadia Jim Schladen has been with the company for 34 years (joined in 1986 and was named president in 2000). He has “more than three decades of experience in the commercial building products industry and Expertise in commercial and high-end residential architectural building products, including manufacturing, operations, sales and marketing”. He also Co-founded Wilson Partitions, a commercial interior products business acquired by Arcadia in 1998.

- Price paid & Valuation: For a capital-light FCF-rich market leader that grew at 23% CAGR in the past decade (who also paid a $50mm dividend to stockholders in 2019), I think a 13x FCF multiple (7.5% cap rate) is more than conservative.

Assuming no growth, Arcadia is worth at least $540mm (using 2019 FCF). DMC currently has a TEV of $715mm (assuming the purchase of the remaining 40% interest is financed by debt). This means the market values DynaEnergetics and NobleClad at $715-$540=$172mm. Don’t forget that in 2019 when oil was at $60, (Baker Hughes International rig count at 2,000-2,200; frac spread at ~400) these two (which at the time were the whole DMC) were valued at $40-70/sh ($600mm-$1bn) in 2019.

So how much are DynaEnergetics and NobleClad worth today?

DynaEnergetics

DynaEnergetics is a manufacturer of perforating systems and associated hardware and a leading provider of well-completion and well decommissioning solutions for the oil industry.

According to the latest 10k:

During the well drilling process, steel casing is inserted into the well and cemented in place to isolate and support the integrity of the wellbore. A perforating system, which contains a series of specialized explosive shaped charges, is used to punch holes through the casing and cement liner of the well and into the geologic formation surrounding the well bore. The channels created by the shaped charges allow hydrocarbons to flow back into the wellbore. When hydraulic fracturing is employed, the perforations and channels also provide a path for the fracturing fluid to enter and return from the formation.

In unconventional wells, multiple perforating systems, which generally range from seven inches to three feet in length, are connected end-to-end into a perforating “string.” The string is lowered into the well and then pumped by fluid across the horizontal lateral to the target location within the shale formation. When the perforating system is initiated via an electronic or digital signal from the surface, the shaped charges detonate. DynaEnergetics designs, manufactures and sells all five primary components of a perforating system: the initiation system, shaped charges, detonating cord, gun hardware, and a control panel.

Long story short, DynaEnergetics sells a system that punches holes on the ground and puts support materials in the hole for E&P companies to drill wells. Its earnings have been fluctuating in the past decade due to depressed oil, but generally show an upward trend. I believe the market is undervaluing DynaEnergetics for the following reasons:

- DynaEnergetics is inherently capital light: Historically Dyna has been generating satisfactory ROIC if the macro (oil price) is favorable. For example, in 2019, Dyna generated $69mm OI with only <$5mm depreciation expense. Dyna and NobleClad combined only had $108mm PPE, against 34mm NI($40mm FCF). It had no debt and realized 21% ROIC ($171mm equity-$11mm net cash=$160mm capital invested). They also generated modest FCF even during bad years.

- Moat: Dyna has a 20% market share in the $1.5bn TAM (per IR presentation). Since 2015, Dyna has been leading a transition from field assembly of components to fully integrated systems manufactured in factories and delivered just-in-time to the wellsite. In simpler words, the conventional perforating systems are assembled on-site by the operator, which requires substantial capex, expertise, and labor. Different from the conventional ones, Dyna’s systems are vertically integrated and manufactured in factories. As a result, Dyna’s product can improve efficiencies, tie up less working capital, reduce the number of people on location, and lower overall costs. A vertically integrated manufacturing platform also enables technology and product innovation, and provides customers with a single-source supplier, which simplifies logistics and supply chain. According to the management, the operators who use Dyna’s products can achieve cost savings of up to $250,000 per well. Dyna’s patented integrated perforating systems are also recognized as the safest, most efficient and most reliable in the unconventional oil and gas sector (per company IR presentation).

