MarsYu/iStock via Getty Images

DLS strategy and portfolio

The WisdomTree International SmallCap Dividend ETF (NYSEARCA:DLS) has 872 holdings, a 12-month distribution yield of 4.96% and an expense ratio of 0.58%. Distributions are paid quarterly. It has been tracking the WisdomTree International SmallCap Dividend Index since 06/16/2006.

As described by WisdomTree, the underlying index selects companies in the bottom 25% of the market capitalization of the WisdomTree International Equity Index after the 300 largest companies have been removed. They are rebalanced annually based on annual cash dividends paid (not yields). The parent index excludes the U.S. and Canada.

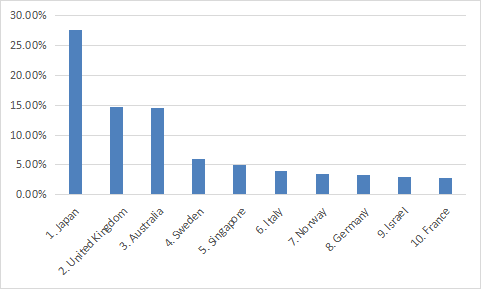

About 66% of asset value is in small and micro cap companies per Fidelity classification, and 34% in mid-caps. The fund is quite balanced between Europe (about 48%) and Asia-Pacific (about 46%), with most of the remaining part in the Middle East. The next chart plots the top 10 countries, representing almost 85% of asset value. Japan is the heaviest one by far (27.6%), followed by the U.K. (14.8%) and Australia (14.5%). Other countries weigh no more than 6% each. Direct exposure to geopolitical and regulatory risks related to China is insignificant: Hong Kong and China weigh 0.65% together.

Top 10 countries ( Chart: author; data: WisdomTree)

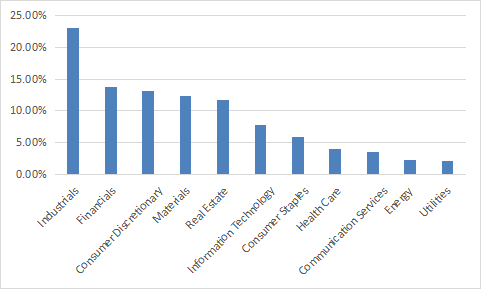

The heaviest sector is industrials with 23% of asset value. Then, come financials, consumer discretionary, materials and real estate, each one between 12% and 14%. Other sectors are below 8% individually and 26% in aggregate. Defensive sectors are underweight.

Sector breakdown (chart: author, data: WisdomTree)

The portfolio is well-diversified: less than 6% is in the top 10 holdings, and the heaviest one weighs 0.84%. As a consequence, risks related to individual companies is very low.

|

Name |

Ticker / Exchange |

Weight % |

|

D/S Norden |

DNORD DC |

0.84% |

|

Azimut Holding SpA |

AZM IM |

0.64% |

|

Charter Hall Long Wale Reit |

CLW AU |

0.63% |

|

SSAB AB |

SSABA SS |

0.60% |

|

Coface |

COFA FP |

0.57% |

|

Sims Metal Management Ltd |

SGM AU |

0.55% |

|

Deterra Royalties Ltd |

DRR AU |

0.52% |

|

NOS SGPS SA |

NOS PL |

0.52% |

|

Sydbank A/S |

SYDB DC |

0.50% |

|

VGP |

VGP BB |

0.50% |

Past performance

Since inception in June 2006, DLS shows an annualized return of 4.41% with dividends reinvested, and a maximum drawdown of -63%. The share price has gained less than 16% in 16 years, which is far from offsetting inflation (about 48% in total, or 2.3% annualized).

DLS share price history (TradingView on SeekingAlpha)

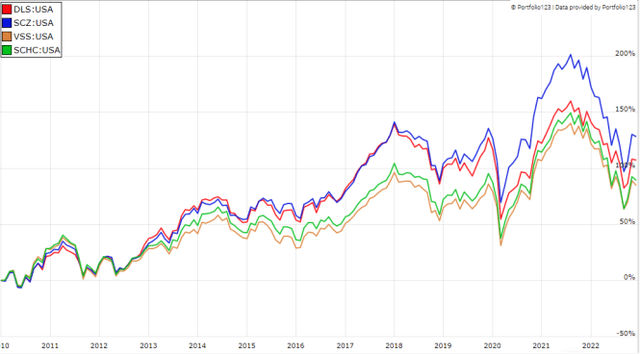

Compared to more popular global small-cap ETFs from January 2010, DLS has beaten the Vanguard FTSE All-World ex-US Small-Cap ETF (VSS) and the Schwab International Small-Cap Equity ETF (SCHC), but lags the iShares MSCI EAFE Small-Cap ETF (SCZ).

DLS vs competitors since 2010 (Portfolio123)

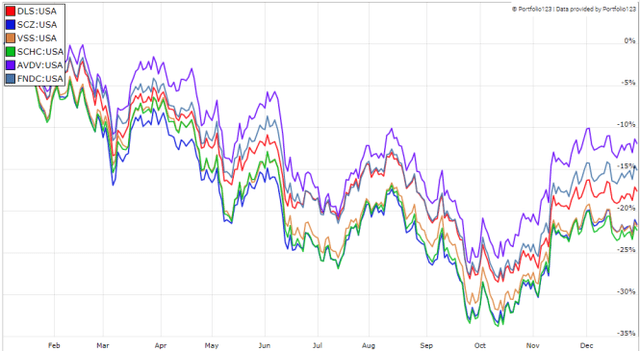

In 2022, it was more resilient than the same funds, but lags two competitors with a more recent inception: the Avantis International Small Cap Value ETF (AVDV) and the Schwab Fundamental International Small Co. Index ETF (FNDC).

DLS vs competitors in 2022 (Portfolio123)

The next table compares the current aggregate valuation and growth ratios of these funds. Regarding portfolio fundamentals, DLS looks a bit better than SCZ, VSS, SCHC and FNDC. However, AVDV is cheaper and has a higher earnings growth.

|

DLS |

SCZ |

VSS |

SCHC |

AVDV |

FNDC |

|

|

Price/Earnings TTM |

8.12 |

10.99 |

10.66 |

10.36 |

7.04 |

9.74 |

|

Price/Book |

1.05 |

1.24 |

1.27 |

1.22 |

0.91 |

0.97 |

|

Price/Sales |

0.62 |

0.8 |

0.84 |

0.84 |

0.52 |

0.54 |

|

Price/Cash Flow |

6.34 |

8.29 |

7.54 |

7.49 |

4.44 |

6.22 |

|

Earnings growth |

15.87% |

12.72% |

16.66% |

15.48% |

17.29% |

10.27% |

|

Sales growth |

3.62% |

-11.71% |

0.60% |

-1.26% |

0.87% |

-0.75% |

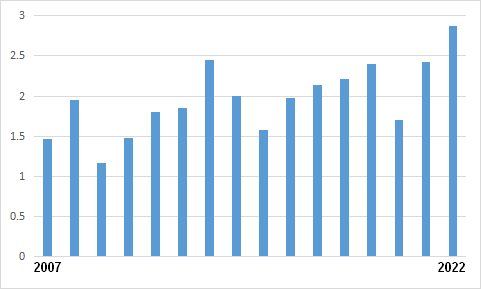

The next chart plots the annual sum of distributions from 2007 to 2022. The annualized dividend growth rate since 2007 is 4.56% (about twice the annualized inflation rate), and the progression has been quite irregular.

Annualized distributions per share from 2007 to 2022 (Chart: author; data: WisdomTree)

Takeaway

DLS holds over 800 ex-U.S. dividend stocks, mostly in the small-cap segment, weighted based on paid dividends. It pays quarterly distributions, and the annual rate is about 5%. The portfolio is heavy in Japanese companies (27.6% of asset value) and in industrials (23%). Compared to competitors, the fund is in the middle of the pack regarding past performance, and among the best regarding fundamentals. The annualized dividend growth rate since 2007 beats inflation, but the share price doesn’t. As a conclusion, this fund is a good instrument for investors seeking exposure to global small cap with an above-average yield. However, AVDV looks more attractive regarding fundamentals and performance. For transparency, a dividend-oriented part of my equity investments is split between a passive ETF allocation (DLS is not part of it) and my actively managed Stability portfolio (14 stocks), disclosed and updated in Quantitative Risk & Value.

Be the first to comment