- Restructuring: Dyna further improved efficiencies at its Blum, Texas manufacturing center, where assembly of its integrated perforating systems requires 60% fewer direct-labor hours than before the pandemic. The completion of the restructurings can also lift earnings (2019 restructuring expense was $19mm).

- According to the letter to shareholders, DynaEnergetics maintained its North American market share and added new international customers. Dyna’s revenue has also been highly correlated to oil activities(in 2Q22 Dyna’s revenue was up 38% sequentially and 60% yoy, with gross margin going from 26% in the first quarter to 30%), so in the valuation below we don’t need to worry about market share loss.

DynaEnergetics Valuation

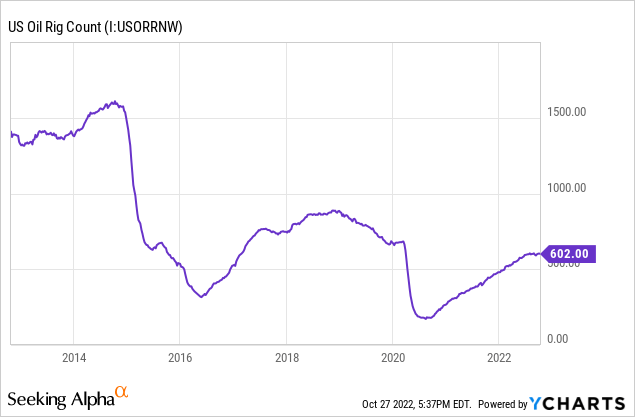

Today, Baker Hughes International rig count is at 1825 vs. 2,000-2,200 in 2019; Baker Hughes US rig count is at 759 vs. ~1,100 in 2019; US frac spread is at 269 vs ~400 in 2019; oil price is at $90 today vs. $60 in 2019. OPEC’s financial breakeven point is $80, and it just reduced 10,000 BPD production in September, right after increasing the same amount in August. The global spare production capacity is at an all-time low, and the pricing of E&P equipment went wild. Macro events such as the Russia-Ukraine war and China potentially coming out of covid can only make things worse. This oil upcycle is created by the underinvestment in the oil field in the past decade.

Although the management indicates that the EBITDA margin might not be back to the 2019 level due to product mix (caused by the integrated system transition), this product mix drives more revenues. In the 2Q22 earnings call, an analyst asked if the dollar value of Dyna’s EBITDA can return to the 2019 level despite lower margins, and the management gave a positive answer.

So what does EBITDA going back to the 2019 level look like? I will use $90mm for EBITDA since 2019 OI was $68mm and adj. EBITDA was $94mm (adjusted for $19mm restructuring expense, which was near zero in 2020 and 2021). The pro-forma EBITDA multiple was 10x during good years, but for the sake of conservatism I will use 5x. So Dyna is worth ~$450mm at 5x $90mm EBITDA.

NobleClad

NobleClad manufactures Explosion-welded clad metal. Explosion-welded cladding technology is a method for welding metals that cannot be joined using conventional welding processes, such as titanium-steel, aluminum-steel, and aluminum-copper.

According to the 10k:

Explosion-welded clad metal is primarily used in the construction of large industrial processing equipment that is subject to high pressures and temperatures and/or corrosive processes. Explosion-welded clad plates also can be cut into transition joints, which are used to facilitate conventional welding of dissimilar metals. It serves industries such as oil and gas, petrochemical, alternative energy, hydrometallurgy, aluminum production, shipbuilding, and power generation, with oil and gas and chemical and petrochemical constituting approximately two-thirds of NobelClad sales in 2019. This business has high barriers to entry including mastery of large-scale production and technology know-how.

Explosion-welded clad metal was once the largest segment of DMC (about 13 years ago), whose revenue declined from $200mm in 2008 to $87mm in 2019. I read the past filings and believe this was caused by a secular decline of the industry, and there is little info that explains the reasons. Nevertheless, NobleClad still has 20% of the $500mm TAM (per IR presentation) and earned $7mm OI in 2019 with little capital requirement. For the sake of conservatism, I will assume NobleClad’s value is zero, although it also has a large exposure to oil and new markets such as alternative energy and solar projects. It should be noted that the pandemic had minimal impact on NobleClad’s earnings.

The Big Picture

I like DMC as a whole and the management for the following reasons:

- Diversified: After the acquisition, Arcadia will account for 46% of the revenue and Dyna 41%. Before the acquisition, 70% of DMC’s revenue was from Dyna, whose performance highly depends on the oil price. This acquisition successfully diversified DMC’s operations and can limit the downside risks if the oil call option doesn’t work out.

- The management has been a conservative steward for shareholders’ assets. I believe the unstable performance during the last decade is largely attributed to unfavorable macro conditions. Before the acquisition of Arcadia, DMC had no net debt in the last decade, and the acquisition was made possible by the strong balance sheet. Note how the Arcadia acquisition was also made conservatively: the payment is spread over three years through option. The debt-to-EBITDA ratio after close will be 2.79x, a very manageable level. Also, as far as I can tell, the management didn’t make any dumb acquisitions in the past decade: It’s just that the industry is inherently unstable. Based on the track record, I wouldn’t say they are excellent capital allocators (although Arcadia is a fantastic investment), but they are definitely not terrible ones.

- The management clearly has a long-term value investor mindset: according to the 2021 Investor Presentation, DMC has adopted three tenets to guide superior share price performance: 1)Maximize free cash flow through financial discipline. 2)Maximize return on invested capital by achieving operational excellence and making discerning investment decisions. 3)Invest in new technology, product, and market development to drive sustained growth and increased profitability. From these, we can see the management sees DMC as an investment vehicle instead of an empire-building conglomerate.

- A little company history: The company started as a licensee of Detaclad, the explosion-weld clad process developed by DuPont in 1959. In 1996, the Company purchased the Detaclad operating business from Dupont. 20 years ago, DMC acquired NobleClad to enhance its explosion welding business. 13 years ago, when the explosive welding business accounted for 81% of DMC’s revenue, the old management acquired Dyna and grew it to a significant size (rev grew from $28mm in 2008 to $310mm in 2019). Today NobleClad only accounts for 10% of revenue. If the old management didn’t acquire Dyna there would be no DMC today.

Valuation

Constant: Arcadia is worth 13x 2019 FCF=$540mm, with no growth;

NobleClad is worth $0.

Bull case/Base case: The oil option works out, and Dyna’s EBITDA went back to 2019 level:

DynaEnergetics= 5*2019 EBITDA=$450mm; DMC market cap=$450mm + $540mm – $301mm net debt (adjusted for the $187mm extra debt for the remaining 40% interest)=$990mm ($50/sh, 170% upside). Note that this valuation uses a very conservative 5x multiple vs. pro-forma 10x, and assumes no more growth over 2019 EBITDA.

Bear case: oil option doesn’t work out, DynaEnergetics is valued at $100mm (post 2014 oil crash market valuation when Dyna’s EBITDA was negative, a very conservative scenario); DMC market cap= $100mm + $540mm -$301mm debt = $341mm ($17.5/sh, ~6% downside).

Going Forward: There are three analysts covering BOOM. They estimate 2023 earnings of an eye popping ~$2.37/share, which puts BBOM’s forward PE at ~8.5x. Based on analysis above, I believe the estimate is achievable.

Risks

- Oil prices go down.

- RE market cooling down may affect Arcadia’s performance, but it is mitigated in valuation since I assumed no growth for Arcadia. Arcadia’s low correlation to the RE market can also be evident by 2020 results and the business nature.

Conclusion

In the past year, BOOM was down 52% for no reason. I believe it was caused by the market’s irrationality. The Q3 earnings will be released on Nov 3. I believe BOOM can meet or beat the guidance ($160 million sales with 30% gross margin), which can serve as a potential near-term catalyst for stock price appreciation, since Q3 earnings results are a confirmation that Q2 earnings surge is sustainable. I recommend to hold on to BOOM stock as long as oil rig count is below 2019 level and oil prices are above $80.

Be the first to comment